Philip Elmer-Dewitt reports on analysts’ expectations for iPhone sales in Apple’s first financial quarter of 2012 (which ended last week):

The numbers from the 22 Wall Street analysts who have responded so far to our call for estimates range from a high of 35 million iPhones from BTIG’s Walter Piecyk to a low of 25.2 million from Gabelli’s Hendi Susanto. The average among this group is 29.74 million, which would represent a year-over-year increase of 83%.

The average among our panel of 15 independents – an assortment of bloggers, enthusiasts and individual investors – is 33.42 million iPhones, or an annual increase of nearly 106%. Among this group, the estimates range from a high of 35.75 million from Posts at Eventide’s Robert Paul Leitao to a low of 30.17 million from Alexis Cabot of the MacObserver’s Apple Finance Board.

To put these predictions in context, here’s how Apple performed in its previous Q1s:

- Q1 2008: 2.315 million units

- Q1 2009: 4.363 million units

- Q1 2010: 8.7 million units

- Q1 2011: 16.24 million units

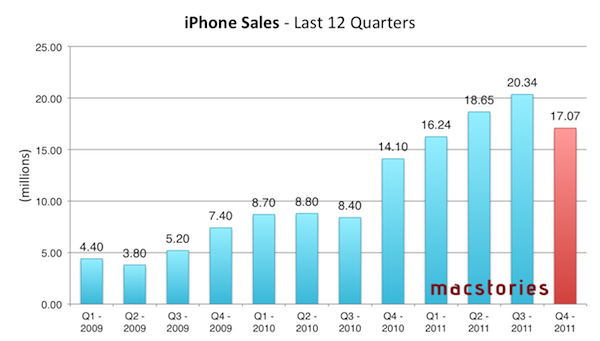

And here’s a graph showing every iPhone quarter to date:

Predictions for Q1 2012 (results will be announced on January 24) now range between 25.2 million and 35.75 million iPhones sold. Either way, it’s going to be a “blow-out quarter” for iPhone sales – even if we consider Apple’s Q3 2011, the biggest ever for iPhone sales to date with 20.34 million units sold.

It’ll be interesting to observe how Asia-Pacific will perform in relation to iPhone sales, too, as Apple reported overall sales more than doubled in Q4 2011. As for Q1 2012 itself, Apple CEO Tim Cook said they were confident to have enough 4S supply to go through the holiday season, and also confirmed the company was expecting record iPhone sales for the quarter with revenue guidance set at $37 billion (Asymco’s Horace Dediu, however, expects revenue to hit $44 billion).