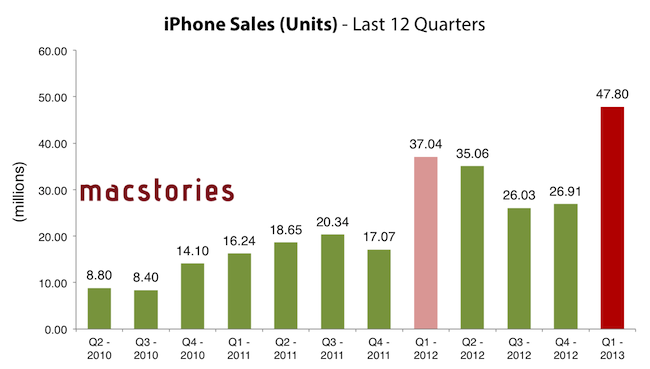

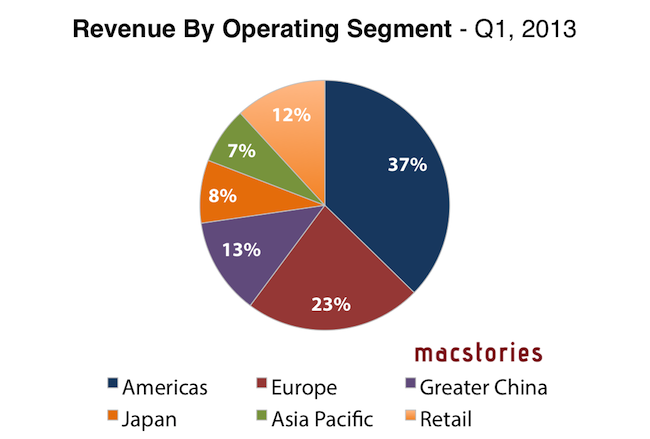

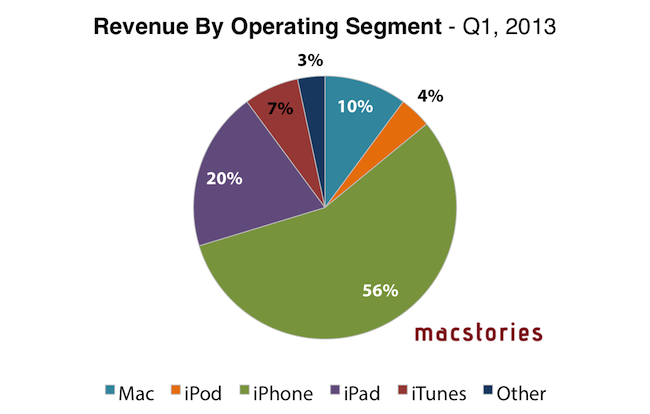

Apple has just posted their Q1 2013 financial results for the quarter that ended in December 2012. The company posted revenue of $54.5 billion ($13.81 per diluted share), with 22.9 million iPads, 47.8 million iPhones and million 4.1 Macs sold. Apple sold 12.7 million iPods. The company reported quarterly net profit of $13.1 billion.

We’re thrilled with record revenue of over $54 billion and sales of over 75 million iOS devices in a single quarter,” said Tim Cook, Apple’s CEO. “We’re very confident in our product pipeline as we continue to focus on innovation and making the best products in the world.”

“We’re pleased to have generated over $23 billion in cash flow from operations during the quarter,” said Peter Oppenheimer, Apple’s CFO. “We established new all-time quarterly records for iPhone and iPad sales, significantly broadened our ecosystem, and generated Apple’s highest quarterly revenue ever.

Compared to last year’s Q1 – which had an extra week – Apple made $8.2 billion more revenue, but the same profit.

Q1 2013

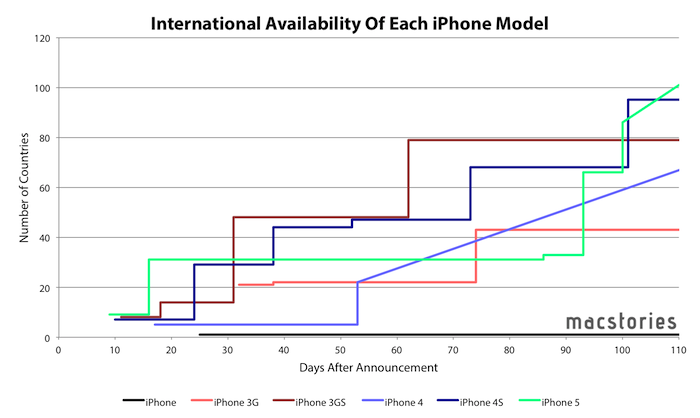

The first fiscal quarter is traditionally the biggest quarter of the year for Apple, as it directly follows the holiday season. Q1 2013 provides a first real insight into sales of the iPad mini and iPhone 5 following several international launches in the past few months (international sales accounted for 60 percent of Apple’s revenue in Q4 2012) and the fact that, when Q4 2012 ended on September 29th, the iPhone 5 had only been out for 8 days in 9 countries (where it was released on September 21st).

On December 3rd, the iPhone 5 was available in 47 countries; after Apple’s announcement, the availability of the device jumped to 102 countries by the end of December 2012, with an average of 1.04 countries added in 98 days since the first rollout on September 14th (when pre-orders were launched). In mid-December, Apple announced that first weekend sales of the iPhone 5 in China topped 2 million units.

As we noted in a separate article, the iPhone 5 had a big ramp-up at the start with 31 countries having the device just 16 days after the announcement.

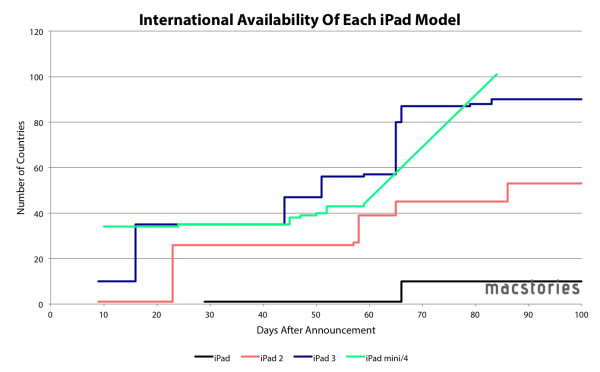

As for the iPad, the WiFi version of the mini went on sale on November 2 in 34 countries alongside the fourth generation model. Various international rollouts followed the initial launch; Apple also started releasing the WiFi + Cellular version of the iPad mini in mid-November. On November 5th, Apple announced it had sold 3 million iPads (mini + 4th gen) in three days. For context, the 3rd generation iPad launched in 10 initial countries, and then rolled out to 25 more a week later; both WiFi and WiFi + Cellular versions of the 3rd generation iPad were available at launch.

As our Graham Spencer noted, “the iPad mini has been like the iPhone 5 in that it had a rapid initial rollout and then paused for a while”.

Estimates and Previous Quarters

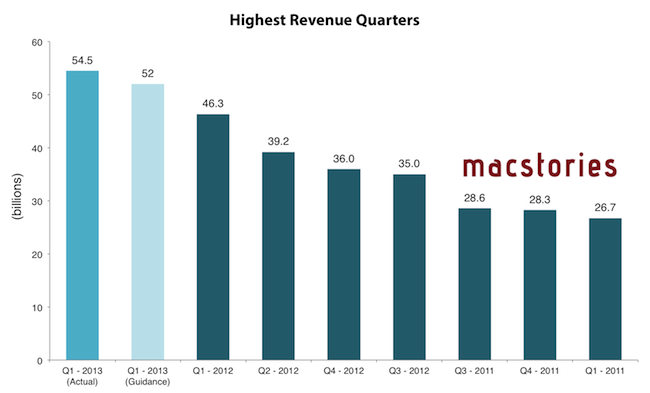

For Q1 2013, Apple had set its guidance at revenue of about $52 billion and diluted earnings per share of about $11.75.

The Street consensus’ average estimate was earnings of $13.44 per share and revenue of $54.73 billion.

On January 15, Fortune polled 67 analysts (39 professionals and 28 independents) and collected their forecasts for Apple’s revenue in Q1 2013. As Fortune notes, last year’s Q1 2012 included 14 weeks of sales, while Q1 2013 only had 13. In Fortune’s poll, the “pros” averaged earnings per share of $13.45 on sales of $54.74 billion; the independent analysts forecasted earnings of $15.11 on sales of $58.84 billion. The median estimate was for earnings of $14.20 on sales of $55.96 billion.

Fortune also polled analysts for sales of iPhones, Macs, and iPads. For the iPhone – which represented 48% of Apple’s revenue in Q4 2012 – analysts’ consensus forecasted 49.5 million units sold; for the Mac, they forecasted an average of 5.2 million units sold; and last, they predicted an average of 24 million iPads sold.

On January 7, Horace Dediu of Asymco published his forecast for Apple’s Q1 2013 results. Dediu explained how Q1 2013 would be a difficult quarter to forecast for a number of reasons: 80% of Apple’s revenue would come from new, recently launched products, Apple’s supply chain was constrained in the quarter with long waiting times for the iPhone 5 and iPad mini, but at the same time the iPhone 5 rolled out in more than 100 countries before the end of 2012.

Production was constrained. It was quite a long time before waiting times decreased for the iPhone–longer than what we saw last year. In the earnings call Tim Cook said “It’s difficult to predict when supply and demand will balance, but I’m feeling very confident on our ability to supply quite a few iPhones”. This again implies significant acceleration but did they achieve the targets? He did also announce that they met their target of 100 countries during the quarter but it’s not clear if this was as quickly met as they would have liked.

Horace Dediu’s forecast was the following:

- iPhone units: 55.5 million

- Macs: 5.0 million

- iPads: 24.4 million

- iPods: 11.2 million

- Music (incl. app) rev. growth: 25%/38%

- Peripherals rev. growth: 10%/19%

- Software rev. growth: 5.5%/14%

- Total revenues: $60.0 billion

- GM: 39.8%

- EPS: $15.74 (13%)

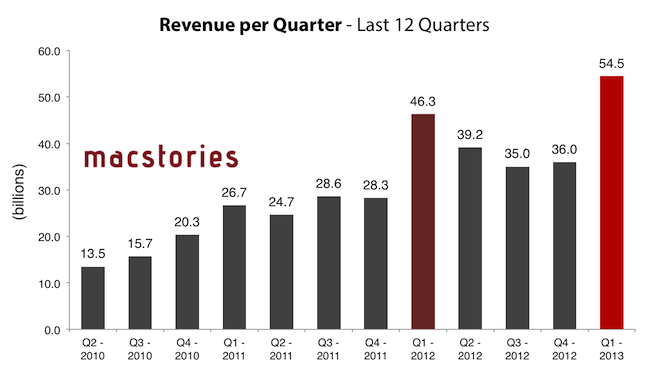

In the previous quarter, Q4 2012 (which ended on September 29th), Apple posted revenue of $36 billion ($8.67 per diluted share), with 14 million iPads, 26.9 million iPhones and million 4.9 Macs sold. In Q4 2012, the company reported quarterly net profit of $8.2 billion, and the entire 2012 fiscal year generated $156.53 billion revenue for Apple.

In the year-ago-quarter, Q1 2012, Apple posted revenue of $46.33 billion, with 15.43 million iPads, 37.04 million iPhones and 5.2 million Macs sold. Unlike Q1 2013, Q1 2012 had an extra week (14 weeks vs. 13 weeks in Q1 2013).

Apple will provide a live audio feed of its Q1 2013 conference call at 2:00 PM PT, and we’ll update this story with the conference highlights.

Graphical Visualization

Below, a series of graphs showing Apple’s Q1. Click the images for larger size.

Notes from the call

- Tim Cook: We are incredibly pleased to report an extraordinary quarter with $54.5 billion in revenue. Just in the last few months, we’ve introduced new products in every category that we make. This reflects our dedication to making the very best products in the world.

- Tim Cook: You’re going to hear a lot of impressive numbers, but they’re not the only way we measure success at Apple.

- Tim Cook: We’ve sold well over half a billion iOS devices including a staggering 10 per second in the last quarter alone.

- 3.7 million iPhones per week, compared to 2.6 million per week year-over-year

- iPhone sales doubled year-over-year in China

- iPhone 5 in over 100 countries by end of December 2012, fastest iPhone rollout ever

- iPhone and iOS continue to deliver an exceptional experience people love and provide a secure and trusted ecosystem IT departments require

- iPad is the tablet of choice for businesses and government agencies

- Barclays rolled out over 8000 iPads - their most successful IT deployment to date

- The App Store is now available in 155 countries

- 2 billion+ iMessages are sent per day

- Apple ended the quarter with 401 stores, 150 outside US

- Relocated 14 stores that had outgrown former space

- Apple retail: $6.4 billion in revenue ($16 million per store)

- Peter Oppenheimer: Going forward, we’ll report guidance as “a range of guidance we are likely to achieve”

- Apple is proving guidance for the March quarter with revenue between $41 billion and $43 billion

- Q: Many of your smartphones are differentiating with larger screens, how do you think about competitive dynamics? Do you think it’s a valid point? Do you think there’s a case for variety for iPhone? Tim Cook: iPhone 5 offers a new 4-inch Retina display, which is the most advanced display in the industry. No one comes close to match that level of quality. It also provides a larger screen size without sacrificing one-handed ease of use. We put a lot of thinking into screen sizes and we picked the right one.

- Tim Cook on rumors of order cuts: I don’t want to comment on a rumor, but I would question accuracy of any kind of rumor about build plans, and also stress even if a particular data point was factual, it would be impossible to point what it actually meant - supply chain is complex - there’s just an inordinate long list of things that would make any single data point not a great proxy for what’s going on.

- Q: You started the call talking about Apple’s philosophy and making great products, against that backdrop, how important is marketshare preservation? Is holding share in smartphone market in 2013 a priority for Apple? Yes/No and why? And realistically how does Apple hold share given that segment is expected to grow a lot slower and you have pretty dominant share in that high end? Tim Cook: The important thing for us is to make products that enrich people’s lives. We aren’t interested in revenue for revenue’s sake. We could put the Apple logo on anything and sell a lot more stuff. I think we’ve had a great track record at doing different products at different price points (iPod) - I wouldn’t view things as mutually exclusive as some might, but the high order bit is making a great product that enriches customers’ lives. That’s what we’re focused on.

- Tim Cook: In Notification Center, we’ve sent over 4 trillion notifications. As Peter mentioned in his comments, for iMessage we’ve sent over 450 billion notifications. We have 200 million Game Center users, almost 800,000 apps on the App Store.

- Oppenheimer on capital expenditures: We are buying equipment that we will own that we will put in partner facilities. Primary motivation is supply. We’re also adding equipment to data centers to support our services.

- Q: (Editor’s note: the following question is by Gene Munster, who has been repeating the same question for the last 7 earning calls. Tim Cook has always replied with the same answer. Just drop it, Gene.) Good afternoon. Apple TV: can we take a step outside of the form factor and talk about how important this market is? can you accomplish what you ultimately want to accomplish? Tim Cook: Let me see if I can find some comments to make. In terms of product we sell today, we sold more Apple TVs last quarter than we’ve ever sold before. It was up almost 60% year-over-year, so there’s good growth with that product. And what was a small niche of people that loved it is a much larger number that loved it. This is an area of intense interest, it remains that, and I tend to believe that there’s a lot we can contribute to this space and we can contribute, but I don’t want to be more specific.

- Tim Cook on cannibalization of products: As I’ve said for 2 or 3 years, I believe the tablet market and PCs are beginning to converge. I think another thing for us, maybe not for others, but for us, is if somebody buys an iPad mini, and it’s their first Apple products, we have great experience knowing that those people will buy another type of Apple product. We have called it the halo effect - it happened with iPod and Mac. We’re seeing evidence of that on iPad. And so I see cannibalization as a huge opportunity.

- Tim Cook on LTE rollouts: We have 24 carriers the provide LTE support, those are in countries like US, Korea, UK, Germany, Canada, Japan, Australia. Next week, we are adding 36 more carriers for LTE; these carriers will be in Italy, Denmark, Switzerland, Philippines, and several Middle East countries. Subscriber base in those countries is over 300 million.