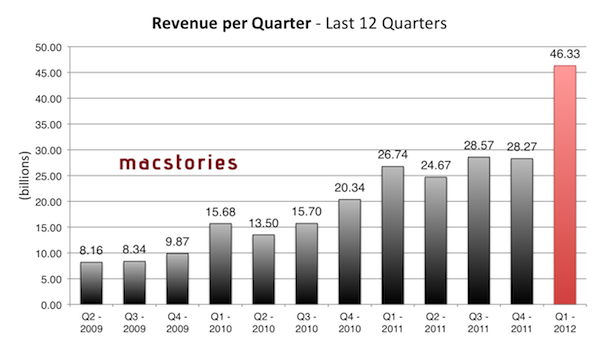

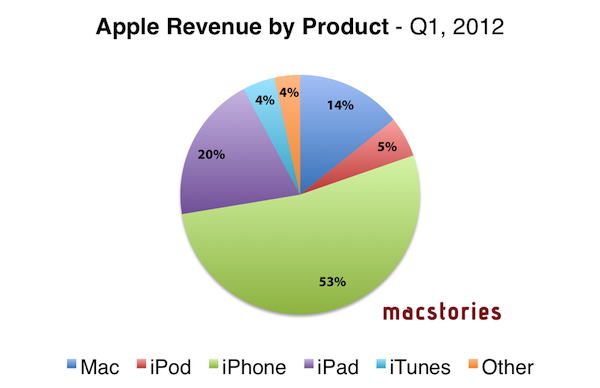

Apple has just posted their Q1 2012 financial results. The company posted record-breaking revenue of $46.33 billion, with 15.43 million iPads, 37.04 million iPhones and 5.2 million Macs sold. Apple sold 15.4 million iPods, a 21 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $13.06 billion, or $13.87 per diluted share. iPhone represented a 128 percent unit growth over the year-ago quarter, while iPad reported a 111 percent unit increase over the year-ago quarter.

We’re thrilled with our outstanding results and record-breaking sales of iPhones, iPads and Macs,” said Tim Cook, Apple’s CEO. “Apple’s momentum is incredibly strong, and we have some amazing new products in the pipeline.”

“We are very happy to have generated over $17.5 billion in cash flow from operations during the December quarter,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the second fiscal quarter of 2012, which will span 13 weeks, we expect revenue of about $32.5 billion and we expect diluted earnings per share of about $8.50.

This is Apple’s best quarter ever. Until today, Apple’s most profitable quarter had been Q3 2011 with $28.57 billion revenue.

Estimates and Previous Quarters

Wall Street consensus’ estimate was earnings of $10.08 per share and revenue of $38.85 billion; six institutional/independent analysts polled by Fortune expected earnings per share of $11.57 and $41.87 billion revenue. In Q4 2011, Apple said they expected revenue of about $37 billion and diluted earnings per share of around $9.30 in the first fiscal quarter of 2012.

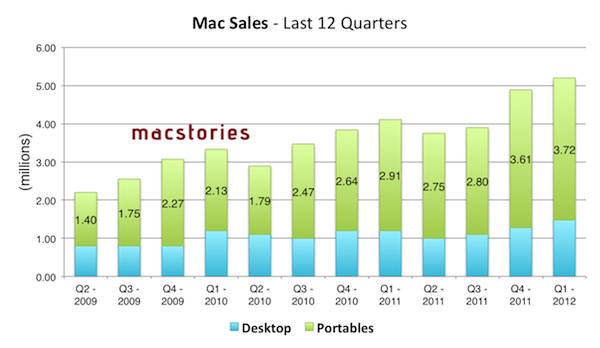

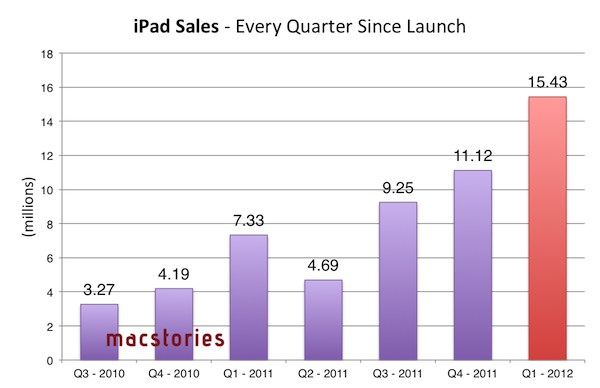

In Q4 2011, Apple posted revenue of $28.27 billion, with 11.12 million iPads, 17.07 million iPhones and 4.89 million Macs sold. The company posted quarterly net profit of $6.62 billion, or $7.05 per diluted share. iPhone represented a 21 percent unit growth over the year-ago quarter; iPod sales were down 27 percent from the year-ago quarter, and Apple reported the best iPad quarter to date with over 11 million units sold and a 166% increase over the year-ago quarter. In the year-go quarter, Apple posted revenue of $26.74 billion with 7.33 million iPads, 16.24 million iPhones and 4.13 million Macs sold.

Apple will provide a live audio feed of its Q1 2012 conference call at 2:00 PM Pacific, and we’ll update this story with the conference highlights. You can find the full press release and a graphical visualization of Apple’s Q1 2012 after the break. A recap of estimates and product releases happened during the quarter is available here.

Notes from the call

Peter Oppenheimer - We’re very proud with these results. Numerous new records, including all-time highs for iPhone, iPad, and Mac sales. We’re extremely pleased with momentum of our business.

- iPhone, iPad, Mac sales fueled it, also fueled by a 14th week.

- Mac sales grew 26% year-over-year compared to forecast of 0.

- MacBook Pro, MacBook Air and iMac ended quarter with 3-4 weeks of channel inventory.

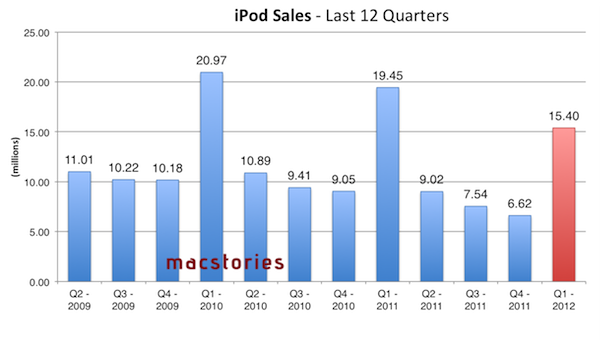

- iPod touch accounts for half of all iPods sold. iPod continues to be top mp3 player in most countries with 70% of market share.

- December 25th, 140 million downloads of content on that day.

- iPhone: 37 million iPhones, compared to 16.2 million year-over-year.

- 128% yoy growth, compared to 48% growth of smartphone market overall.

- Tremendous popularity of iPhone 4S.

- Nearly every company of Fortune 500 is using or deploying iPhone.

- Thousands of employees using iPhones and business apps: Timberly Clark, St. Jude Medical, Nike, and Facebook.

- 600,000 copies iBooks Author downloaded.

- 1.5 million iPads already in use in education institutions.

- As of today, over 3 million copies of iTunes U app downloaded.

- We’ve surpassed 315 million cumulative iOS device sales.

- iCloud has 85 million customers.

- App Store: 550,000 apps, 175,000 apps for iPad.

- $4 billion cumulative, $700 million in December quarter paid to developers.

- iPhone sales robust and doubling year-over-year; sales up year-over-year thanks to iPad 2 and strong holiday buying.

- 22,000 visitors per Apple retail store on average per week.

- $97.6 billion in cash at end of December, compared to $81.6 billion at end of September with an increase in $16 billion.

- We don’t have anything specific to announce, we’re actively discussing cash and not letting it “burn a hole in our pockets”.

- Peter Oppenheimer - For the next quarter, we set guidance of $32.5 billion, compared to $24.7 billion for Q2 2011.

- Q: Describe iPhone momentum, what is included in guidance and enthusiasm for product, any more detail on metrics? Tim Cook - We were thrilled with 37 million iPhones sold. Breathtaking customer reception of iPhone 4S with iOS 5 and Siri, and incredible camera – customers love these products. We made a bold bet as to what demand would be, and as it turns out, despite being a very bold bet, we were short of supply throughout quarter and with significant backlog as Peter said. The situation has improved, but we still are short in some key areas currently. I think we made a correct decision to go with a broad range of iPhones - turned out to be a benefit as we thought it would - 14th week is also part of this. We could not be happier.

- Q: Good mix of 4S and higher capacity 4S, could you comment on that vs. iPhone 4? Tim Cook - 4S most popular device during quarter, consistent with most launches… We typically see a higher mix at the front end of the launch.

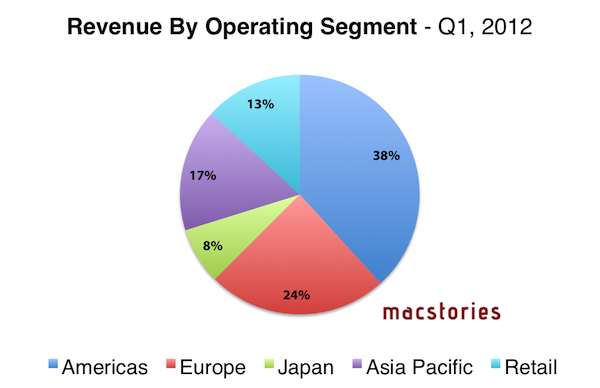

Tim Cook - Demand in China is staggering - we are selling through our online store and demand is off the charts. We’re happy with demand response there. Other countries that we’ve launched in earlier this quarter were smaller countries in a demand sense. We’ll see how it goes from a supply demand view.

We did make progress as we’ve moved through the quarter. There are still some countries that we are not caught up in. In terms of components, generally speaking it’s favorable - one of the things that allowed us to overachieve on gross margin - and we predict that it will stay favorable on most peak commodes except hard drives affected by tragic situation in Thailand.

Tim Cook - Apple won’t have a material supply issue during the quarter - but we will pay more for drives as suggested in our guidance.

Q: iPad - strong shipments - with that said, did you see any impact from lower price tablets? How do you think about competition from lower price tablets and subsidized content like that of Amazon?

Tim - We’re happy with 15.4 million iPads we were able to sell. This is consistent with long-term belief that we’ve had… before we introduced the product, that this is a huge opportunity for Apple over time. As I’ve said before I believe and many others believe that there will come a day where tablet market will overgrow the PC; it’s interesting to know in US, it’s clear from IDC, that tablets succeeded desktop PCs last quarter in US. iPad is in a class by itself. Optimized applications from day 1 to take advantage of a larger canvas, and over 170,000 apps (iPad specific) compared to only a few hundred from competition - people want to do multiple things with a tablet, and we don’t see limited functions of other tablets and e-readers being in the same category. Customers will buy those, they’ll sell a fair amount, but people who want iPads won’t settle for limited functions. Last year was supposed to be year of the tablet, but most people would agree it was the year of the iPad for the second year in the row. We’re going to continue to innovate like crazy and compete with anyone that is currently shipping tablets or that might enter in the future.

Q: Can you dig in a bit more to what you’re learning with elasticity with iPhone 4 and 3GS price points? Tim - iPhones were important in achieving 37 million total units - we’re glad to cover broad range with great products. 4S most popular among those. There’s a much smaller difference in what customer paid in subsidized, much larger in prepaid market (we don’t really have an answer yet to see how this will play out). We want to learn as much as we can to adjust and do better in the future.

Q: Actively discussing uses of cash - any different from what you’re doing historically, or you’re suggesting that you’re thinking more constructively? Peter Oppenheimer - we have always discussed management of our cash, we recognize that cash is growing for the right reasons, and I would characterize our discussions as “active” as far as what to do with balance. Q: Any timeframe? Finished discussions? Is there a process for which there is an ending? Peter Oppenheimer - When we have something to announce then we will. We are actively discussing best uses of cash balance.

Q: Congrats! I’m back from CES - everyone has connected TV now. TV offering seems limited - high level - how should we be thinking about strategy? Tim Cook - TV product is growing actually very well – last fiscal year, we sold a bit above 2.8 million units of the Apple TV product, and just in December quarter we set a new record at over 1.4 million.

In the scheme of things, if you dollarize our revenue, it’s still a hobby. We continue to add things to it, I can’t live without the latest one. It’s a fantastic product and we continue to pull strings and see where it takes us. Otherwise, no comment.

Q: Tim, one thing for you: discussions around iCloud - the perspective on iCloud - what’s your perception on how value is being added - what metrics are you guys using…if it indeed is driving success around various products? Tim Cook - There are over 85 million iCloud users - this has happened in just a few months. We’re thrilled with response and response with customers has been incredible. iCloud solves a lot of problems customers were having and made their lives much easier. iCloud is a fundamental shift - recognizing that people had numerous devices and wanted bulk of content in the cloud, easily accessible, and we’re seeing response to that. It is a very, very important part - it’s not a product - it’s a strategy for next decade.

Tim Cook - China is an extremely important market for us - we continue to look at how to grow it further.

Q: Tim/Peter: Acquisition, talk about strategy about acquisitions, including most recently Anobit. Peter Oppenheimer - Shannon, we have done acquisitions, they were medium/smaller companies with great engineering and talent…technologies and IP we’d like to bring into Apple. That’s the acquisitions that we’ve done; we do several a year, and our track record has been strong. Q: Are they standalone divisions? Tim Cook - We don’t believe in lots of divisions, we run this company as one, the semiconductor team works for Mansfield and does hardware engineering for the whole company, so Bob and his team have integrated Anobit into that team. Anobit has fantastic technical talent, we’re fortunate to have obtained them.

Q: Tablet market, iPad growth outpaced expectations - do you think that Apple benefits lower costs and reduced features so they traded up to iPad. Do you see that happening as well with MacBook Air and Ultrabooks this year? Tim Cook - When I looked at data in US on a weekly basis about Kindle Fire, I’ve heard your theory, but whether that’s happening or not… I don’t know. My own view is that there is no obvious change in data. For what it’s worth, that’s how I see it. There is cannibalization of Mac by iPad, but we continue to believe that there is much more cannibalizing of PCs from iPad, and we love that. iPad is beginning to appear everywhere. Enterprise has adopted it; global Fortune 500, edu and K-12 have adopted it - twice as many iPads as Macs and education adopts tech very slowly, so that’s surprising. iPad is winning market by market by market - consumers that go in and look at it and think about the ecosystem and huge advantages and customer experience - we will win a fair number of those - you can see that in results - we couldn’t be happier with over 15 million units sold, and we’ve sold over 55 million iPads since April 2010.

Tim Cook - Android Vs. iPhone is not Mac Vs. Windows at all. Mac has outgrown market for 20 quarters in a row, but still has single digit market share worldwide. We’ve sold over 315 million iOS devices, but I don’t have comparable numbers on Android - as they don’t do transparent reporting like we do. If you look at NPD data, it shows that in US, and this is just October - November, it shows just iPhone (not total iOS): iPhone 43% and Android at 47%.

All data in the US is a very close race, I think on iPad side, although I don’t have specific numbers from third parties, all of us believe that iPad is way ahead of the competition. iOS is doing extremely well. I wouldn’t say it’s a two horse race, there’s always a horse in Redmond that will suit up and keep running, so we’ll keep on making good products and ignore how many horses there are.

Q: Follow-up: has popularity of larger screens on Android phones changed or impacted your view… also 4G and battery life thoughts? Tim Cook - No comment on future roadmap, but I will point out that we just sold 37 million iPhones, and we could have sold more if we had more supply. Lots of people really love what we’re doing.

Graphical Visualization

We have compiled a series of graphs and charts to offer a graphical visualization of Apple’s third quarter. Apple’s Q1 2012 data summary is available here.

Storify

We have created a Storify stream of tweets, images, quotes and links about Apple’s Q1 2012. Check it out below.

CUPERTINO, Calif.–(BUSINESS WIRE)–Apple® today announced financial results for its fiscal 2012 first quarter which spanned 14 weeks and ended December 31, 2011. The Company posted record quarterly revenue of $46.33 billion and record quarterly net profit of $13.06 billion, or $13.87 per diluted share. These results compare to revenue of $26.74 billion and net quarterly profit of $6 billion, or $6.43 per diluted share, in the year-ago quarter. Gross margin was 44.7 percent compared to 38.5 percent in the year-ago quarter. International sales accounted for 58 percent of the quarter’s revenue.

The Company sold 37.04 million iPhones in the quarter, representing 128 percent unit growth over the year-ago quarter. Apple sold 15.43 million iPads during the quarter, a 111 percent unit increase over the year-ago quarter. The Company sold 5.2 million Macs during the quarter, a 26 percent unit increase over the year-ago quarter. Apple sold 15.4 million iPods, a 21 percent unit decline from the year-ago quarter.

“We’re thrilled with our outstanding results and record-breaking sales of iPhones, iPads and Macs,” said Tim Cook, Apple’s CEO. “Apple’s momentum is incredibly strong, and we have some amazing new products in the pipeline.”

“We are very happy to have generated over $17.5 billion in cash flow from operations during the December quarter,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the second fiscal quarter of 2012, which will span 13 weeks, we expect revenue of about $32.5 billion and we expect diluted earnings per share of about $8.50.”

Apple will provide live streaming of its Q1 2012 financial results conference call beginning at 2:00 p.m. PST on January 24, 2012 at www.apple.com/quicktime/qtv/earningsq112. This webcast will also be available for replay for approximately two weeks thereafter.