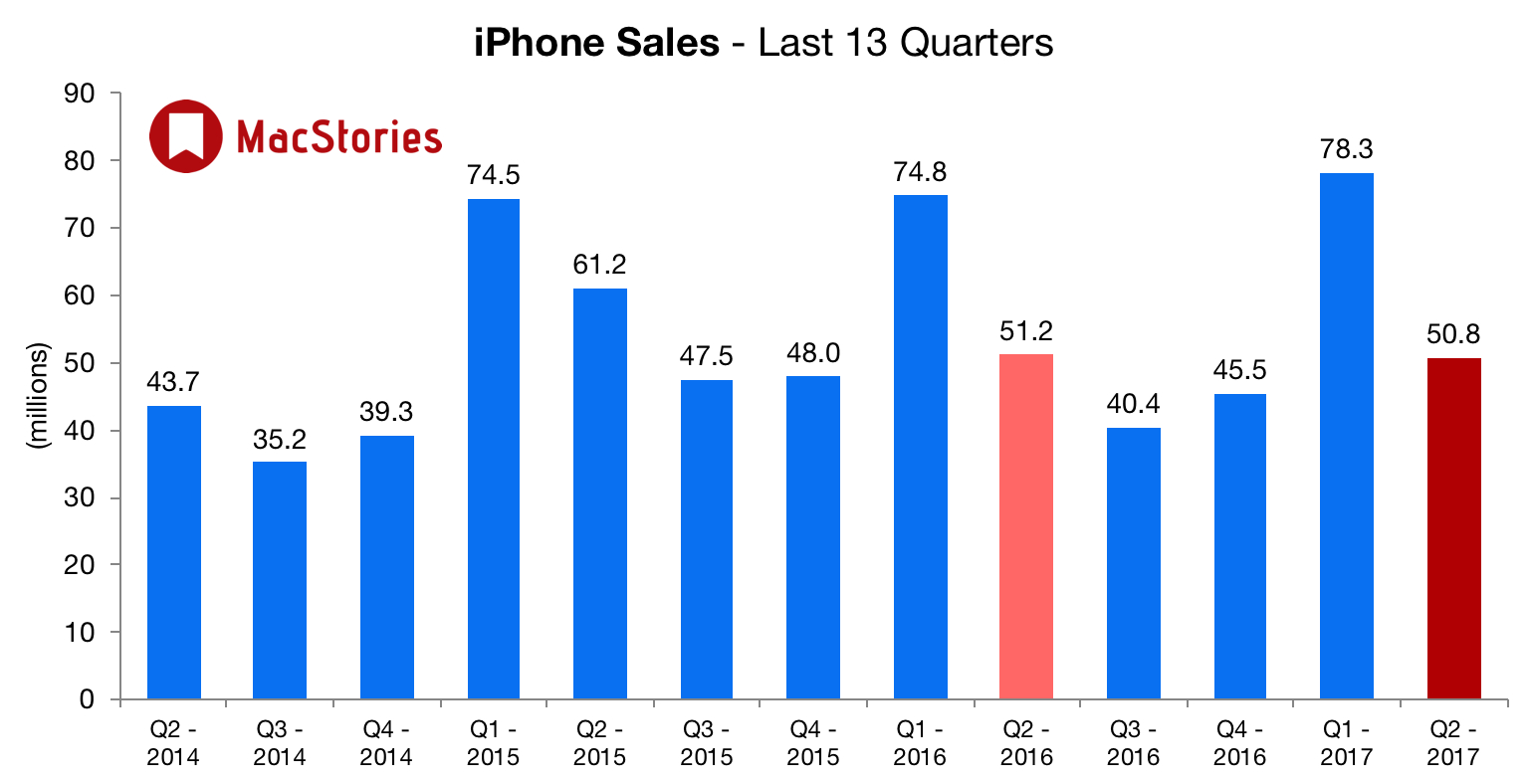

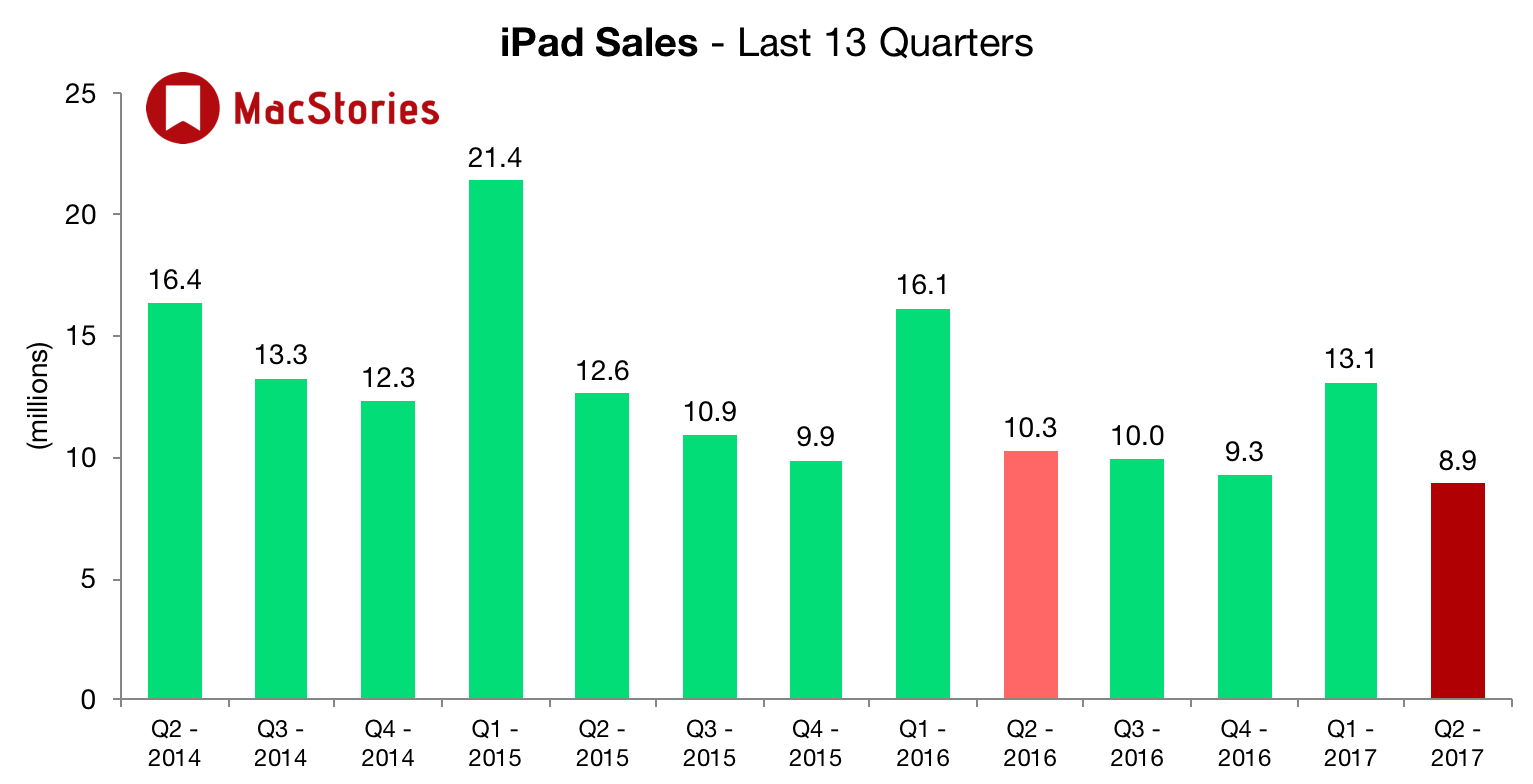

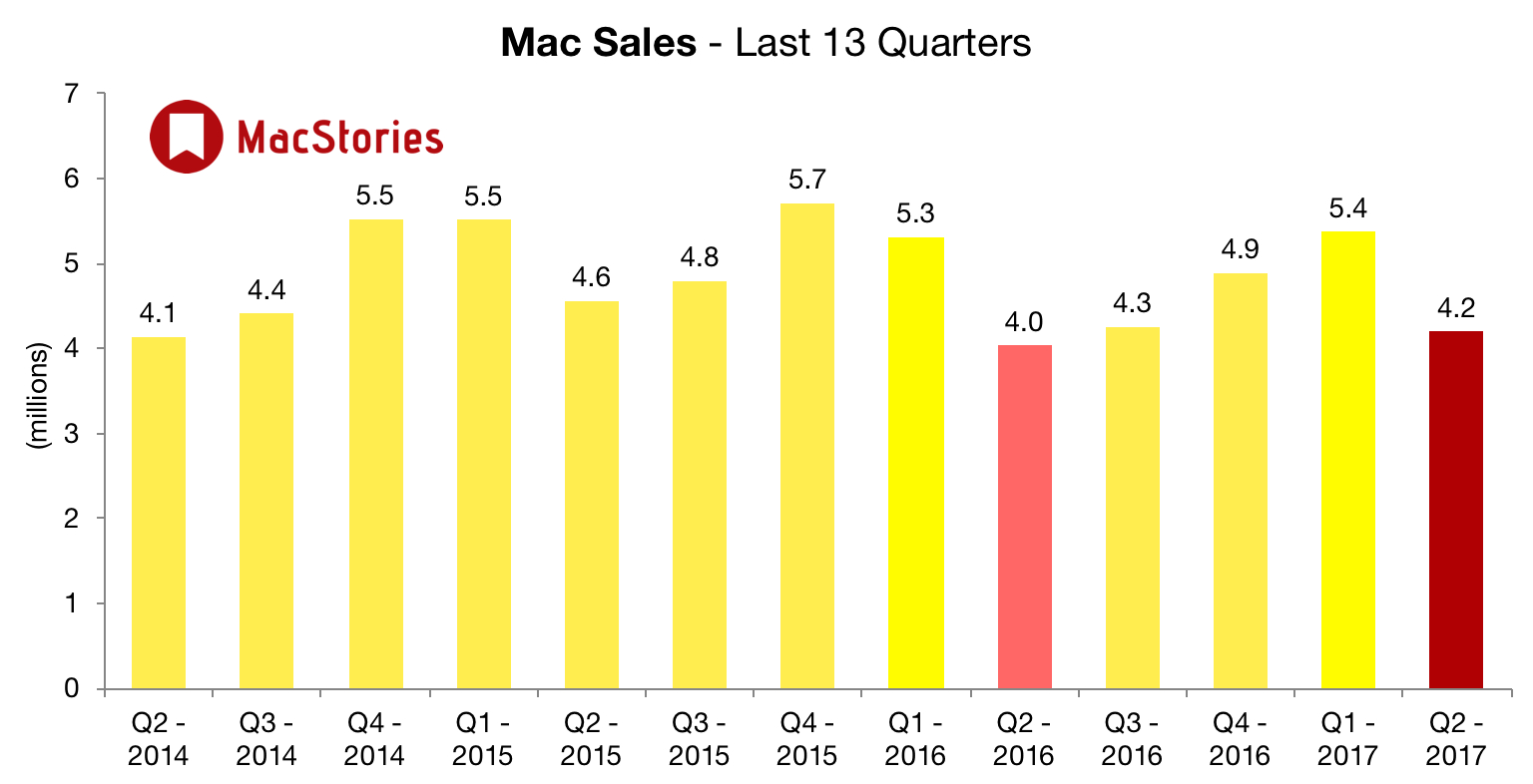

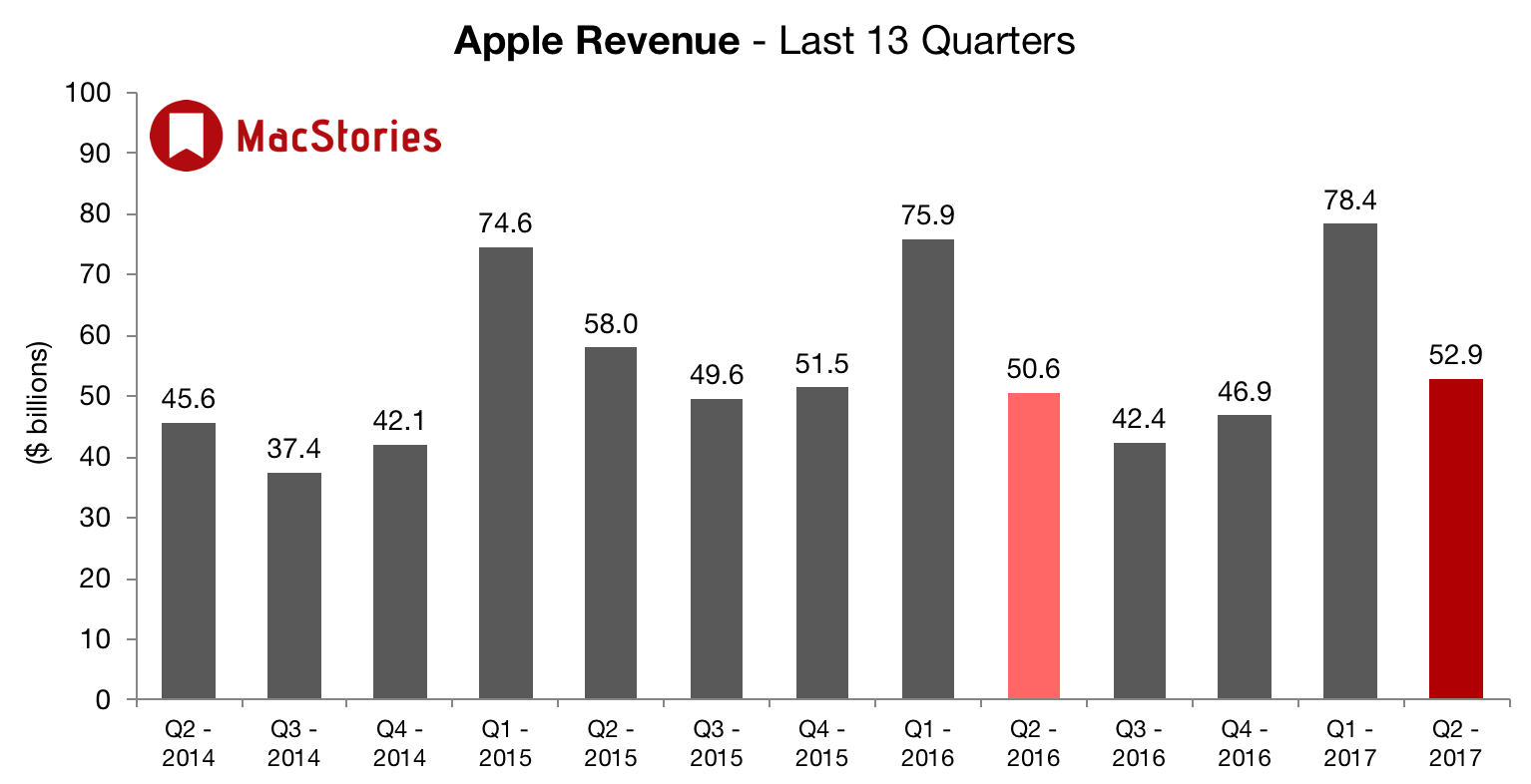

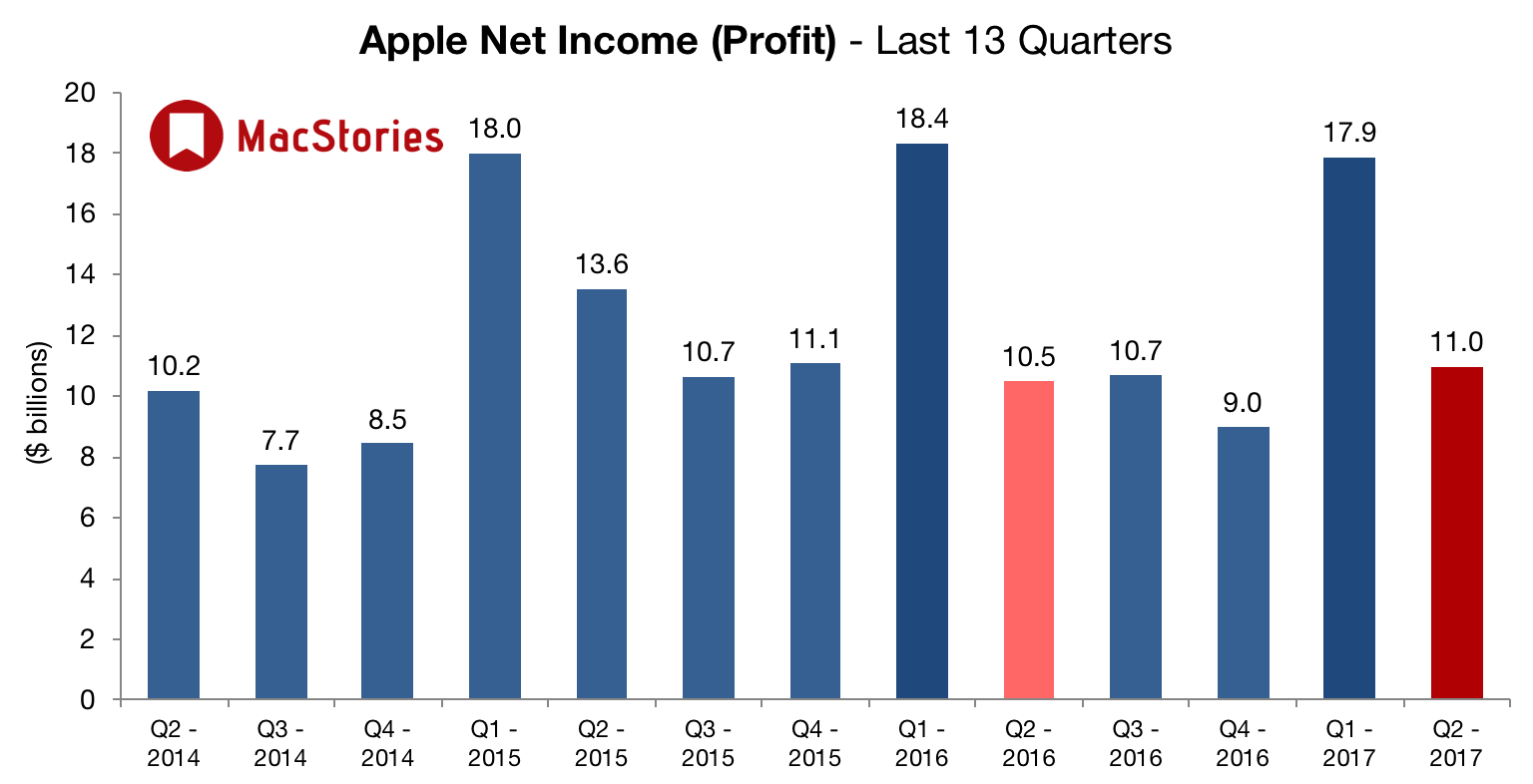

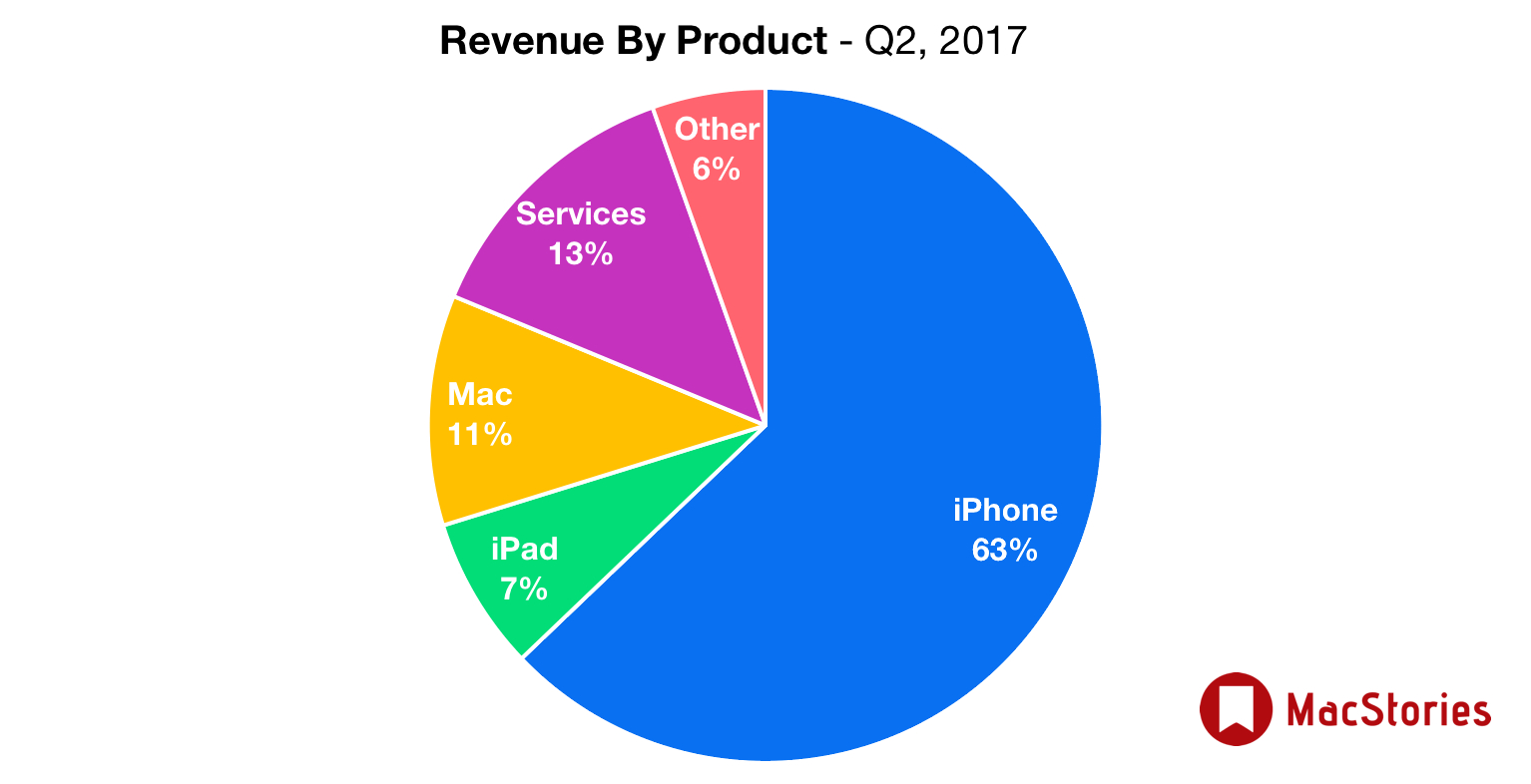

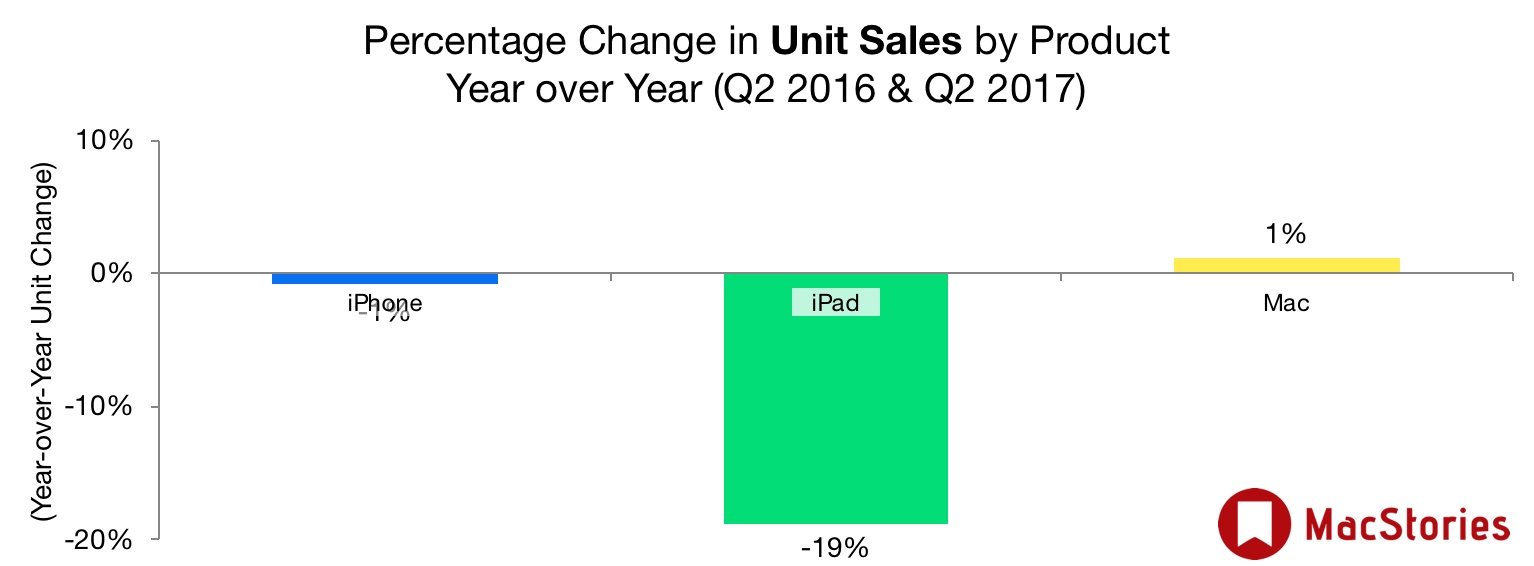

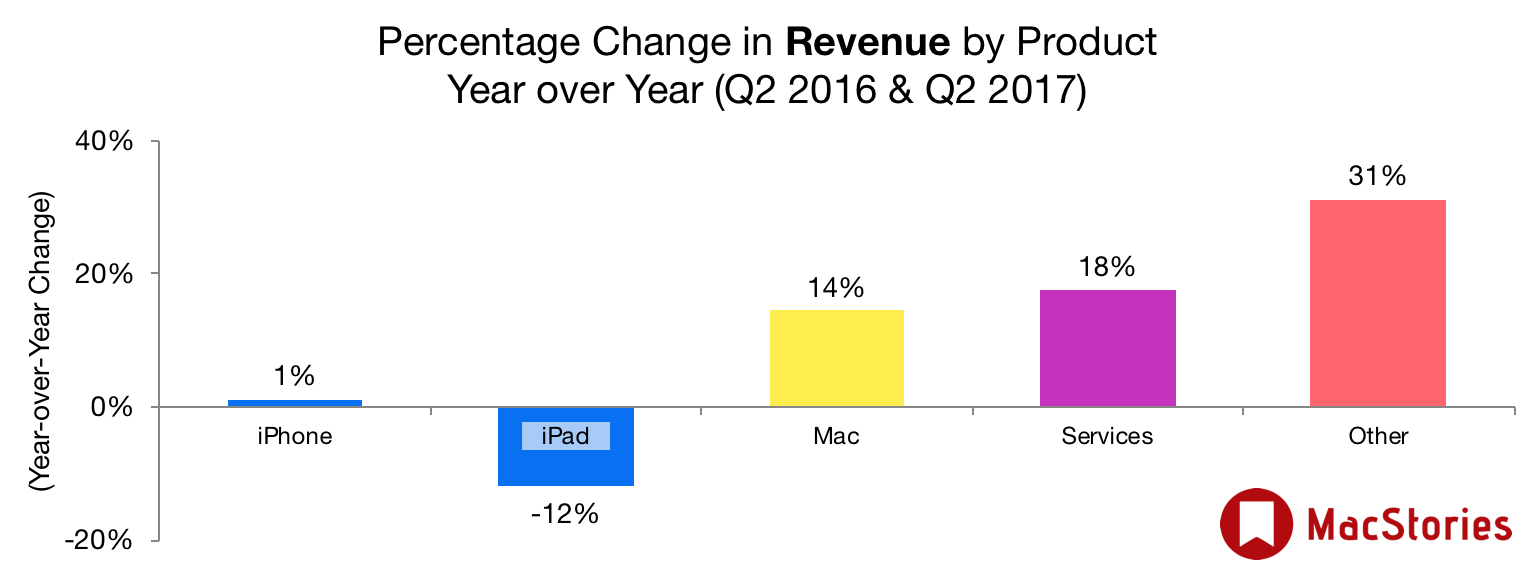

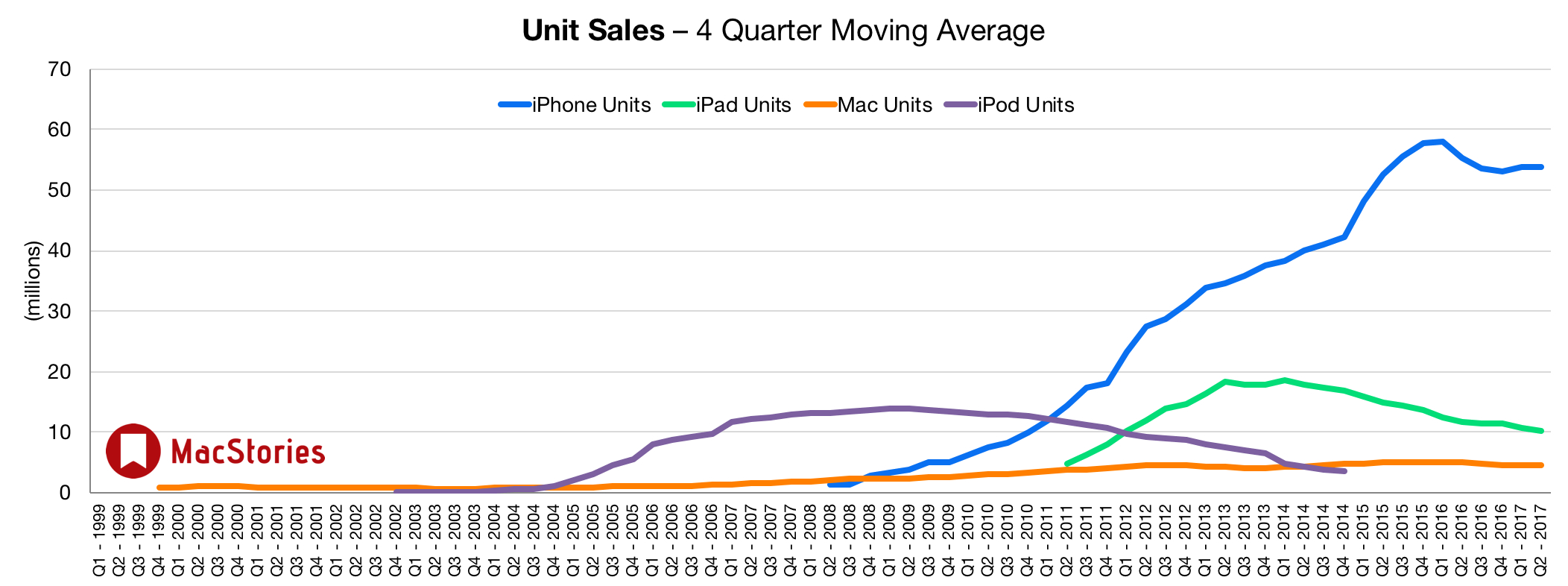

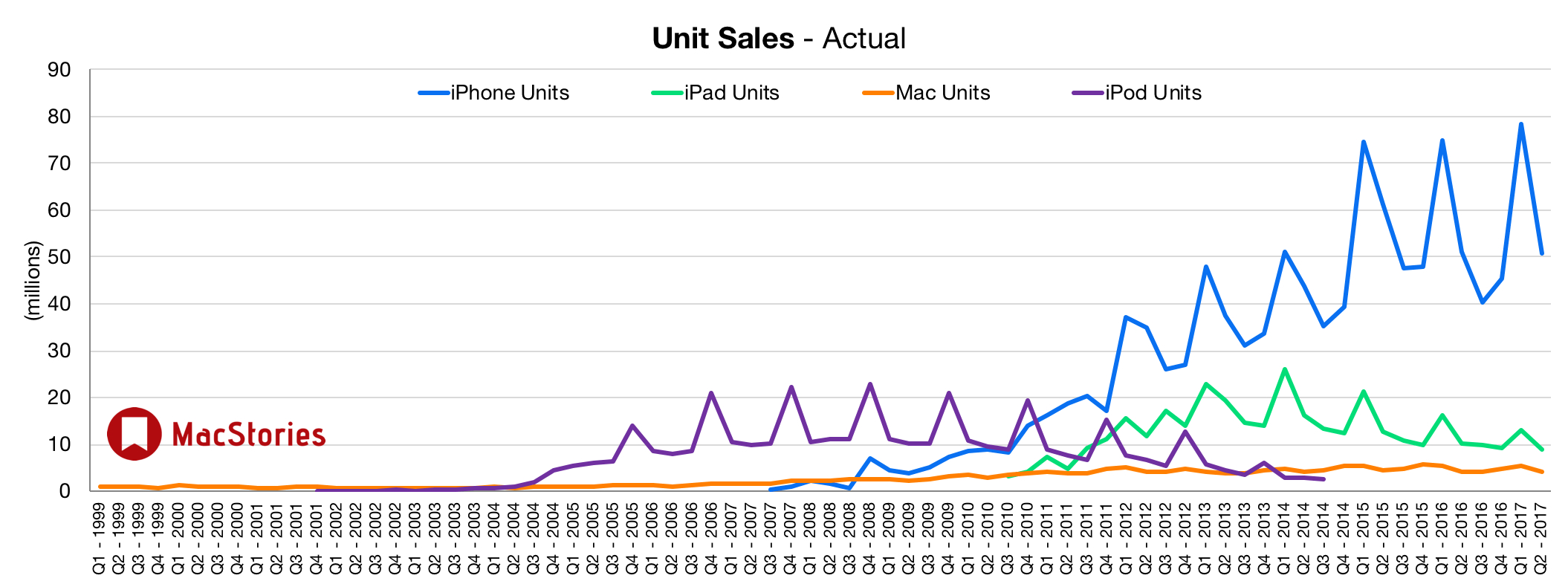

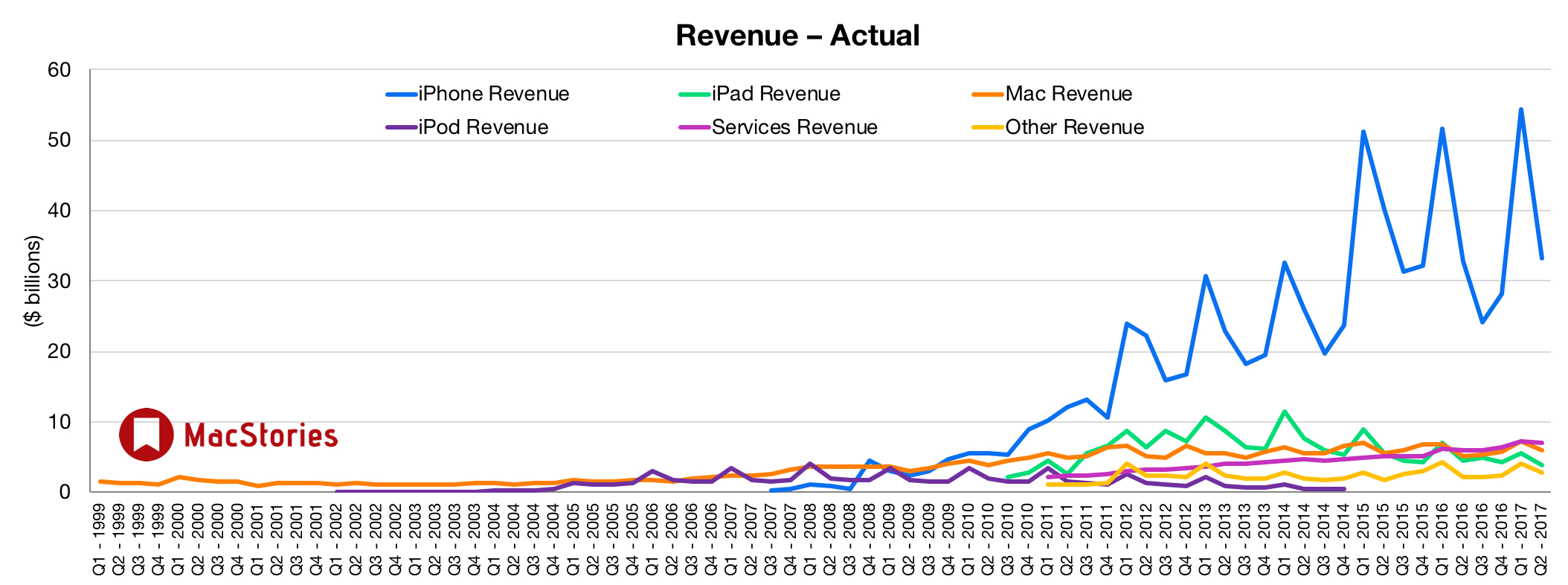

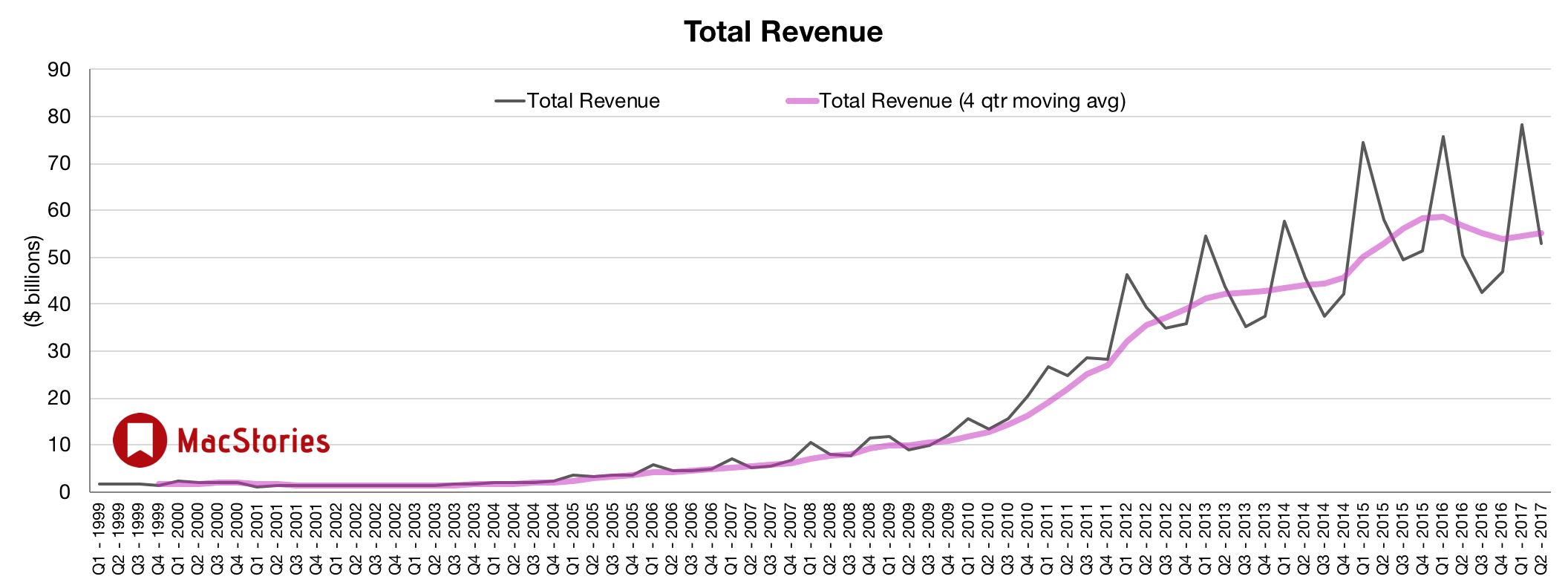

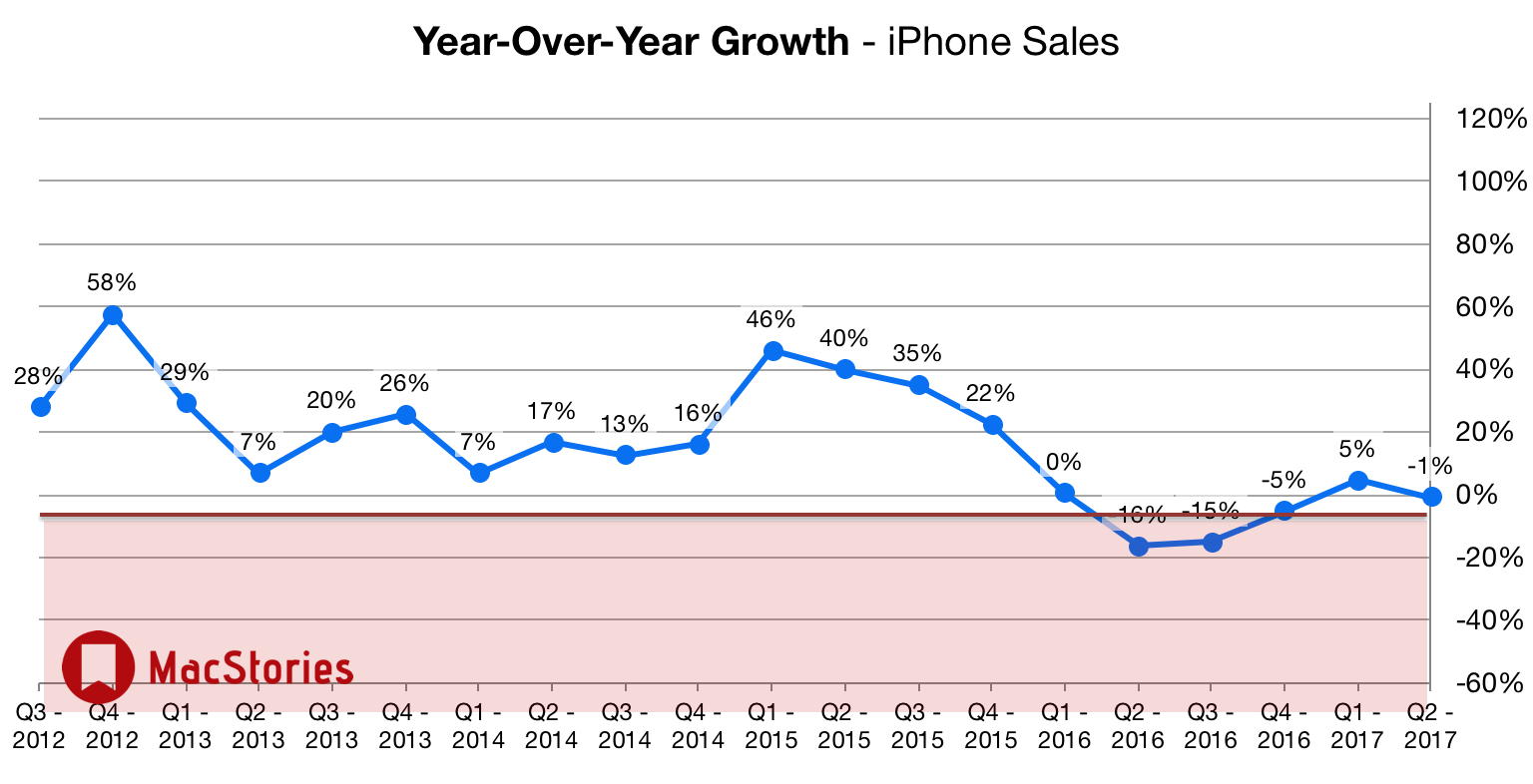

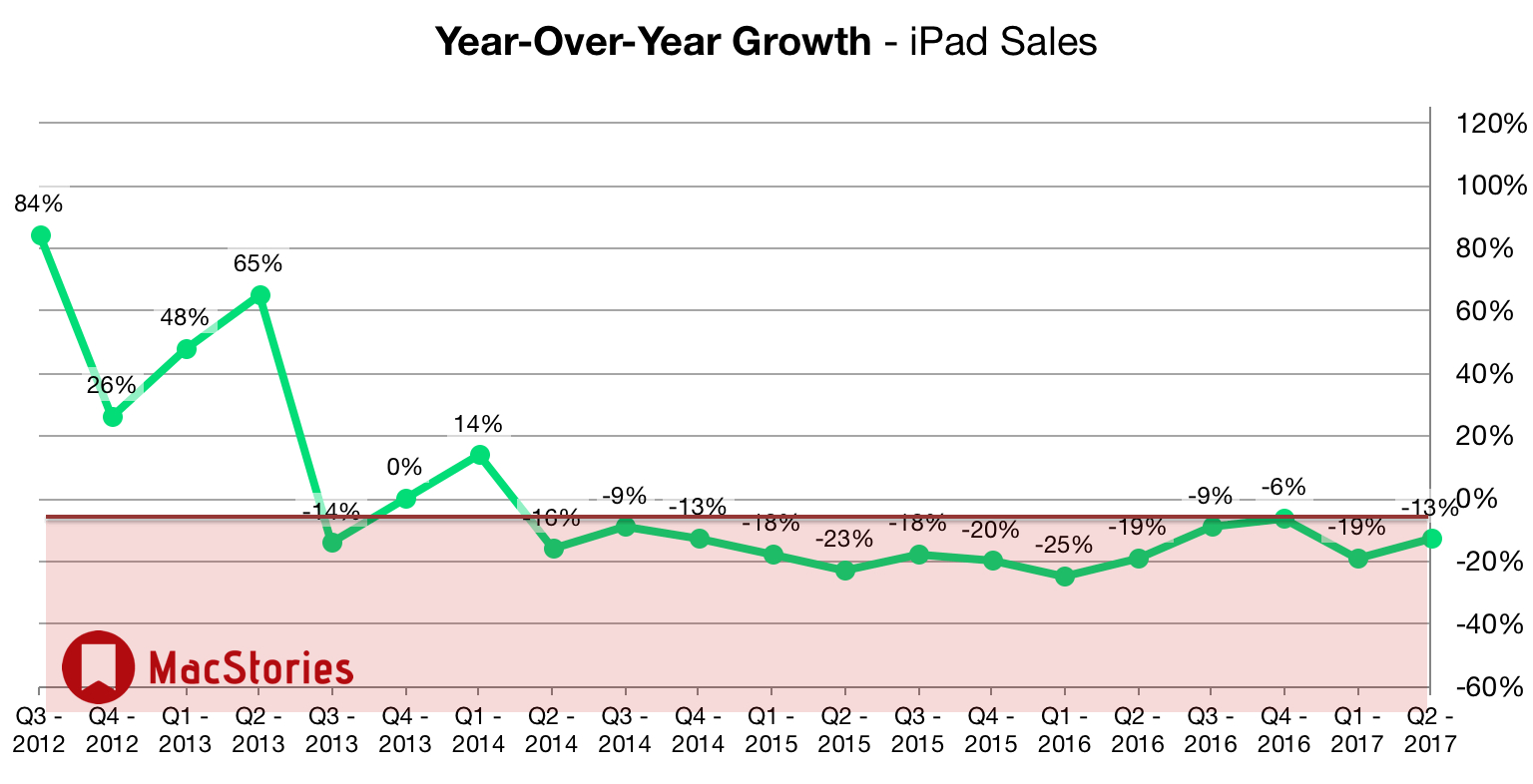

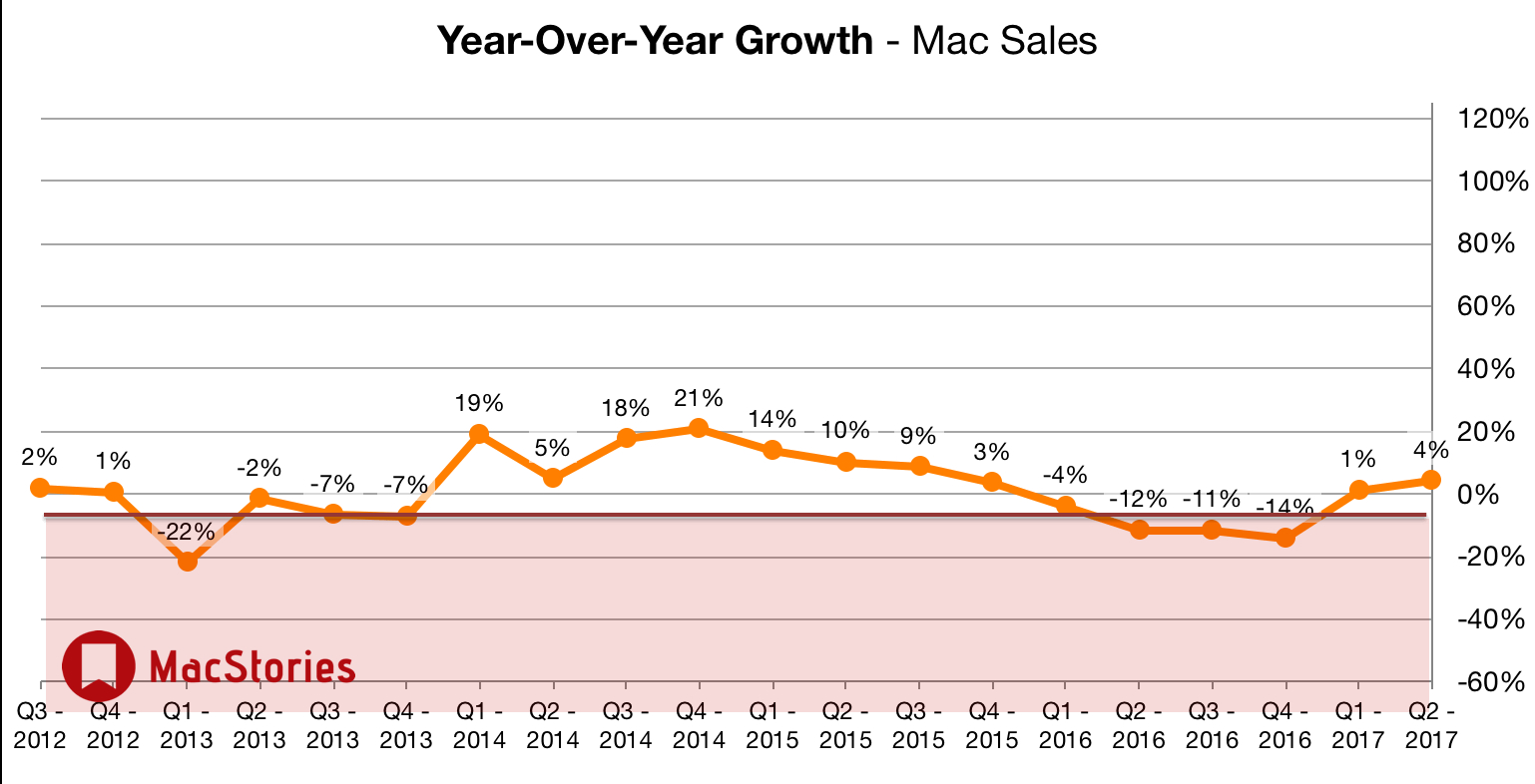

Apple has just published its financial results for Q2 2017, which covered the period from January 1, 2017 through to April 1, 2017. The company posted revenue of $52.9 billion with a quarterly net profit of $11 billion. Apple sold 8.9 million iPads, 50.8 million iPhones, and 4.2 million Macs during the quarter.

“We are proud to report a strong March quarter, with revenue growth accelerating from the December quarter and continued robust demand for iPhone 7 Plus,” said Tim Cook, Apple’s CEO. “We’ve seen great customer response to both models of the new iPhone 7 (PRODUCT)RED Special Edition and we’re thrilled with the strong momentum of our Services business, with our highest revenue ever for a 13-week quarter. Looking ahead, we are excited to welcome attendees from around the world to our annual Worldwide Developers Conference next month in San Jose.”

Estimates and Expectations for Q2 2017, and the Year-Ago Quarter (Q2 2016)

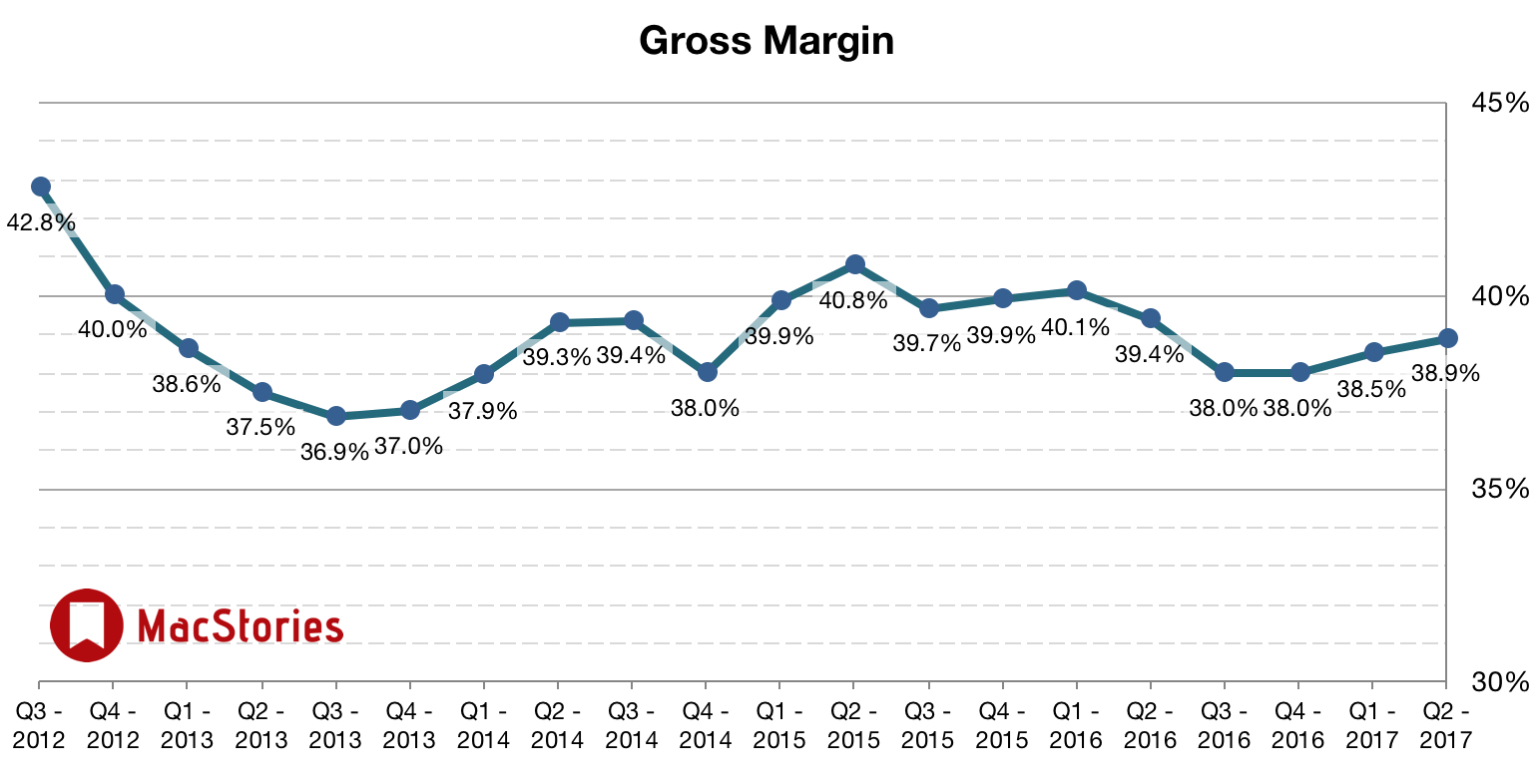

Apple’s revenue guidance for Q2 2017 fell between $51.5 billion and $53.5 billion, with gross margin estimated to be between 38% and 39%.

Going into today’s earnings call, Forbes reported that:

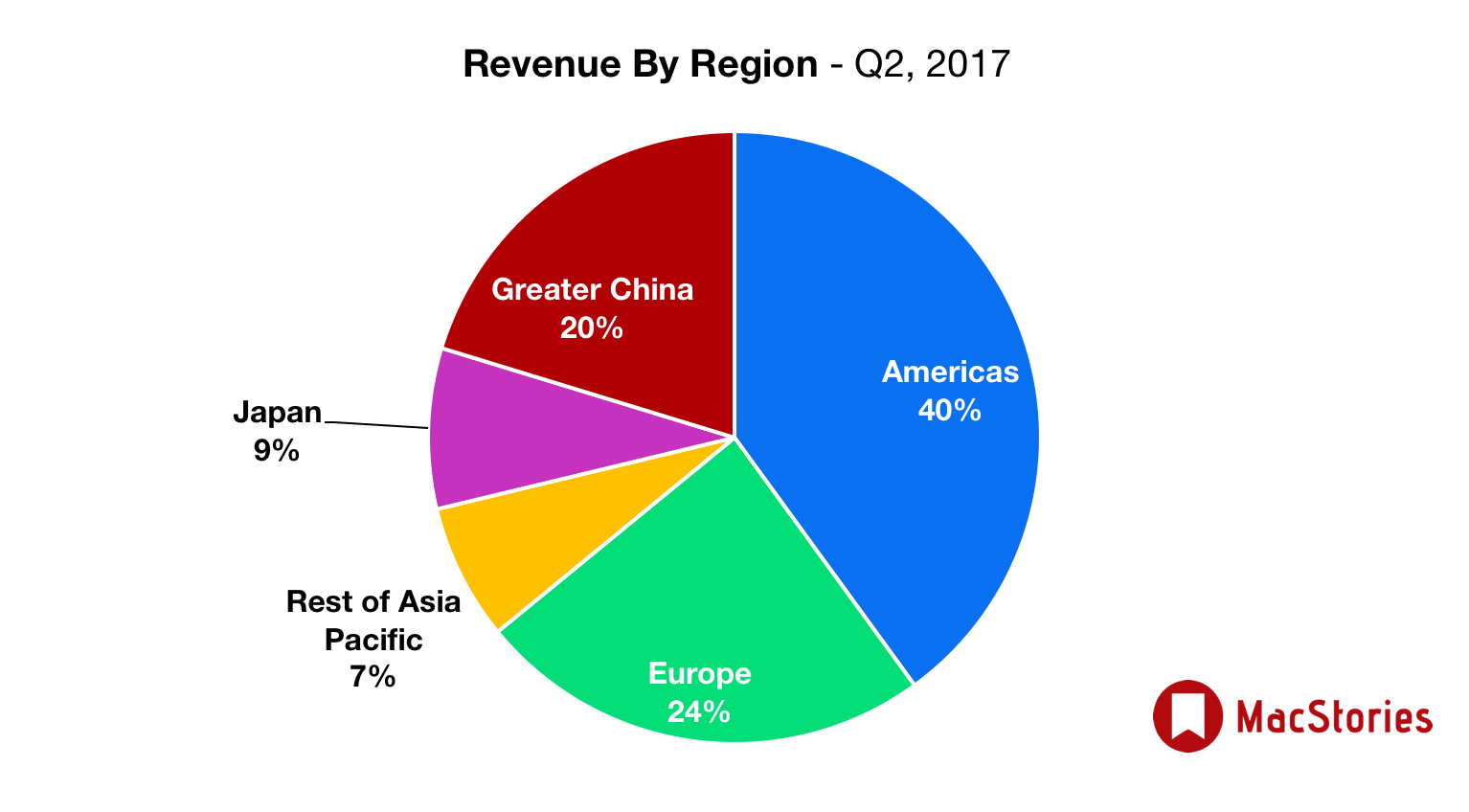

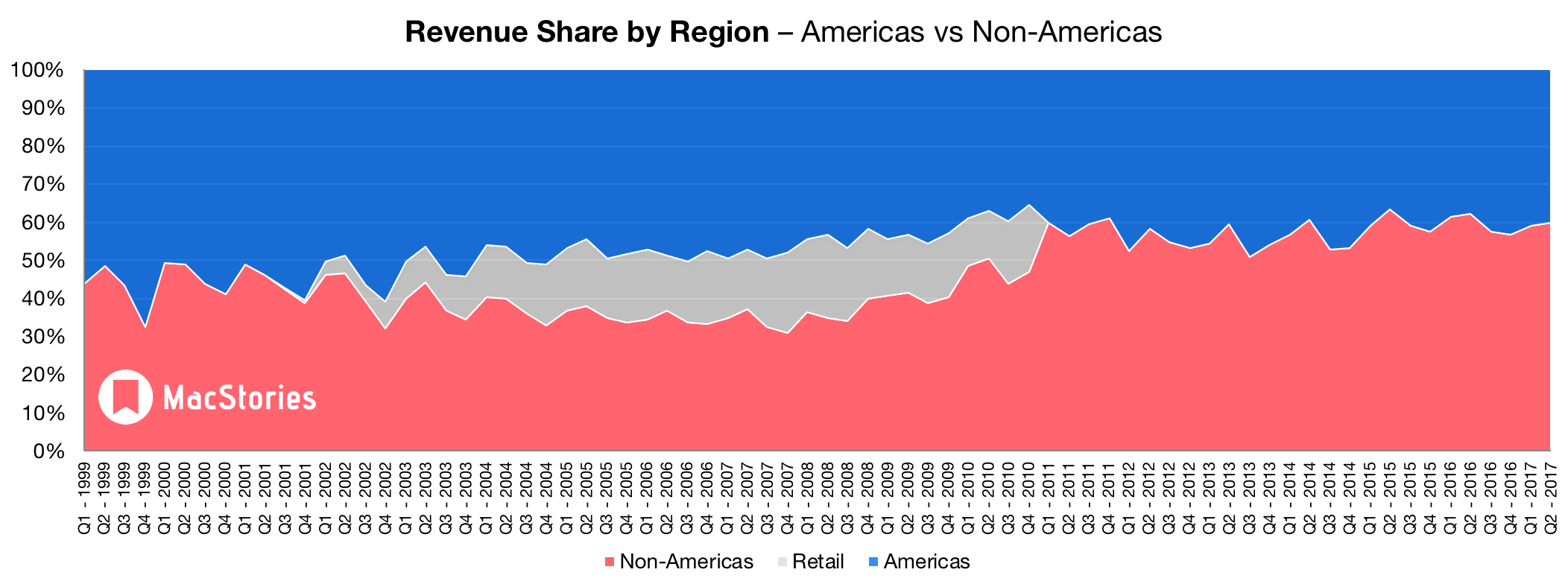

Apple is expected to report earnings of $2.01 per share, up from $1.90 in the same period last year, on revenue of $52.61 billion, according to consensus third-party analyst estimates. In the last quarter, it reported all-time record quarterly revenue on strong holiday results, with international sales accounting for 64% of the quarter’s revenue, according to its earnings press release.

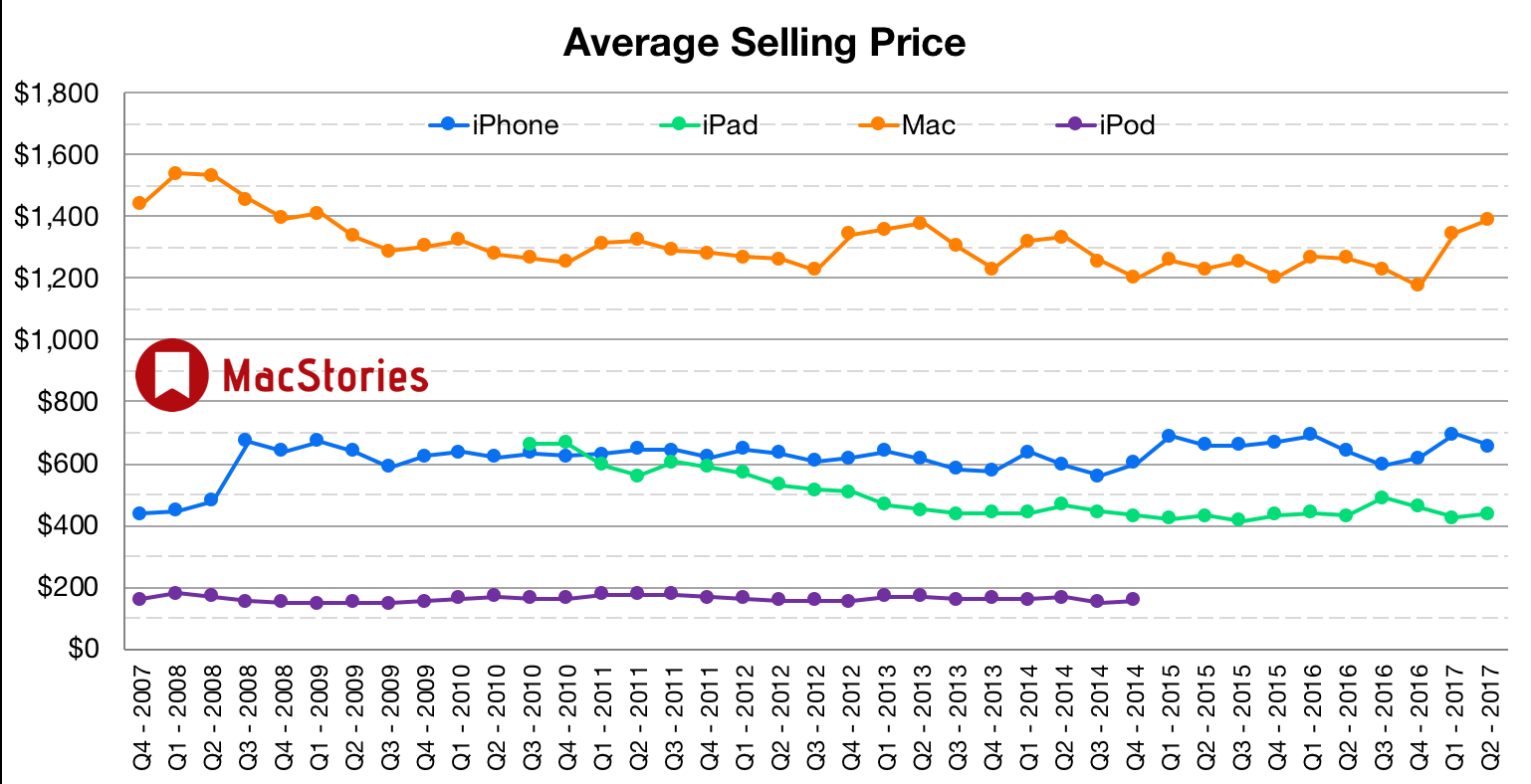

The big focus this quarter is on the company’s flagship smartphone products. iPhone sales are expected to increase 4.3% from a year ago, according to Wall Street estimates. In the previous quarter, Apple benefited from a rise in average selling prices, jumping to $695 from $619 in fiscal Q4. The company attributed the increase to a “very strong product mix and the amazing success of iPhone 7 Plus” on its earnings call.

In the year ago quarter (Q2 2016), Apple earned $50.6 billion in revenue, and $10.5 billion in profit. During that quarter Apple sold 51.2 million iPhones, 10.3 million iPads and 4 million Macs.

Notes from the Call

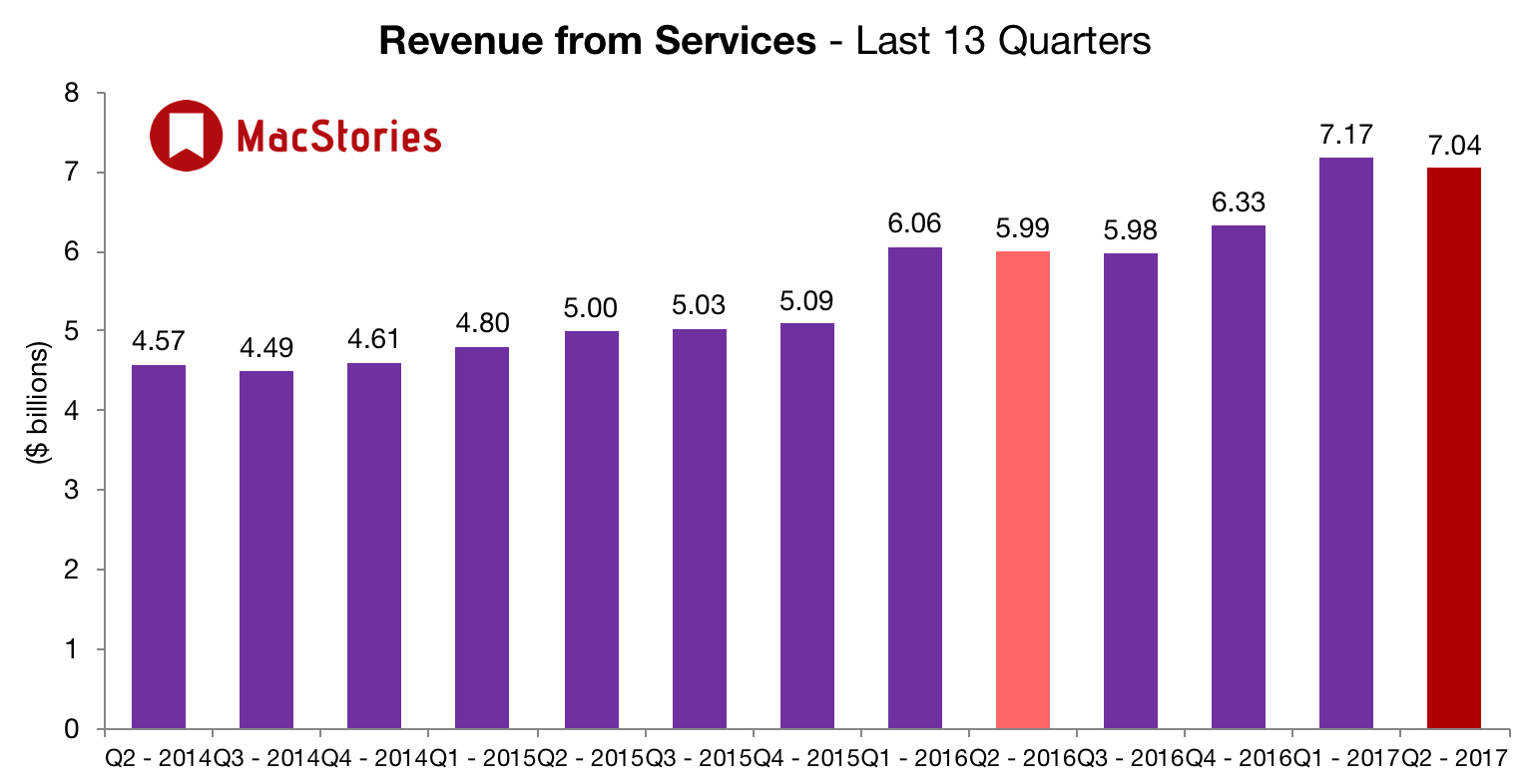

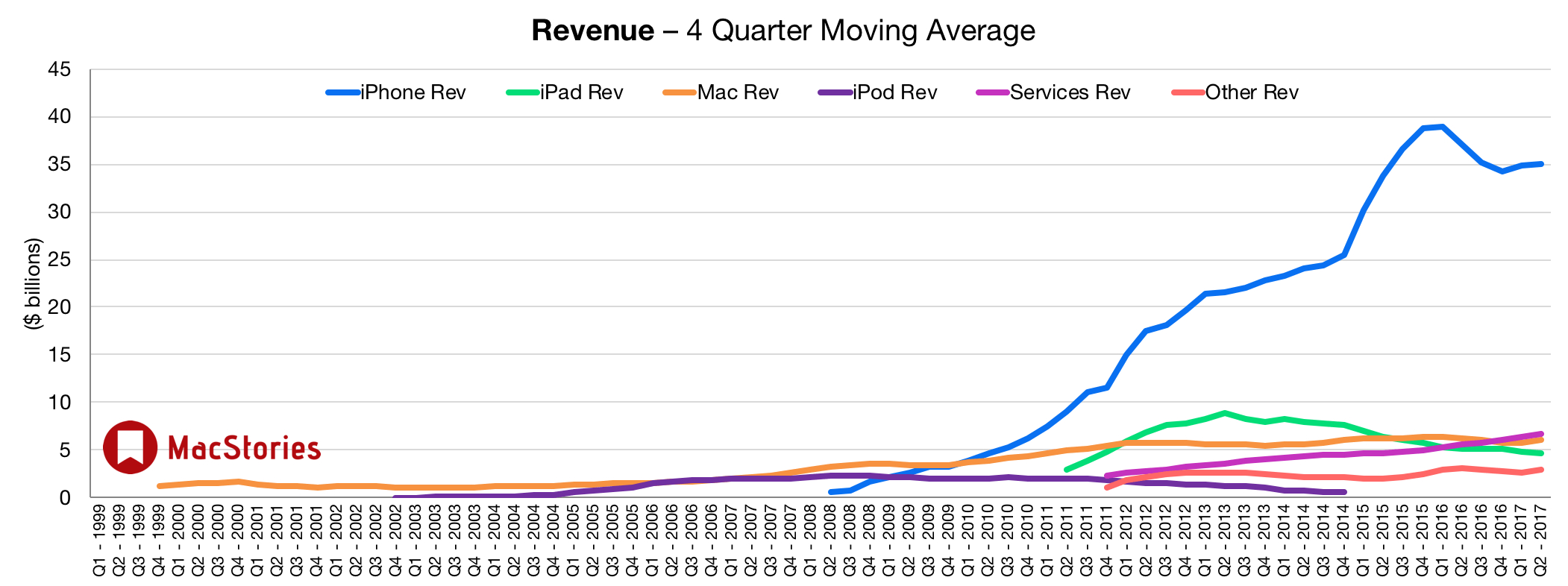

Services revenue tops $7 billion again.

App Store revenue up 40% year-over-year and the number of developers is up 26%.

380,000 messages sent per second during the Super Bowl from Messages app.

Gains in market share for the Mac driven by new MacBook Pro and investing aggressively in the Touch Bar feature.

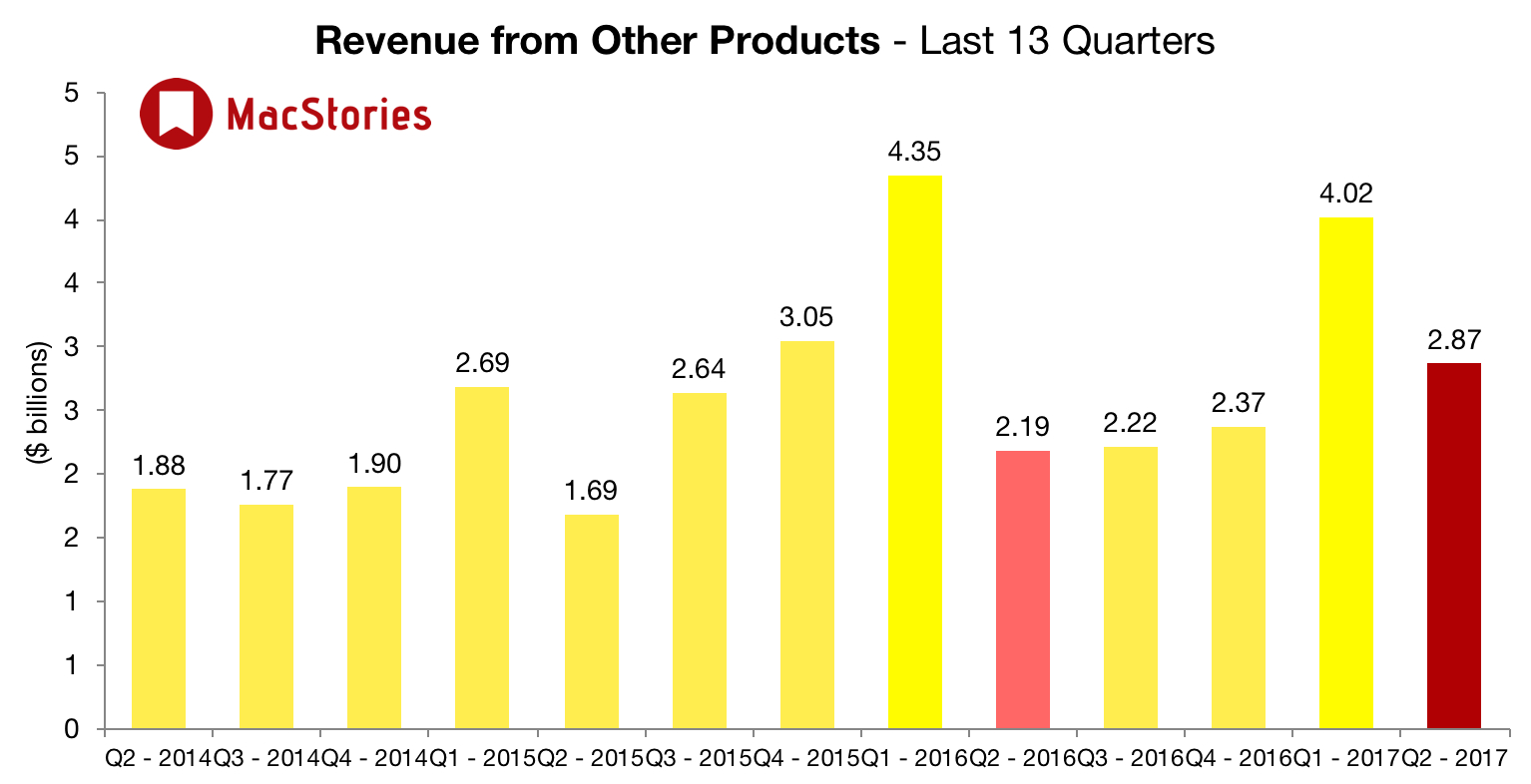

Apple Watch sales doubled year-over-year.

98% customer satisfaction for AirPods and demand exceeds supply.

Revenue from wearables (Apple Watch, Beats, and AirPods) was the size of a Fortune 500 company.

Apple Retail is debuting new experiences to customers like the Dubai Mall store.

Apple spent over $50 billion on US suppliers in the last fiscal year.

iPad sales beat Apple’s expectations.

Apple is raising its dividend to $0.63/share and extending its stock buy-back program to March 2019.

Q3 2017 guidance of $43.5 to $45.5 billion in revenue, gross margin between 37.5 and 38.5%, and operating expenses of $6.6 - $6.7 billion.

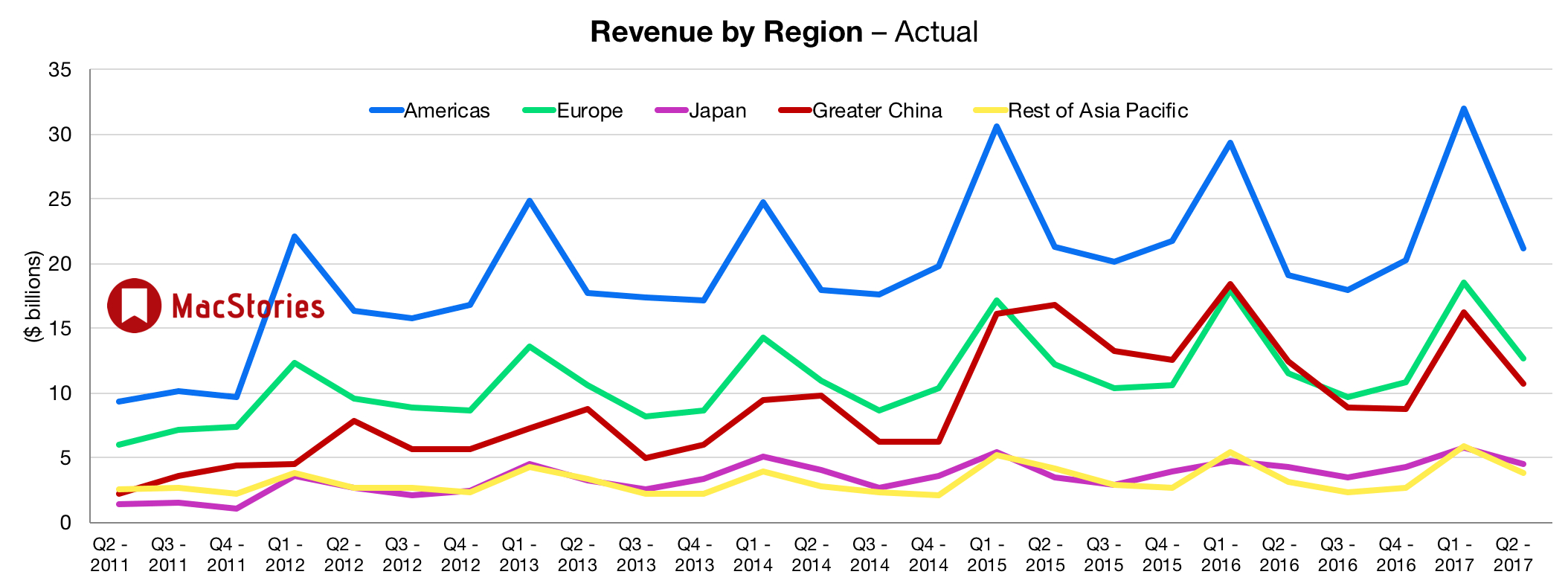

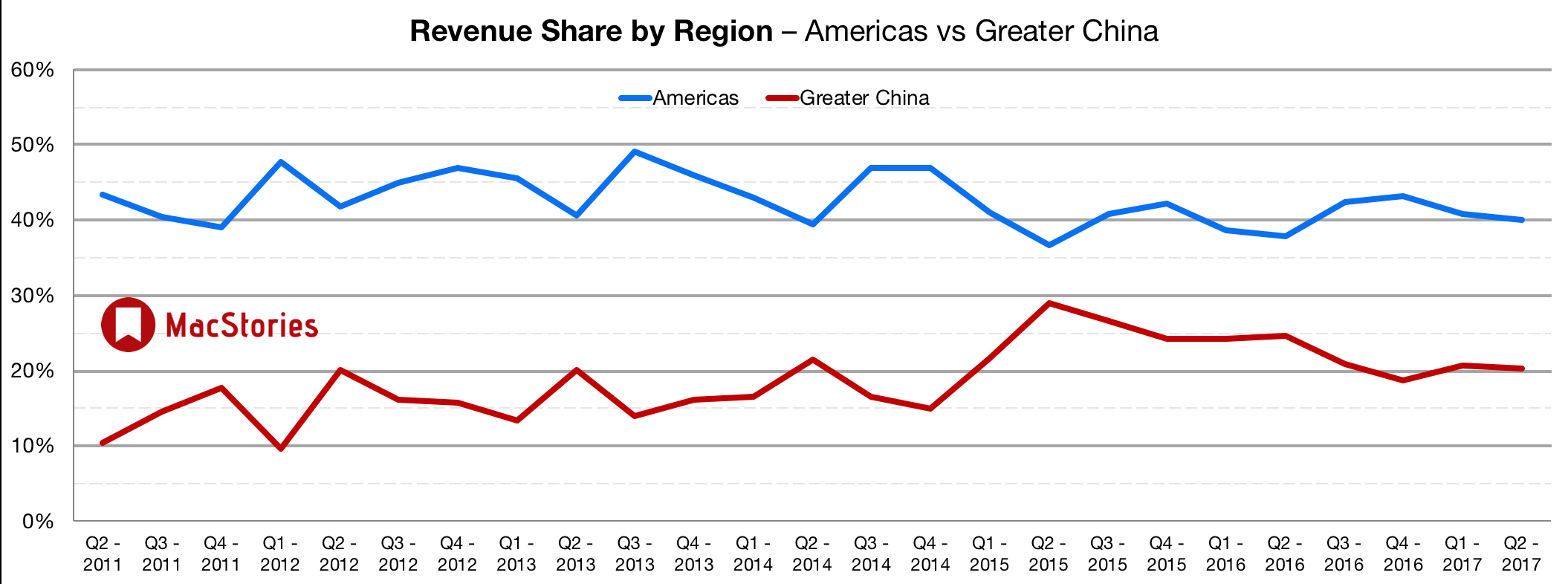

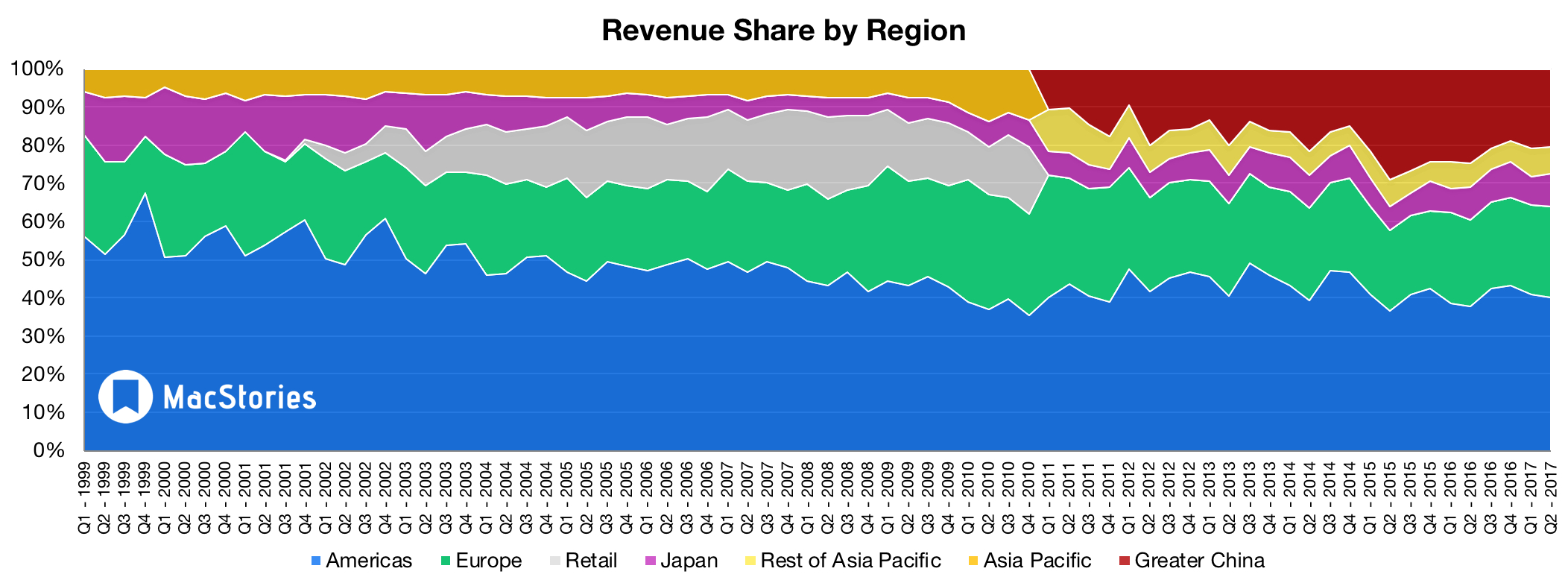

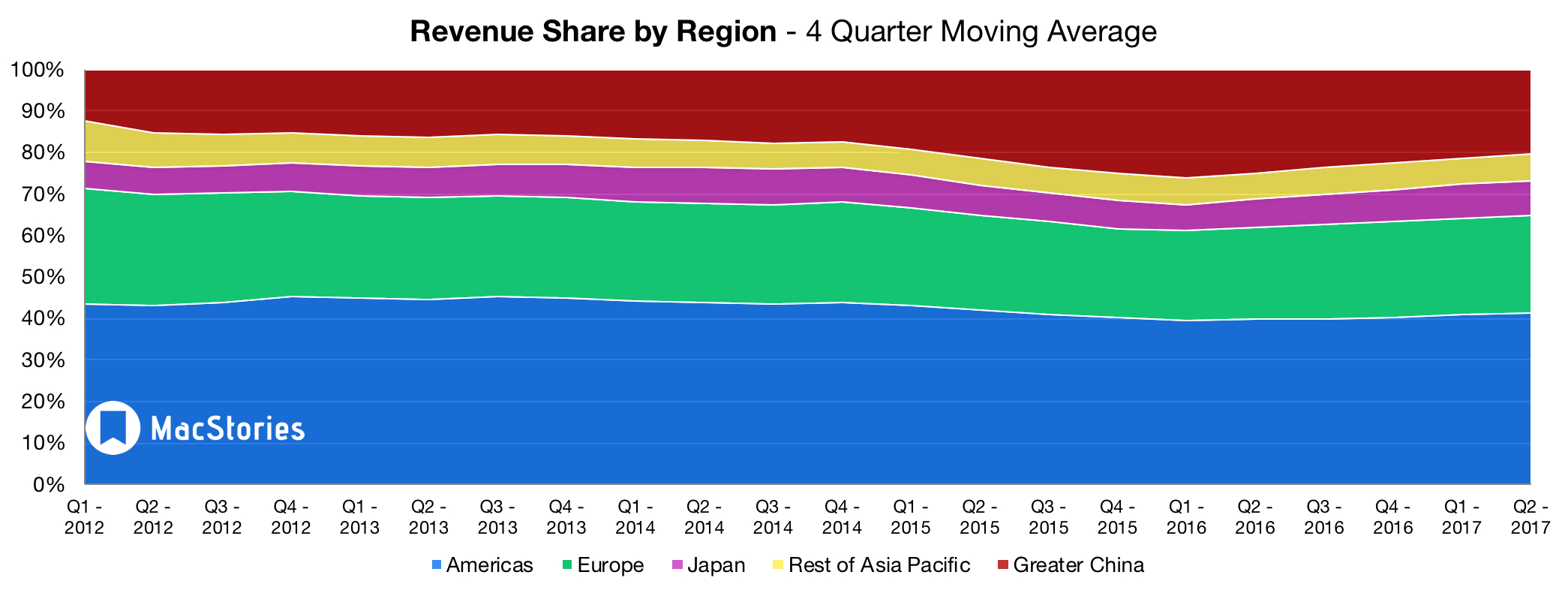

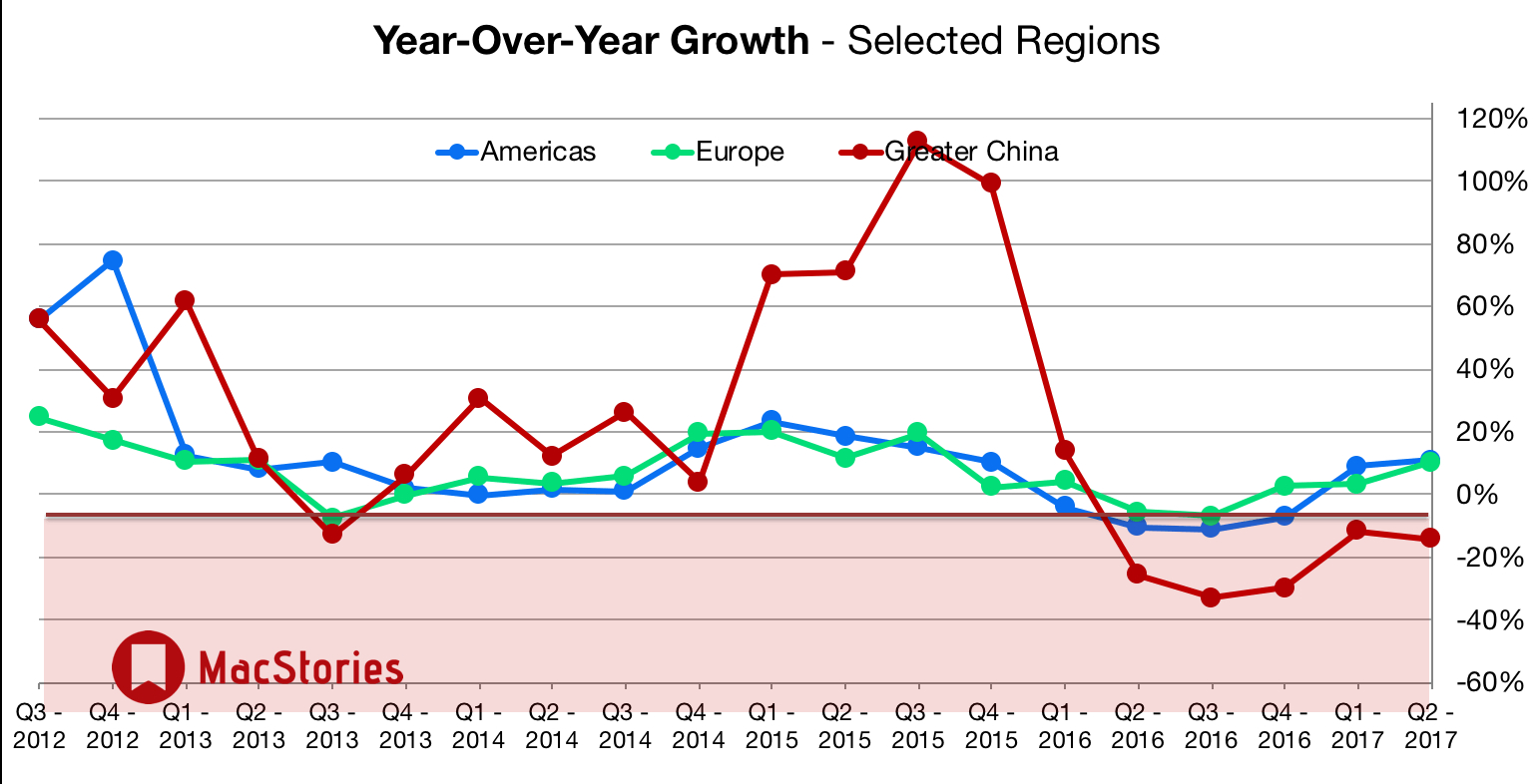

Tim Cook explains that 7 of top 10 trafficked retail stores are in Greater China, but performance was hurt by a 5% devaluation in currency.

Apple Q2 2017 on Twitter:

iPhone unit sales: 50.8M

iPad unit sales: 8.9M

Mac unit sales: 4.2M— Neil Cybart (@neilcybart) May 2, 2017

.@CNBC Apple EPS $2.10, Rev $52.9B, margin 38.9%, $35B more for stock buybacks, $50B more for capital reinvestment

— MacJournals.com (@macjournals) May 2, 2017

.@CNBC Q3 guidance: $43.5-$45.5B, Q3 margin guide 37.5%-38.5%

— MacJournals.com (@macjournals) May 2, 2017

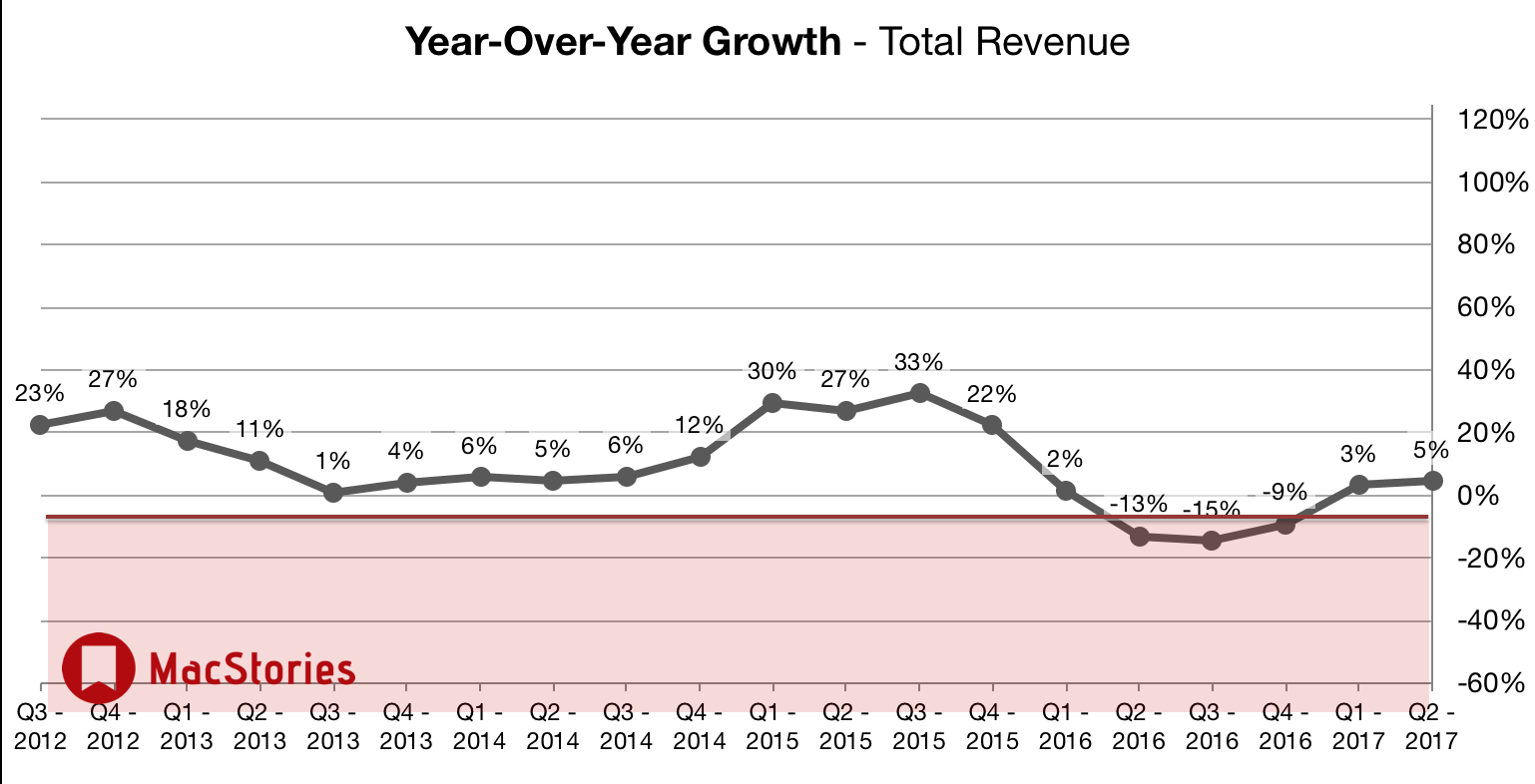

Apple’s return to revenue growth continues pic.twitter.com/QYIjJ7C8sX

— Jan Dawson (@jandawson) May 2, 2017

Growth in Apple’s R&D spend slowing down a bit – stabilizing around 5% of revenues (still far higher in $ and % terms than under Jobs) pic.twitter.com/3uUbMNrErF

— Jan Dawson (@jandawson) May 2, 2017

Slightly surprising to see iPhone ASPs dip below last year’s March quarter given all-time high in Dec 16 quarter pic.twitter.com/lpjY4CB9V7

— Jan Dawson (@jandawson) May 2, 2017

Apple’s services is up YoY, down slightly from Q1.

China off -14 YoY leading to a big fall swing likely.

— Ben Bajarin (@BenBajarin) May 2, 2017

At first glance, looks like a pretty good quarter for Apple Watch sales (note this chart is annualized sales) pic.twitter.com/OuvkFaUDia

— Jan Dawson (@jandawson) May 2, 2017

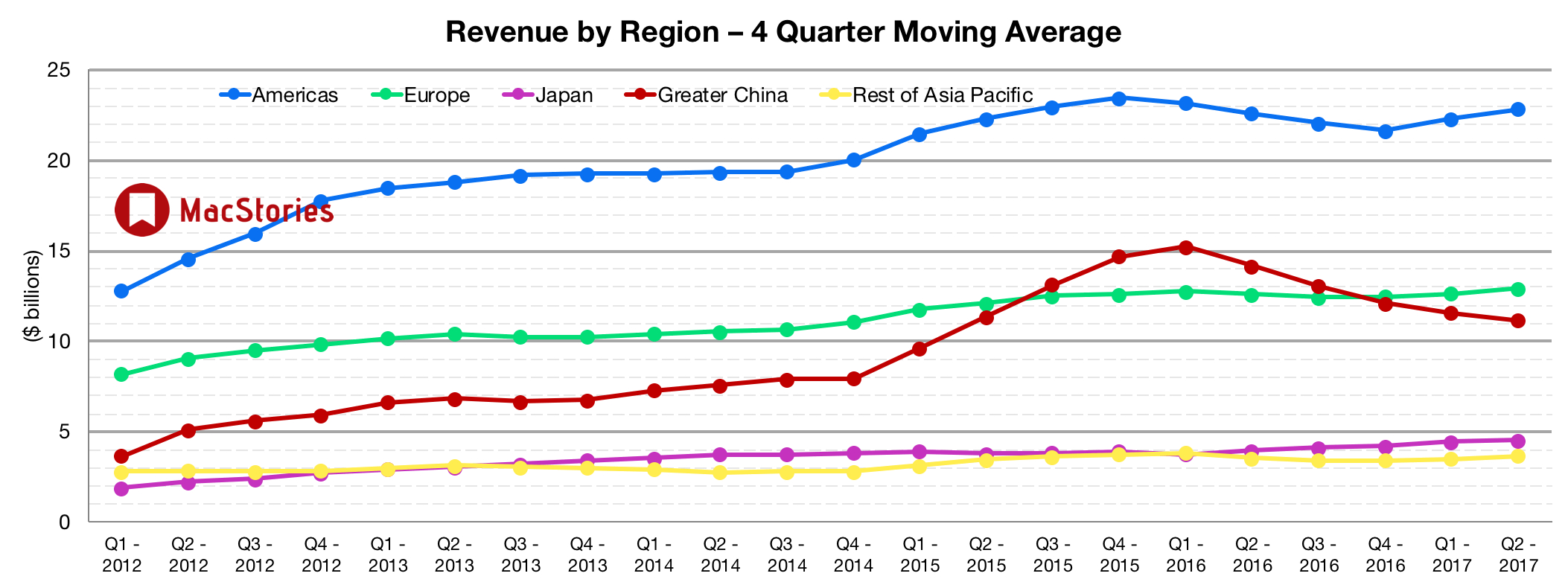

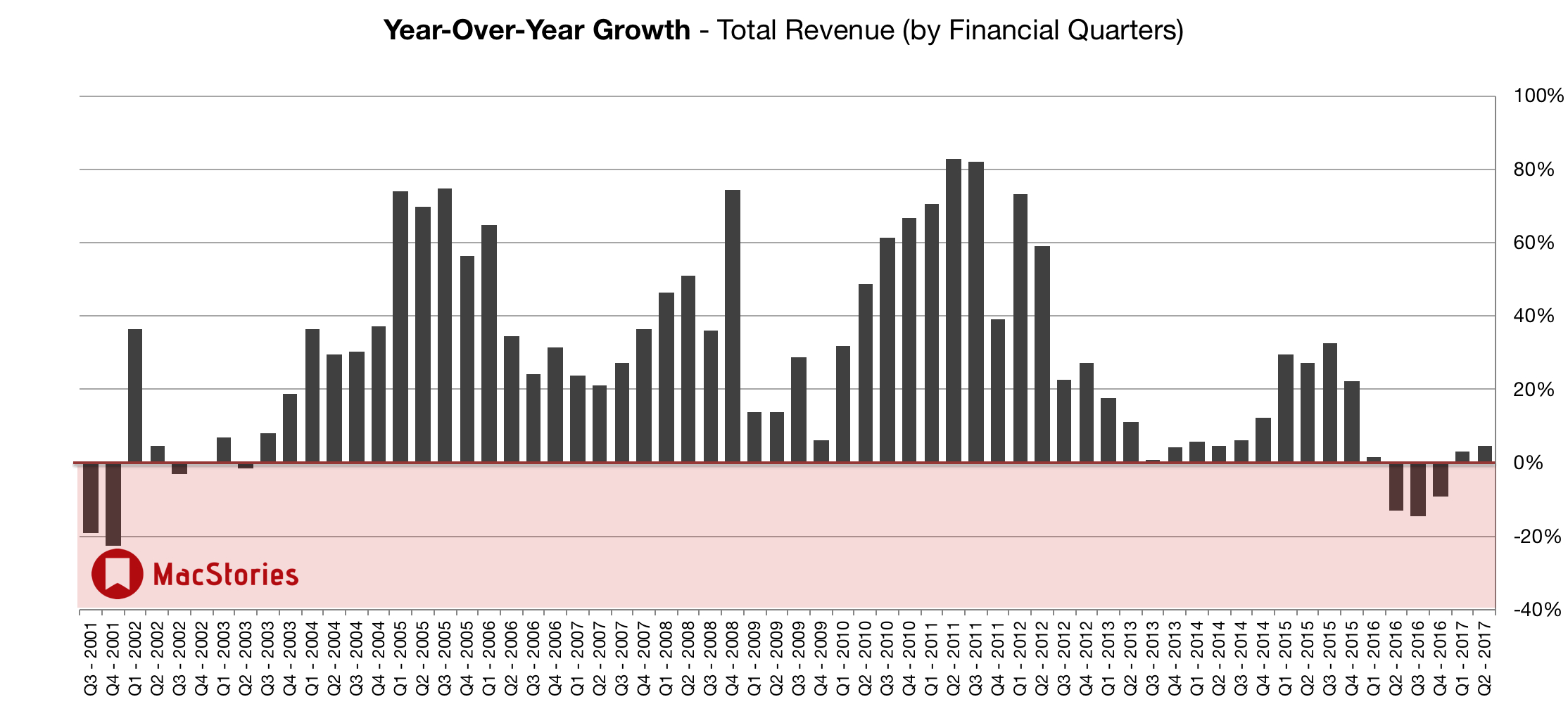

Below, we’ve compiled a graphical visualization of Apple’s Q2 2017 financial results.