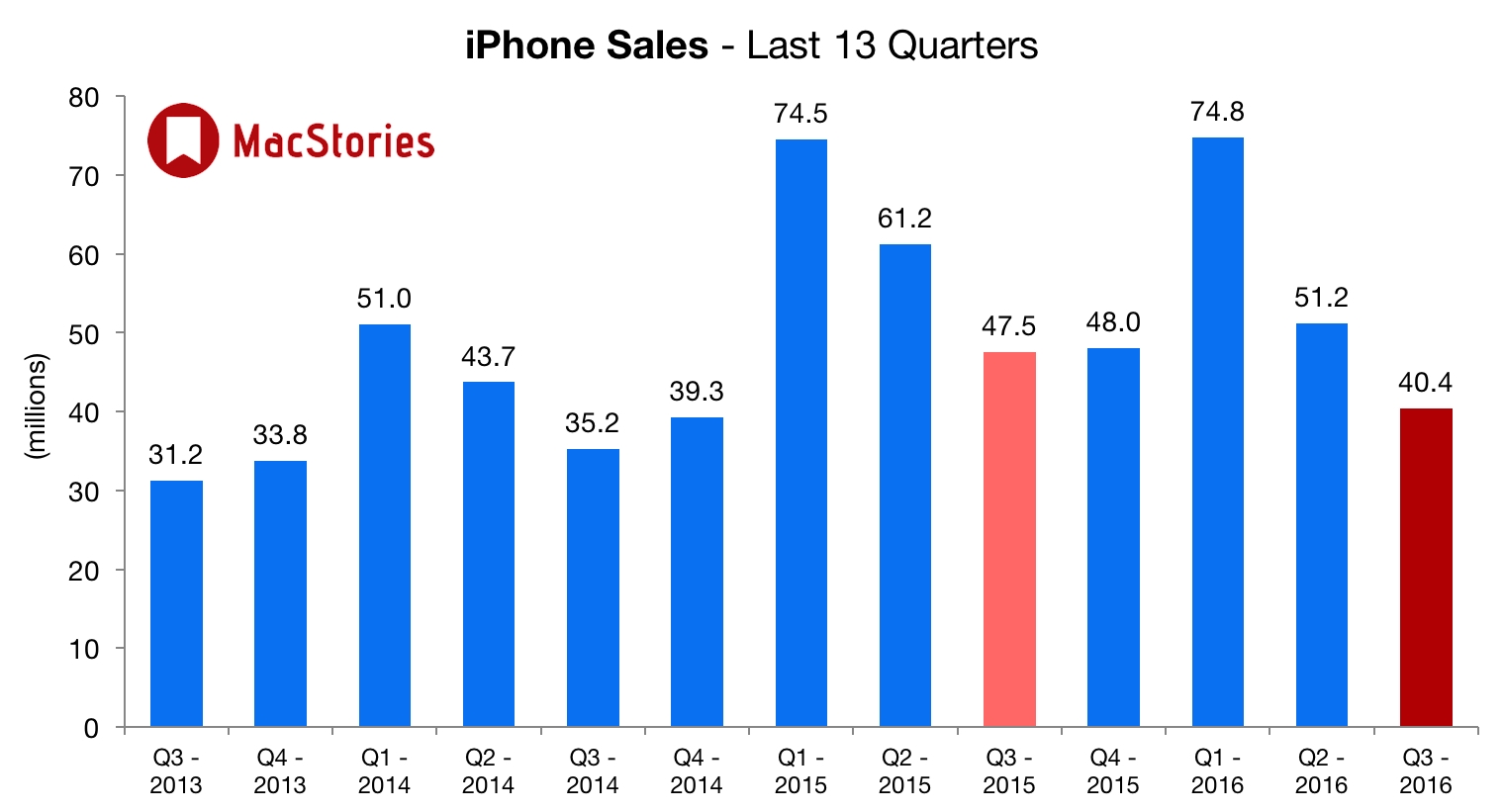

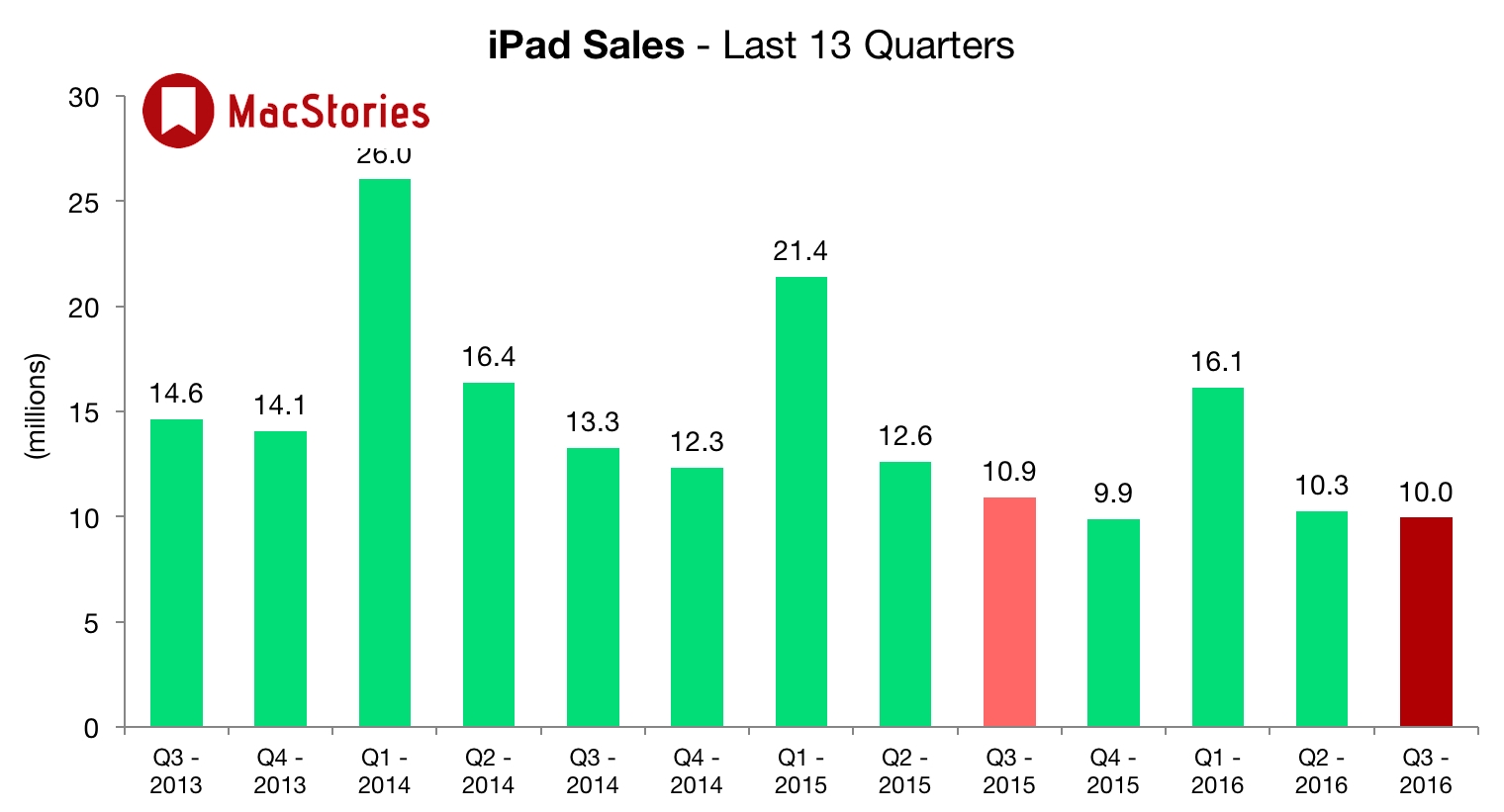

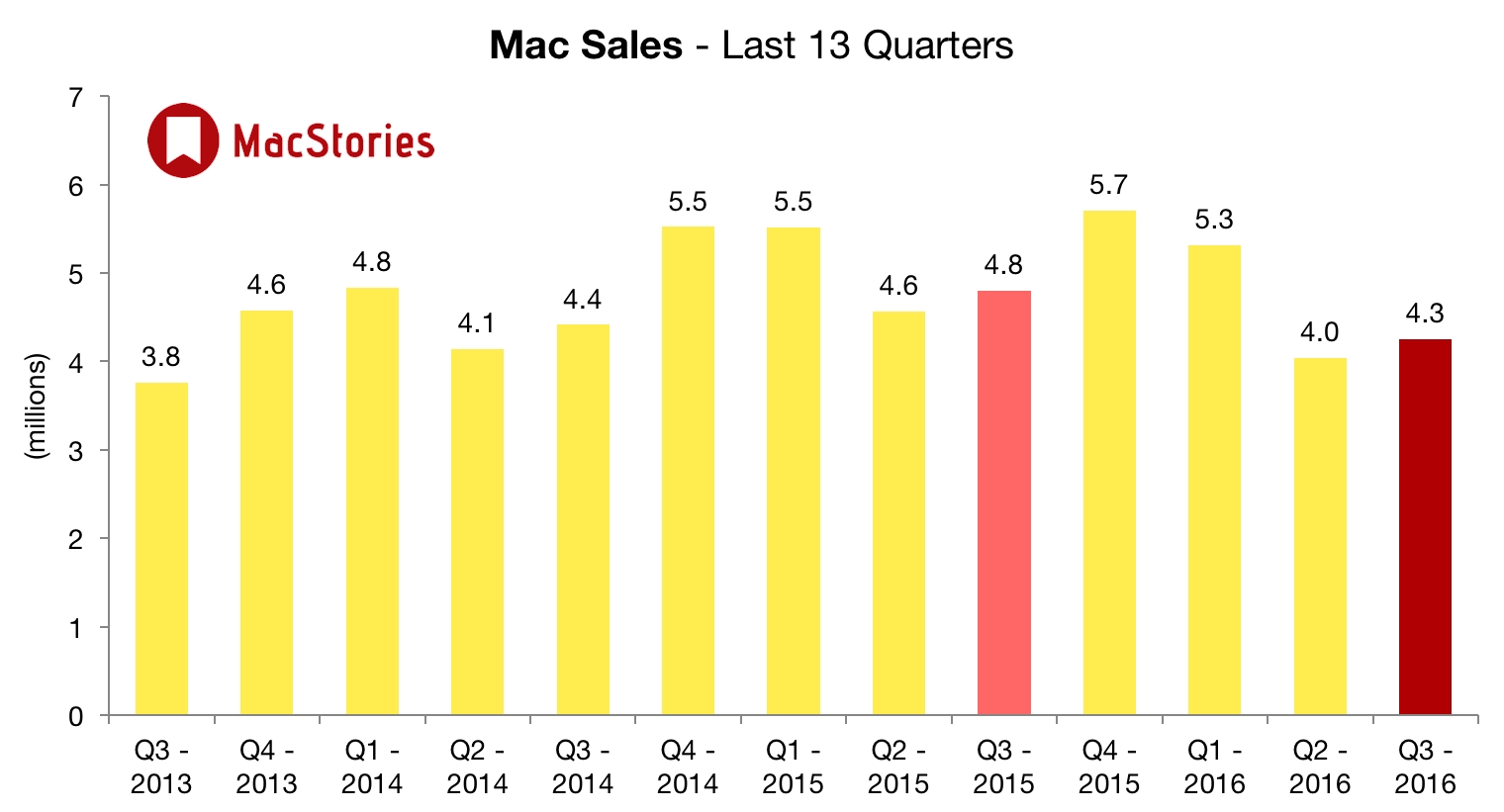

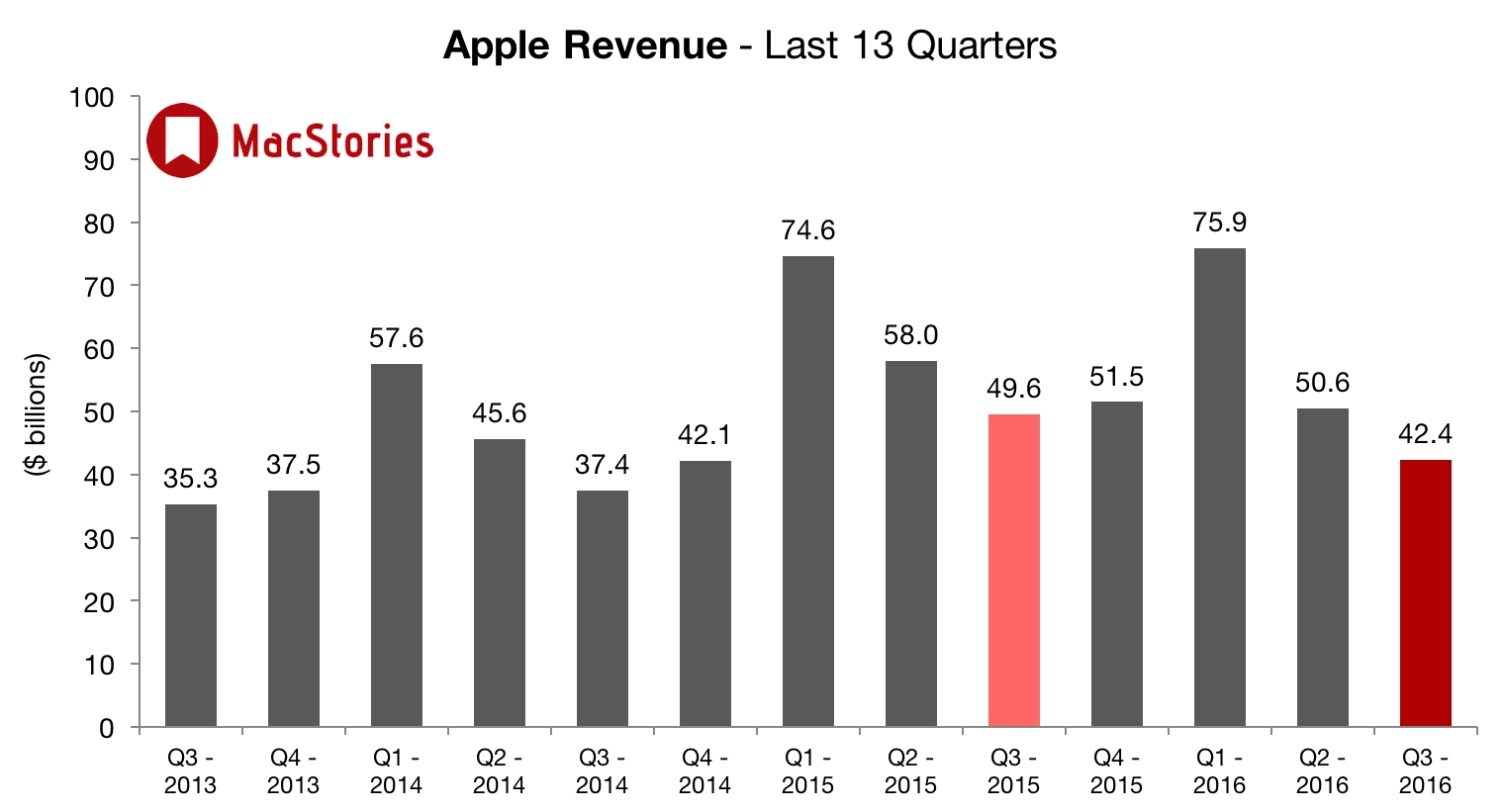

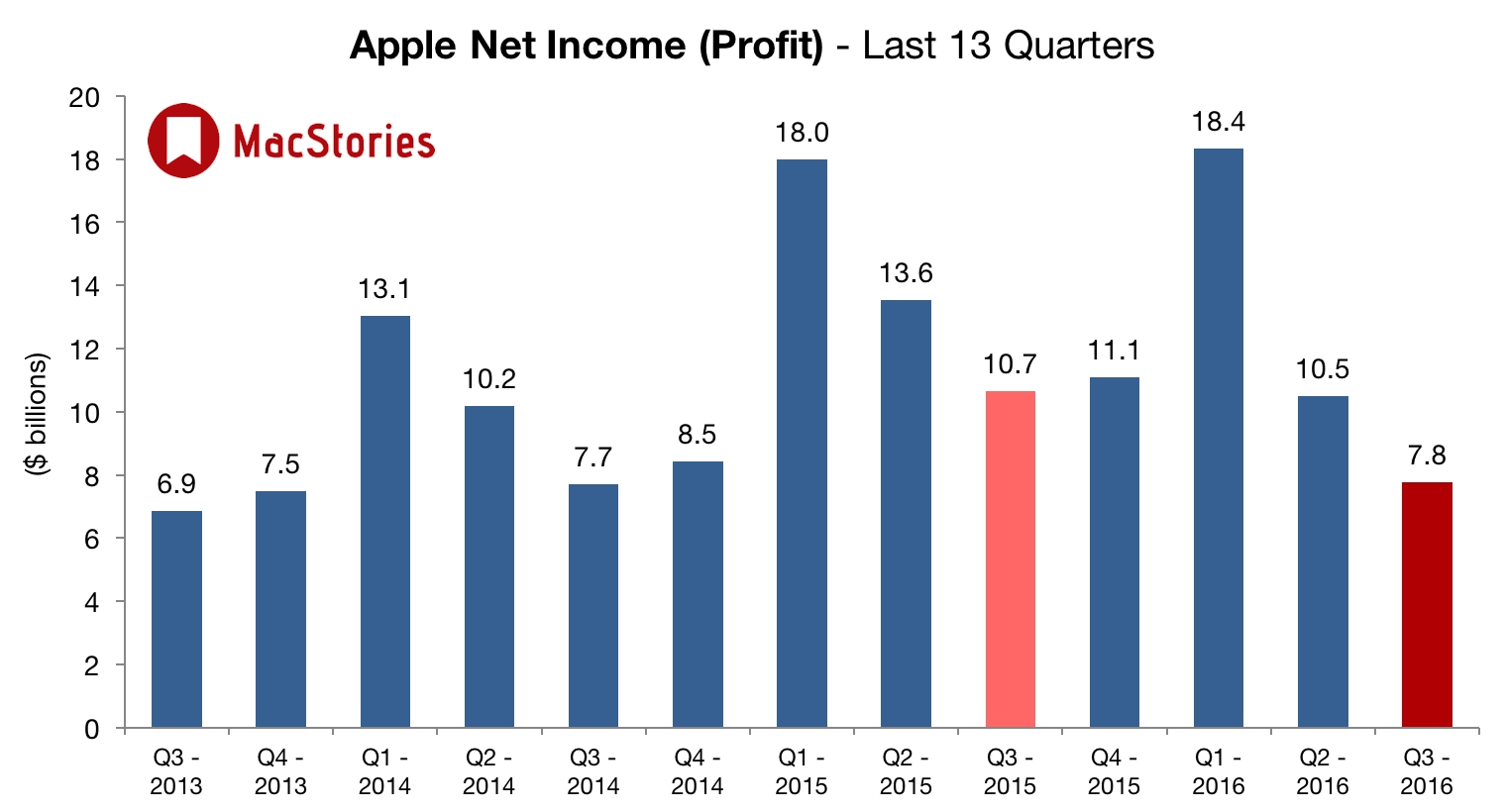

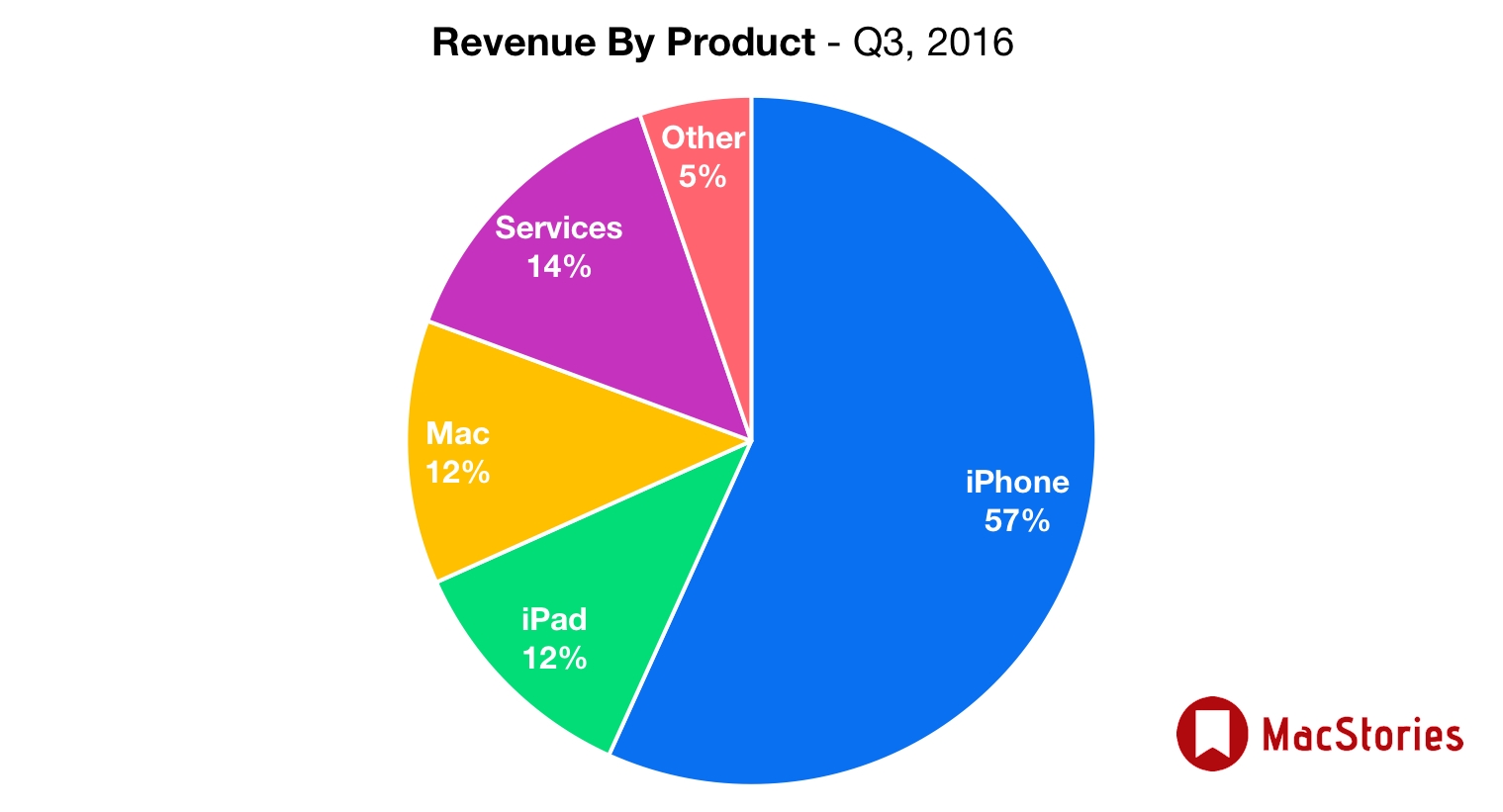

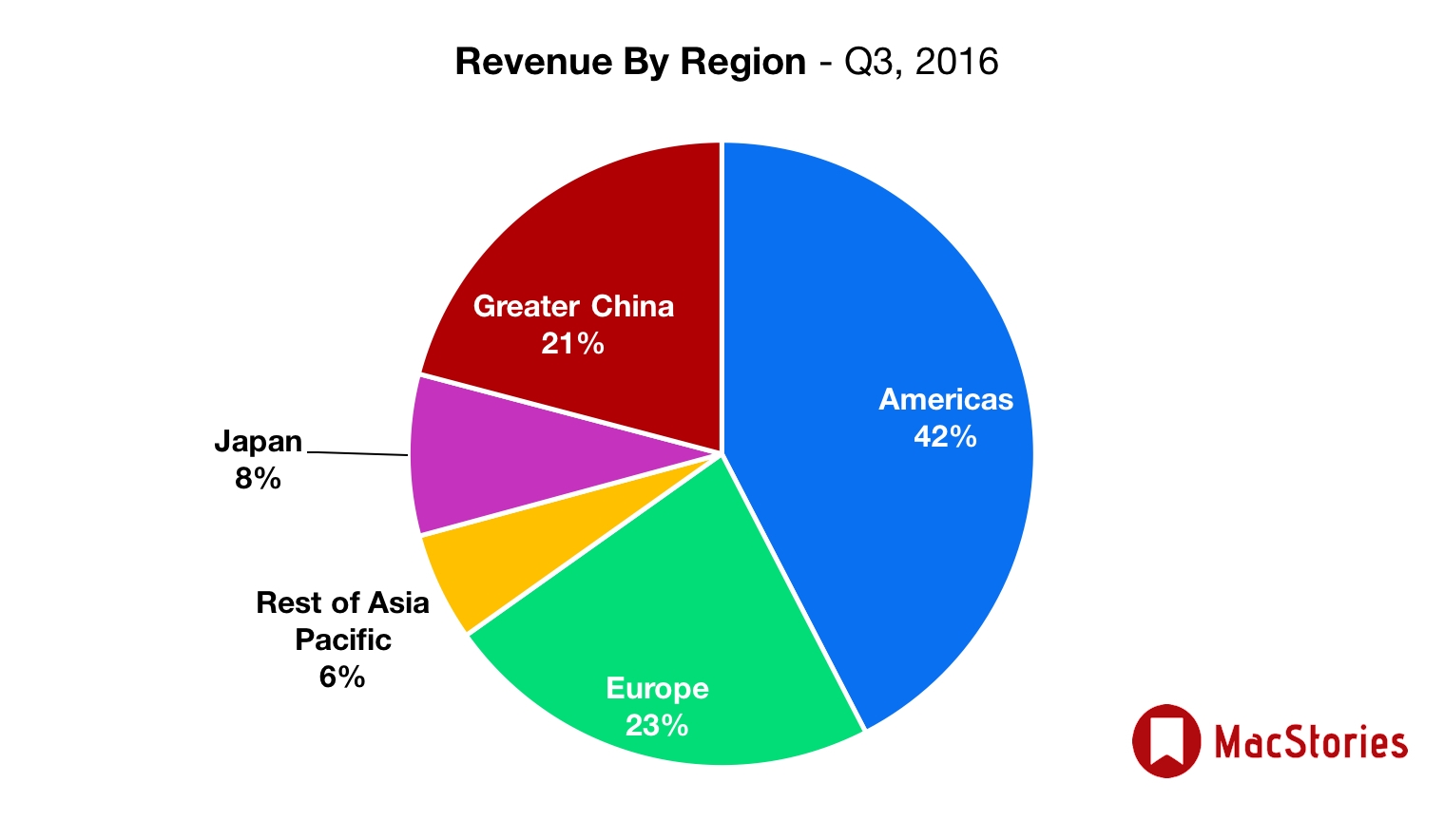

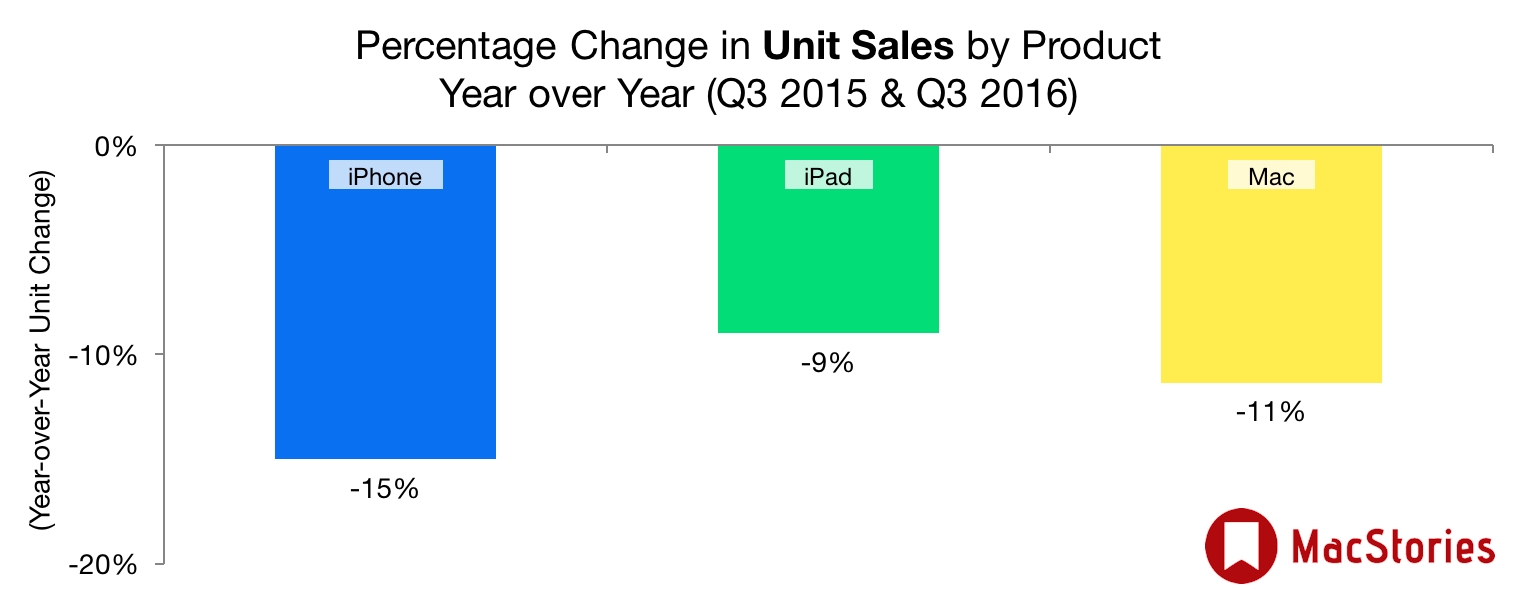

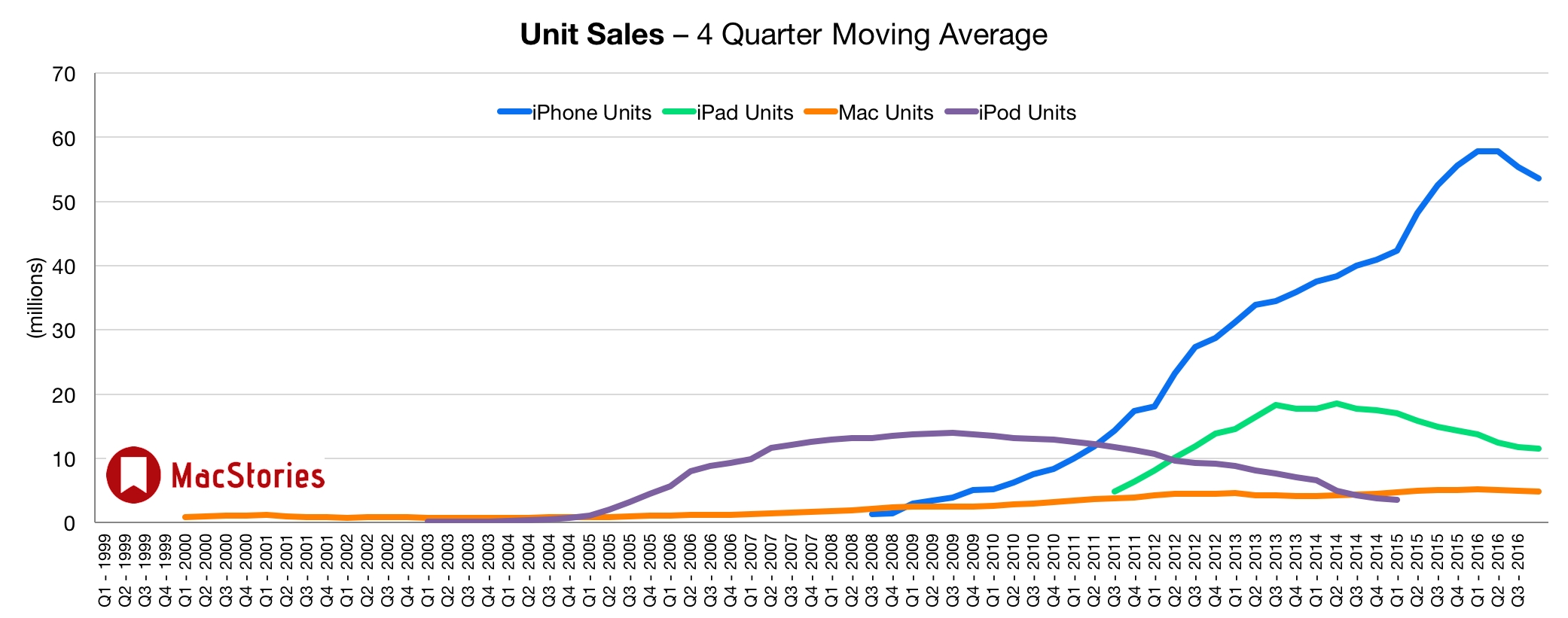

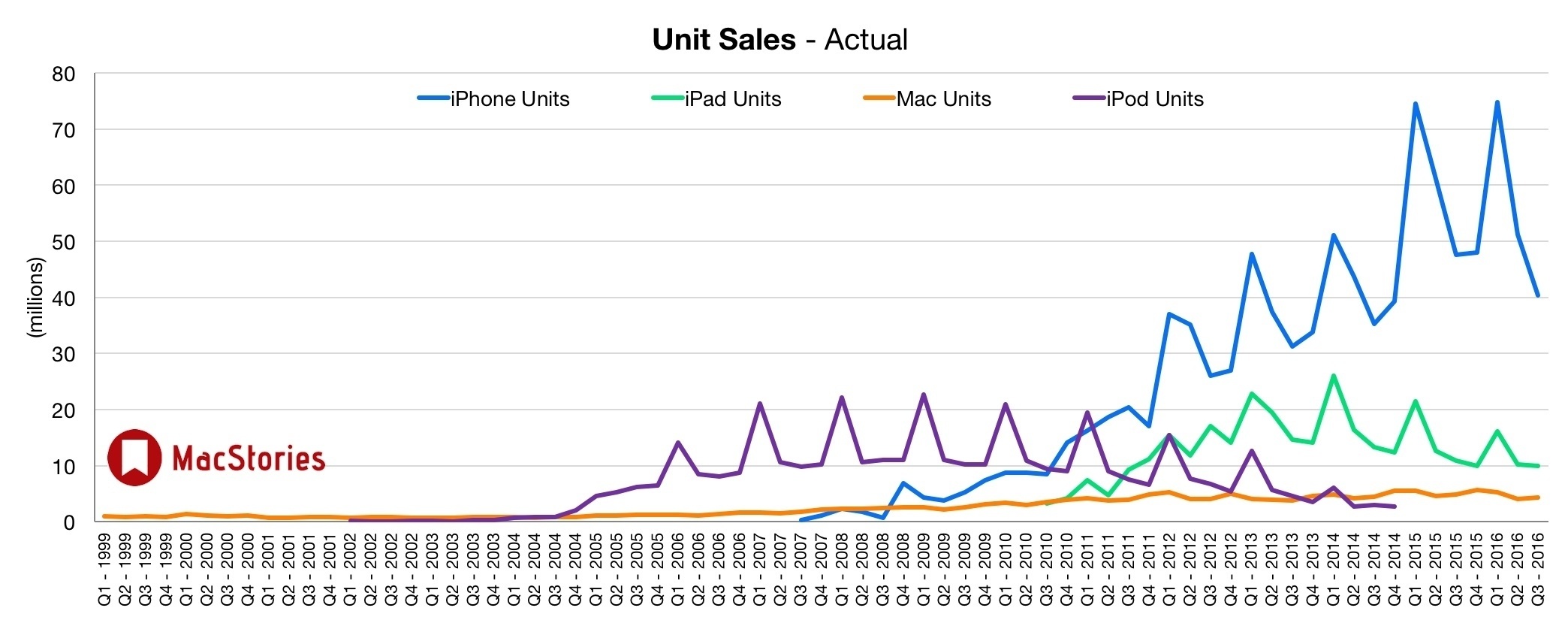

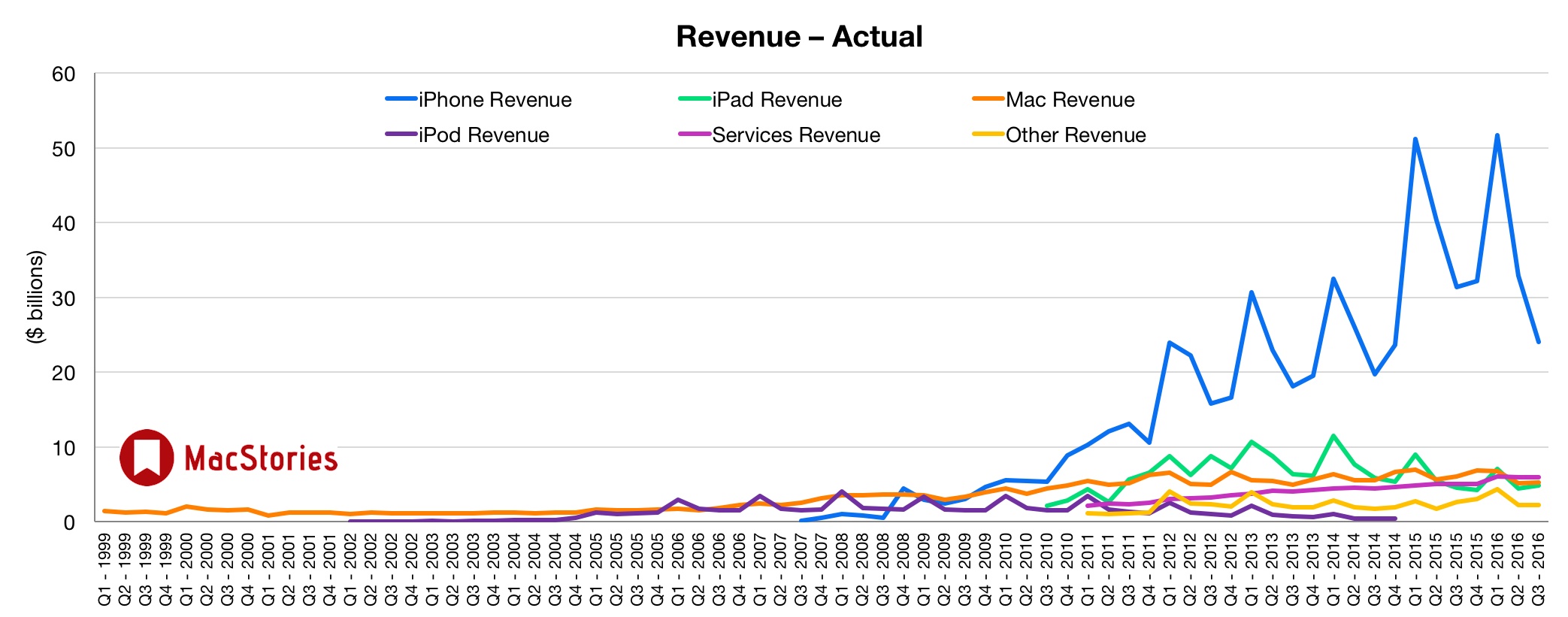

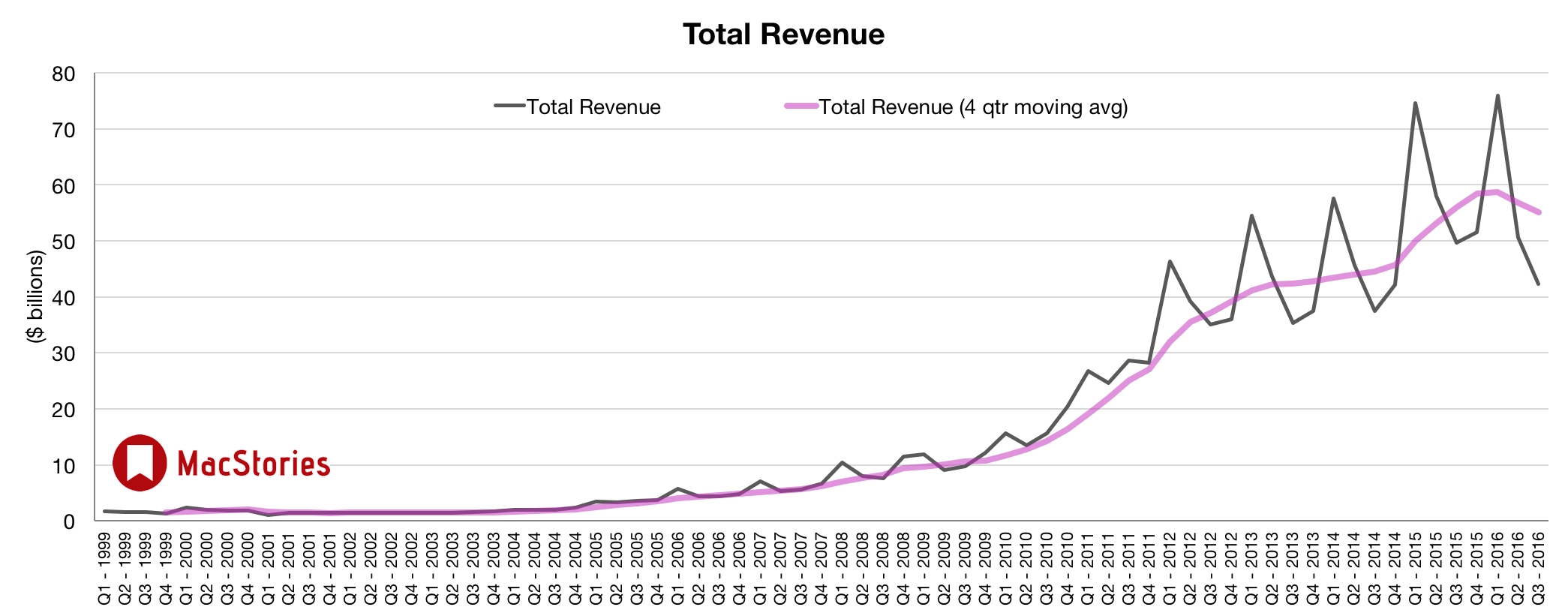

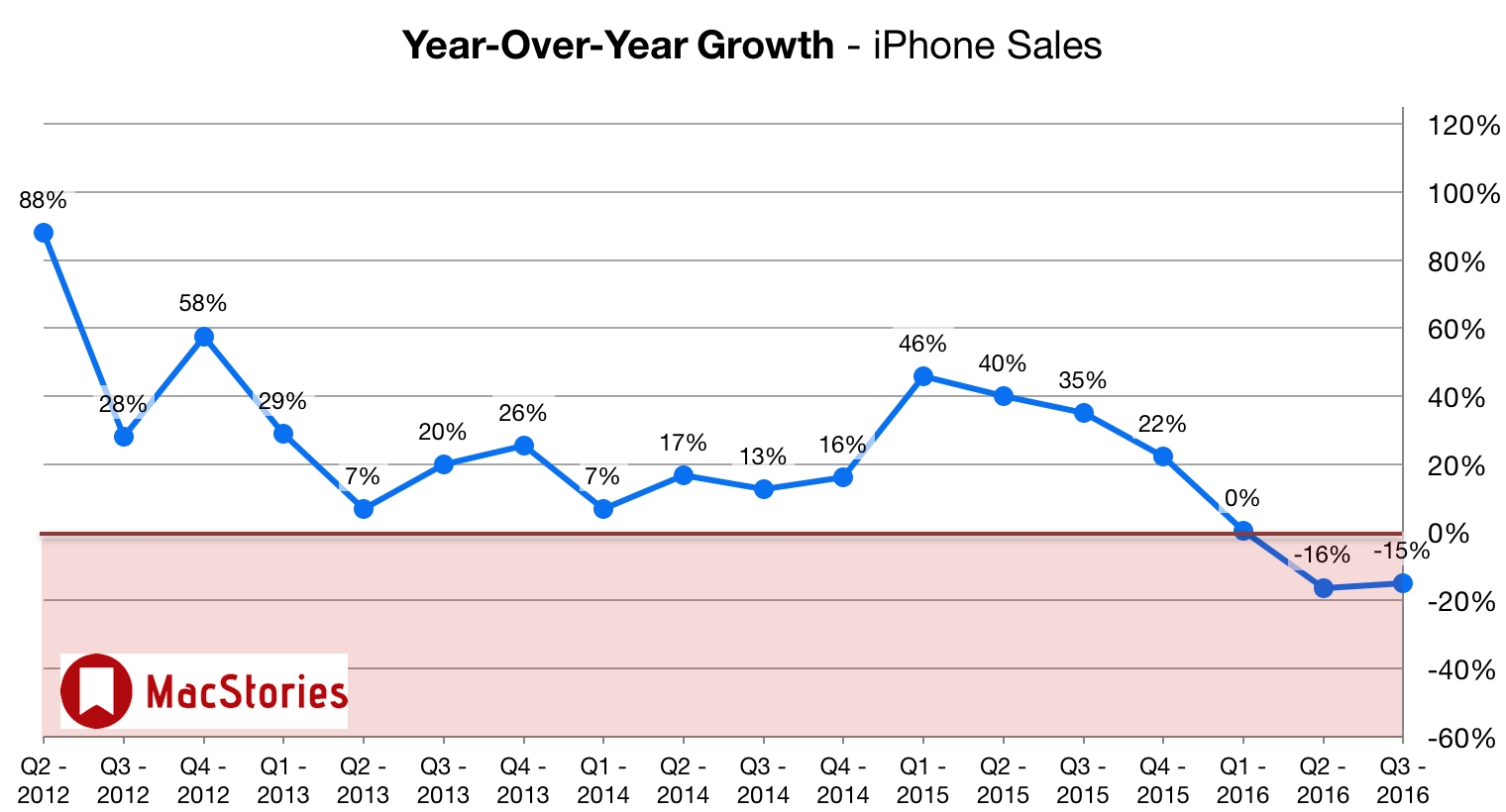

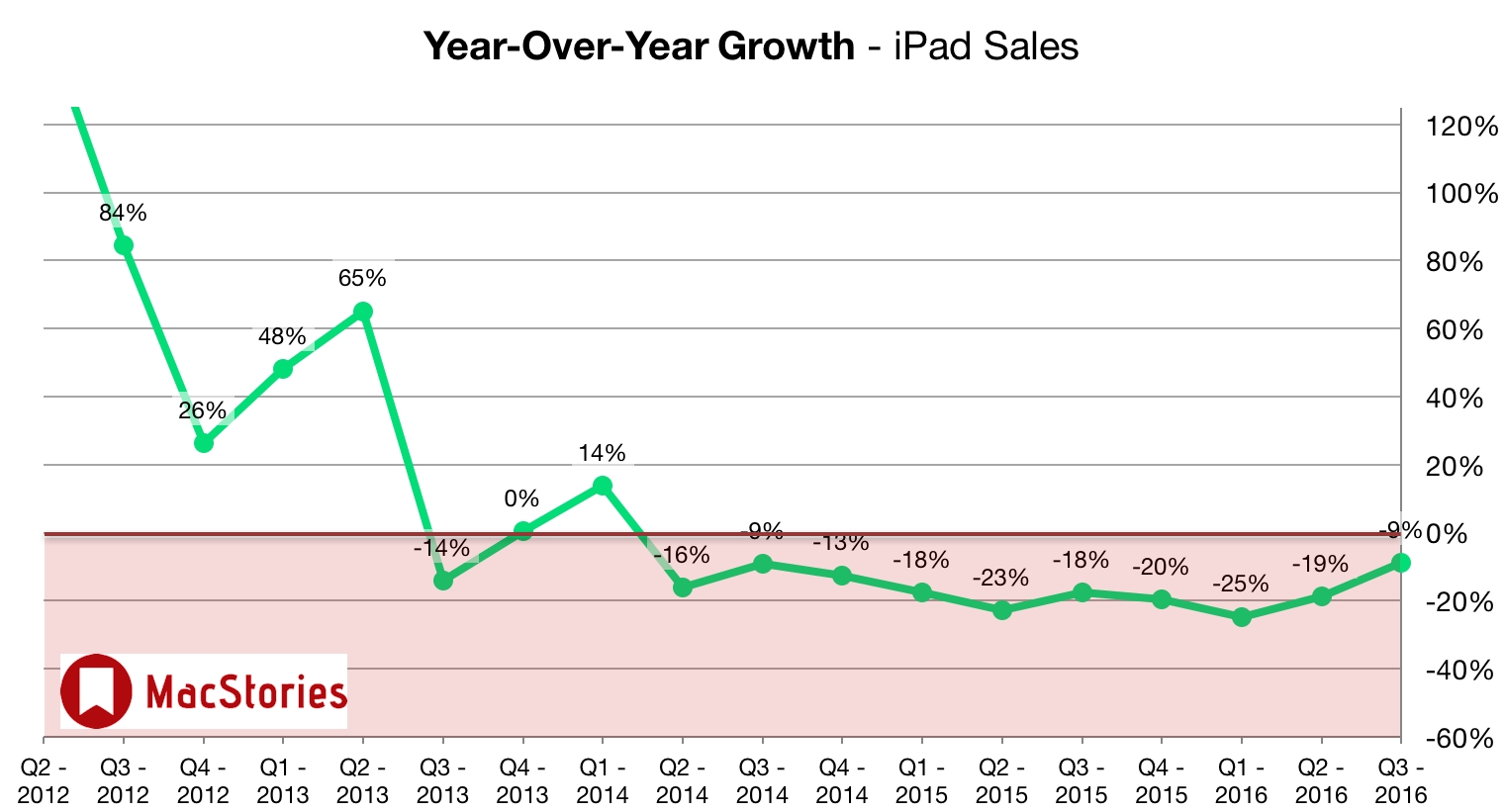

Apple has just published their financial results for Q3 2016, which covered the three months from April to June 2015. The company posted revenue of $42.4 billion. The company sold 10 million iPads, 40 million iPhones, and 4 million Macs, earning a quarterly net profit of $7.8 billion.

“We are pleased to report third quarter results that reflect stronger customer demand and business performance than we anticipated at the start of the quarter,” said Tim Cook, Apple’s CEO. “We had a very successful launch of iPhone SE and we’re thrilled by customers’ and developers’ response to software and services we previewed at WWDC in June.”

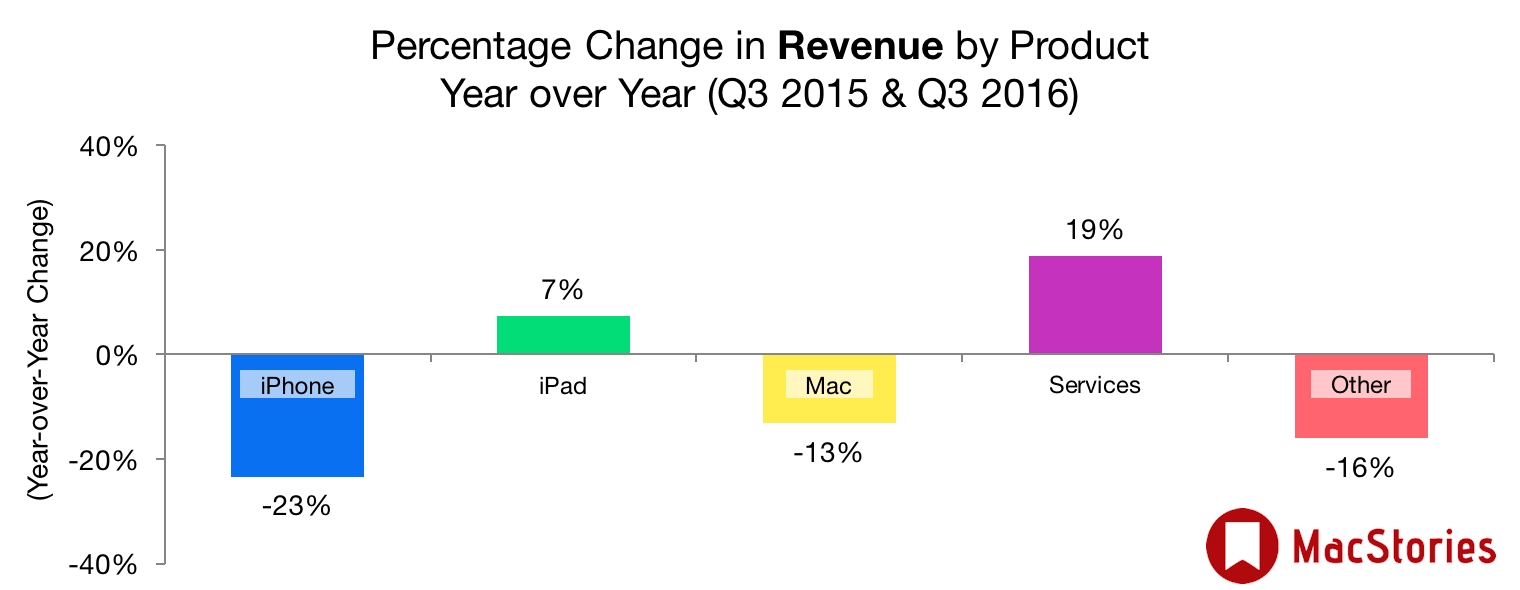

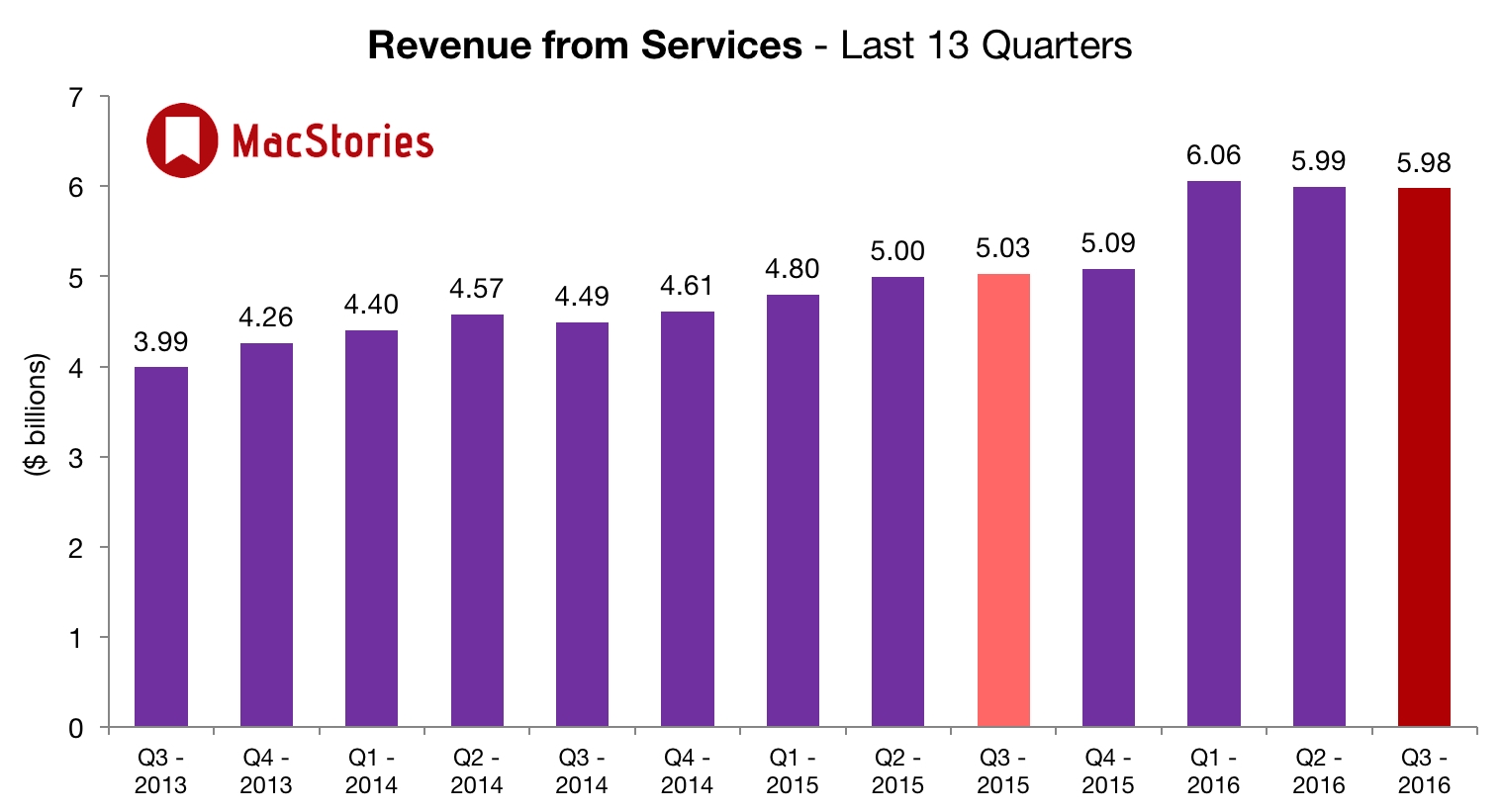

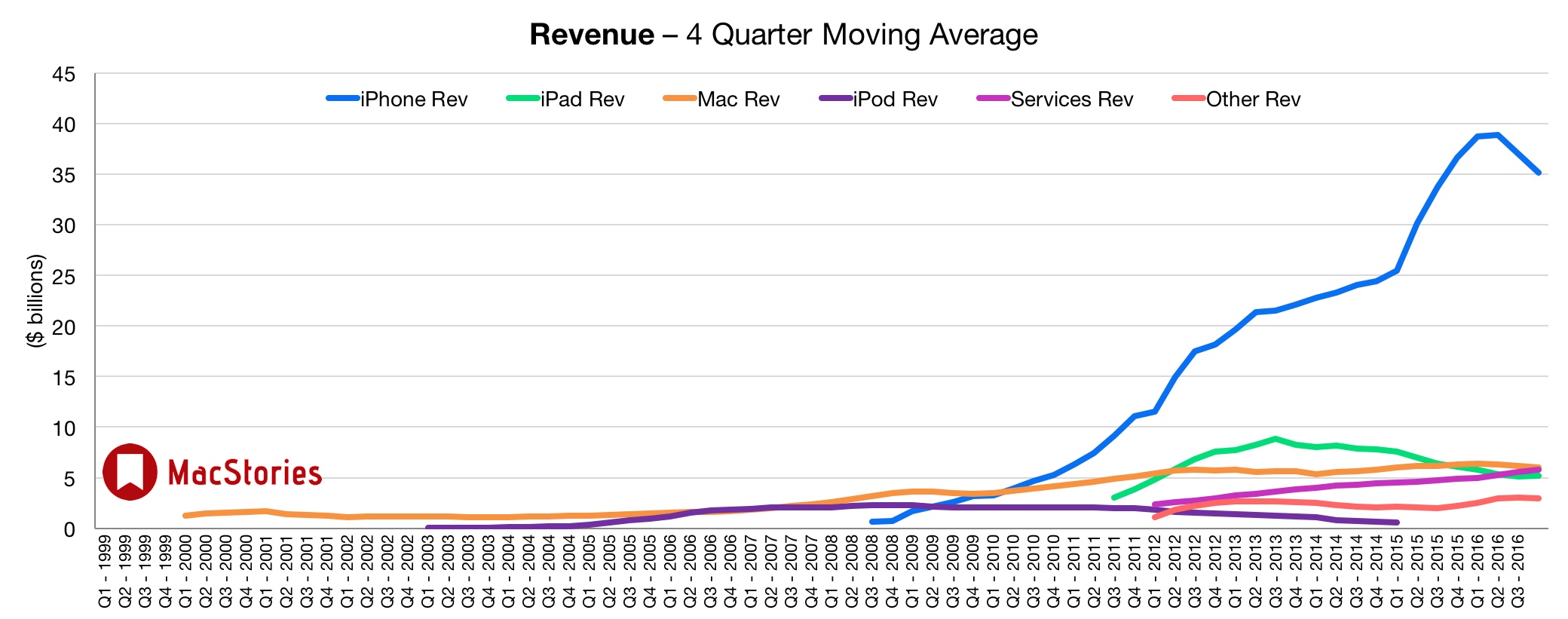

“Our Services business grew 19 percent year-over-year and App Store revenue was the highest ever, as our installed base continued to grow and transacting customers hit an all-time record,” said Luca Maestri, Apple’s CFO. “We returned over $13 billion to investors through share repurchases and dividends, and we have now completed almost $177 billion of our $250 billion capital return program.”

Estimates for Q3 2016 and the Year Ago Quarter (Q3 2015)

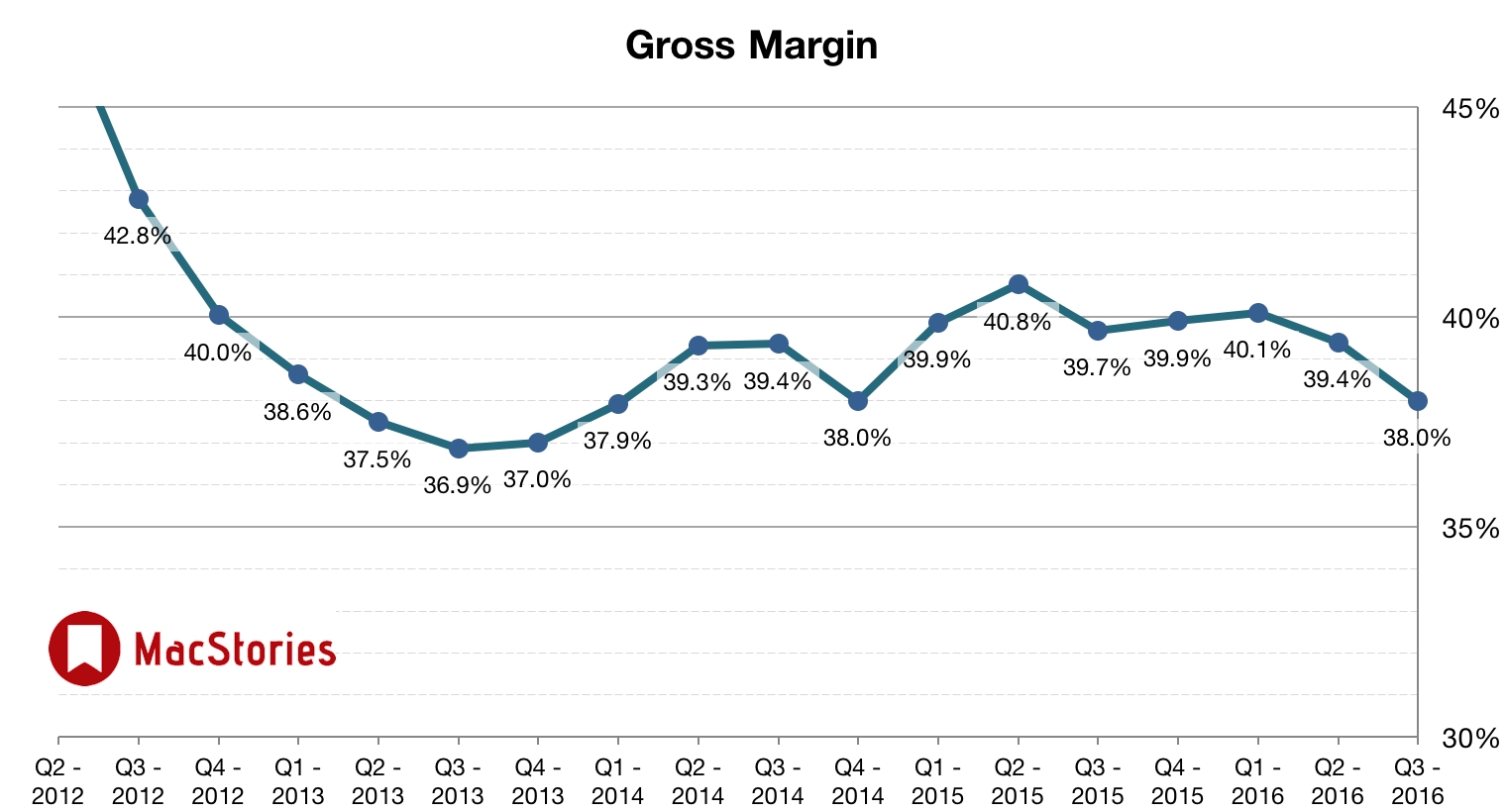

Apple’s guidance for Q3 2016 fell between $41 billion and $43 billion, with gross margin estimated to be between 37.5% and 38%.

In the year ago quarter (Q3 2015), Apple earned $49.6 billion in revenue, and $10.7 billion in profit. During that quarter Apple sold 47.5 million iPhones, 10.9 million iPads and 4.8 million Macs.

Apple Q3 2016 in Tweets

Apple said last 12 months services revenue was $23 bln. Next year, it expects services business to be big enough to be a Fortune 100 company

— Daisuke Wakabayashi (@daiwaka) July 26, 2016

Tim Cook on growth in R&D “there is quite a bit of investment in there for products and services that are not currently shipping” $AAPL

— Walt Piecyk (@WaltBTIG) July 26, 2016

$AAPL R&D/Revenue

2016 FQ3 6.0%

2016 YTD 4.4%

2015 3.5%

2014 3.3%

2013 2.6%

2012 2.2%— Walt Piecyk (@WaltBTIG) July 26, 2016

Cook: “Apple TV todayis not what we want to do - just a foundation”

— Benedict Evans (@BenedictEvans) July 26, 2016

Cook: Didi investment was unusual (we don’t do these typically). We think there are some strategic things here.

…..PROJECT TITAN……

— Neil Cybart (@neilcybart) July 26, 2016

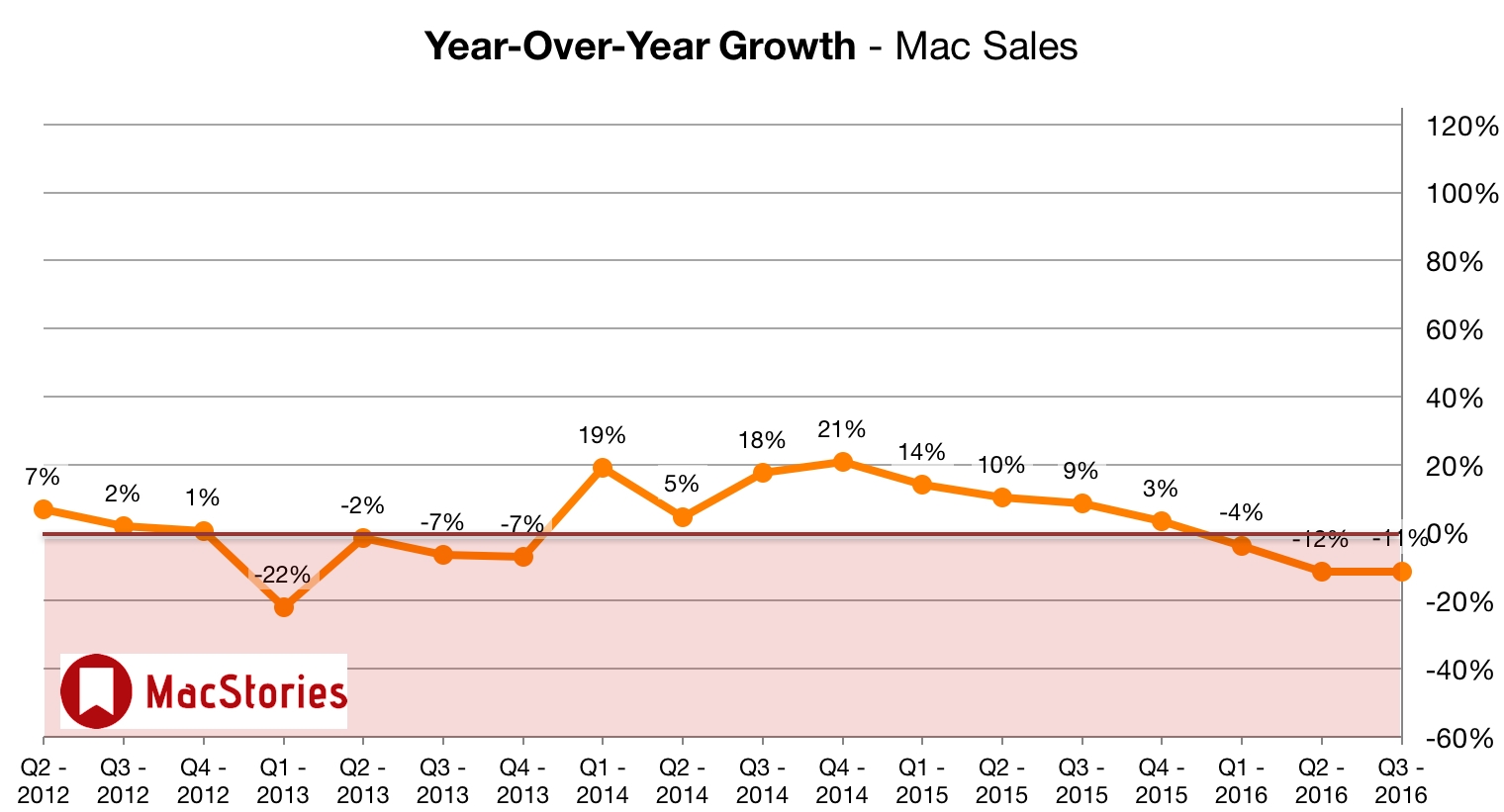

LM: Mac installed base is at an all-time high at the end of the June quarter.

— MacJournals.com (@macjournals) July 26, 2016

LM: Challenging PC sales overall, IDC estimating 4% year-over-year slowdown. Still, Mac gains high percentage of new customers.

— MacJournals.com (@macjournals) July 26, 2016

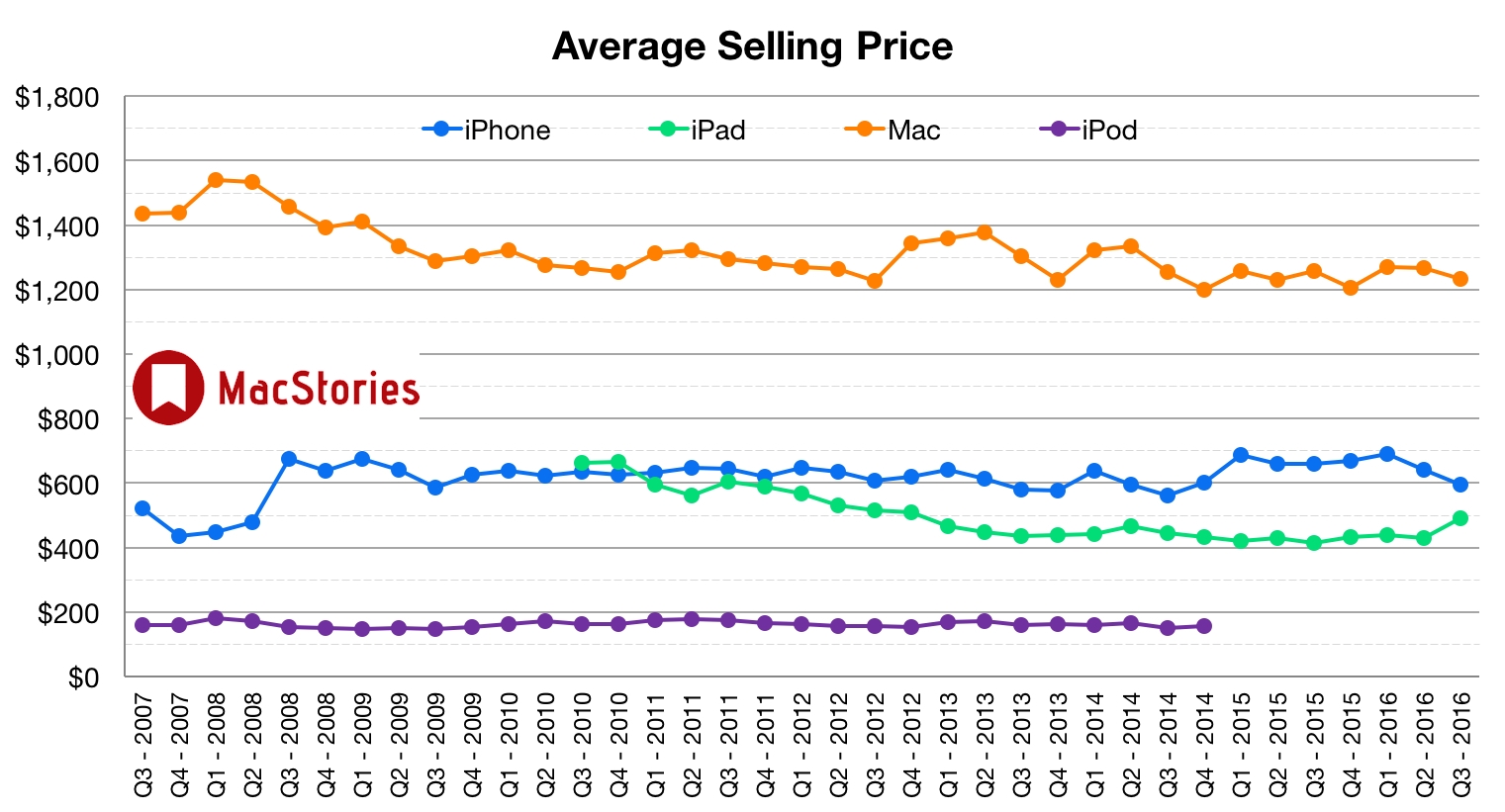

Luca: iPhone SE doesn’t appear to be cannibalizing higher ASP iPhone models.

— Neil Cybart (@neilcybart) July 26, 2016

Apple buys a company on average every 3-4 weeks

— Benedict Evans (@BenedictEvans) July 26, 2016

3/4 contactless payments in the US made with Apple Pay. $AAPL

— Christina Warren (@film_girl) July 26, 2016

Apple books & music stores in China did less than $1m revenue. Not a surprise.

— Benedict Evans (@BenedictEvans) July 26, 2016

Wow. Apple isn’t slowing down with share buyback. Instead, they are doubling down.

— Neil Cybart (@neilcybart) July 26, 2016

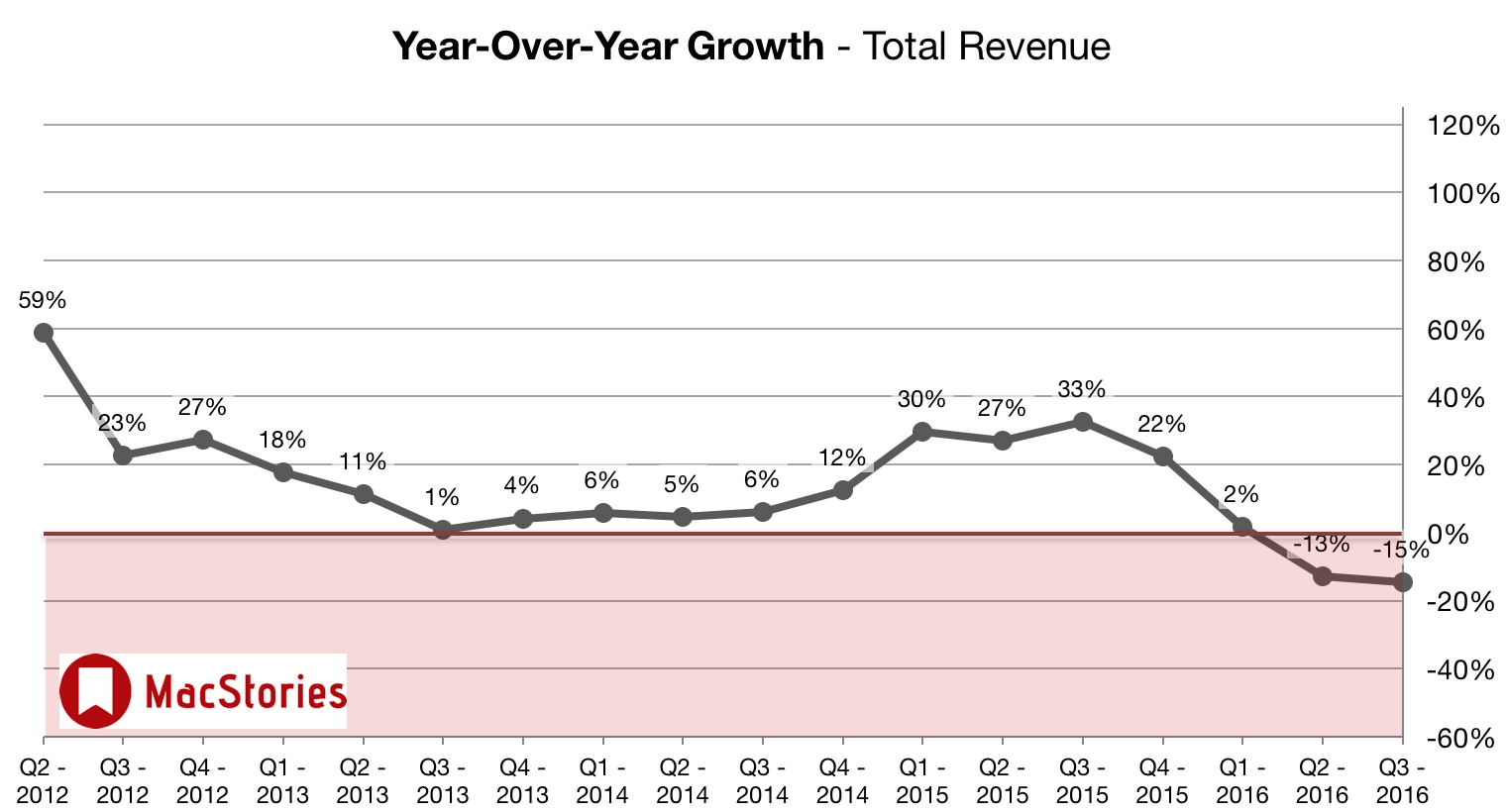

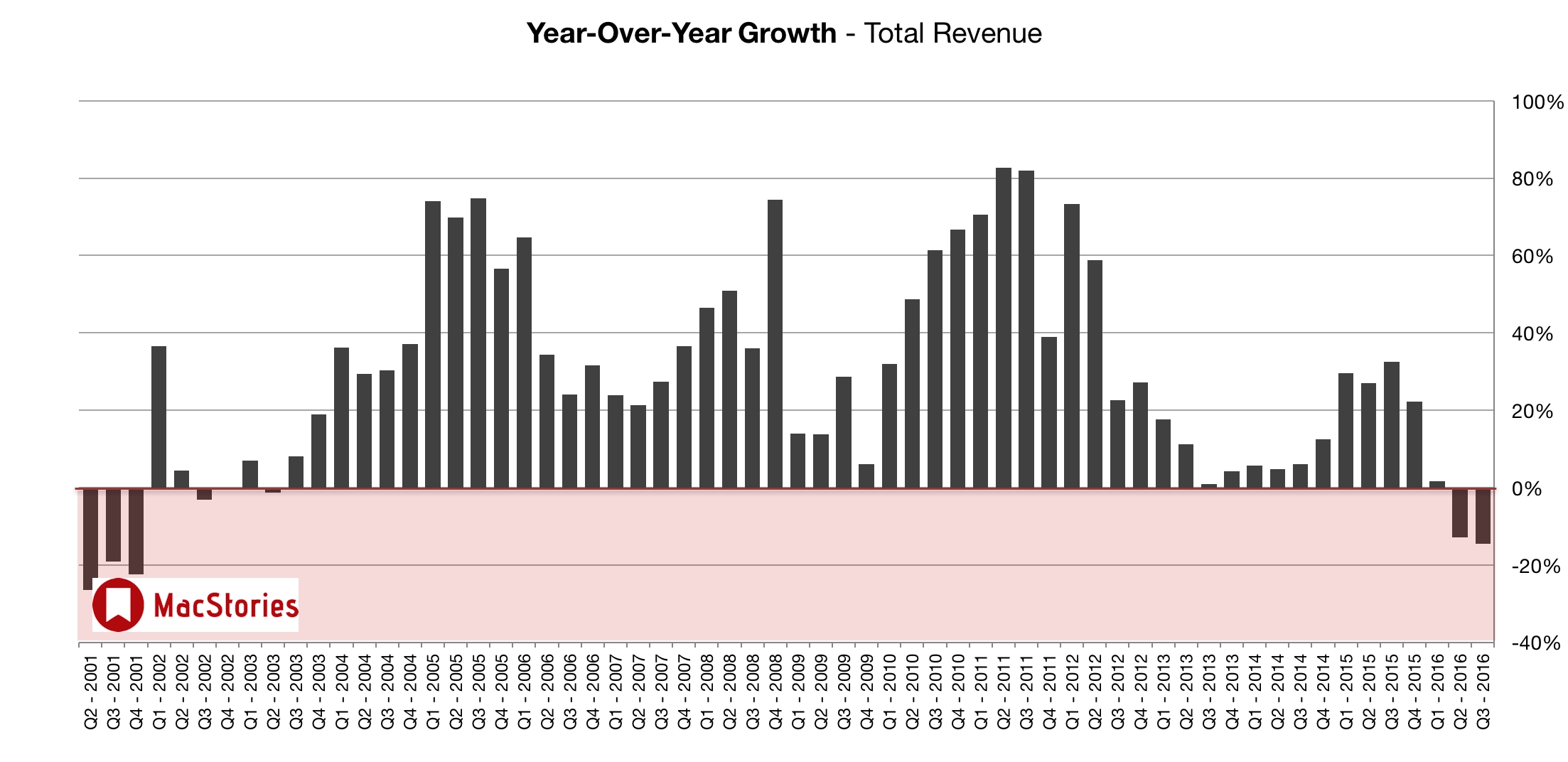

More evidence from Apple earnings that many YoY compares were anomalies from last year. Should not be used for new expectations.

— Ben Bajarin (@BenBajarin) July 26, 2016

Tim Cook says Pokemon Go shows “AR can be really great. We’re high on AR for the long run… I think AR can be huge” https://t.co/WnJhmVAlpJ

— Tim Bradshaw (@tim) July 26, 2016

Highest ever US corporate smartphone intent to buy iPhones: 75% $AAPL

— Daniel Eran Dilger (@DanielEran) July 26, 2016

Cook re: App Store: “We’re focused more these days on discovery, bringing apps to the surface, because there are so many out there”

— Lauren Goode (@LaurenGoode) July 26, 2016

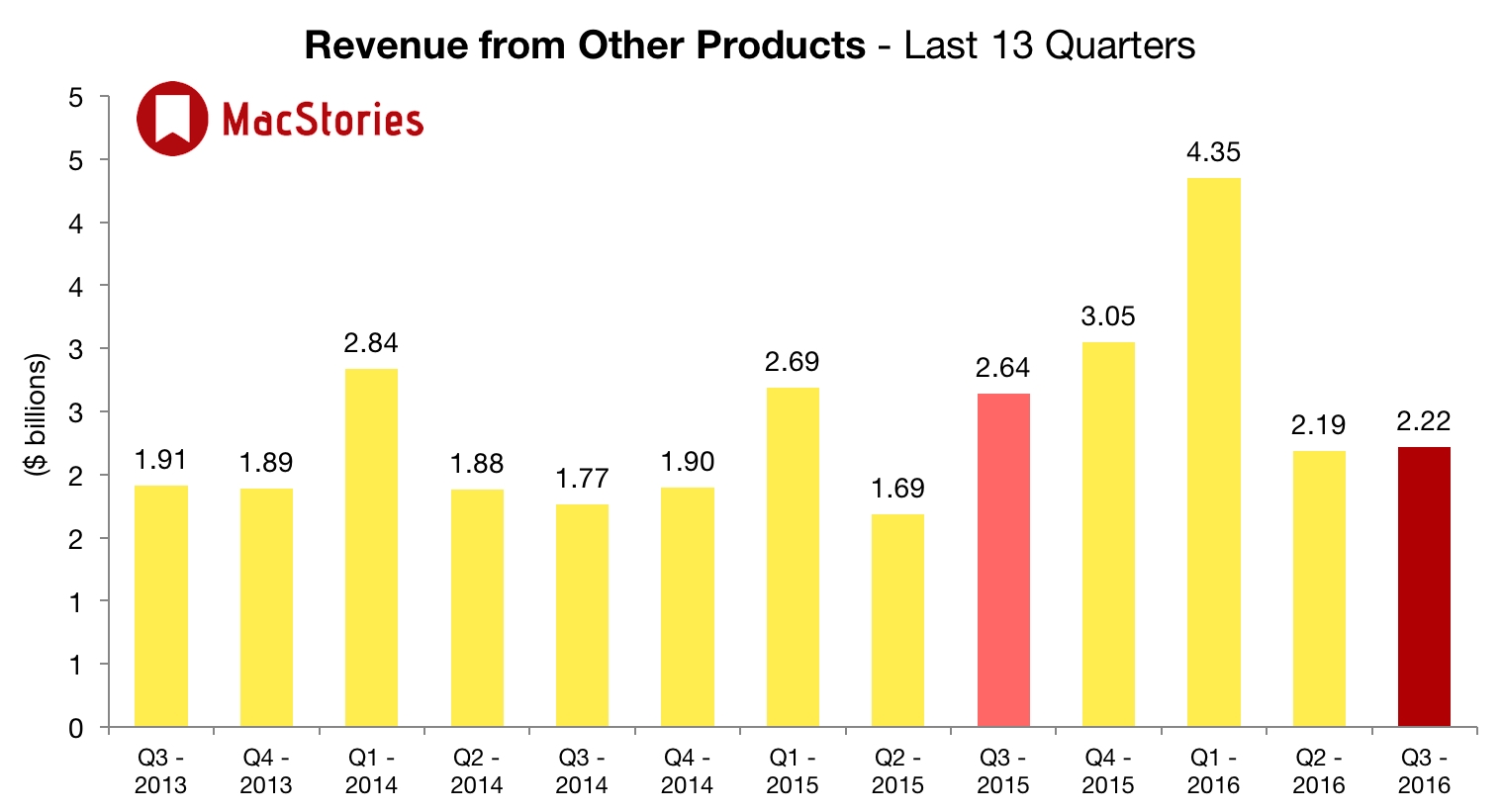

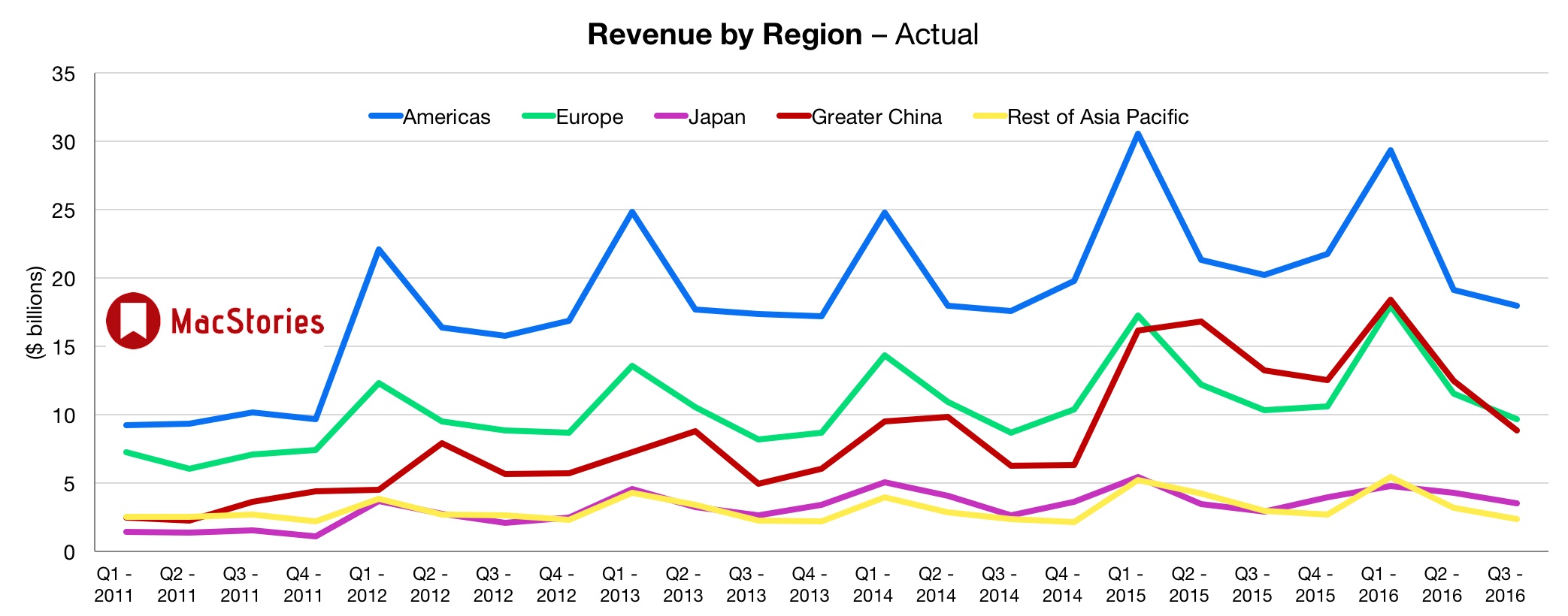

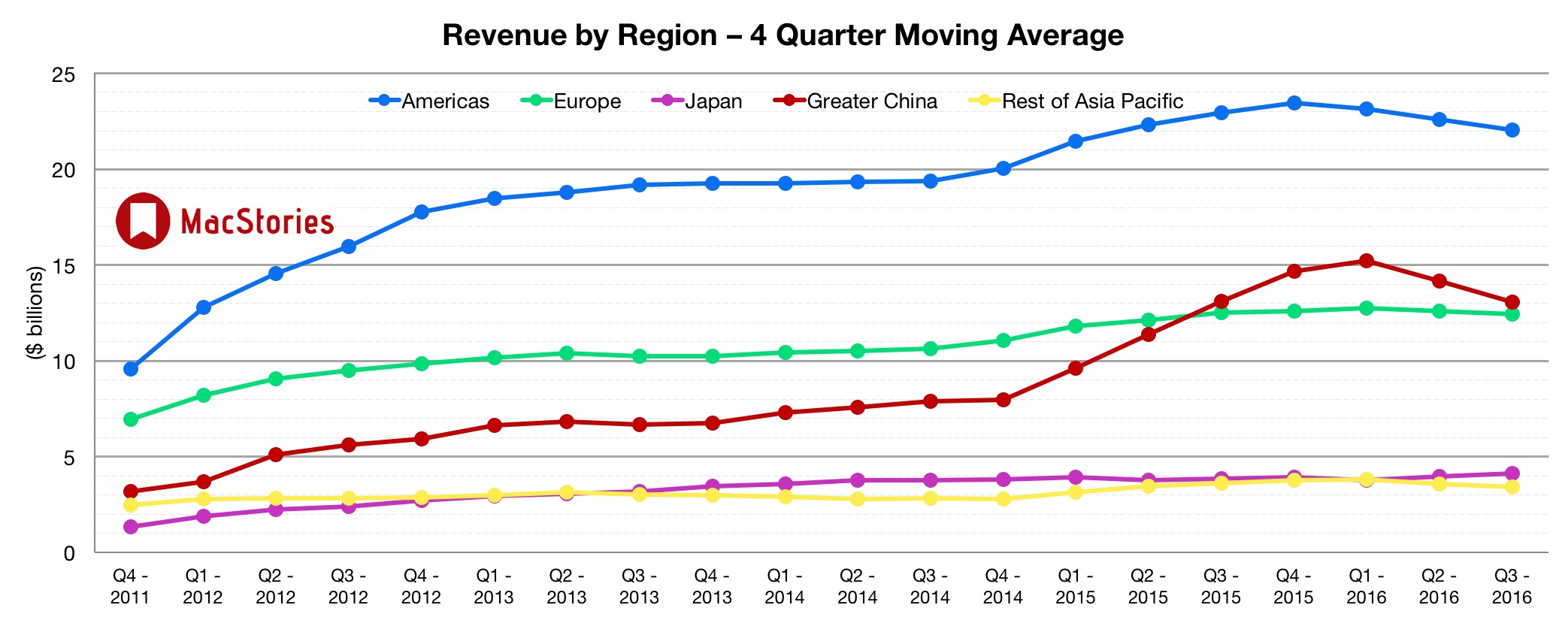

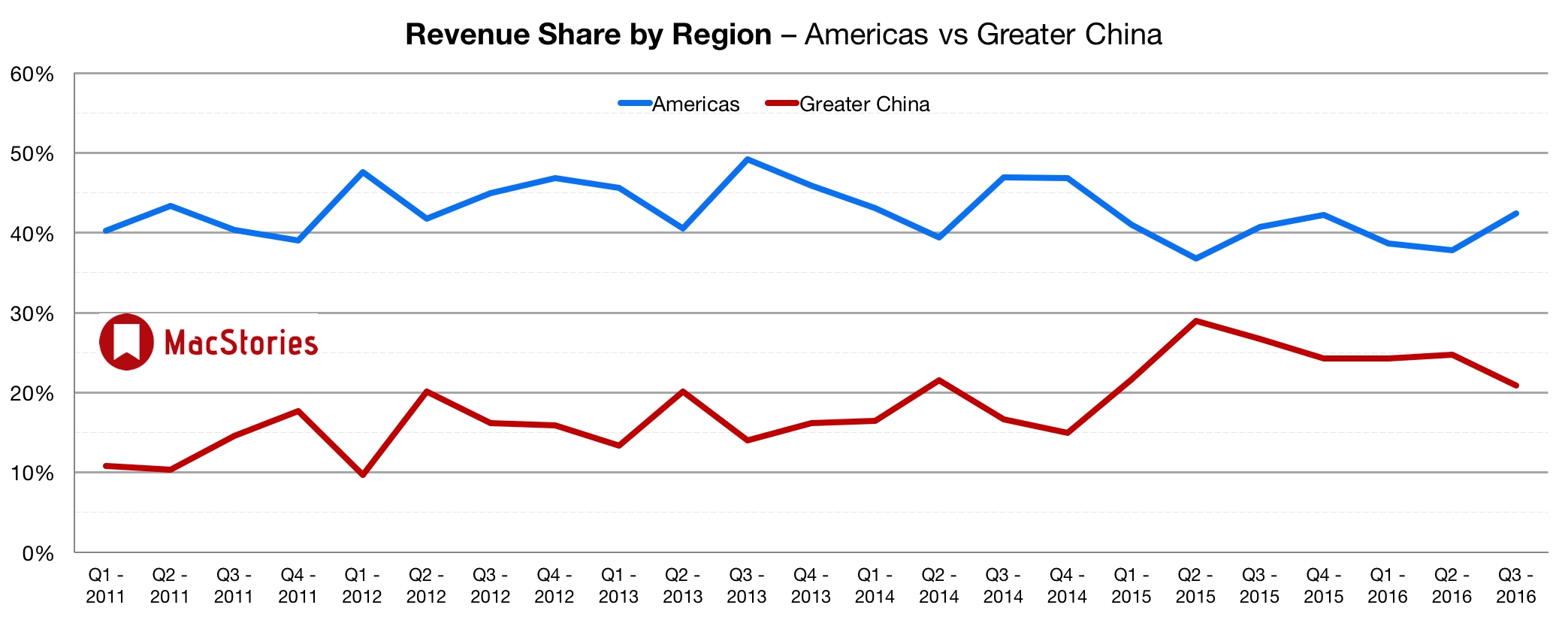

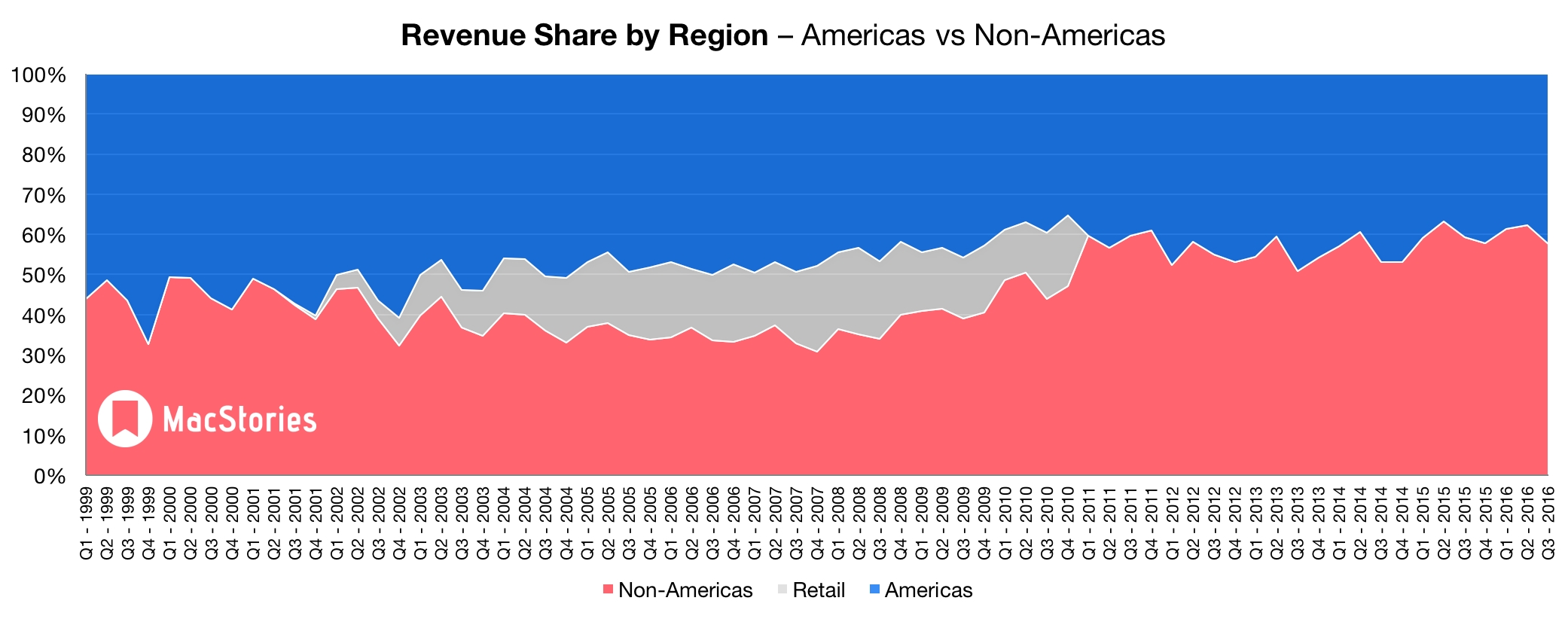

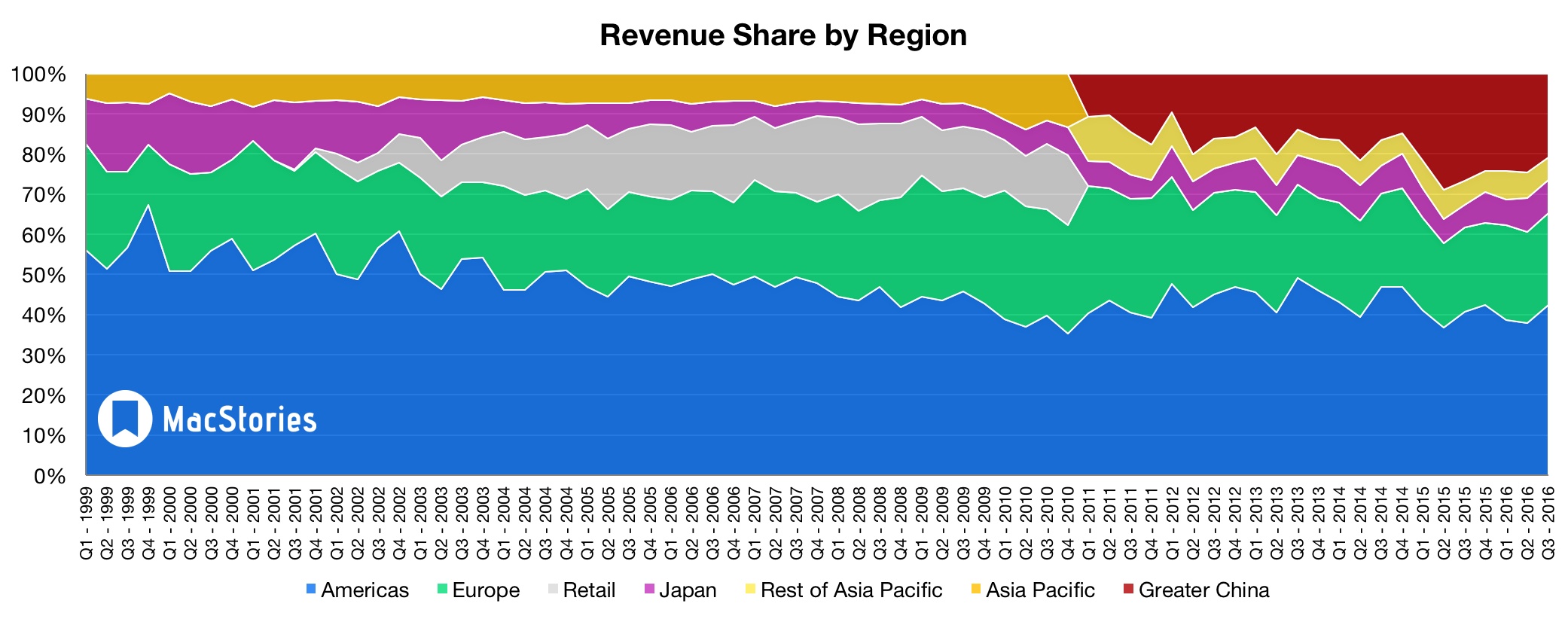

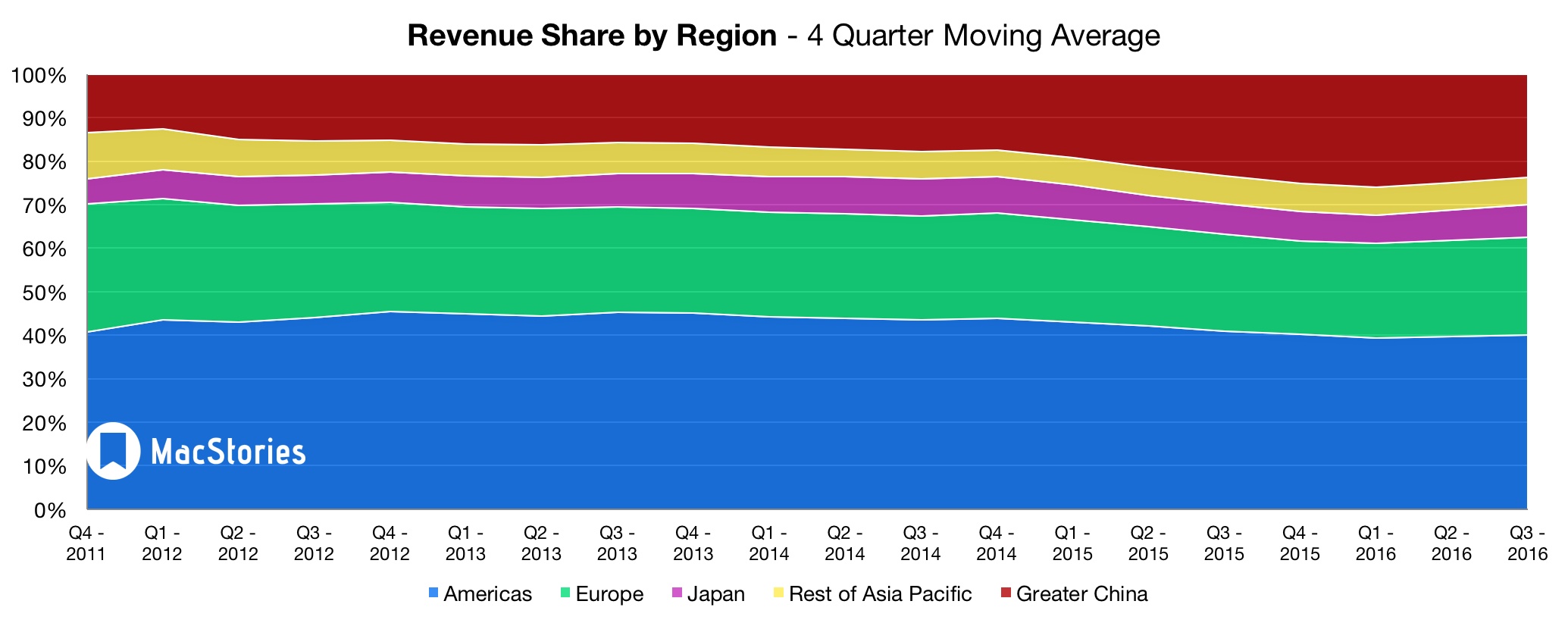

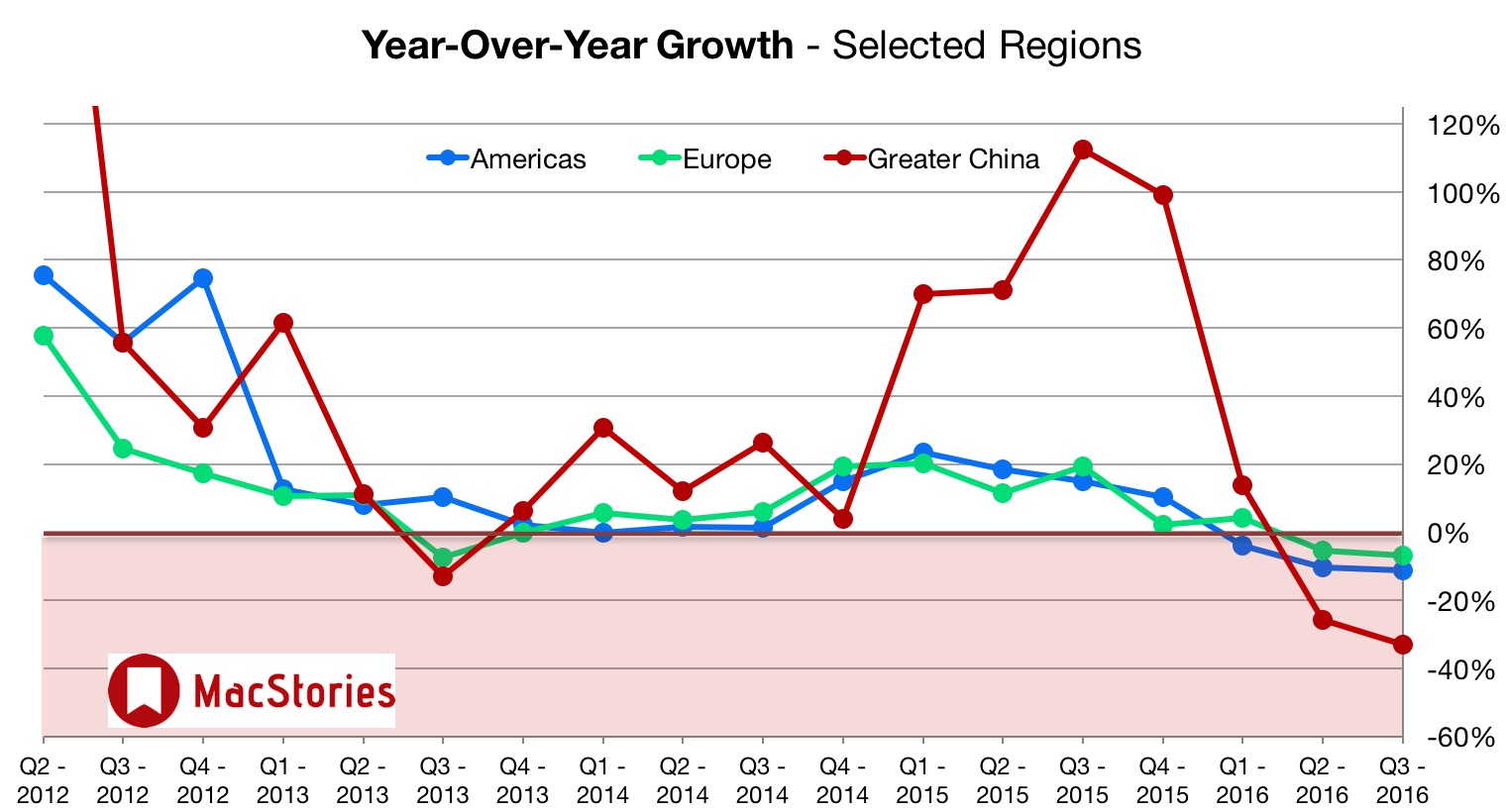

Graphical Visualization

Below, we’ve compiled a graphical visualization of Apple’s Q4 2015 financial results.