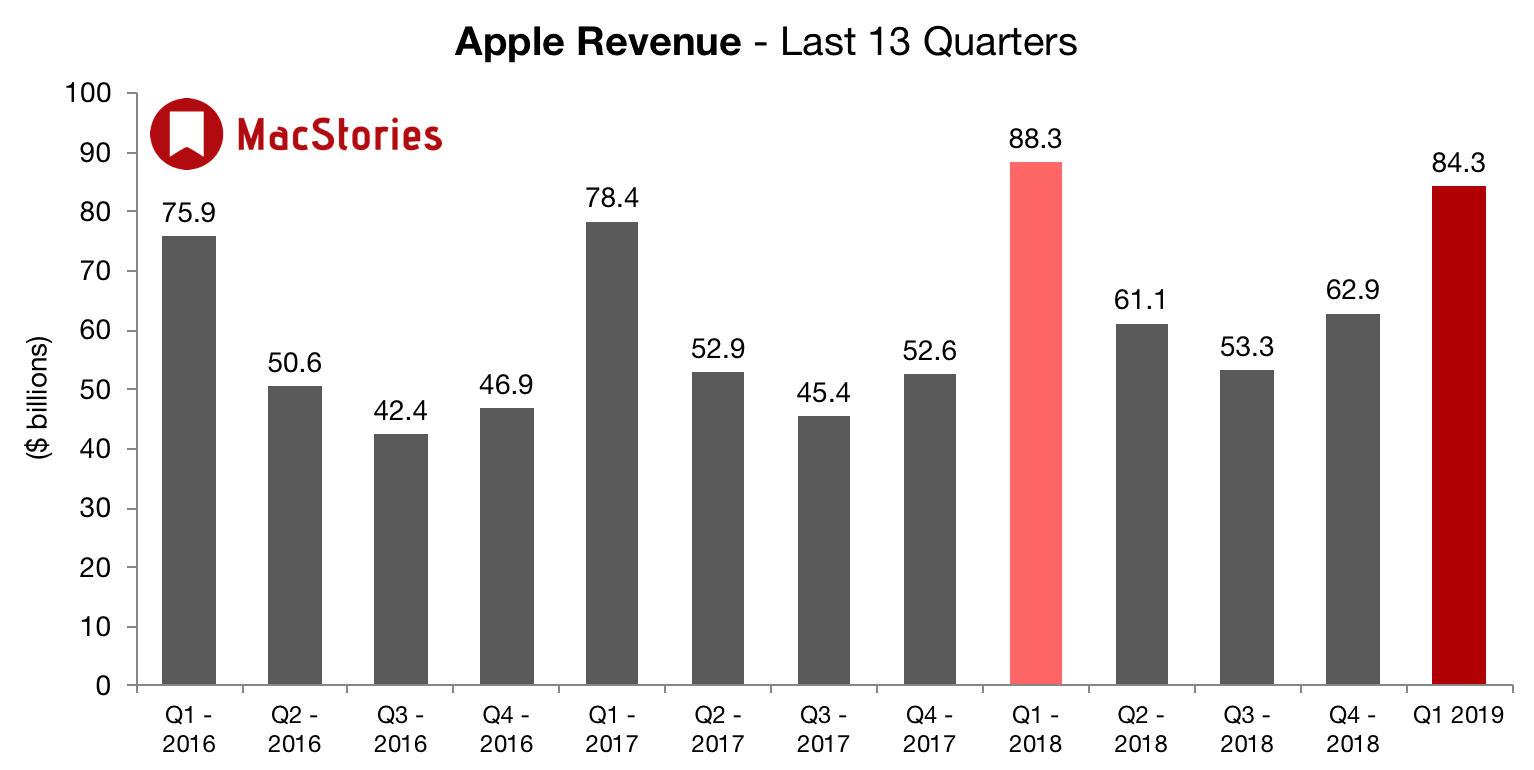

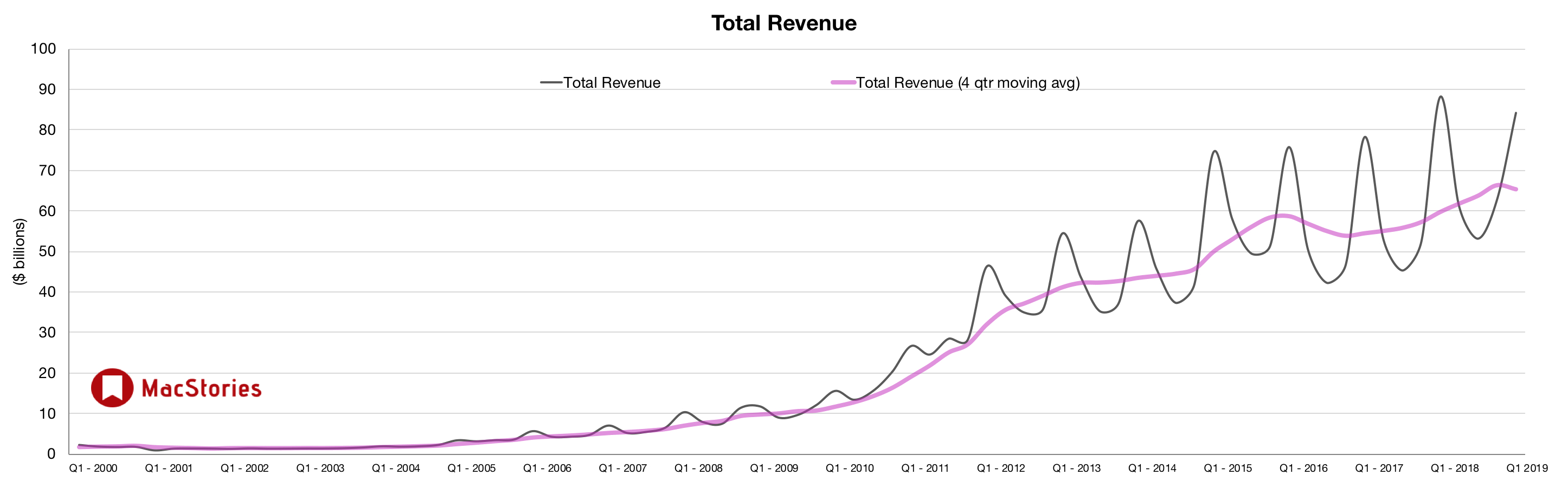

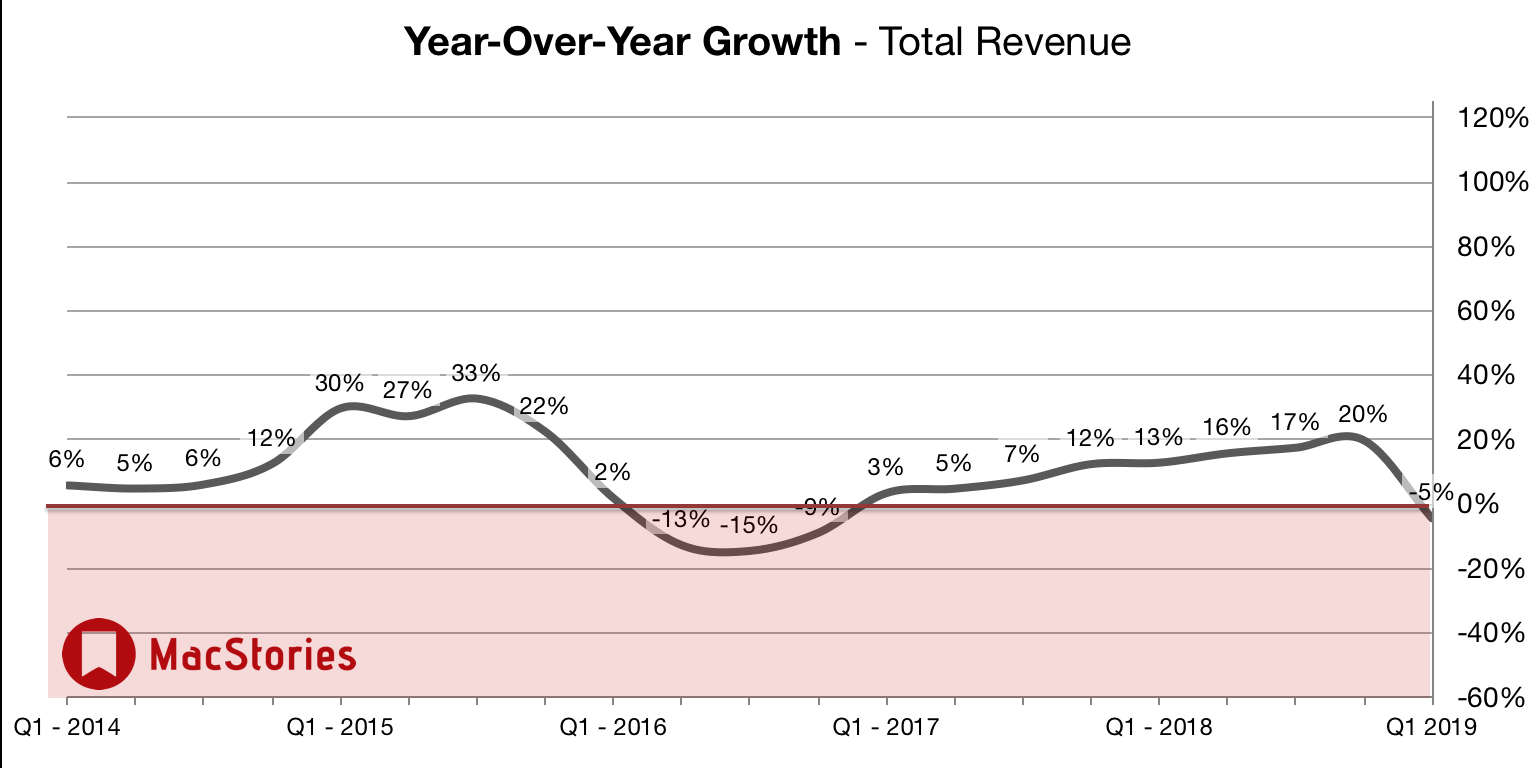

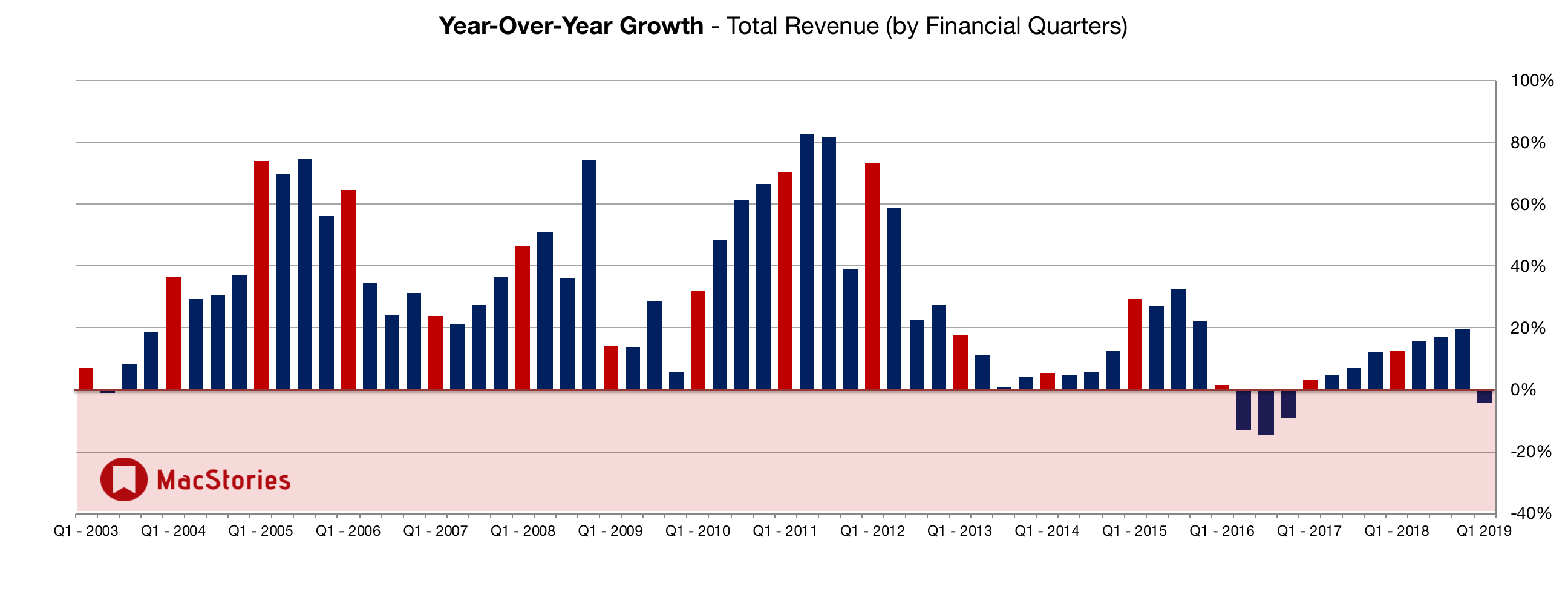

Apple has just published its financial results for Q1 2019, which is the company’s holiday quarter. The company posted revenue of $84.3 billion, which is the first holiday quarter decline in sales since the iPhone’s introduction. Apple CEO Tim Cook said:

“While it was disappointing to miss our revenue guidance, we manage Apple for the long term, and this quarter’s results demonstrate that the underlying strength of our business runs deep and wide,” said Tim Cook, Apple’s CEO. “Our active installed base of devices reached an all-time high of 1.4 billion in the first quarter, growing in each of our geographic segments. That’s a great testament to the satisfaction and loyalty of our customers, and it’s driving our Services business to new records thanks to our large and fast-growing ecosystem.”

Estimates and Expectations for Q1 2019 and the Year-Ago Quarter (Q1 2018)

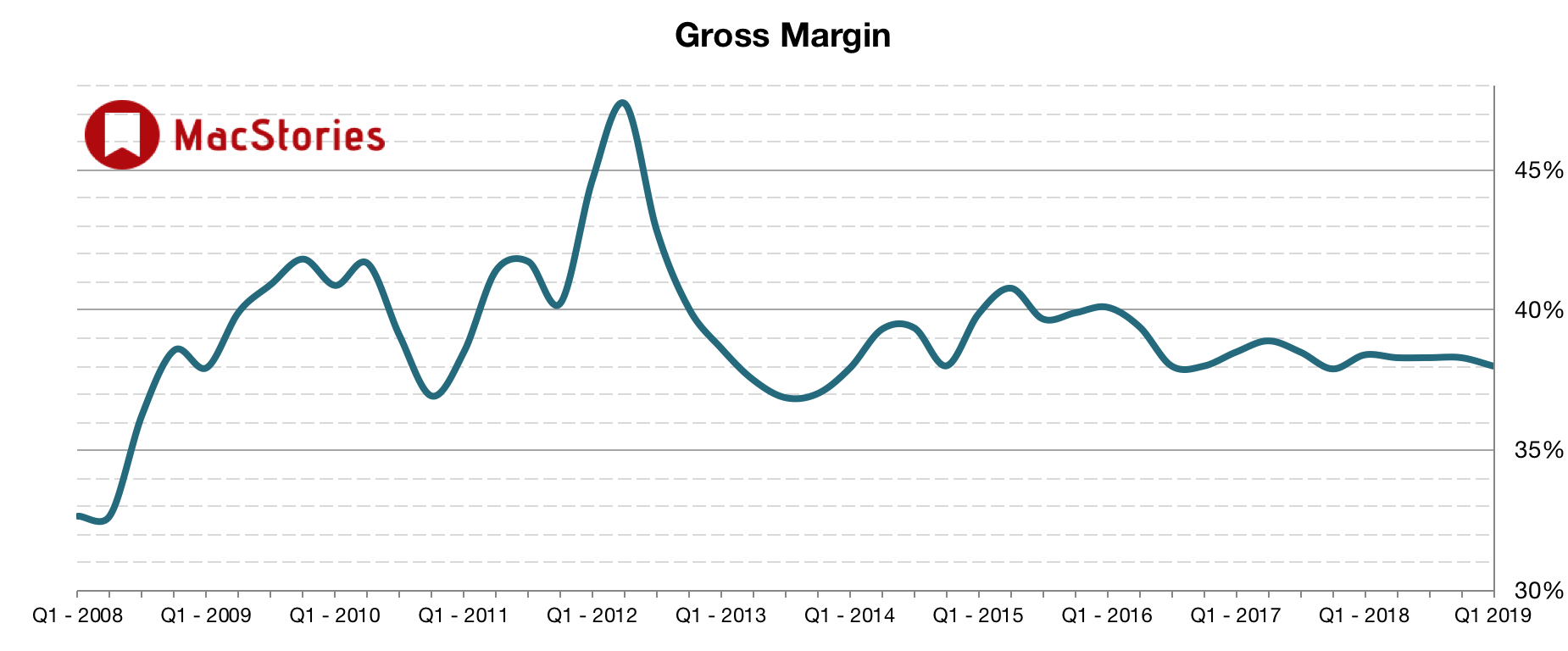

Apple’s original revenue guidance for Q4 2018 fell between $89 billion and $93 billion but was revised downward to $84 billion in a letter from CEO Tim Cook to shareholders that was released on January 2, 2019. Gross revenue which was originally estimated to be between 38% and 38.5%, was revised to 38% in Cook’s letter.

Going into today’s earnings call, Bloomberg reported that:

For Apple, the slowdown is expected to continue with fiscal second-quarter revenue of $59 billion, according to analyst estimate data compiled by Bloomberg. That would be a year-over-year decline of about 4 percent.

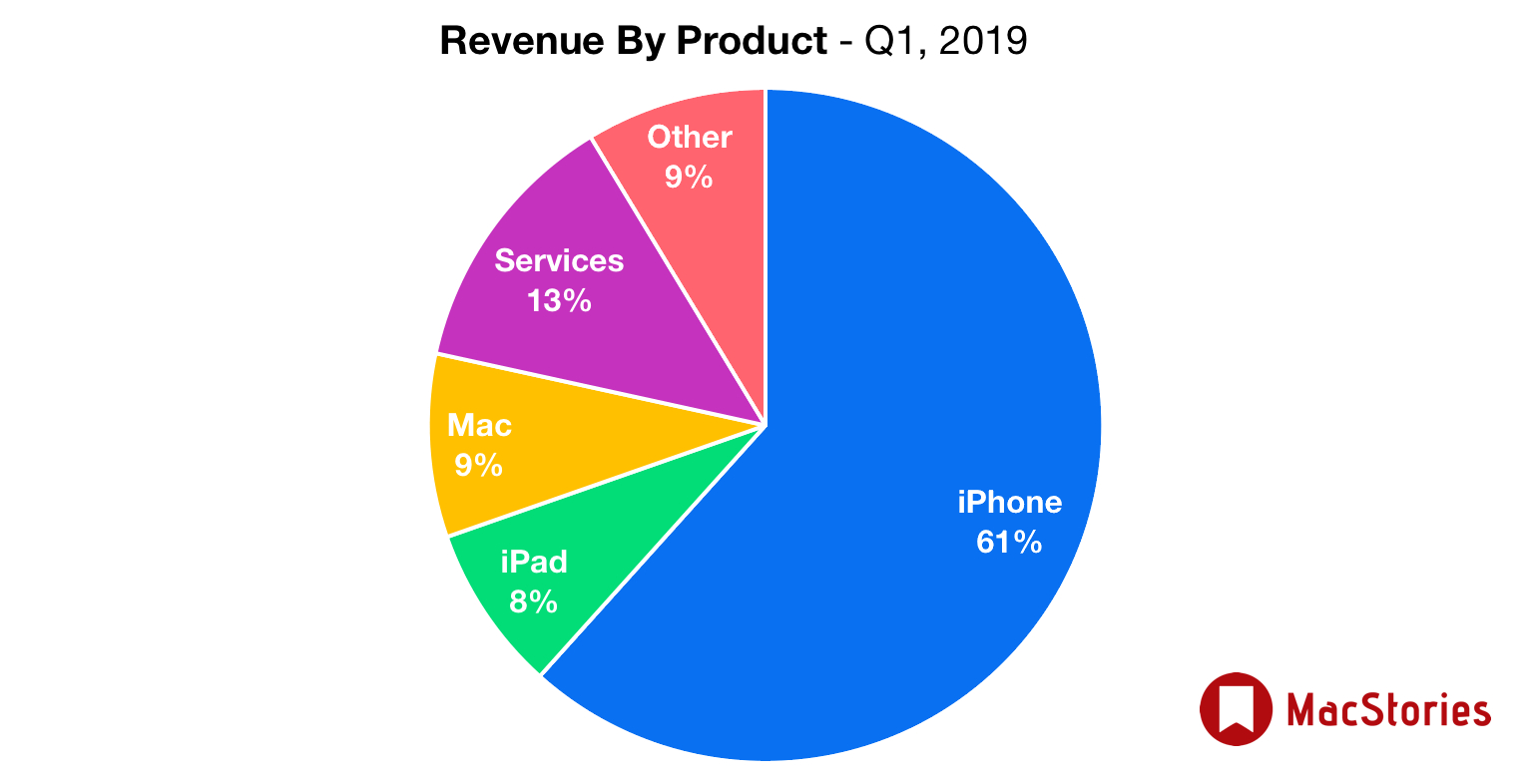

In the year-ago quarter (Q1 2018), Apple earned $88.3 billion in revenue. During that quarter Apple sold 77.3 million iPhones, 13.2 million iPads, and 5.1 million Macs. As announced on Apple’s last earnings call, the company did not report Q1 2019 unit sales for any of its products.

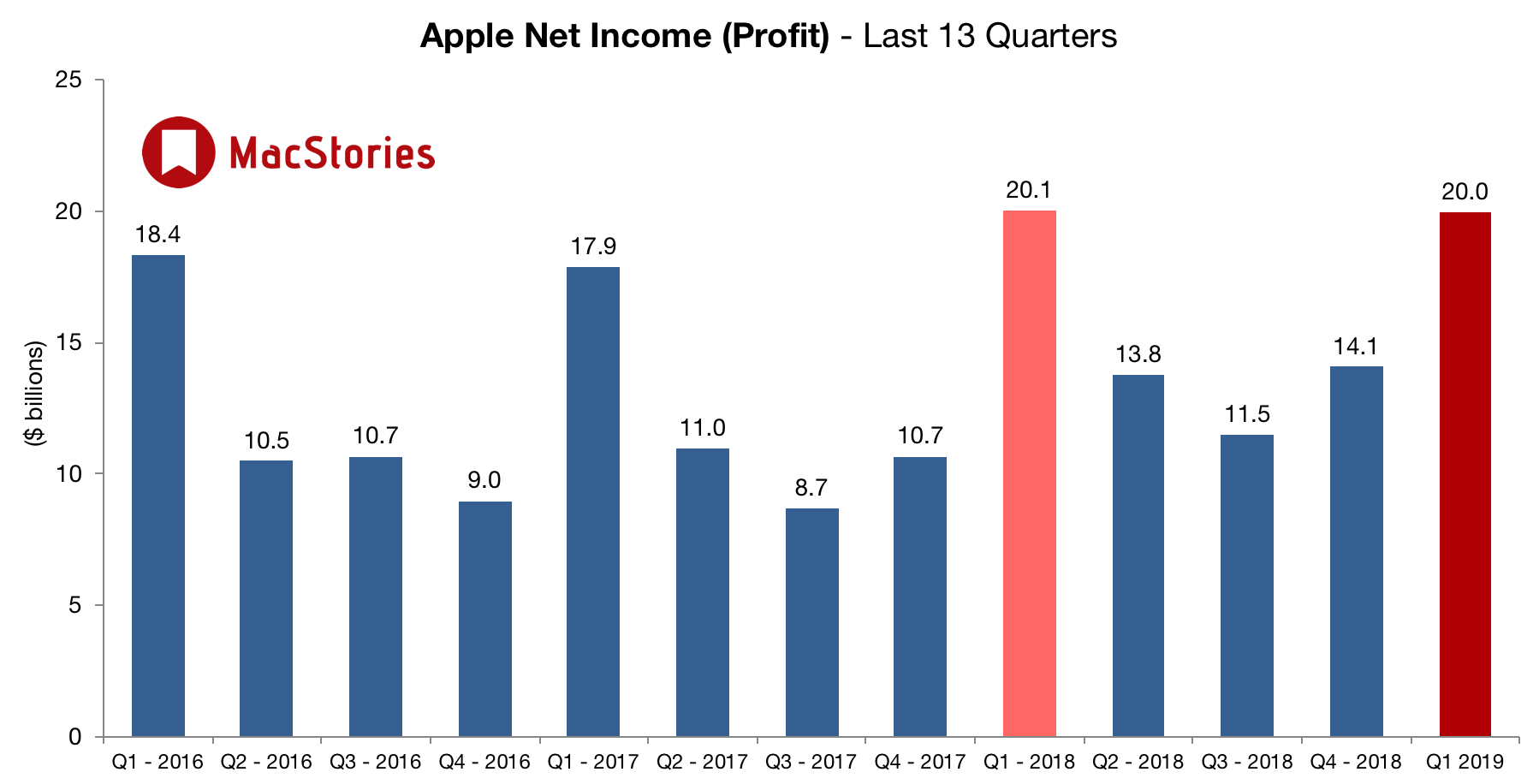

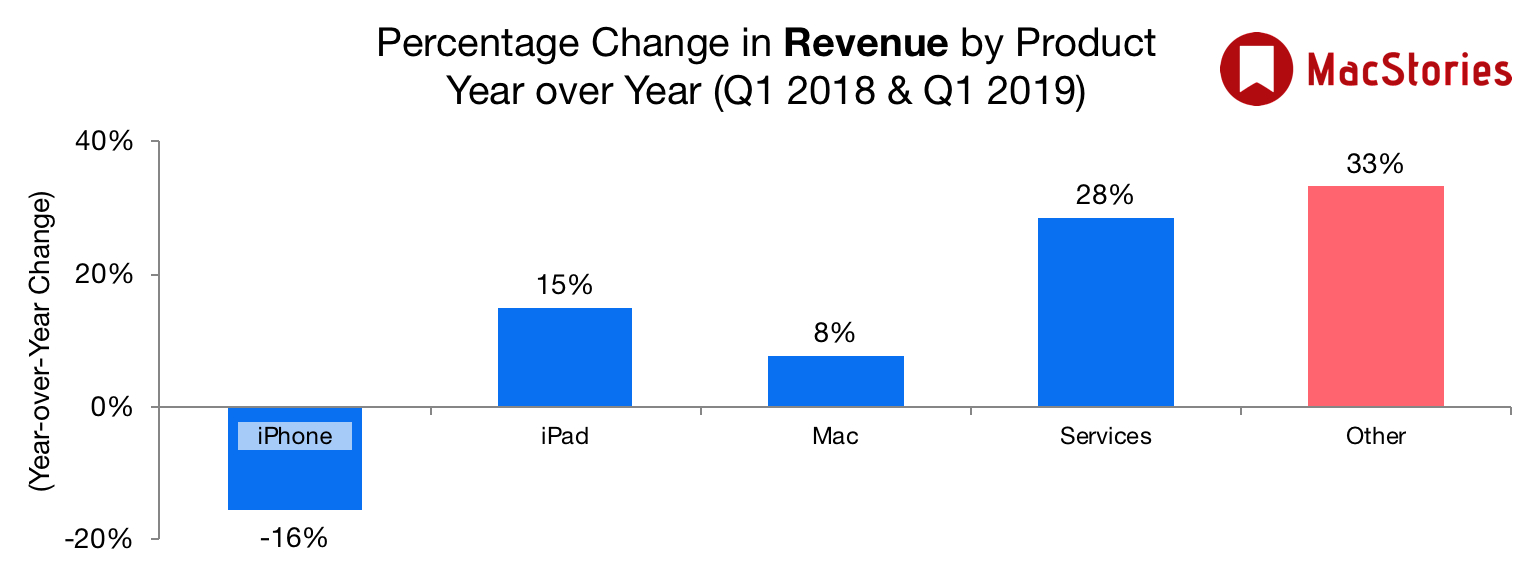

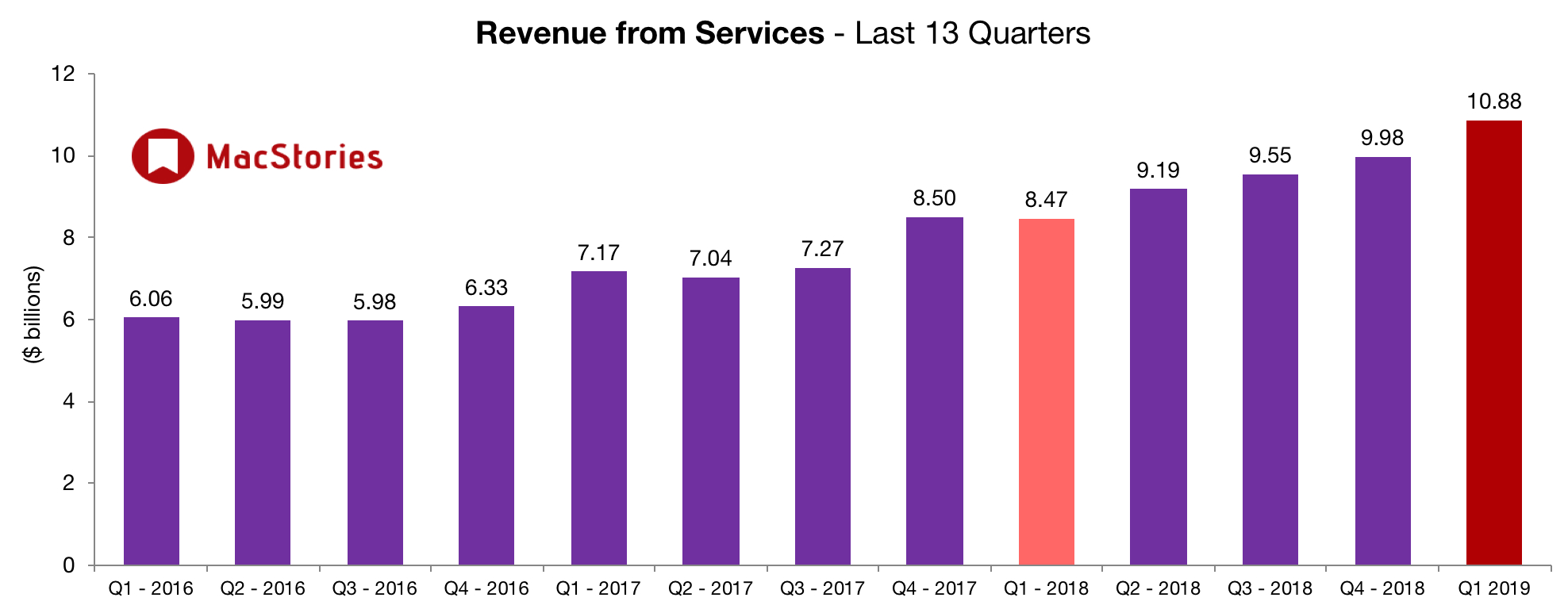

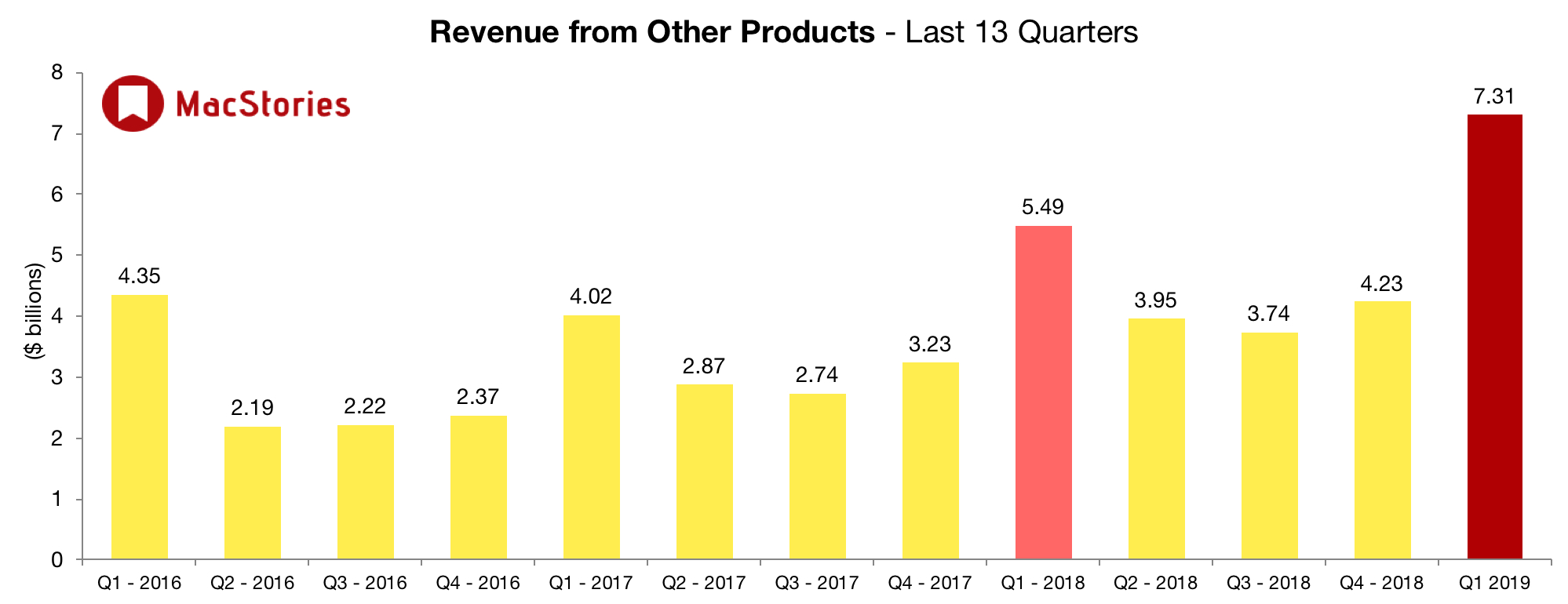

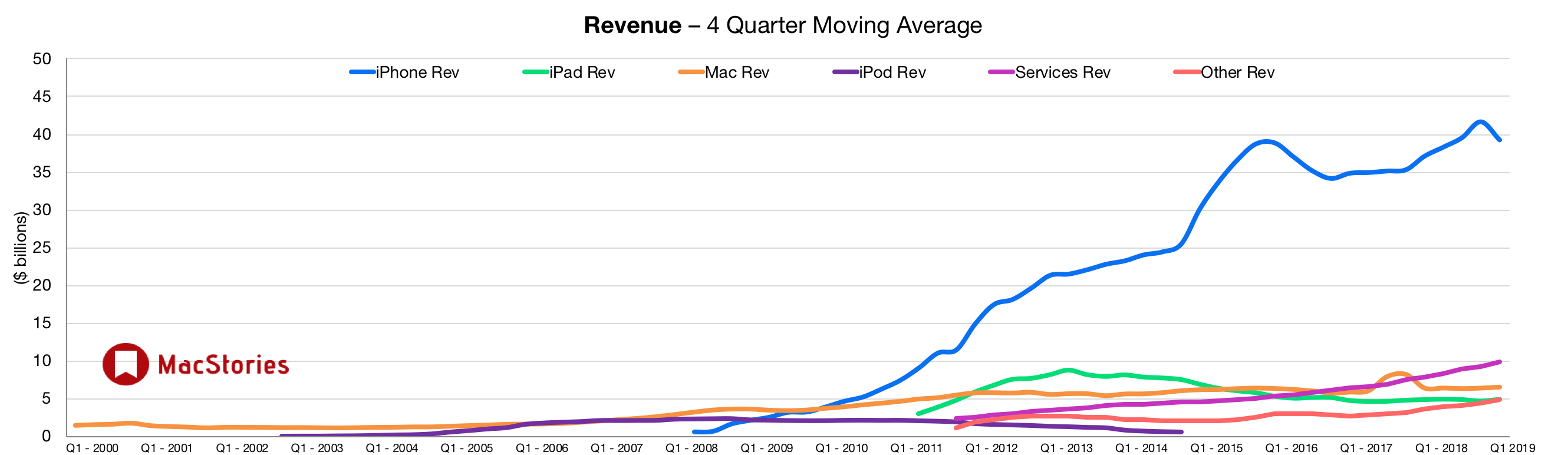

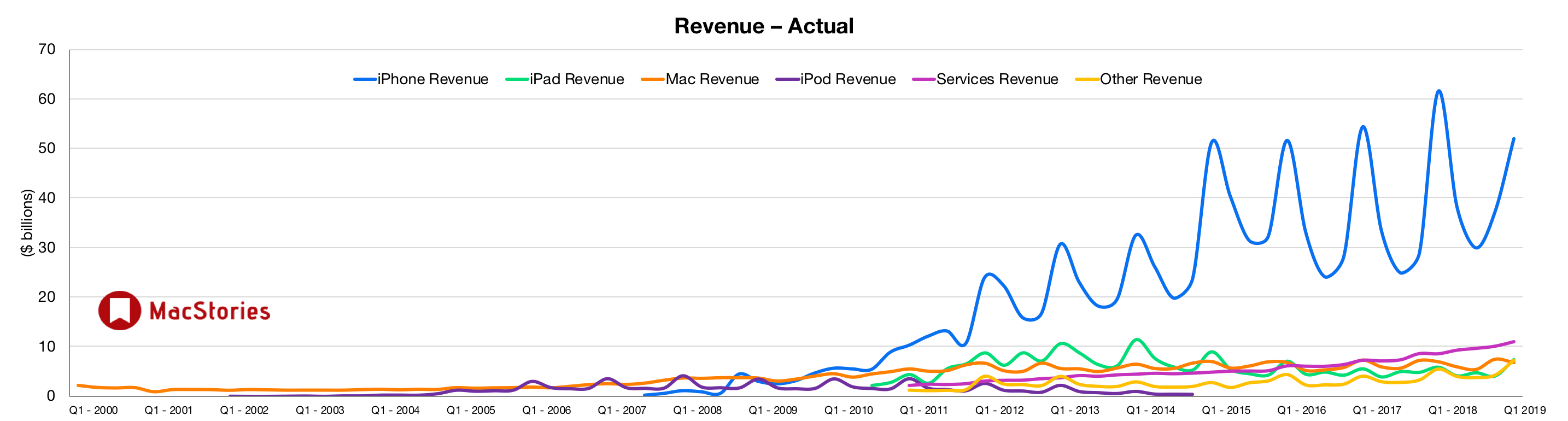

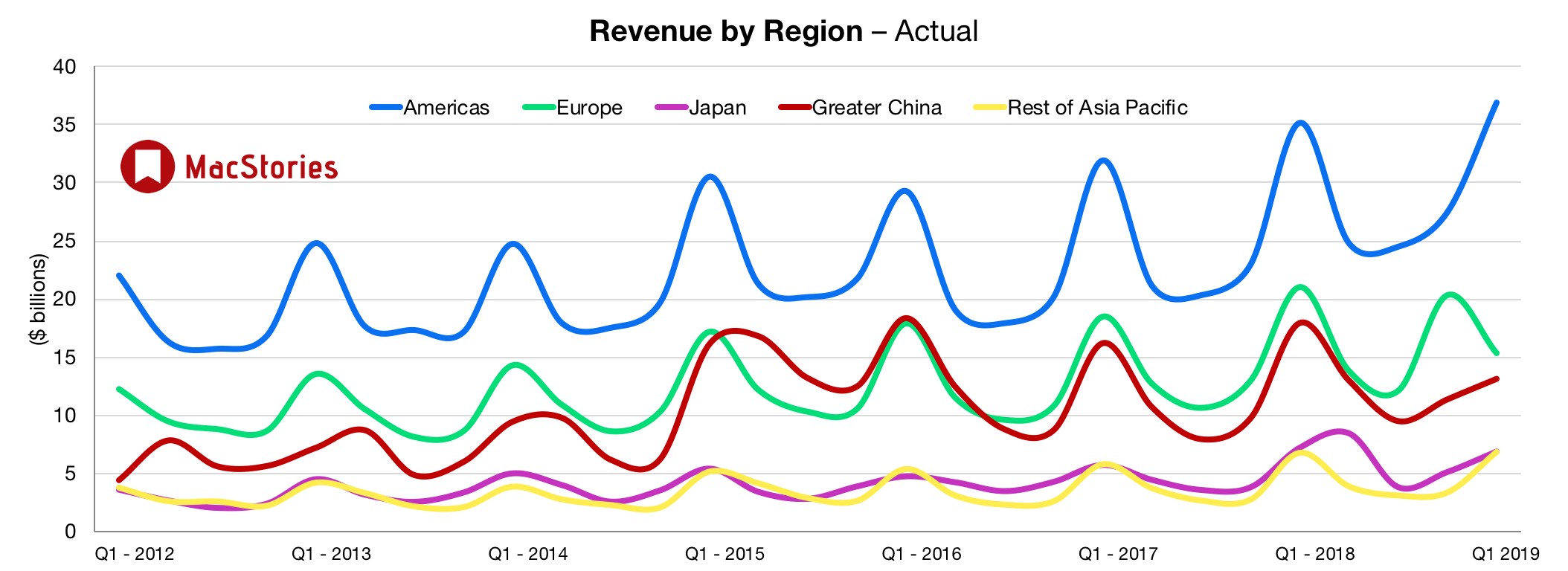

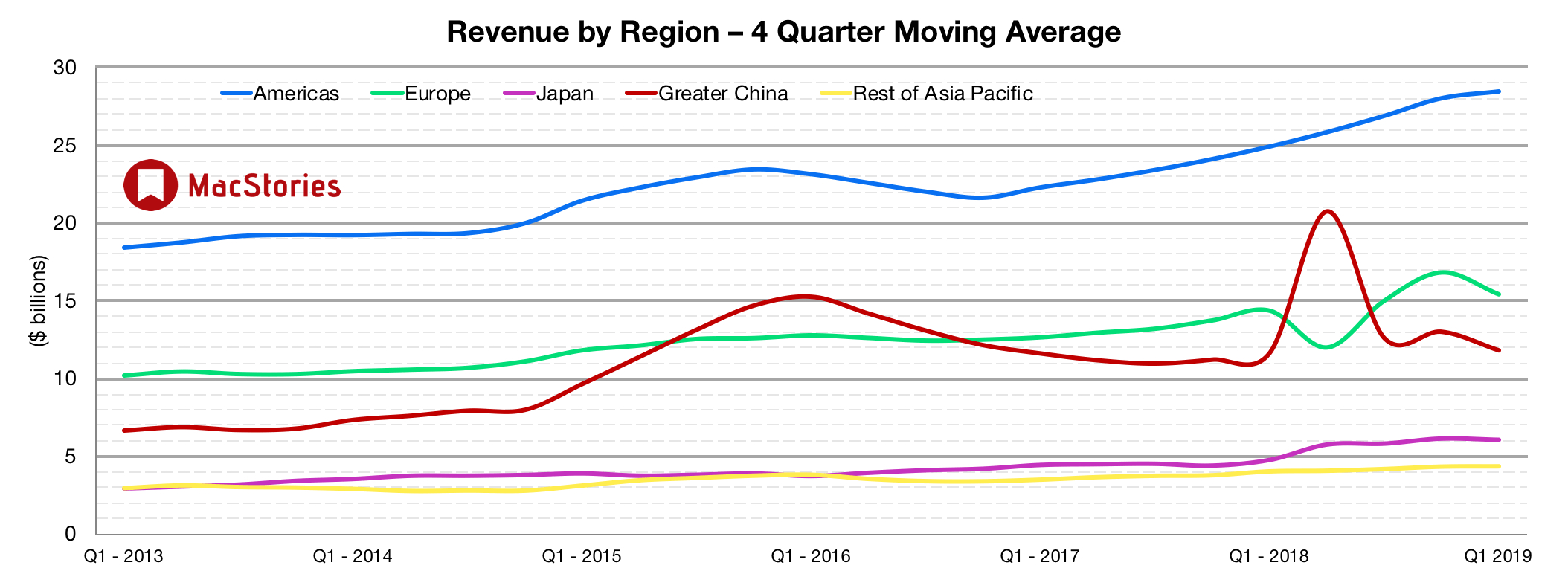

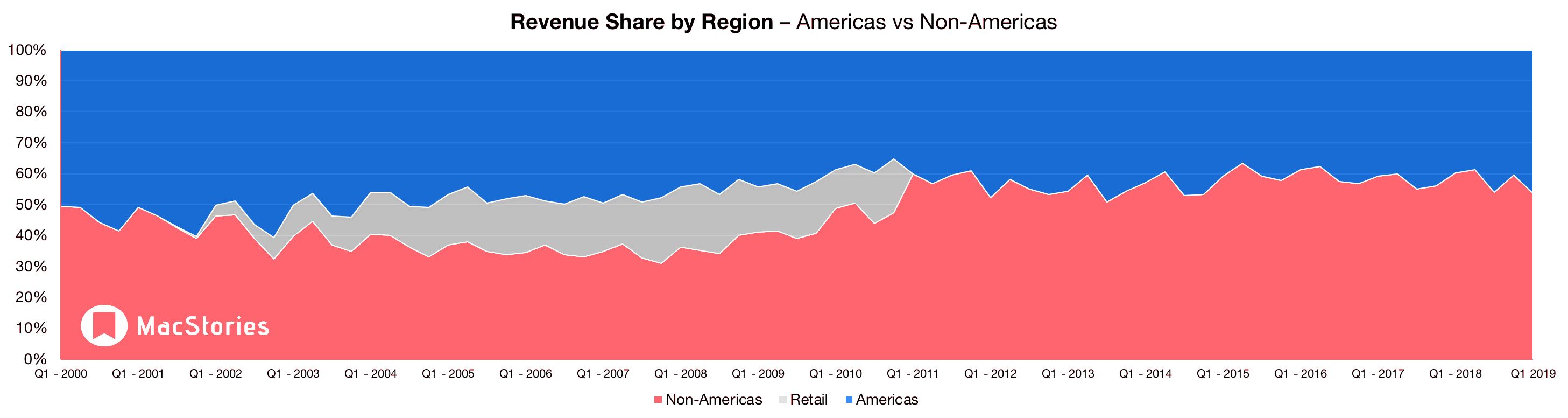

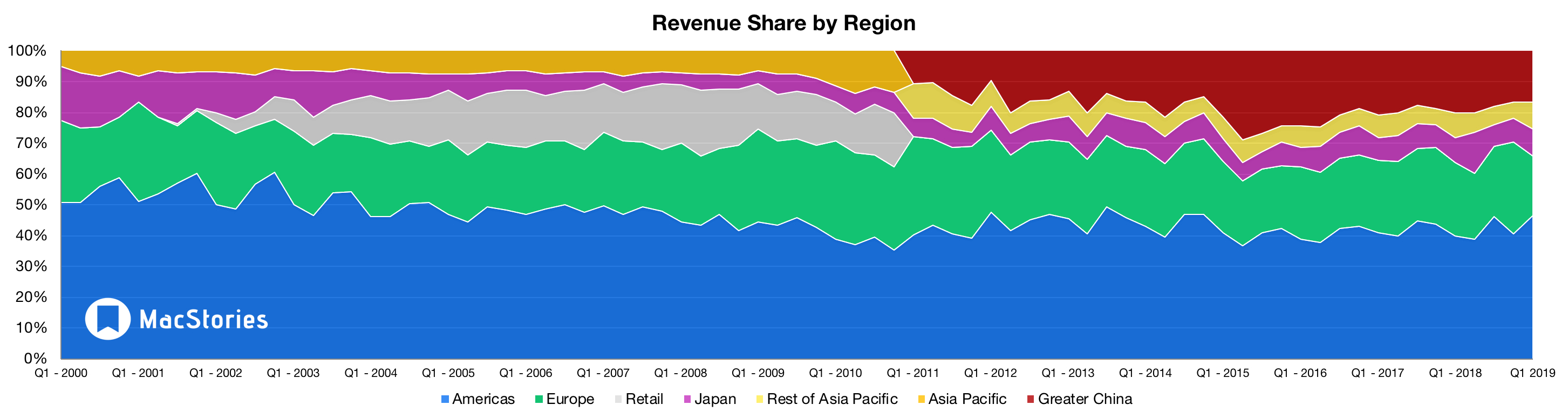

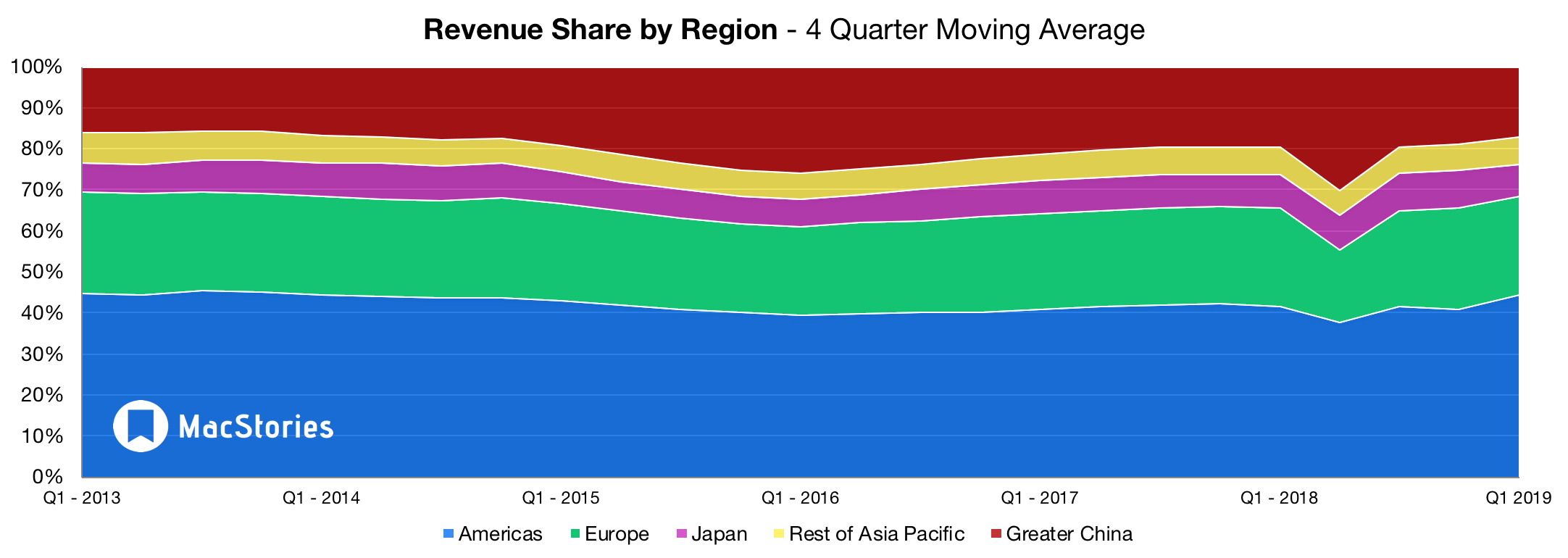

Graphical Visualization

Below, we’ve compiled a graphical visualization of Apple’s Q1 2019 financial results.

Apple Q1 2019 on Twitter

Apple’s guidance for the next quarter:

• revenue between $55 billion and $59 billion

• gross margin between 37 percent and 38 percent

• operating expenses between $8.5 billion and $8.6 billion— jeffersongraham (@jeffersongraham) January 29, 2019

Other segments and YOY percentage changes:

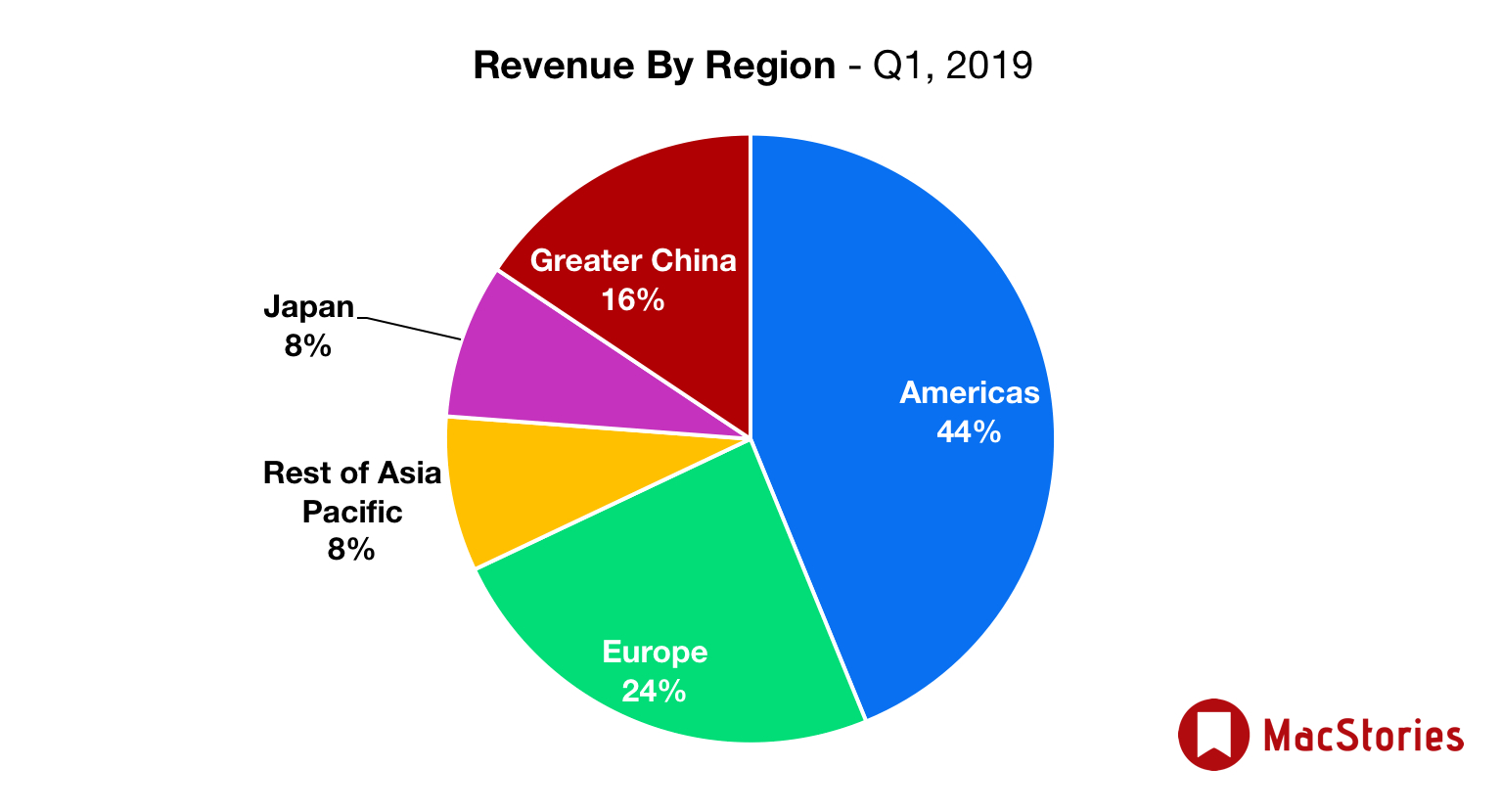

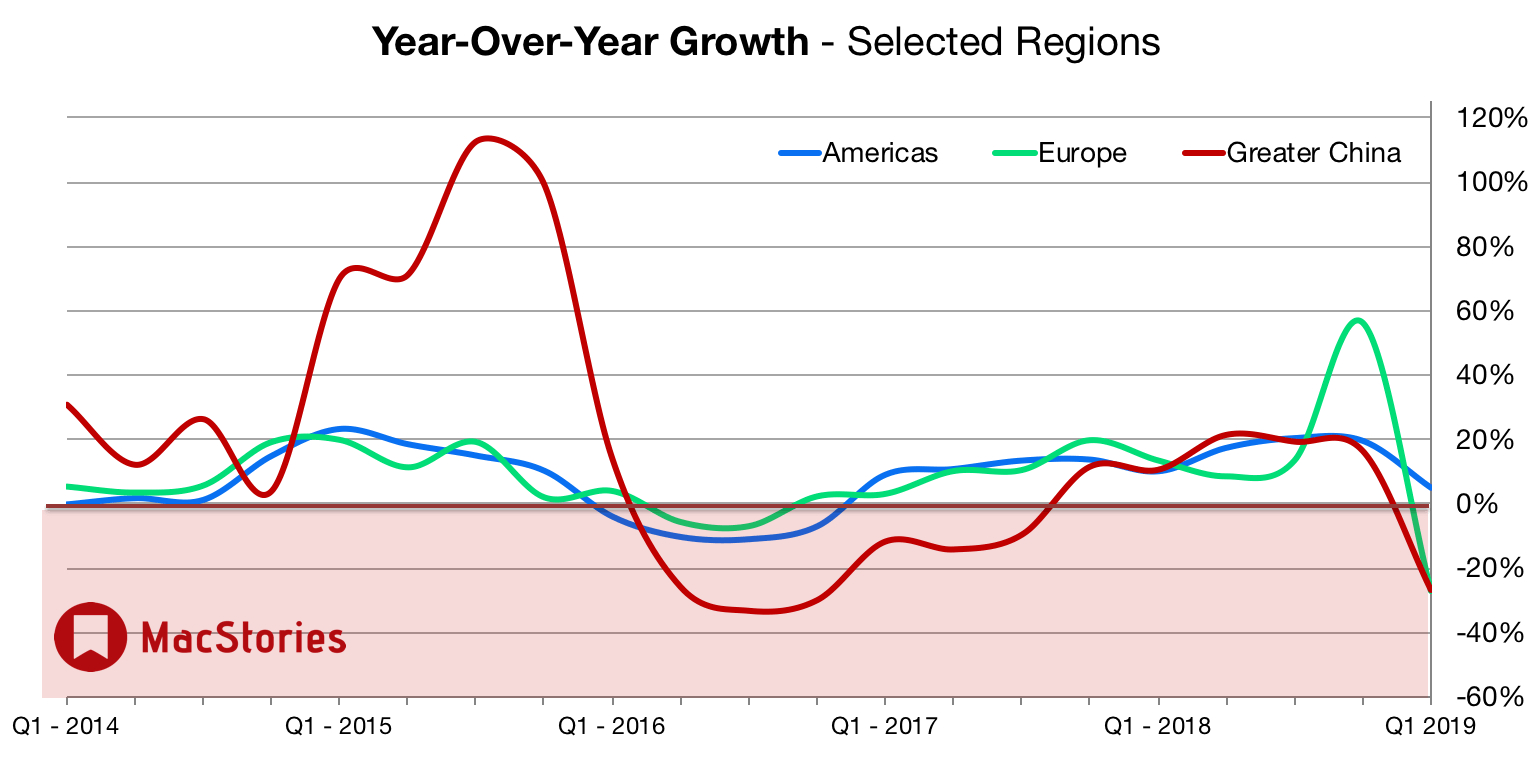

Americas: $36.9b (up 5%)

Europe: $20.4b (down 3.3%)

Japan: $6.9b (up 1%)

Asia-Pacific: $6.9b (up 0.8%)— Six Colors liveblog (@sixcolorsevent) January 29, 2019

Here’s the year-to-year geographic comparison: pic.twitter.com/j1Thb2I6FQ

— MacJournals.com (@macjournals) January 29, 2019

For reference, here are the changes from 2018 “revenue” -> 2019 “net sales by category”:

iPhone: $61.576B -> $61.104B

iPad: $5.862B -> $5.755B

Mac: $6.895B -> $6.824BThese are all for Q1 FY18 (the year-ago period), first as reported at the time as “Revenues” and now as “sales”

— MacJournals.com (@macjournals) January 29, 2019

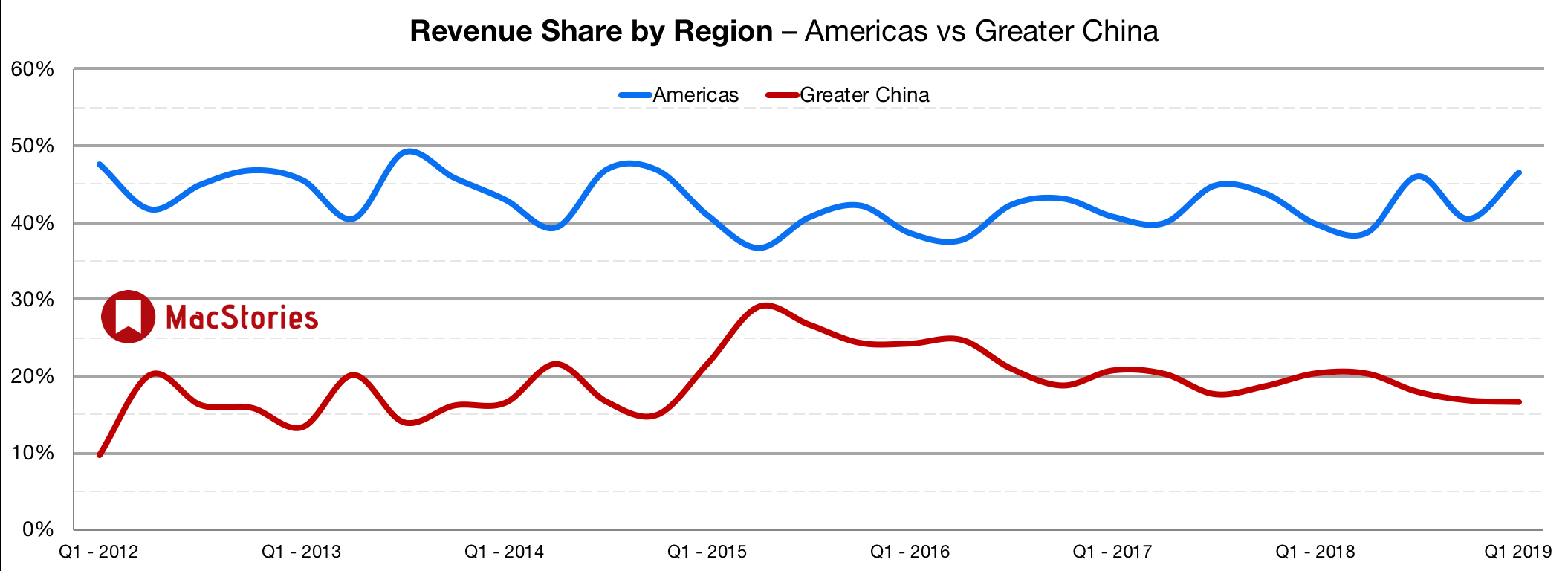

Tim Cook (TC): Over 100% of our worldwide revenue gap from guidance is due to Greater China.

— MacJournals.com (@macjournals) January 29, 2019

Tim: Record performance in large markets, including US, Canada, Germany, Spain, and Korea.

— Six Colors liveblog (@sixcolorsevent) January 29, 2019

JUST IN: Apple now has $245,000,000,000 of cash on hand, up 3% from last quarter. https://t.co/IFm4rlohlG pic.twitter.com/mgWhEmNddt

— CNBC Now (@CNBCnow) January 29, 2019

Over 50 million Apple Music subscribers. iTunes had it’s best revenues ever.

— Rene Ritchie (@reneritchie) January 29, 2019

The battery program was the right thing to do for #AAPL. Not because they are a charity business but because it means delaying revenue rather than upsetting customers and losing them!

— Carolina Milanesi (@caro_milanesi) January 29, 2019

$AAPL’s @tim_cook: Now talking about Apple’s lead in silicon. Pointing out how AI is being built into the technology. “It does all this while keeping personal information private.”

No mention of FaceTime Bug though while banging the privacy drum.

— Ian Sherr (@iansherr) January 29, 2019

Apple confirms 900m active iPhone base

— Benedict Evans (@benedictevans) January 29, 2019