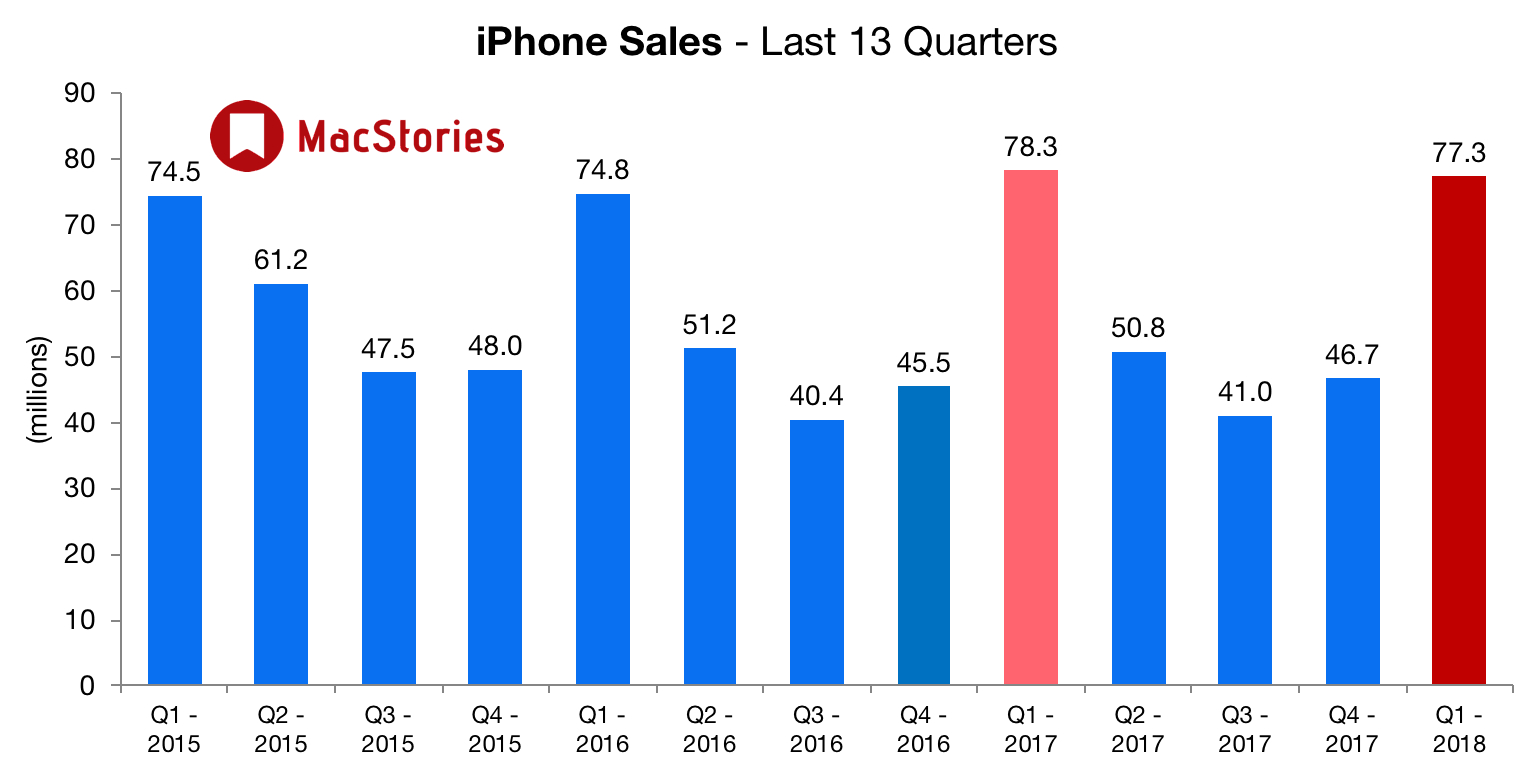

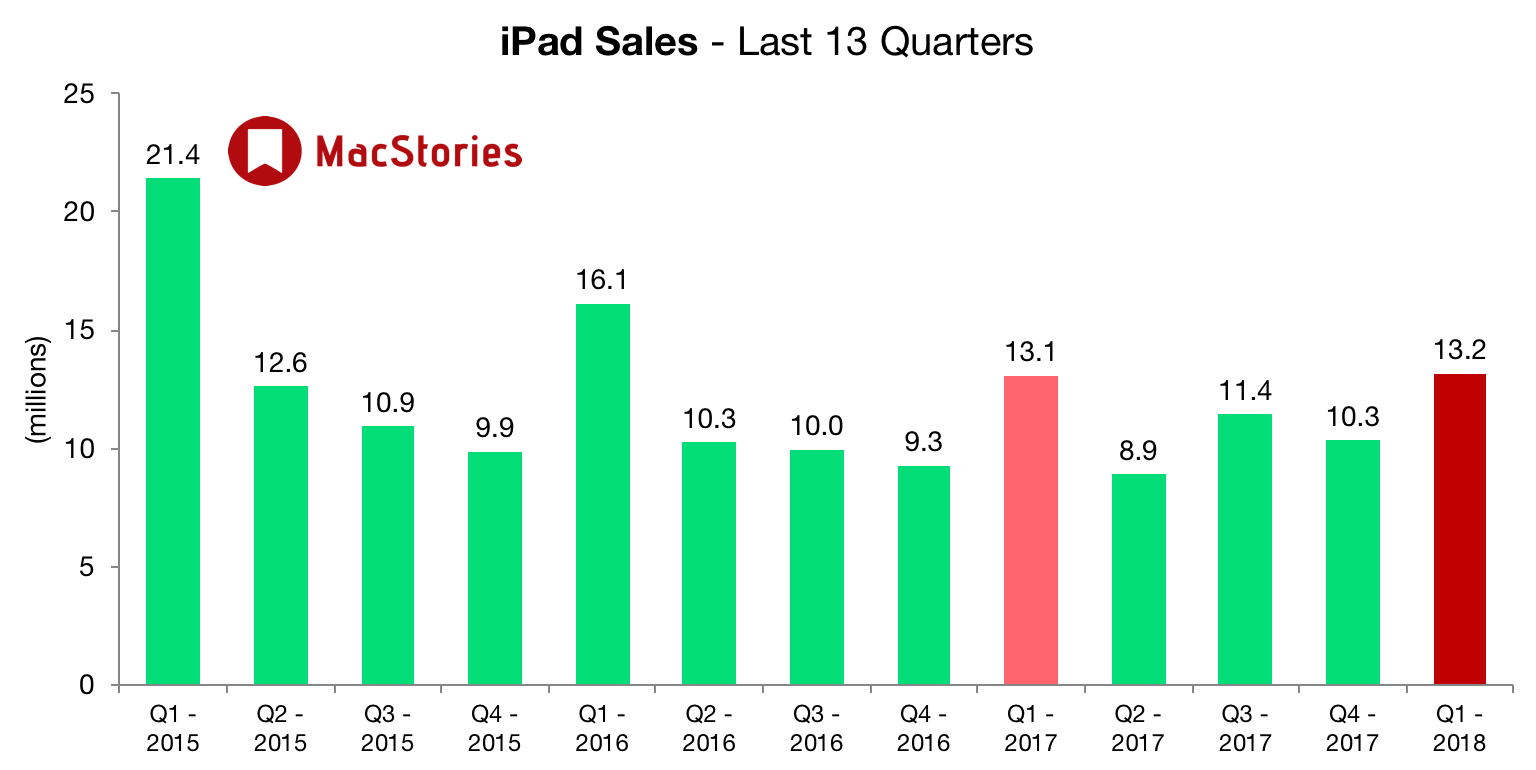

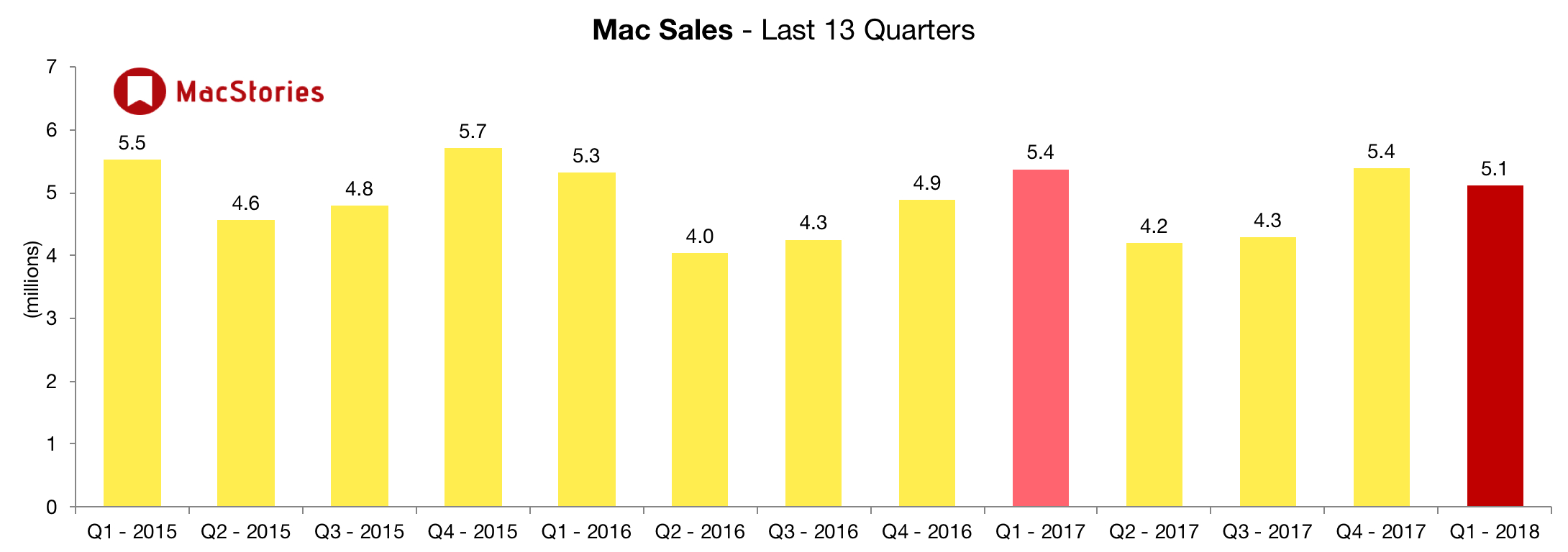

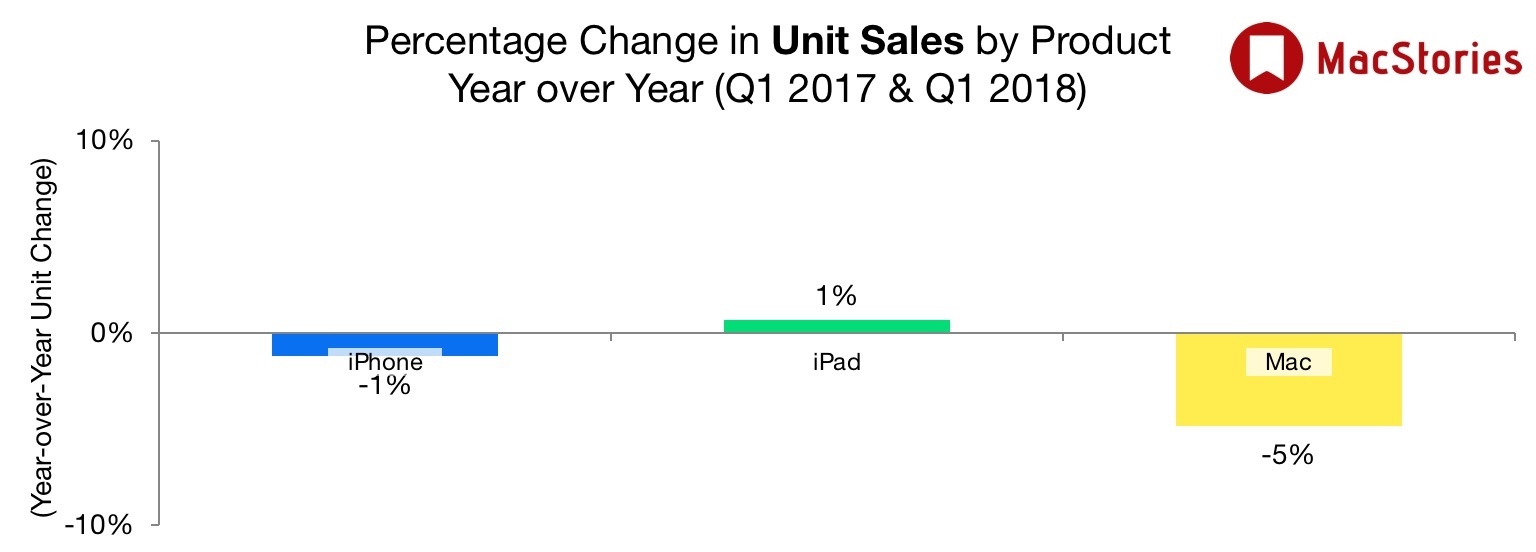

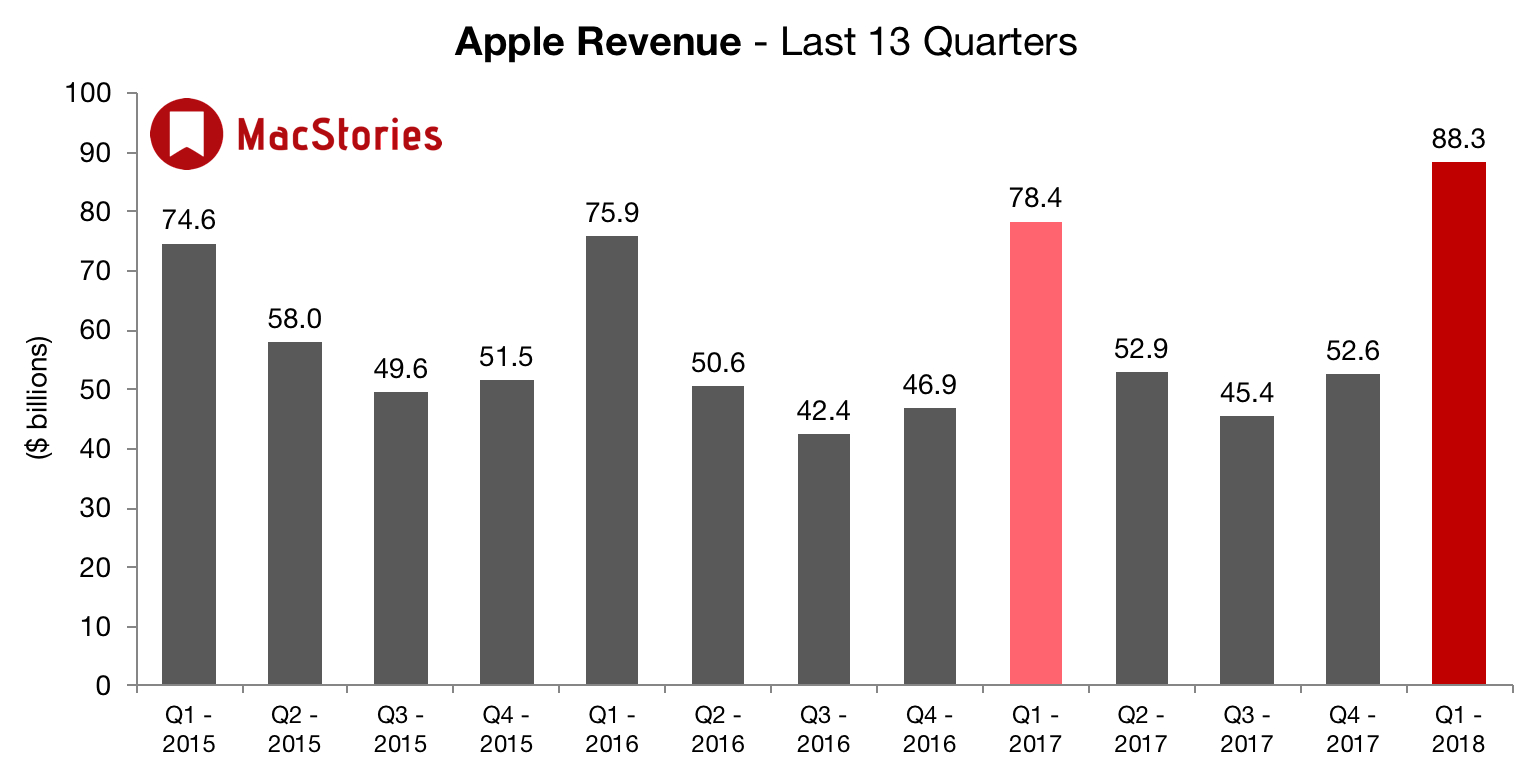

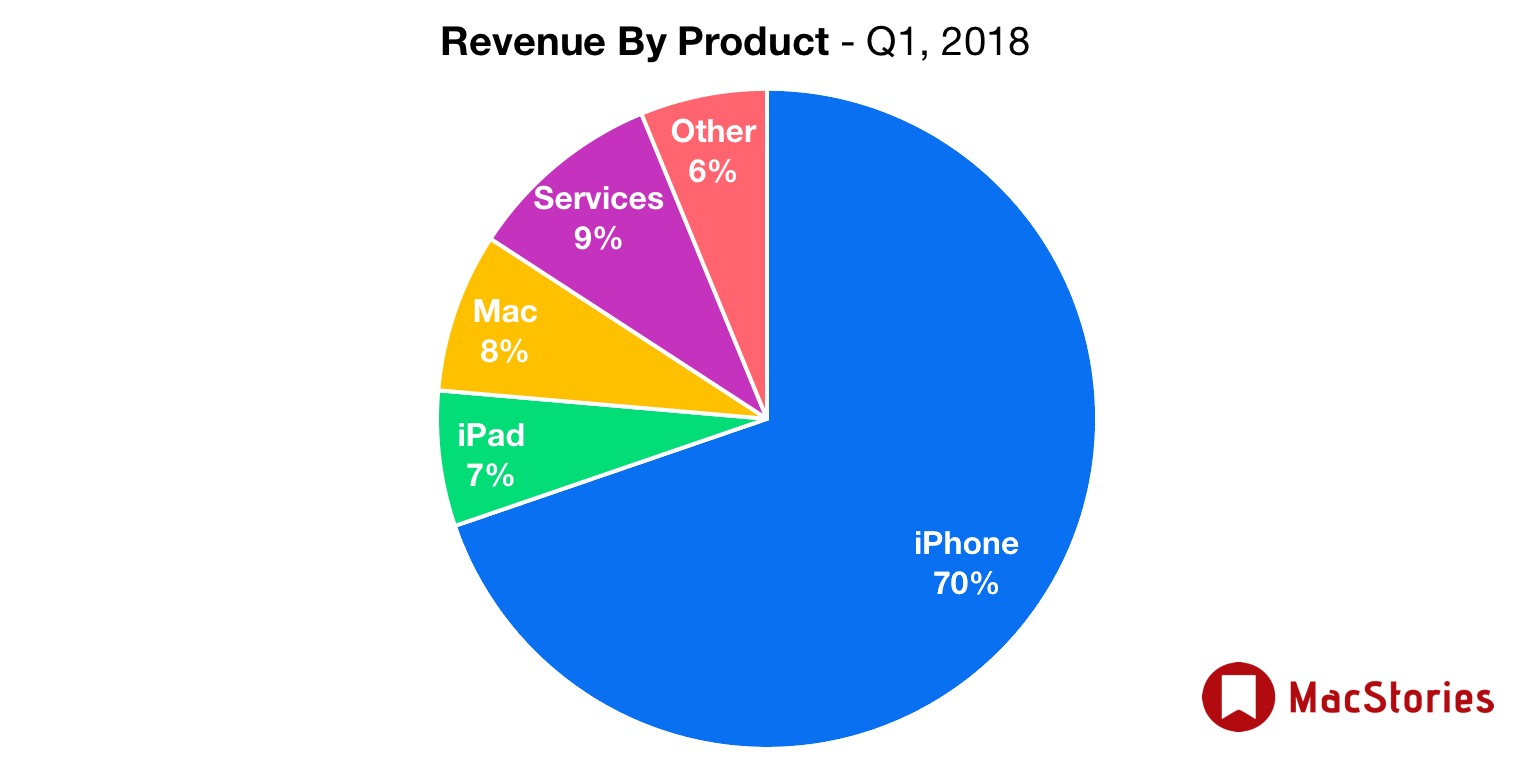

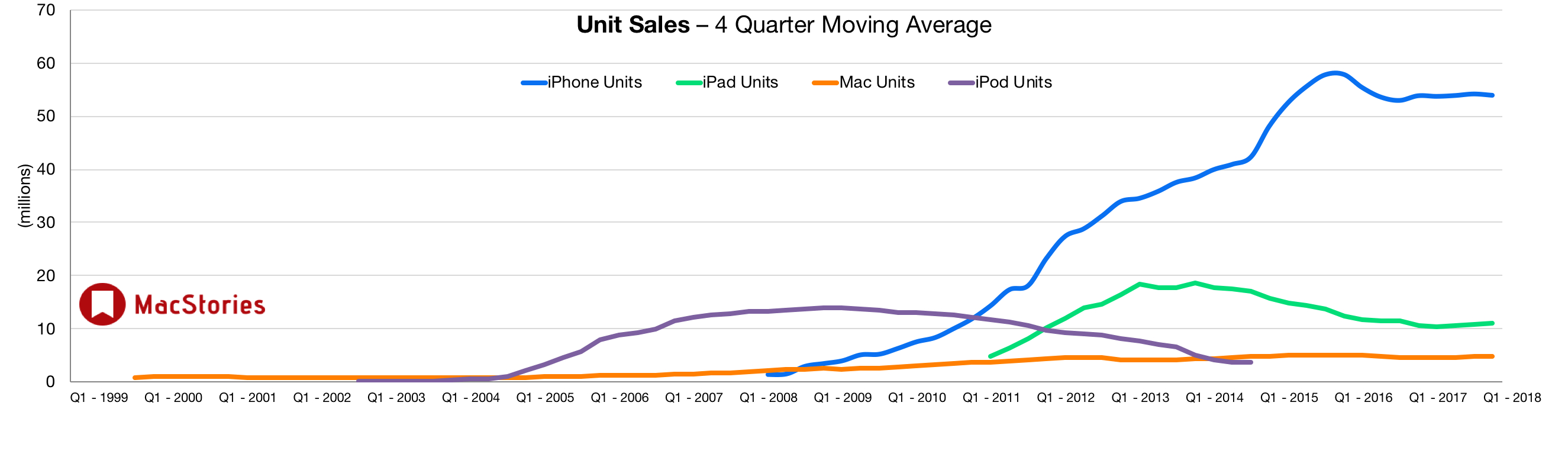

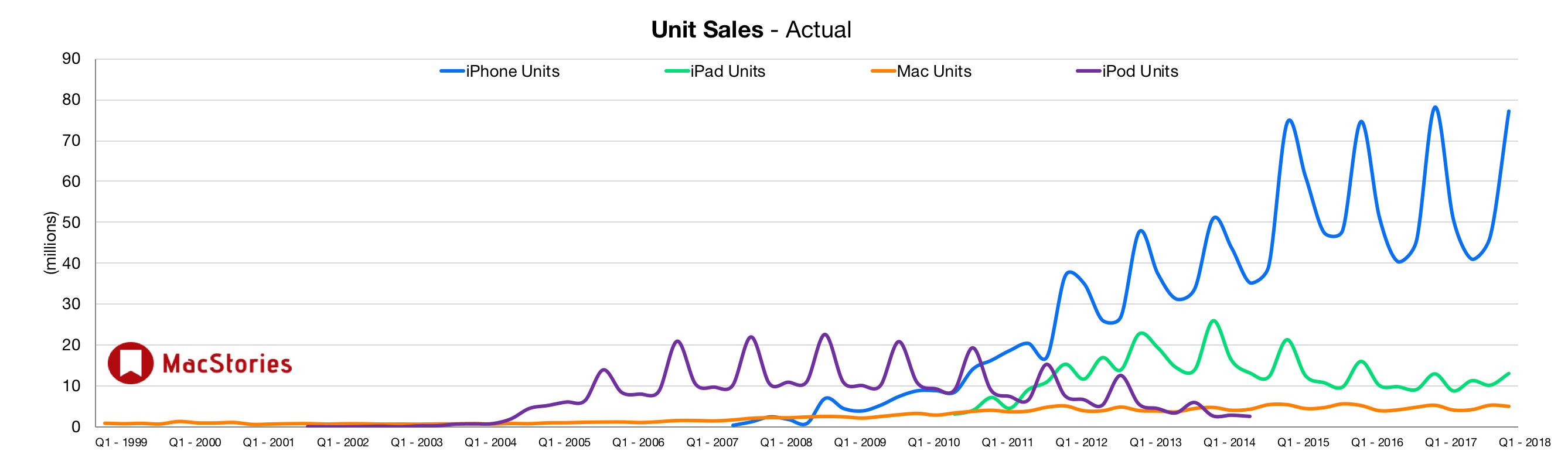

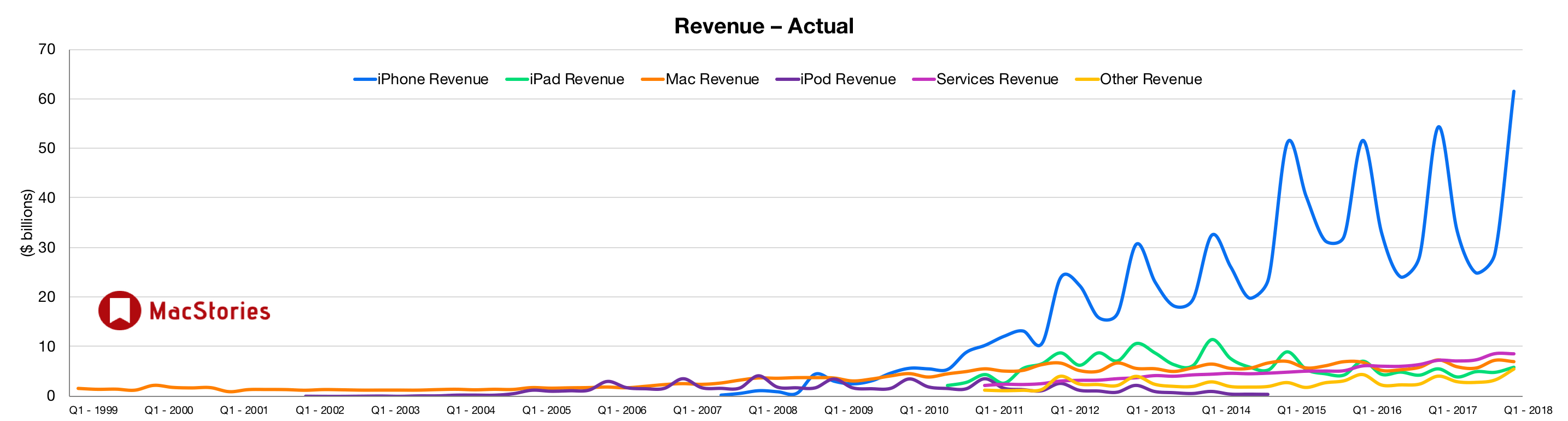

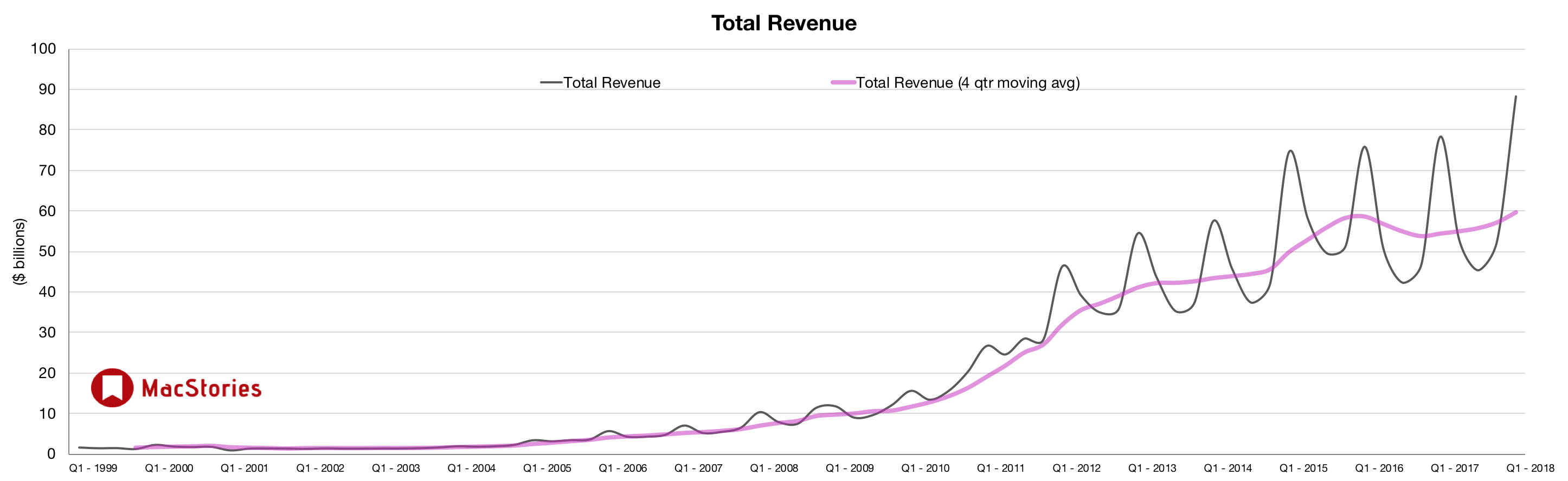

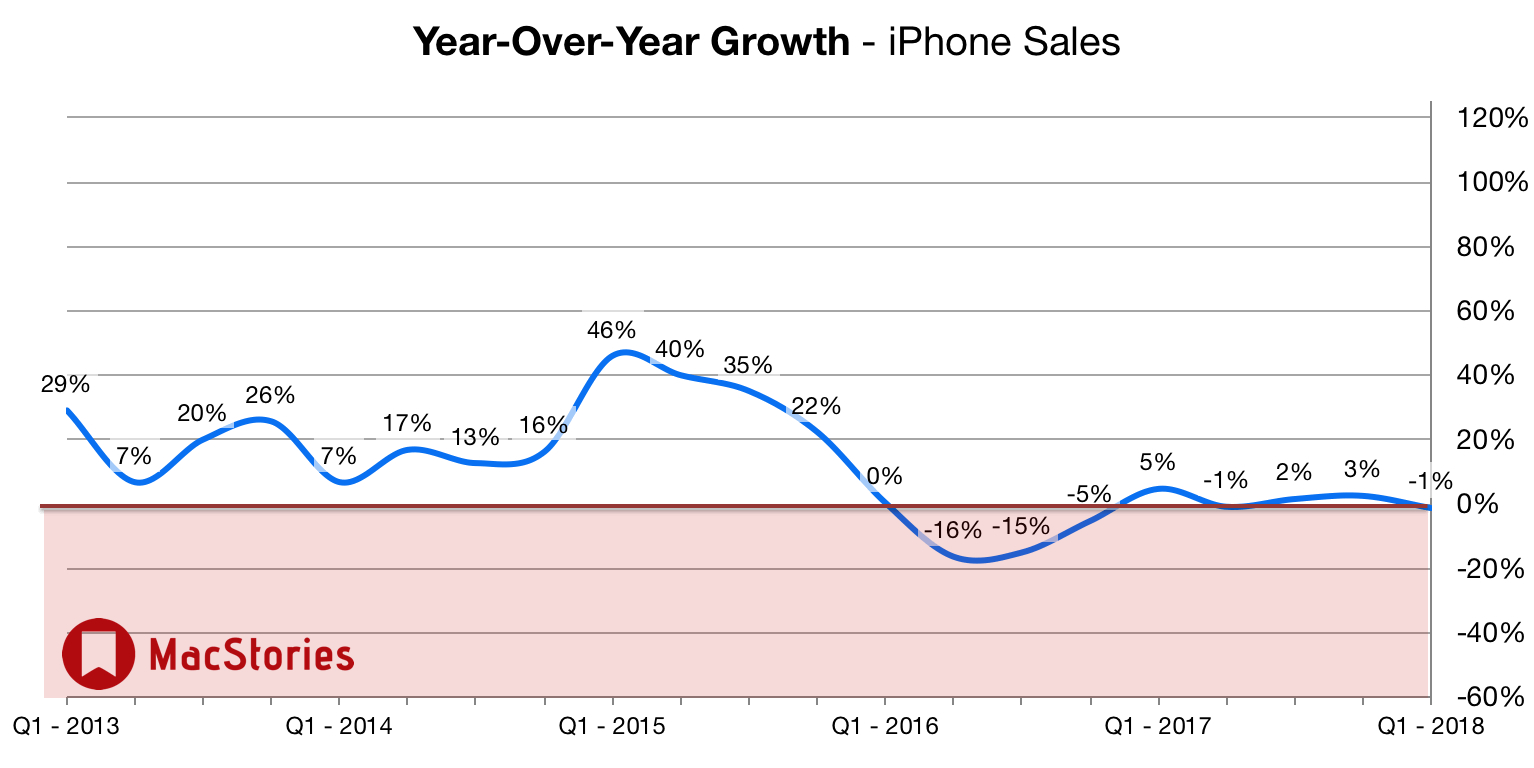

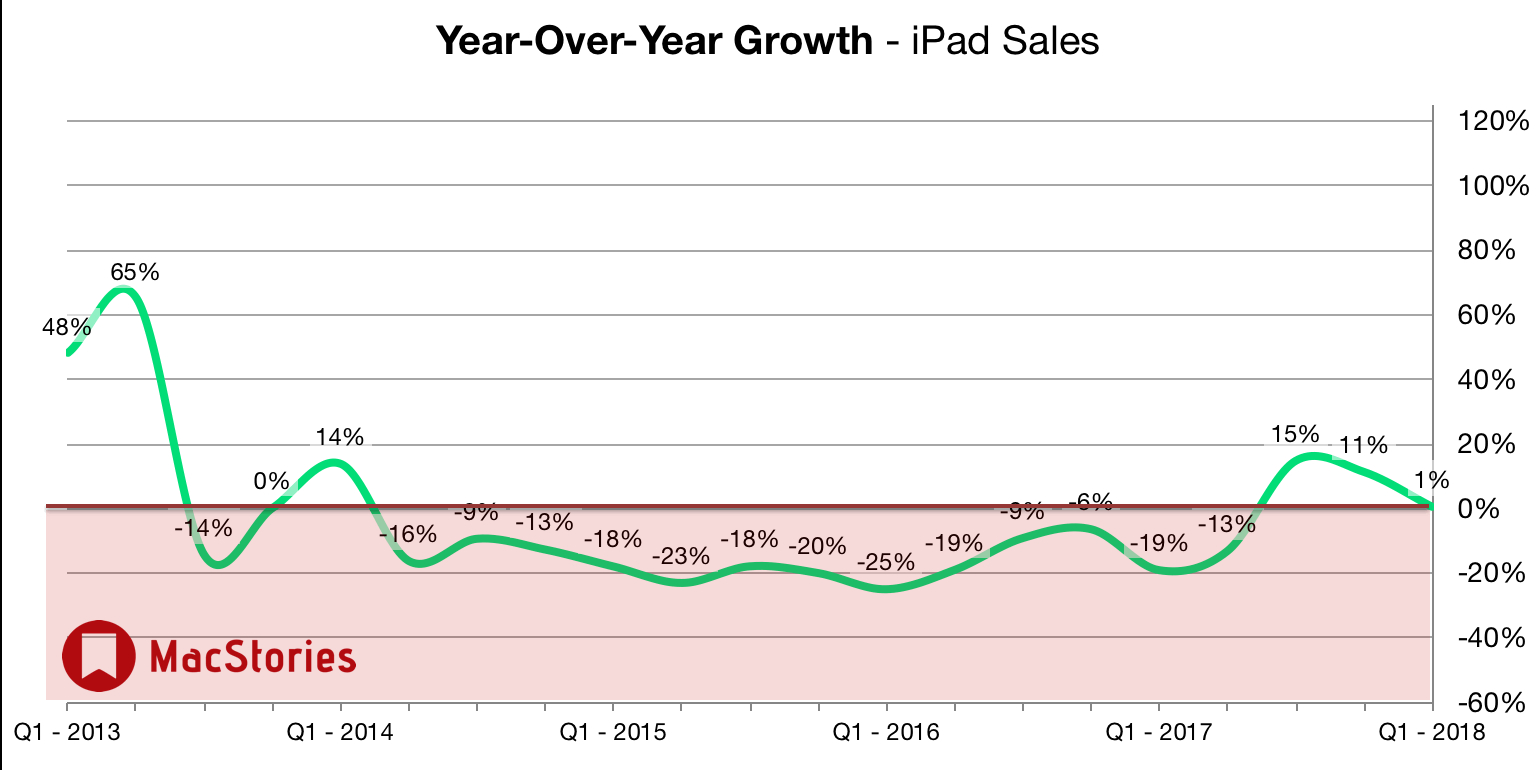

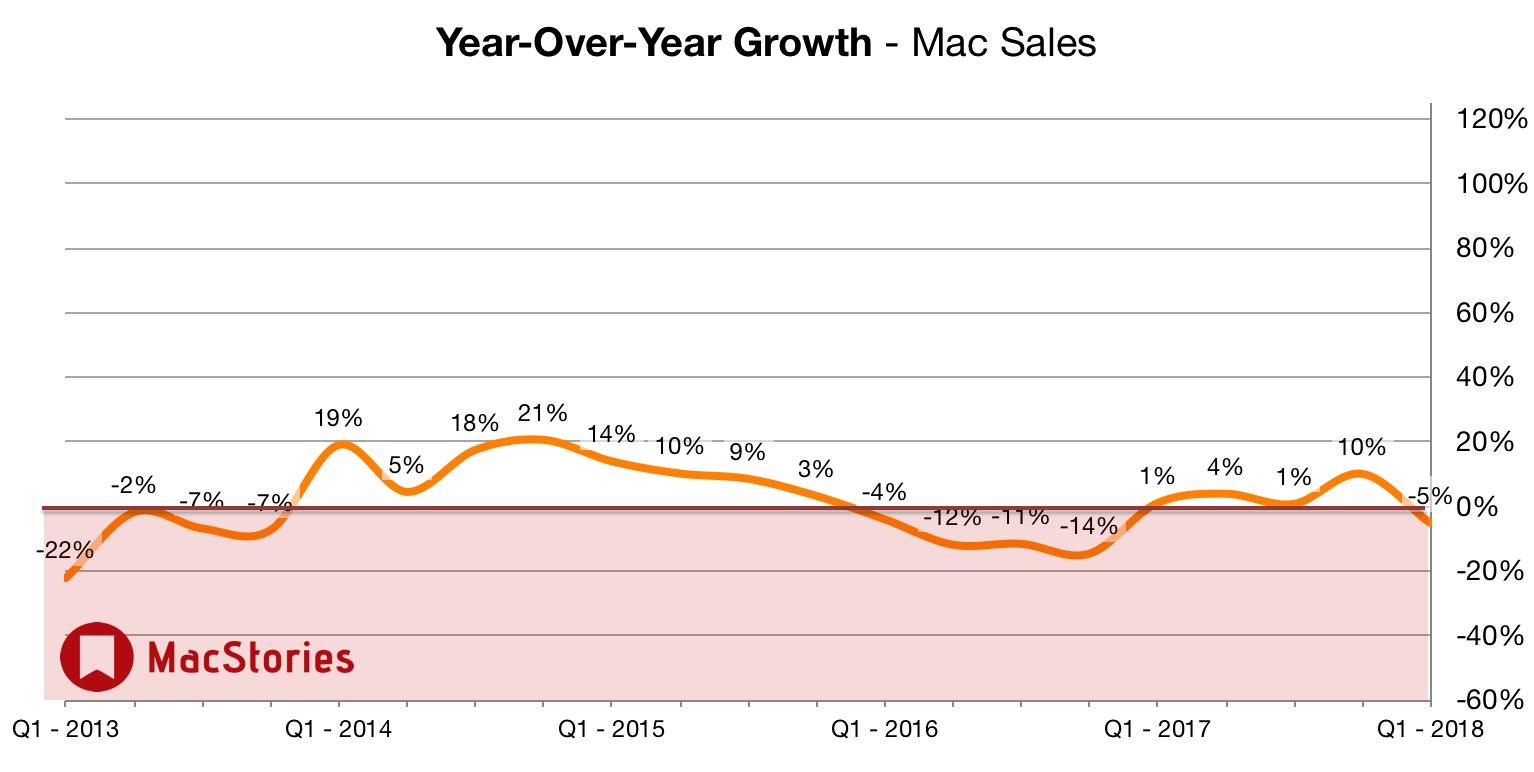

Apple has just published its financial results for Q1 2018. The company posted revenue of $88.3 billion. Apple sold 13.2 million iPads, 77.3 million iPhones, and 5.1 million Macs during the quarter.

“We’re thrilled to report the biggest quarter in Apple’s history, with broad-based growth that included the highest revenue ever from a new iPhone lineup. iPhone X surpassed our expectations and has been our top-selling iPhone every week since it shipped in November,” said Tim Cook, Apple’s CEO. “We’ve also achieved a significant milestone with our active installed base of devices reaching 1.3 billion in January. That’s an increase of 30 percent in just two years, which is a testament to the popularity of our products and the loyalty and satisfaction of our customers.”

Estimates and Expectations for Q1 2018, and the Year-Ago Quarter (Q1 2017)

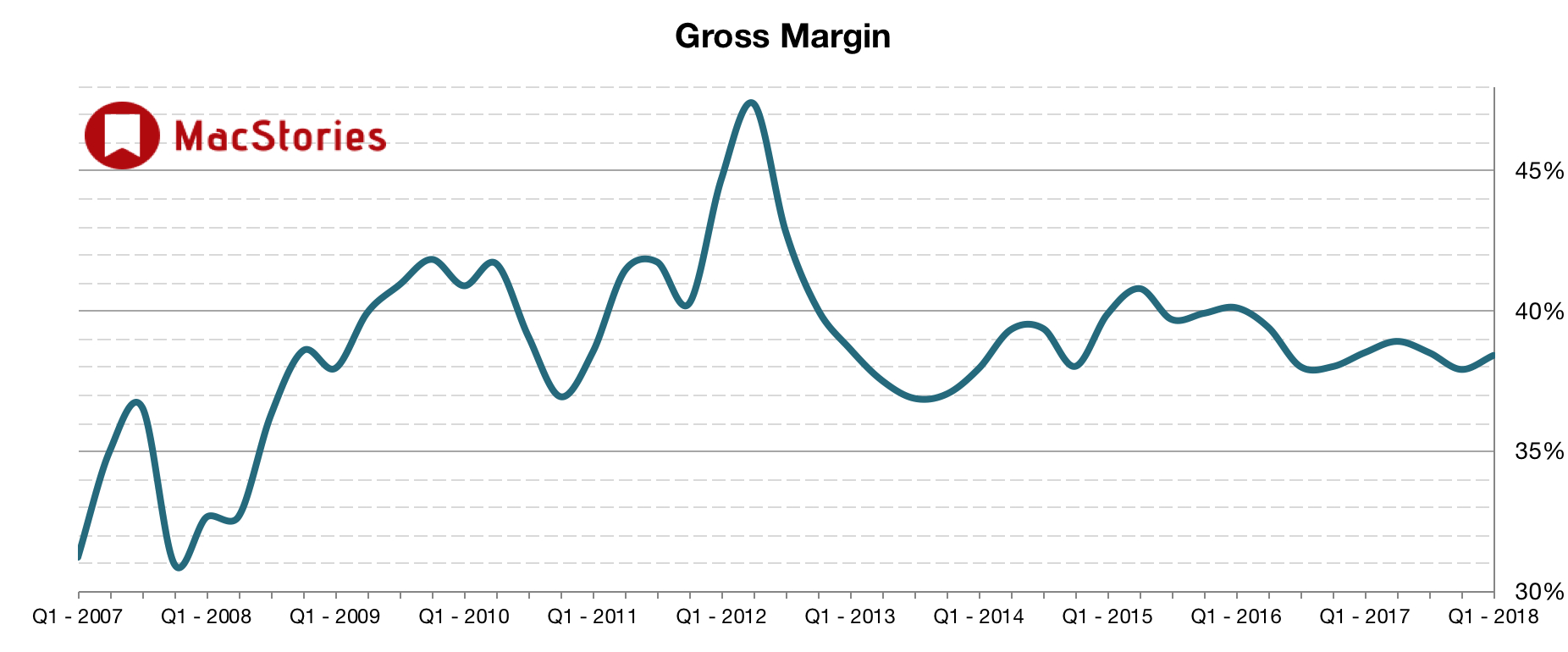

Apple’s revenue guidance for Q1 2018 fell between $84 billion and $87 billion, with gross margin estimated to be between 38% and 38.5%.

Going into today’s earnings call, Nasdaq reported on analysts’ earnings expectations:

The Zacks Consensus Estimate for revenues is currently pegged at $86.02 billion, reflecting year-over-year growth of almost 10%. The Zacks Consensus Estimate for earnings increased 6 cents to $3.81 over the last 30 days, reflecting 13.4% growth over the year-ago quarter.

In a research note, independent Apple analyst Neil Cybart noted that “for the first time in six years, Apple’s FY1Q results will reflect a full flagship iPhone launch”. Cybart estimated revenue of $95.6B (with a 22% YoY growth) and iPhone sales of 82 million units. Other analysts polled by Philip Elmer-DeWitt (both Wall Street professionals and independents) had estimates ranging from $85B revenue to $90B.

In the year-ago quarter (Q1 2017), Apple earned $78.4 billion in revenue. During that quarter Apple sold 78.3 million iPhones, 13 million iPads, and 5.4 million Macs.

Notes from the Call

Apple’s active install base of iOS devices has grown to 1.3 billion – a 30% growth over the past two years.

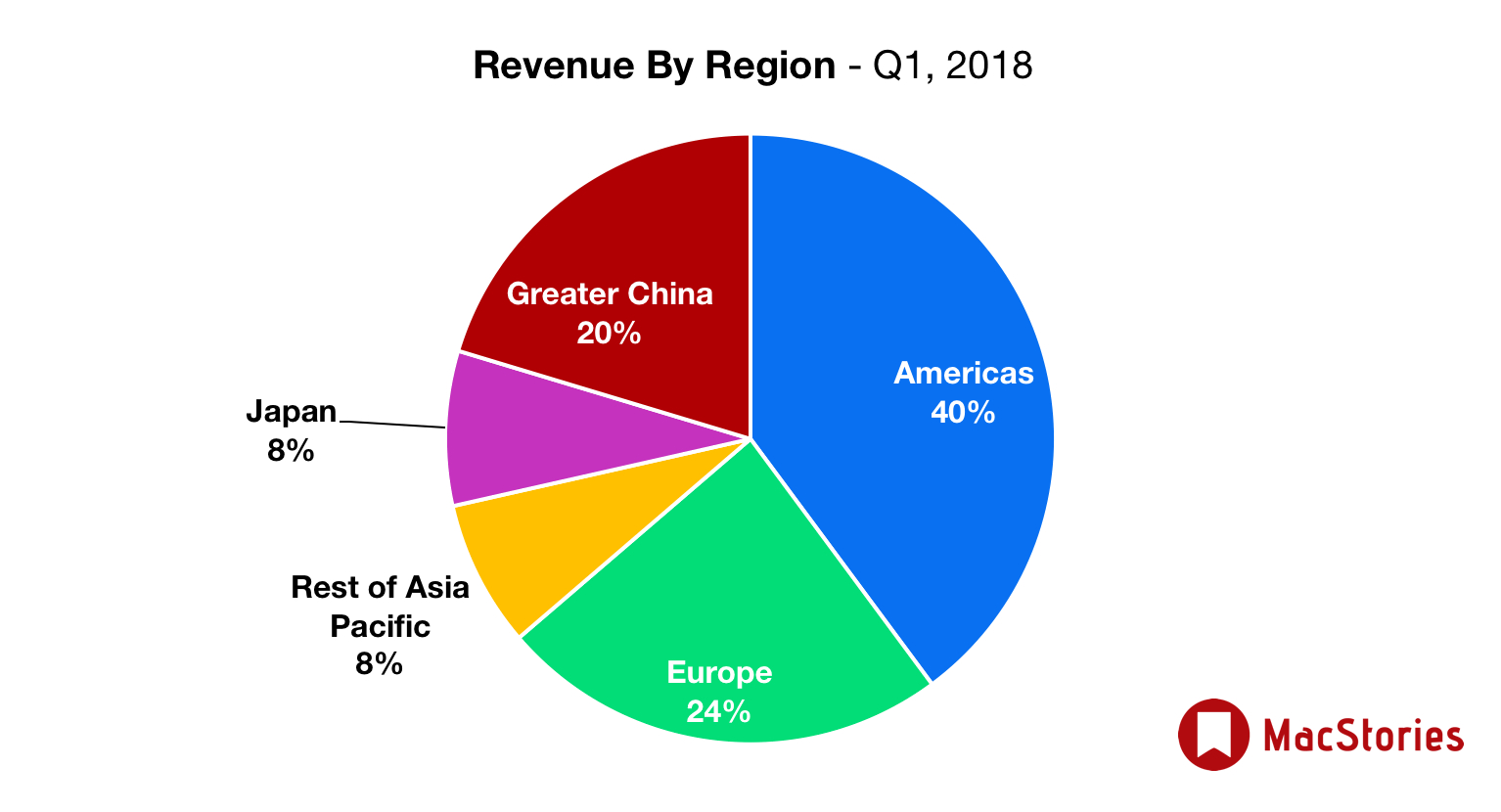

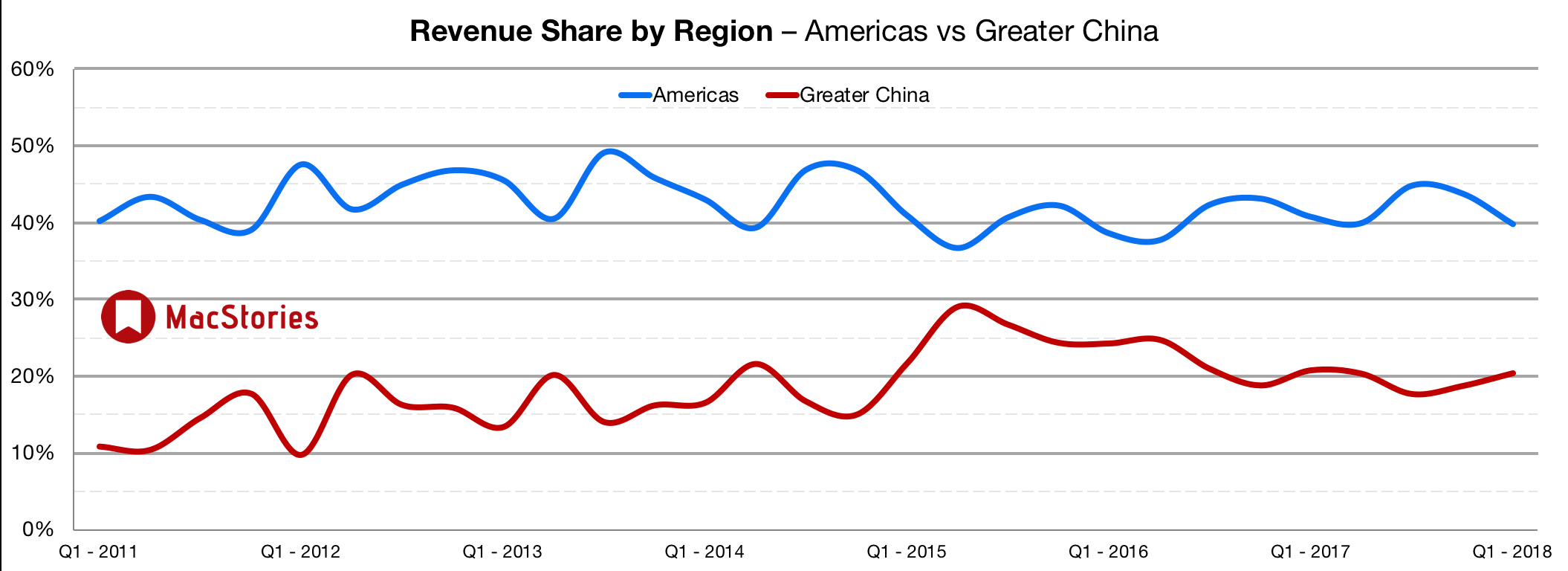

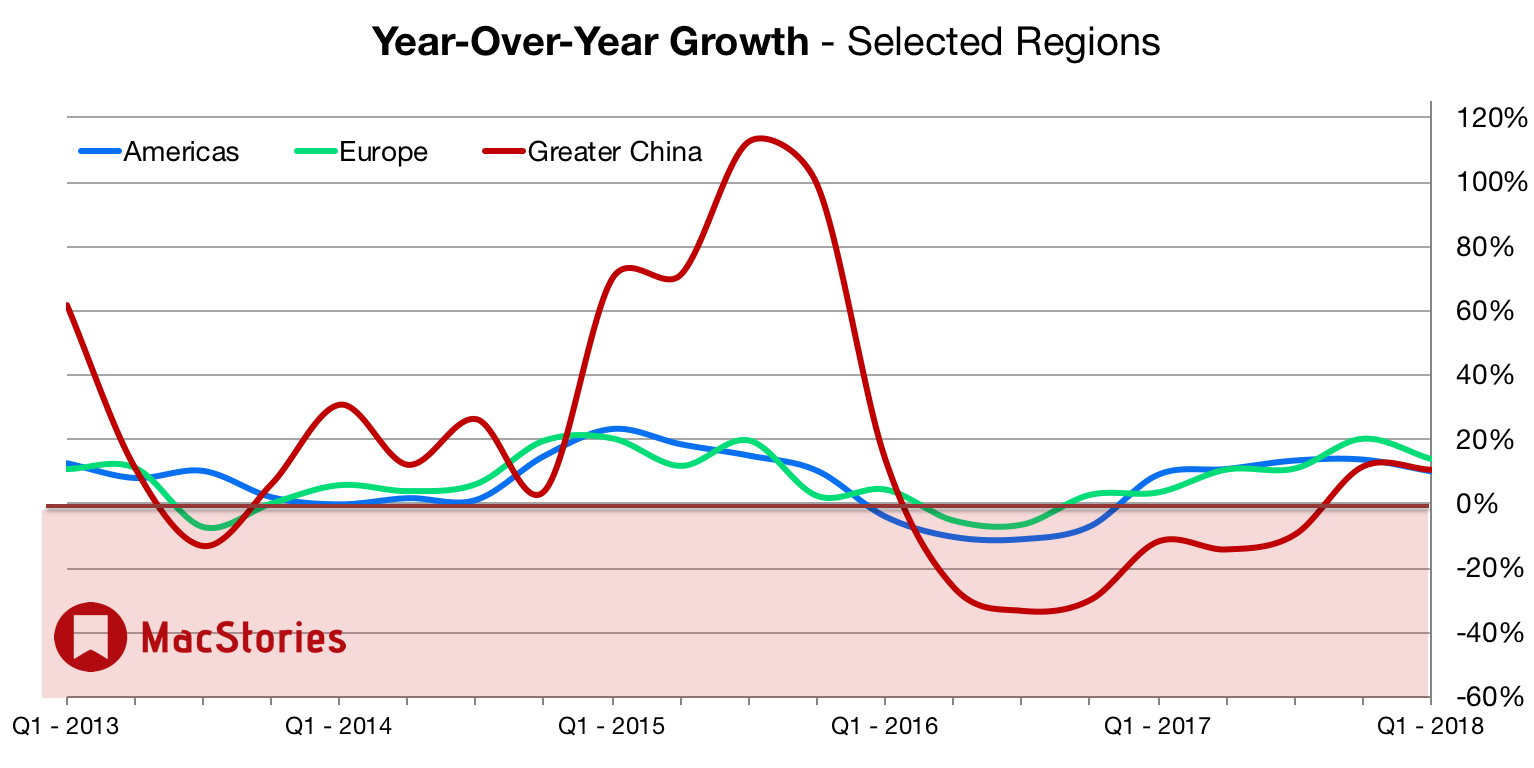

This is Apple’s fifth consecutive quarter with double-digit growth in all geographic segments.

Revenue from the iPhone 8 and X lines was the highest in the company’s history of previous iPhone releases.

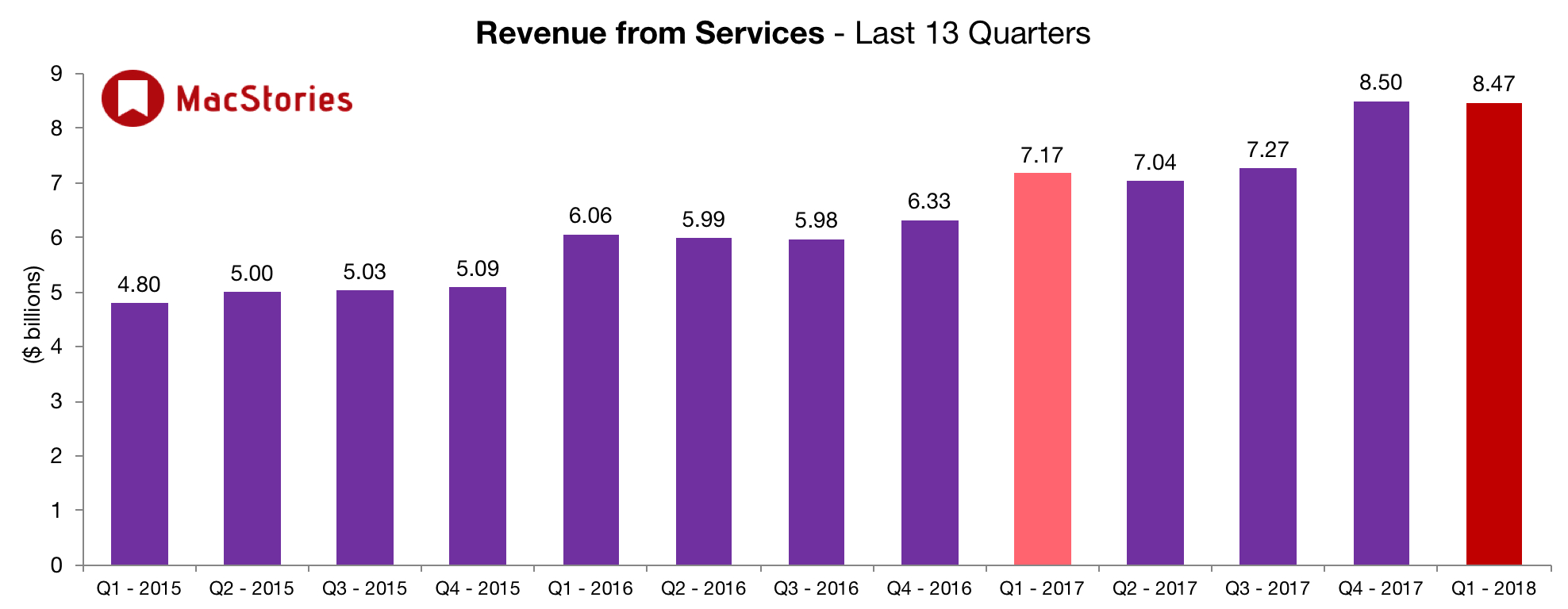

Apple passed 240 million paid subscriptions across their services – a 30 million increase in the past 90 days alone.

Apple Pay has hit 50% year-over-year growth in merchant adoption, now accepted at more than half American retail locations. Apple Pay is available in 20 markets.

Apple Watch has seen 50% growth in unit sales and revenue for the fourth consecutive quarter.

Worldwide, 50% of iPad sales were to first-time buyers and switchers.

Worldwide, 60% of Mac sales were to first-time buyers and switchers – in China, the number goes up to 90%.

Mac unit sales are up 13% year-over-year in emerging markets.

According to data by NPD, iPad has 46% share of U.S. tablet market – up from 36% last year.

Apple is rolling out a new initiative called ‘Apple at Work’ to make it easier to get Apple products to employees.

Tim Cook: “Customer satisfaction for iPhone X is literally off the charts.”

Tim Cook: “I don’t want to say what else we may do with AR, but I could not be happier with how things are going right now.”

Apple did not consider “in any way, shape, or form” what the discounted battery replacement program would do to iPhone upgrade rates.

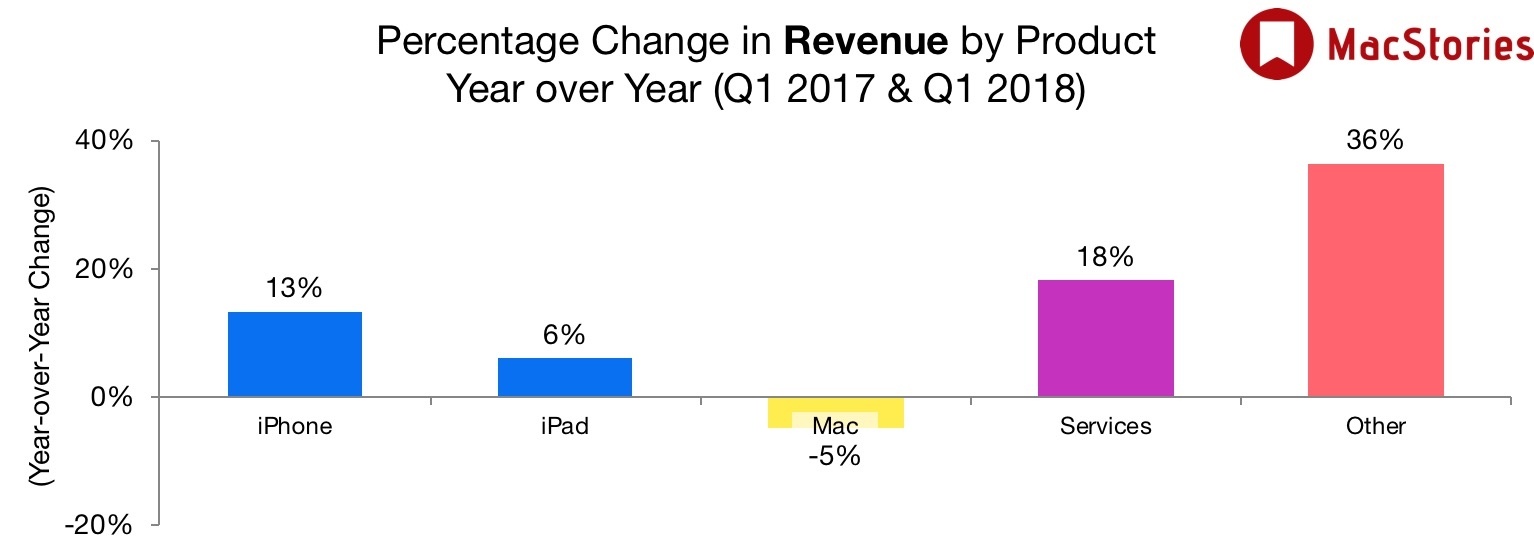

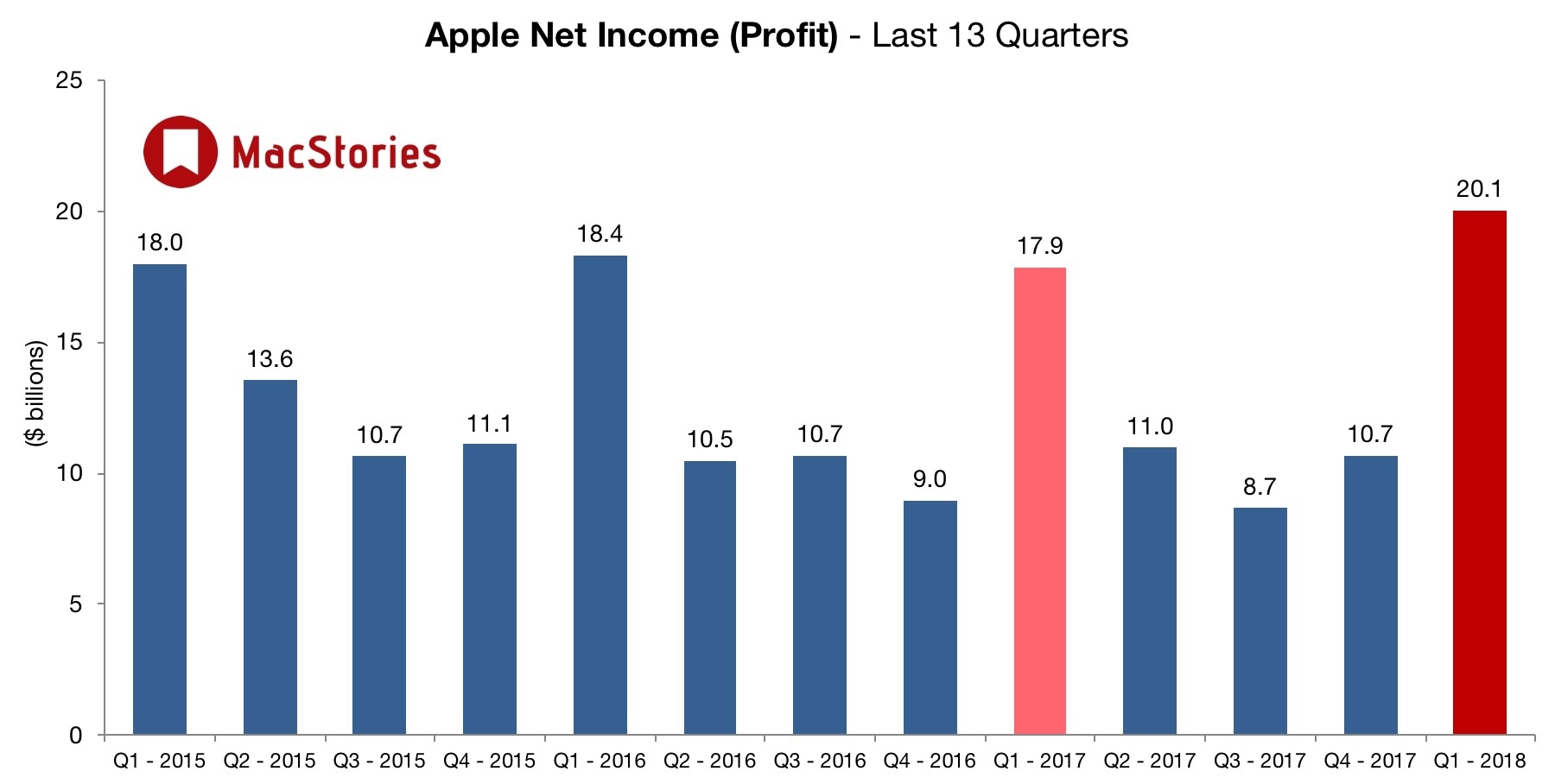

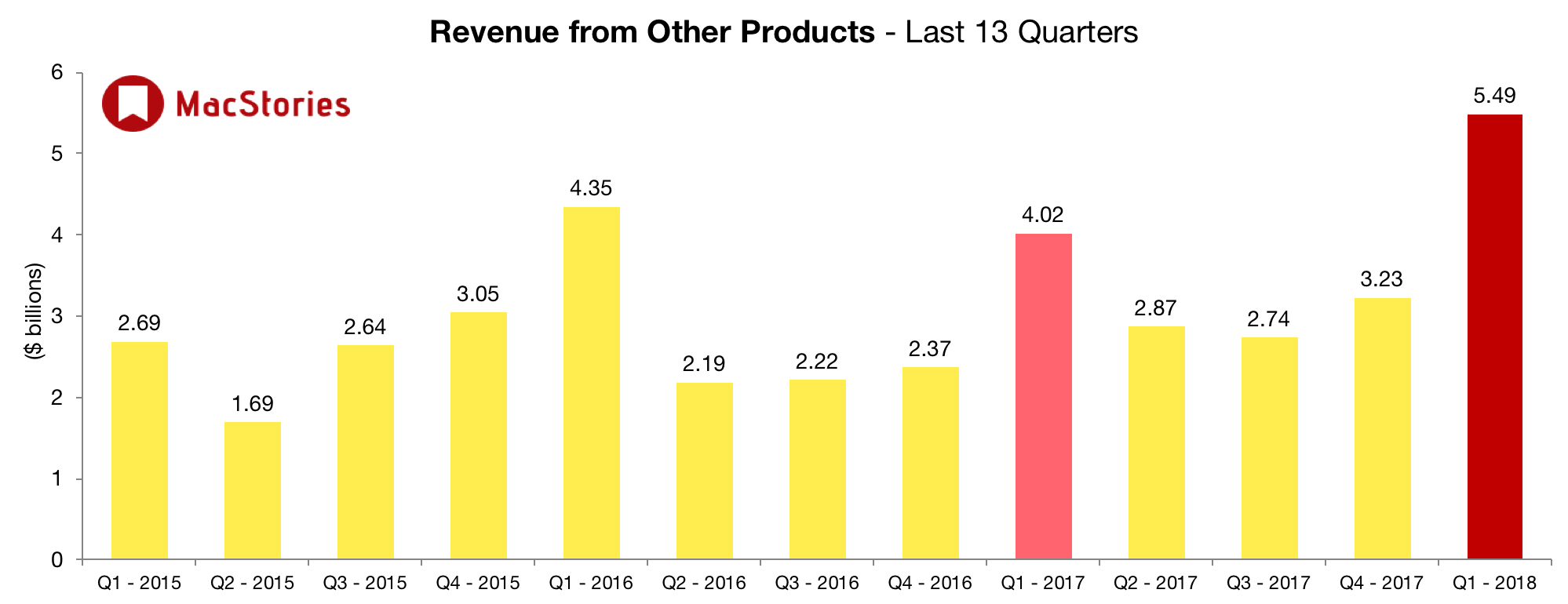

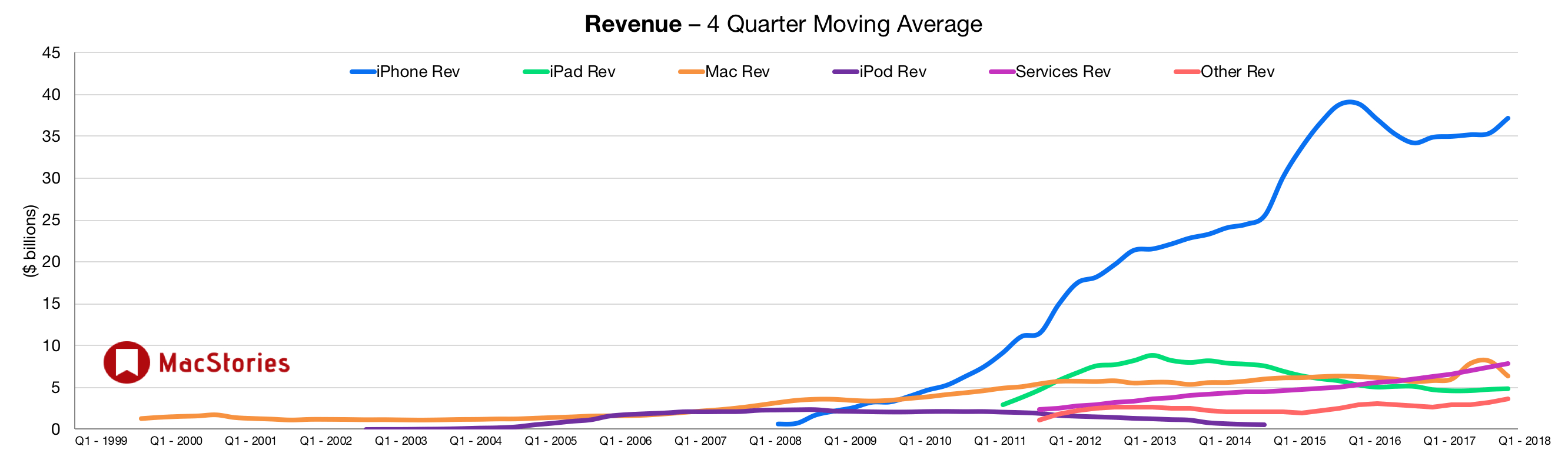

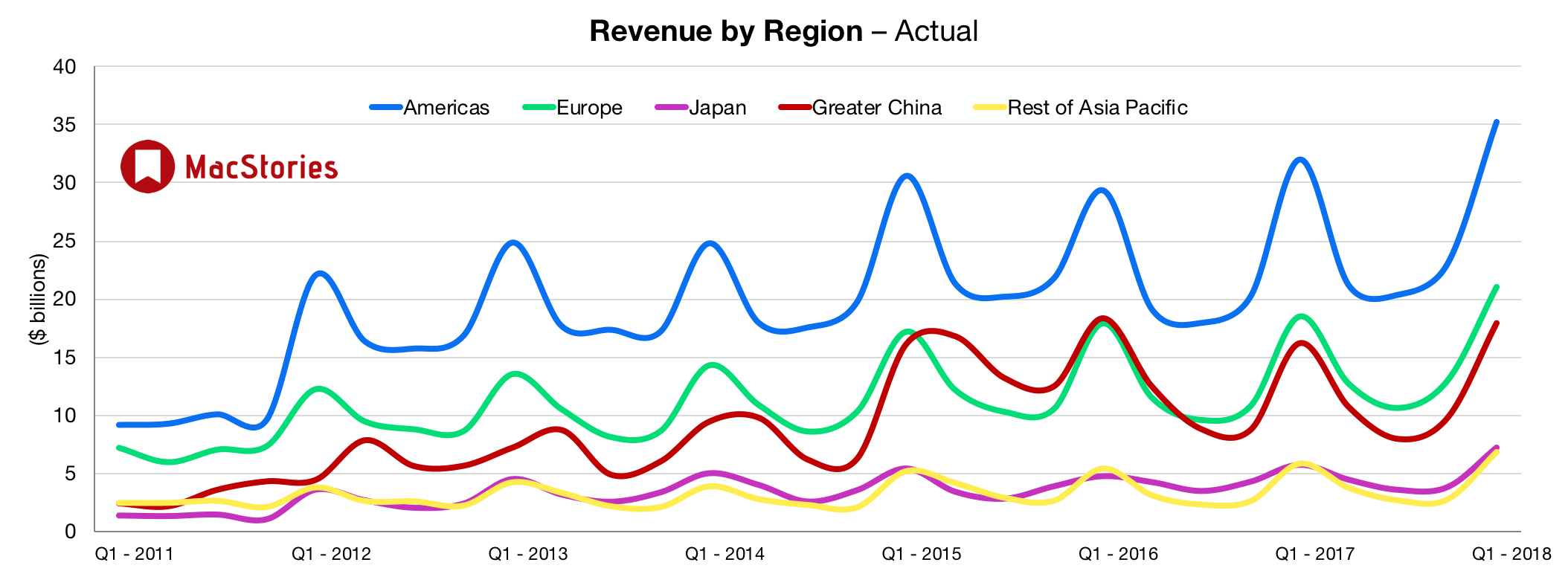

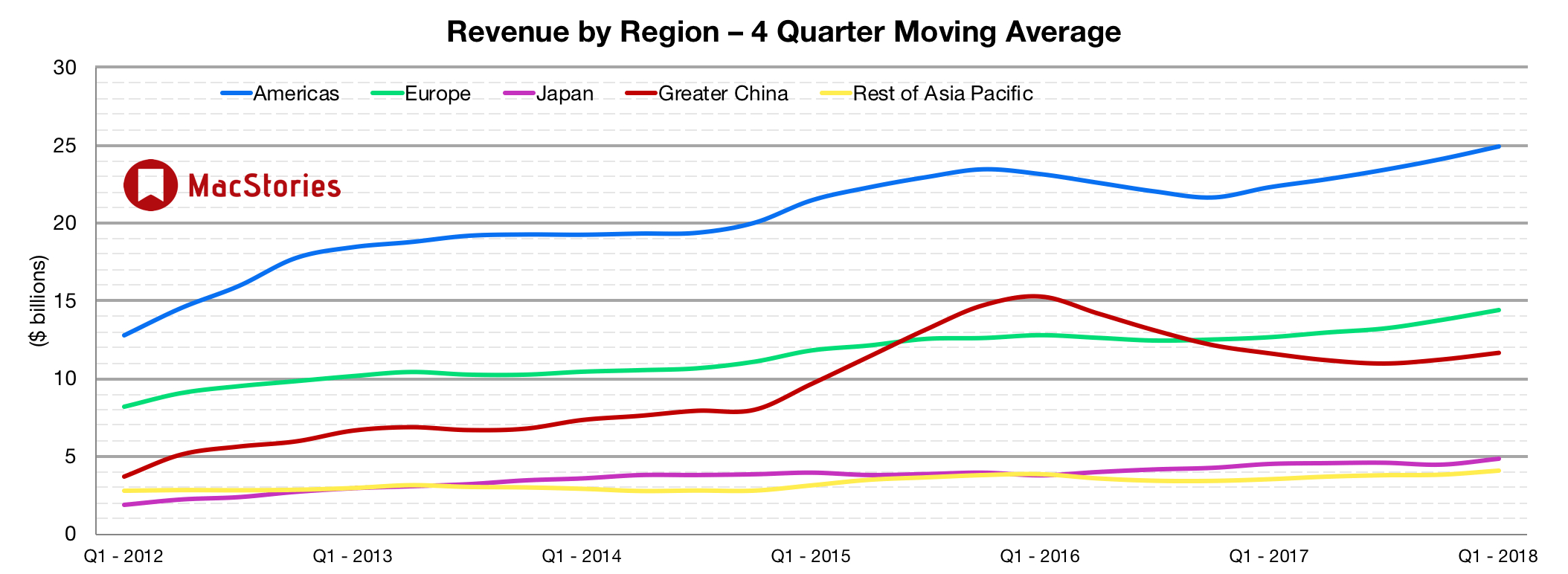

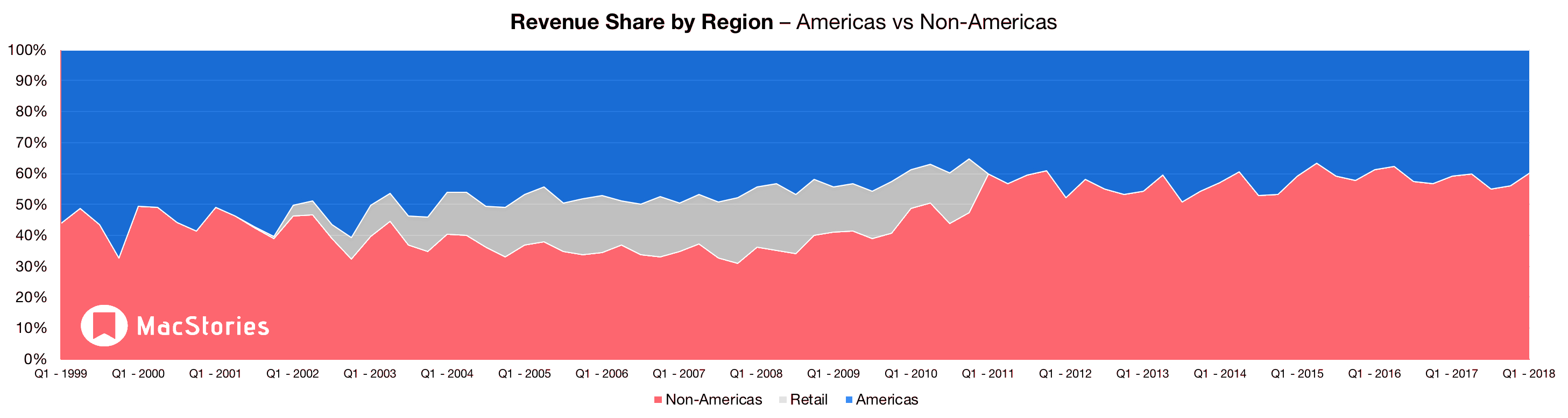

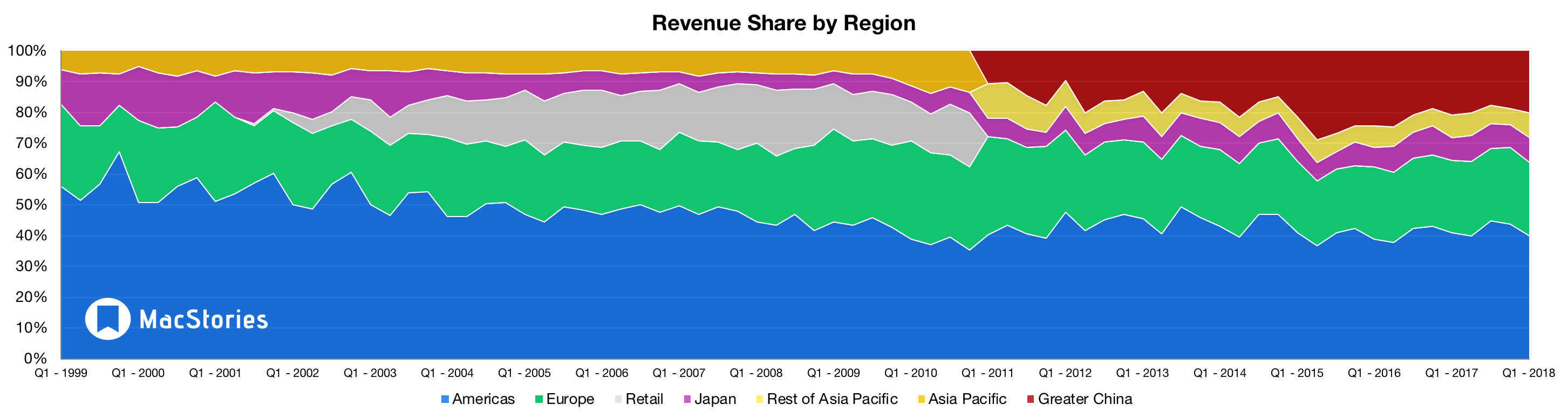

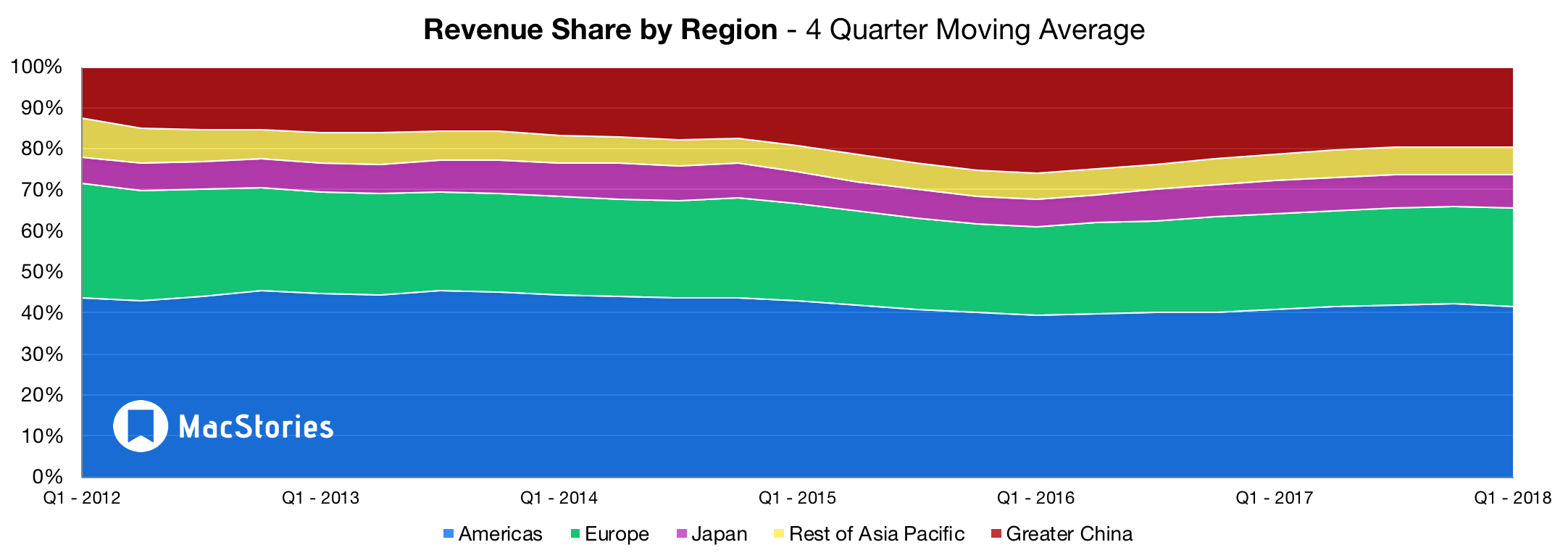

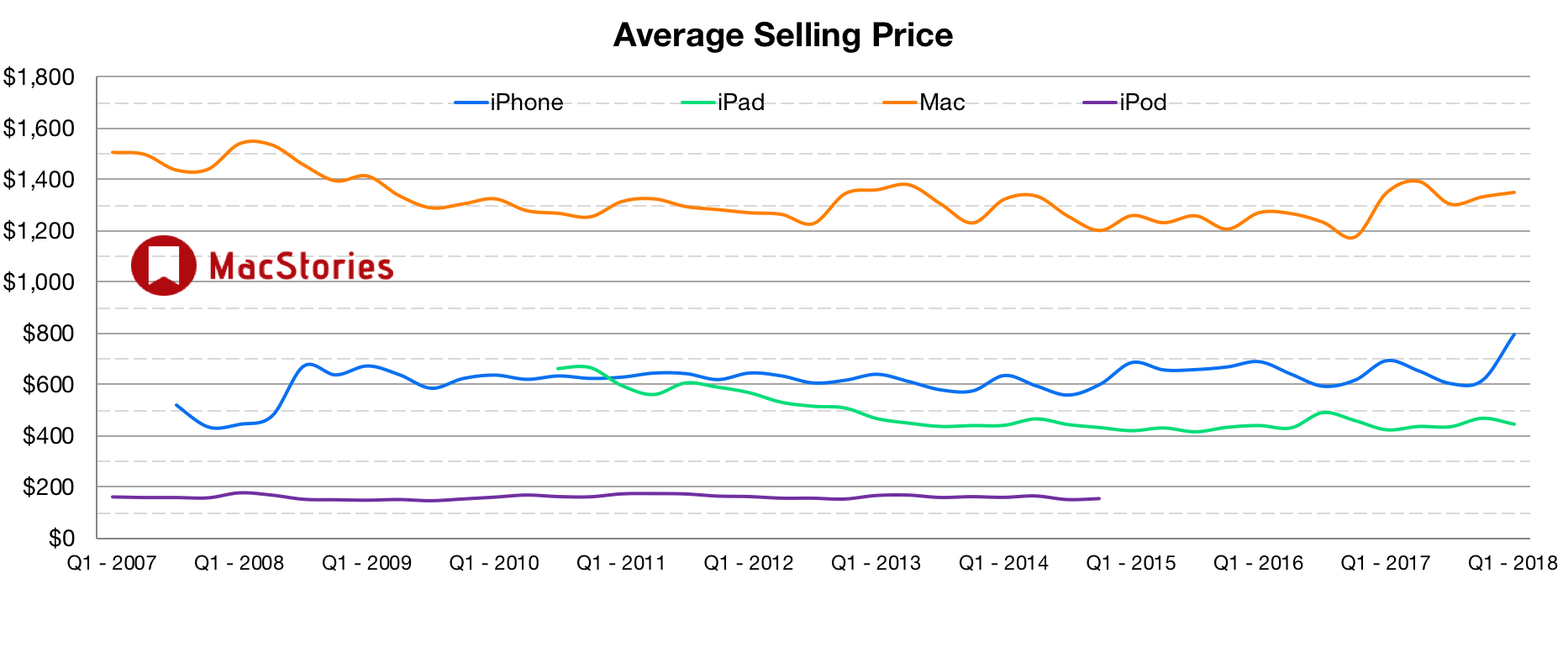

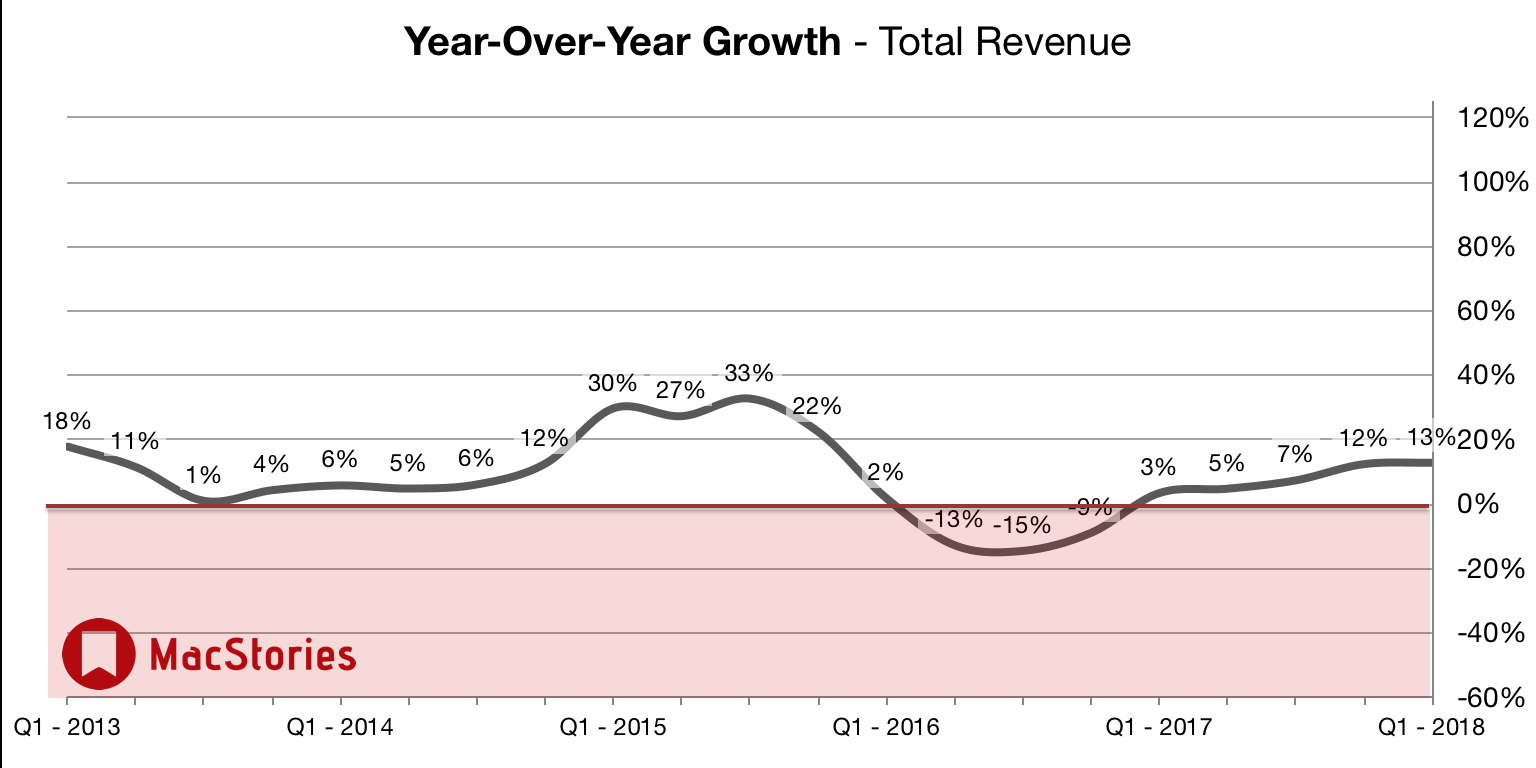

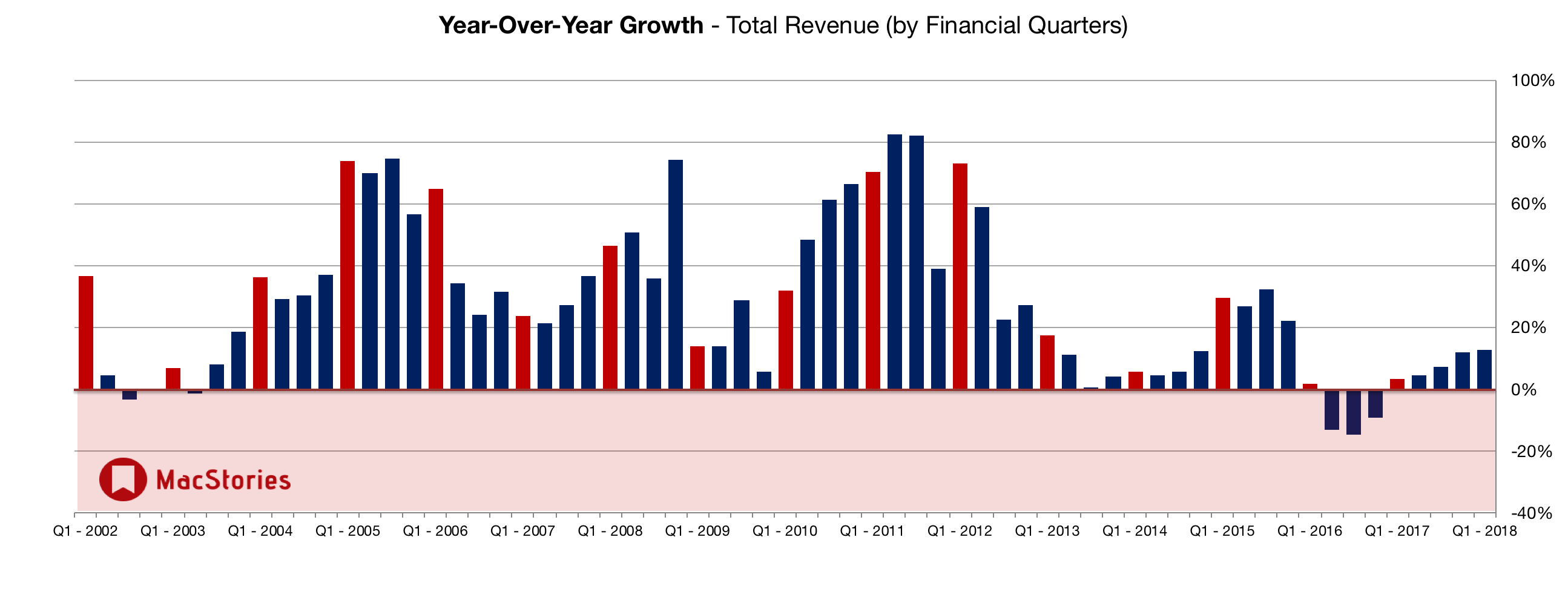

Graphical Visualization

Below, we’ve compiled a graphical visualization of Apple’s Q1 2018 financial results.

(Tap the charts to open them in full-screen.)

Apple Q1 2018 in Tweets

There are now about 800m iPhones in use, over 3bn total smartphones, and around 5bn total mobile phones.

— Benedict Evans (@BenedictEvans) February 1, 2018

Here’s guidance for March quarter. Revenue between $60 and $62 billion. Gross margin between 38% and 38.5%. Tax rate about 15%. Tax reform allow pursuit of more optimal cash position.

— Six Colors liveblog (@sixcolorsevent) February 1, 2018

Love Luca’s little shout out to Italy’s Impresa San Paolo #AAPL

— Carolina Milanesi (@caro_milanesi) February 1, 2018

Apple wearables revenues was up 70% year-over-year. Second-best category in terms of revenue growth (behind iPhone).

— Neil Cybart (@neilcybart) February 1, 2018

App Store saw quarterly store visitors, transacting accounts, and paying accounts, all saw new all-time highs. Record # of purchases in Christmas week. $300 million in purchases on New Year’s Day alone.

— Six Colors liveblog (@sixcolorsevent) February 1, 2018

Apple active device base of 1.3bn (versus 1bn 2 years ago) indicates a lengthening lifespan (often across multiple owners). iPhones now probably lasting 3.5-4 years, iPad 5 years.

— Benedict Evans (@BenedictEvans) February 1, 2018

Worth noting that Apple’s $88.3 billion in revenue was *more* than the high-end of their guidance, which was “just” $87 billion.

— Six Colors liveblog (@sixcolorsevent) February 1, 2018

My estimate for iPhone units was expecting a lot more iPhone 8 with an average pricing of $710. Actual ASP was $796. A LOT of iPhone X were sold.

— Horace Dediu (@asymco) February 1, 2018

iPhone’s sold in first quarter:

Q1 2018: 77.3 million

Q1 2017: 78.3 million

Q1 2016: 74.8 million

Q1 2015: 74.5 million

Q1 2014: 51.0 million

Q1 2013: 47.8 million

Q1 2012: 37.0 million

Q1 2011: 16.2 million

Q1 2010: 8.7 million

Q1 2009: 4.4 million

Q1 2008: 2.3 million— Jon Erlichman (@JonErlichman) February 1, 2018

The *average* analyst revenue estimate of $87.3B is at Apple’s previous high-end, so Apple must beat its own guidance or analysts will say they “missed.” https://t.co/oLxfI9nDDU

— MacJournals.com (@macjournals) February 1, 2018