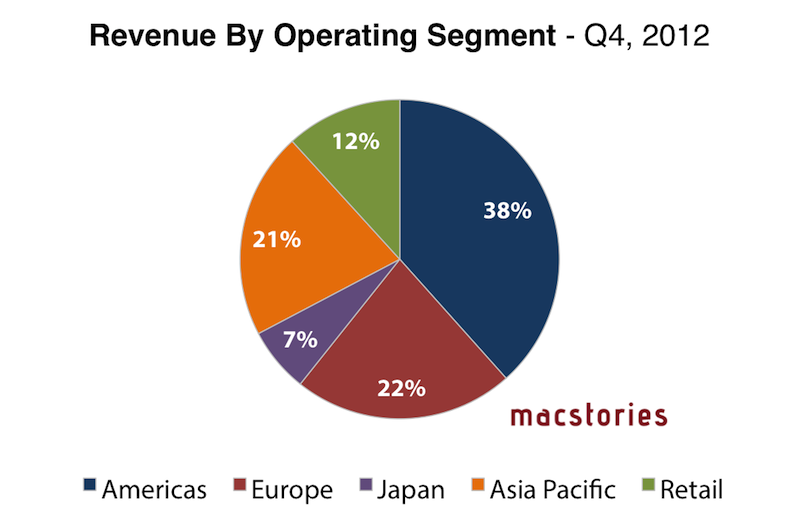

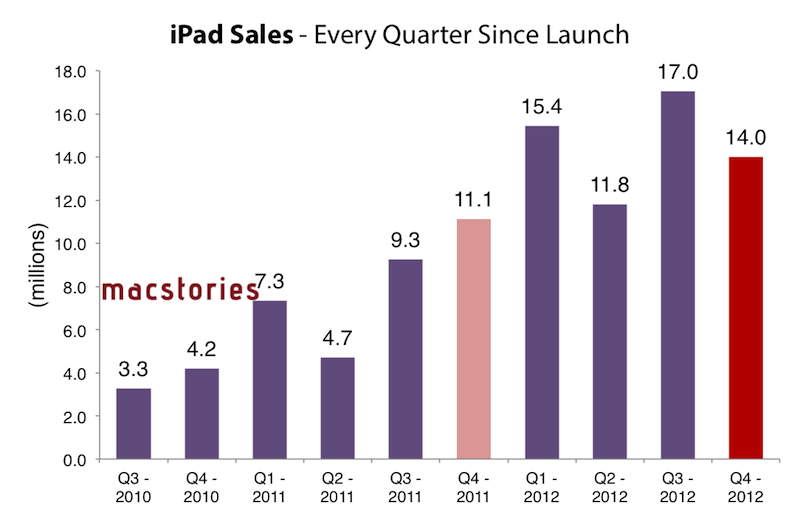

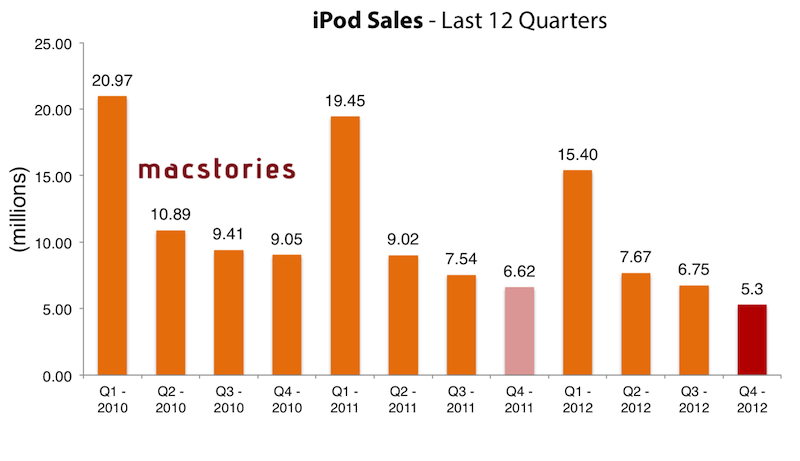

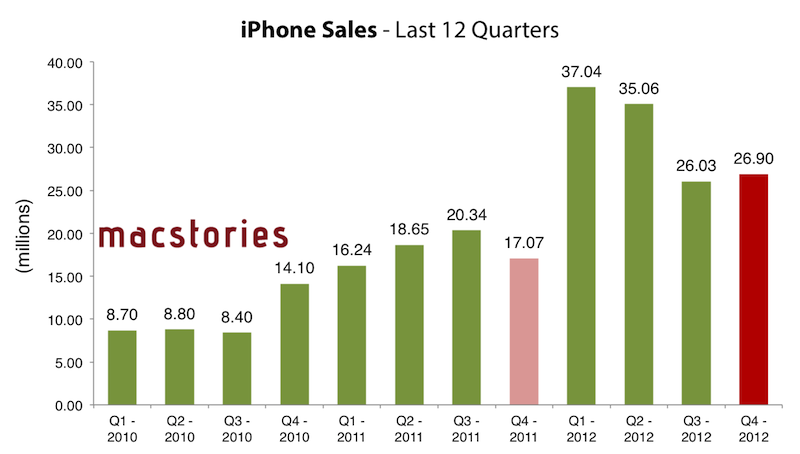

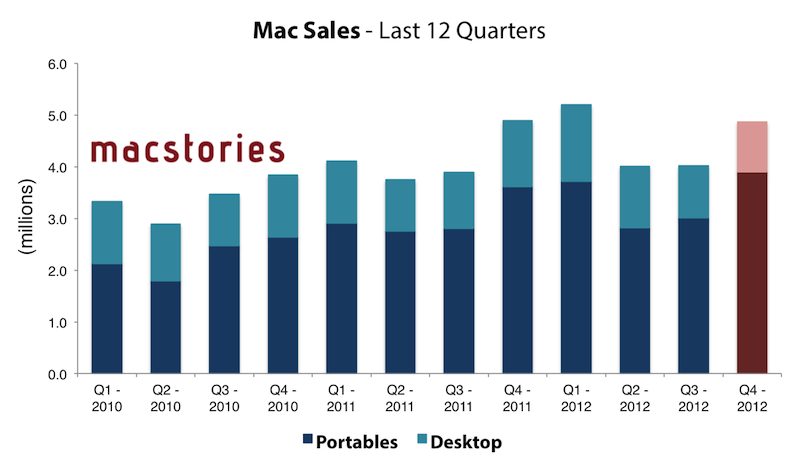

Apple has just posted their Q4 2012 financial results for the quarter that ended on September 29, 2012. The company posted revenue of $36 billion ($8.67 per diluted share), with 14 million iPads, 26.9 million iPhones and million 4.9 Macs sold. Apple sold 5.3 million iPods. The company reported quarterly net profit of $8.2 billion. Gross margin was 40.0 percent compared to 40.3 percent in the year-ago quarter. International sales accounted for 60 percent of the quarter’s revenue.

In this quarter, Apple’s Board of Directors has declared a cash dividend of $2.65 per share of the Company’s common stock.

The dividend is payable on November 15, 2012, to shareholders of record as of the close of business on November 12, 2012.

From the press release:

We’re very proud to end a fantastic fiscal year with record September quarter results,” said Tim Cook, Apple’s CEO. “We’re entering this holiday season with the best iPhone, iPad, Mac and iPod products ever, and we remain very confident in our new product pipeline.

We’re pleased to have generated over $41 billion in net income and over $50 billion in operating cash flow in fiscal 2012,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the first fiscal quarter of 2013, we expect revenue of about $52 billion and diluted earnings per share of about $11.75.

Estimates and Previous Quarters

For Q4 2012, Apple had set its guidance at revenue of about $34 billion and diluted earnings per share of about $7.65.

The Street consensus’ average estimate was earnings of $8.75 per share and revenue of $35.80 billion.

On October 24, 2012, both independent and “pro” analysts polled by Fortune (68 in total) forecasted earnings and revenue higher than Apple’s guidance, as it often happens.

After getting clobbered quarter after quarter for nearly four years by a bunch of bloggers, day traders and other amateur analysts, the professionals seem to be giving their clients more realistic numbers. And having badly misjudged two of the last four quarters, the more bullish independents have, for the most part, started to come back to earth.

In Fortune’s poll, the “pros” averaged earnings per share of $8.82 on sales of $36.02 billion; the independent analysts forecasted earnings of $10.14 on sales of $38.8 billion.

Horace Dediu of Asymco also published his forecast for Apple’s fourth fiscal quarter on September 20, 10 days before the quarter (and fiscal year) ended. As he notes, it’ll be difficult to predict iPhone sales for the quarter as consumers have been probably holding off their purchase due to rumors of a product refresh. Furthermore, the iPhone 5 has only been on sale during the quarter for 8 days: the device went on sale in 9 countries on September 21, and 22 more on September 28. Apple only stated that iPhone 5 sales topped over 5 million units during the opening weekend.

The iPhone is going to be extremely difficult to project. On one hand we have the launch of the i5 which will account for about 10 million units in the quarter, on the other, chances are that sales were very weak prior to the launch as purchases were being deferred even more than during the last quarter.

Horace Dediu’s forecast was the following:

- iPhone units: 27.8 million (62%)

- Macs: 5.6 million (15%)

- iPads: 18.8 million (69%)

- iPods: 5.6 million (–15%)

- Music (incl. app) rev. growth: 40%

- Peripherals rev. growth: 10%

- Software rev. growth: 15%

- Total revenues: $39.5 billion (40%)

- GM: 42%

- EPS: $9.75 (38%)

A better picture of iPhone 5 sales, as well as those from the iPad mini, iPad 4, and recently-updated Macs, will be offered by Apple’s current holiday quarter – Q1 2013.

In the previous quarter, Q3 2012, Apple posted revenue of $35 billion, with 17 million iPads, 26 million iPhones and 4 million Macs sold. iPhone represented a 28 percent unit growth over the year-ago quarter, while iPad reported a 84 percent unit increase over the year-ago quarter. Apple sold 6.8 million iPods, a 10 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $8.8 billion, or $9.32 per diluted share. International sales accounted for 62 percent of the quarter’s revenue.

In the year-ago-quarter, Q4 2011, Apple posted record-breaking revenue of $28.27 billion, with 11.12 million iPads, 17.07 million iPhones and 4.89 million Macs sold.

Apple will provide a live audio feed of its Q4 2012 conference call at 2:00 PM PT, and we’ll update this story with the conference highlights. You can find the full press release and a graphical visualization of Apple’s Q4 2012 after the break.

Notes from the Call

- Highest September quarter revenue and earnings ever.

- 4.9 million Macs sold.

- 3-4 weeks of Mac channel inventory, below target of 4-5.

- MacBook sales now represent 80% of all Mac sales.

- iPod touch accounts for half of all iPod sales.

- iPod share is over 70% in NPD data, iPod is the most popular MP3 worldwide.

- Demand for new iPhone is “phenomenal”.

- iPad sales have been ahead of expectations in all regions.

- Average selling price of laptops was higher than desktop.

- $6.5 billion paid to developers.

- 700,000 apps available on the App Store, 275,000 for iPad.

- iCloud has registered 190 million accounts in the first year.

- Apple retail stores generated $4.2 billion revenue in the quarter.

- 18 new stores in 10 countries.

- Opened first retail store in Sweden.

- 19,000 visitors per store per week.

- $121.3 billion in cash for Apple (after dividend pay out)

- Tim Cook: “We’re dedicated to making the best products in the world.”

- iPad mini’s gross margin is significantly below the corporate average.

- iPhone 5 is the largest product ramp-up in Apple’s history.

- Tim Cook: “Demand for iPhone is extremely robust. We’re thrilled with what we see. We are in a significant state of backlog right now.”

- TC: “We continue to be confident that tablet market will surpass PC market. There is incredible development in both ecosystems and products going on in tablet space. It is already extremely compelling for many customers to choose a tablet, in particular an iPad over a PC. There is an enormous opportunity there - pretty much each quarter you see 80 to 90 million PCs sold. We do think that iPad mini, iPad, and iPad 2 will all be extremely attractive offerings for people in lieu of PCs. We’re going to continue, you know, to very much focus on the future of iPad. We are very confident with what we have in pipeline. We can’t wait until next Friday until we start selling first (iPad mini) units.”

- TC: “We are extremely happy with how we’ve done in China.”

- TC: “I haven’t personally played with a Surface yet, but what we’re reading about it is that it’s a fairly compromised confusing product.”

- TC: “I think one of the toughest things you do when deciding products is to make hard trade-offs and decide what a product should be, and we’ve done that with the iPad. The user experience is incredible. I suppose you could design a car that flies and floats, but it wouldn’t do those things very well. I think people when they look at the iPad vs. competitors, they will conclude they want an iPad. They’ve done that today and will continue to do so.”

- TC: “The way we look at this is that we provide an iPod touch, an iPad, and iPad mini, and an iPad 2. Customers will decide which ones they like and will buy those. We don’t worry about canibalization of our products. Far far bigger opportunity is the 80 to 90 million PCs sold per quarter. I think a great number of those people would be much better off buying an iPad or a Mac. I think that’s a bigger opportunity for Apple. instead of being focused on cannibalising ourselves, I look at it as an enormous incremental opportunity.”

- 1.3 million Apple TVs sold in Q4. Over 100% year-over-year, but still a hobby.

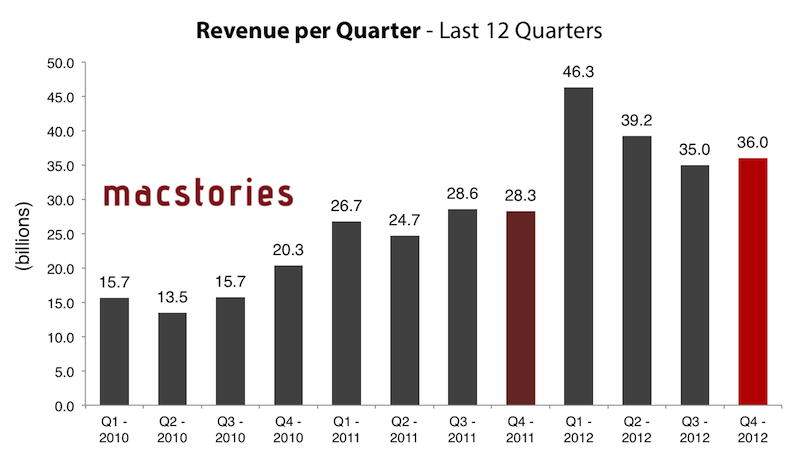

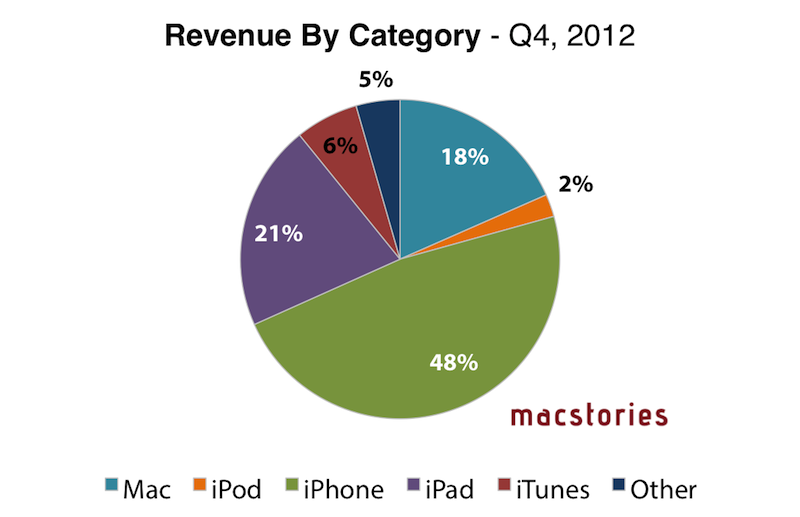

Graphical Visualization

We have compiled a series of graphs and charts to offer a graphical visualization of Apple’s fourth 2012 fiscal quarter. (click for full-size)

Below, a summary of Apple’s previous fiscal quarters by revenue and profit since 2008. For context – 2008, 2009, and 2010 revenue combined generated $134.23 billion for Apple. 2012 alone generated $156.53 billion.

Another interesting tidbit to understand the growth of the company: 2008, 2009, and 2010 combined generated $24.57 billion in profit; 2012 alone generated $41.66 billion.

Previous Fiscal Quarters (in Billions)

| Fiscal Quarters (2012) | Revenue | Profit |

|---|---|---|

| Q1 | $46.33 | $13.06 |

| Q2 | $39.2 | $11.6 |

| Q3 | $35 | $8.8 |

| Q4 | $36 | $8.2 |

| Total | $156.53 | $41.66 |

| Fiscal Quarters (2011) | Revenue | Profit |

|---|---|---|

| Q1 | $26.74 | $6 |

| Q2 | $24.67 | $5.99 |

| Q3 | $28.57 | $7.31 |

| Q4 | $28.27 | $6.62 |

| Total | $108.25 | $25.92 |

| Fiscal Quarters (2010) | Revenue | Profit |

|---|---|---|

| Q1 | $15.68 | $3.38 |

| Q2 | $13.50 | $3.07 |

| Q3 | $15.7 | $3.25 |

| Q4 | $20.34 | $4.31 |

| Total | $65.22 | $14.01 |

| Fiscal Quarters (2009) | Revenue | Profit |

|---|---|---|

| Q1 | $10.17 | $1.61 |

| Q2 | $8.16 | $1.21 |

| Q3 | $8.34 | $1.23 |

| Q4 | $9.87 | $1.67 |

| Total | $36.54 | $5.72 |

| Fiscal Quarters (2008) | Revenue | Profit |

|---|---|---|

| Q1 | $9.6 | $1.58 |

| Q2 | $7.51 | $1.05 |

| Q3 | $7.46 | $1.07 |

| Q4 | $7.9 | $1.14 |

| Total | $32.47 | $4.84 |

Sales and Revenues