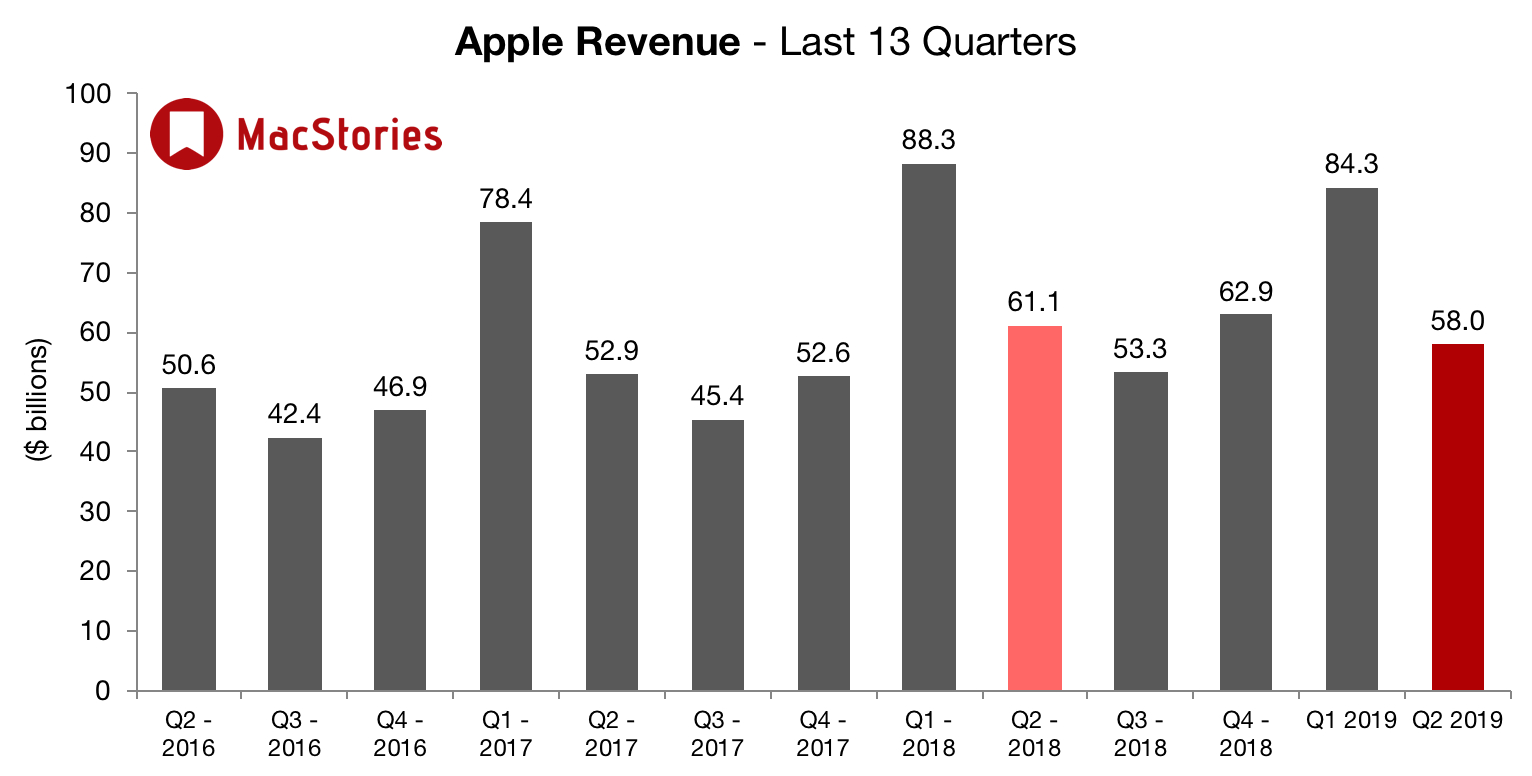

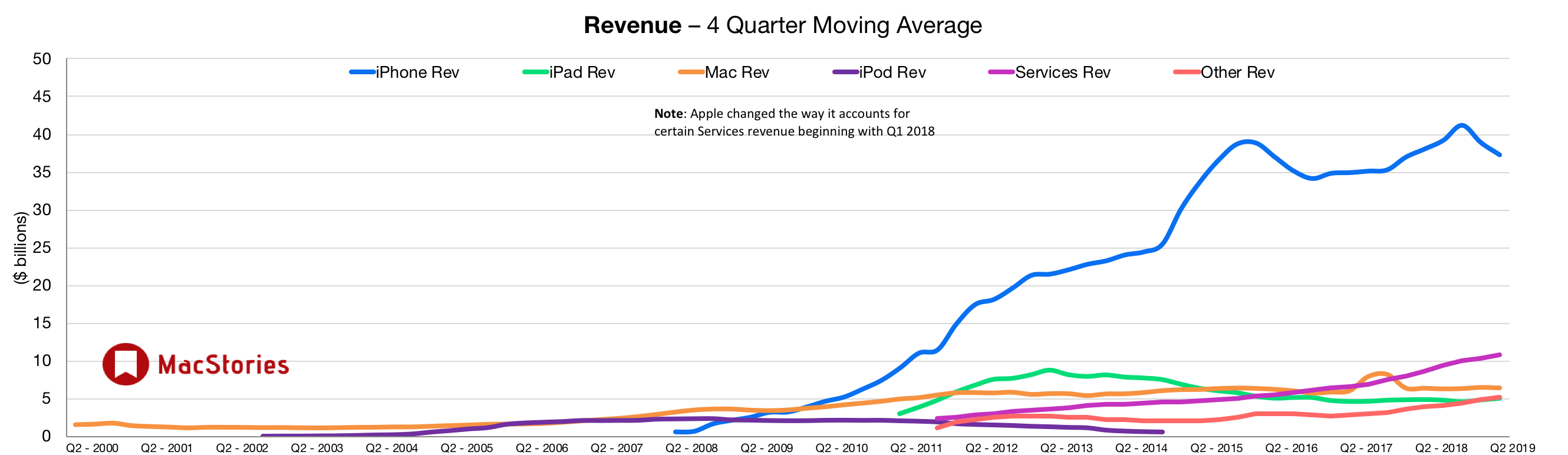

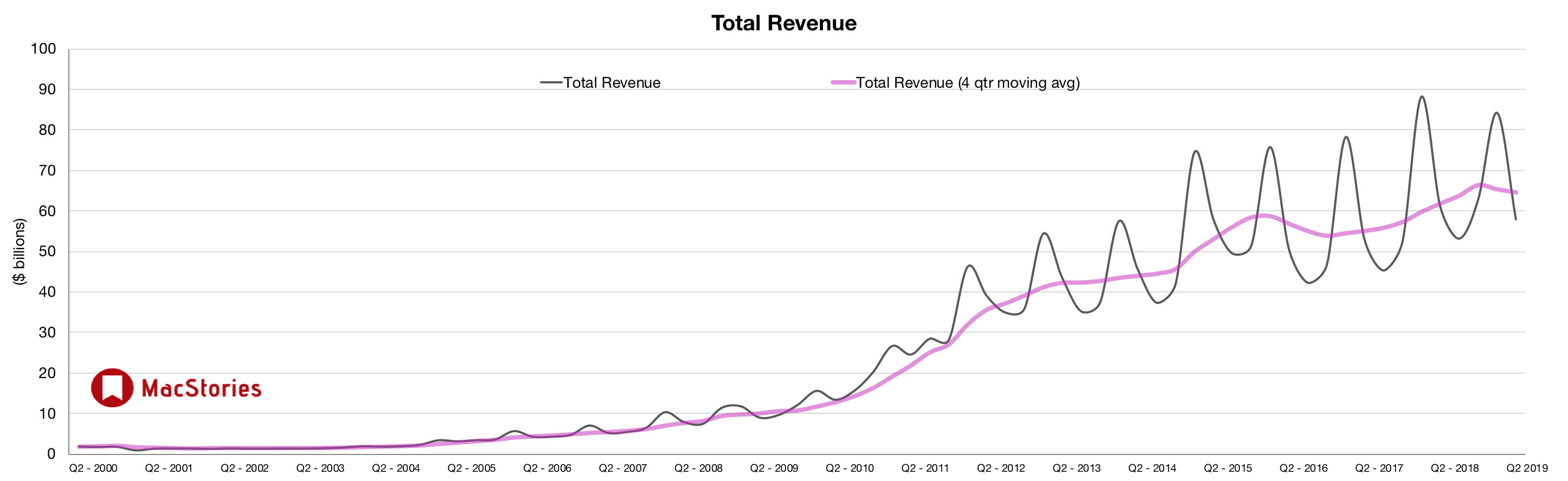

Apple has just published its financial results for Q2 2019, which is the company’s holiday quarter. The company posted revenue of $58 billion. Apple CEO Tim Cook said:

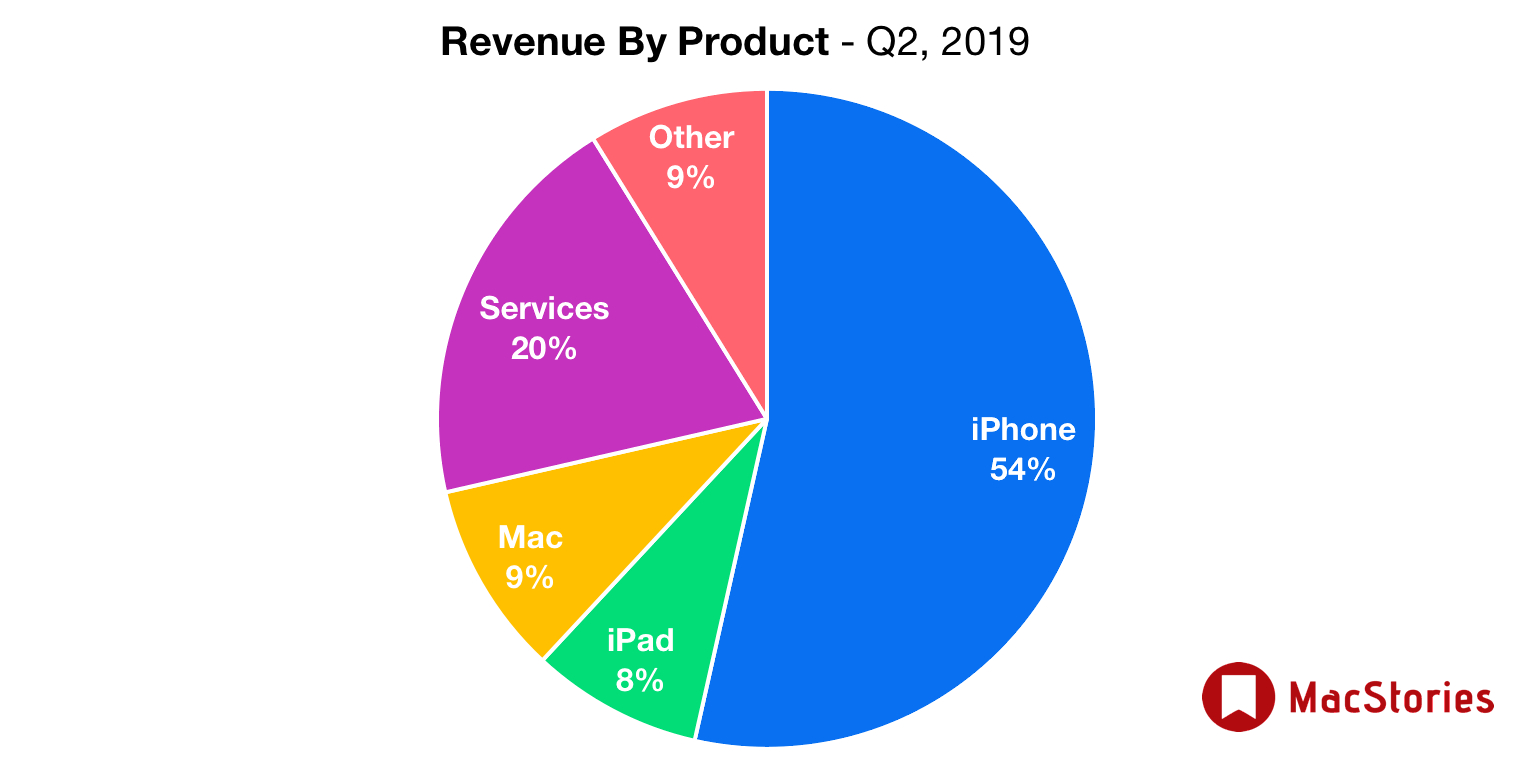

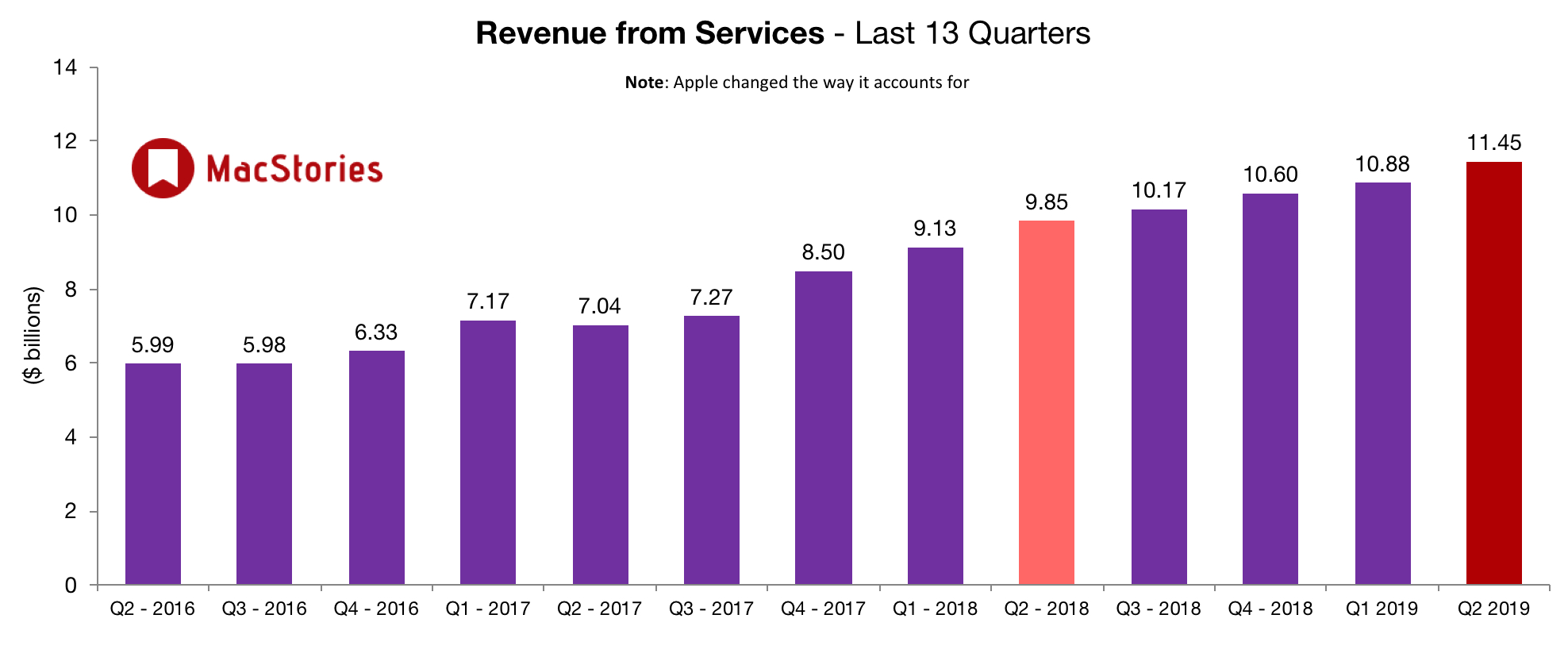

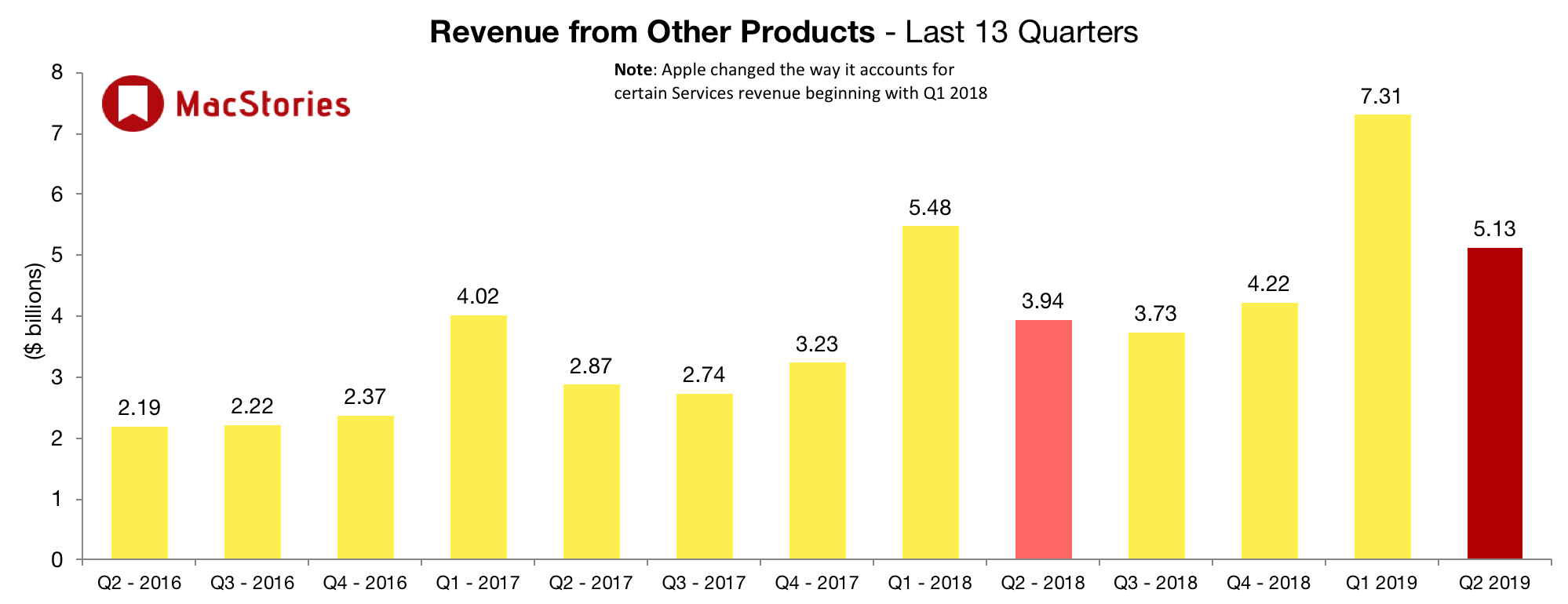

Our March quarter results show the continued strength of our installed base of over 1.4 billion active devices, as we set an all-time record for Services, and the strong momentum of our Wearables, Home and Accessories category, which set a new March quarter record,” said Tim Cook, Apple’s CEO. “We delivered our strongest iPad growth in six years, and we are as excited as ever about our pipeline of innovative hardware, software and services. We’re looking forward to sharing more with developers and customers at Apple’s 30th annual Worldwide Developers Conference in June.

Estimates and Expectations for Q2 2019 and the Year-Ago Quarter (Q2 2018)

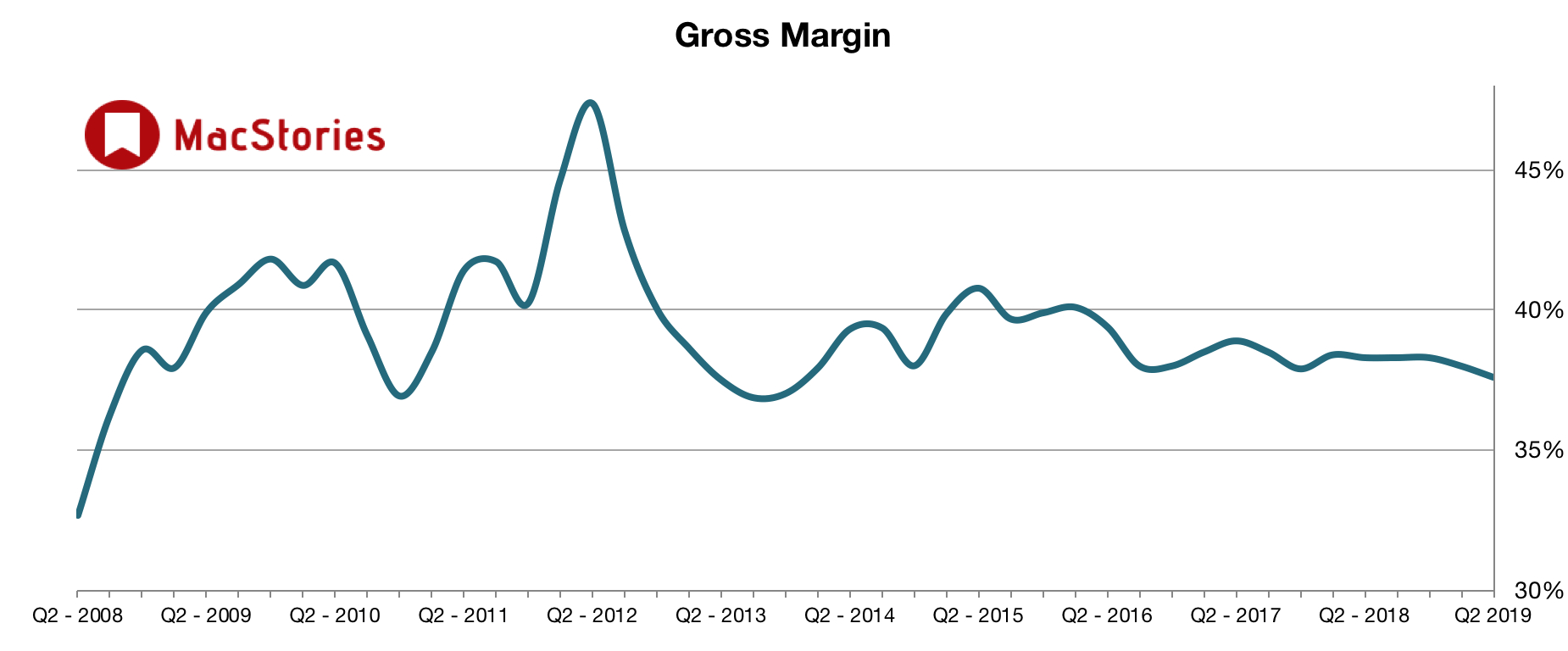

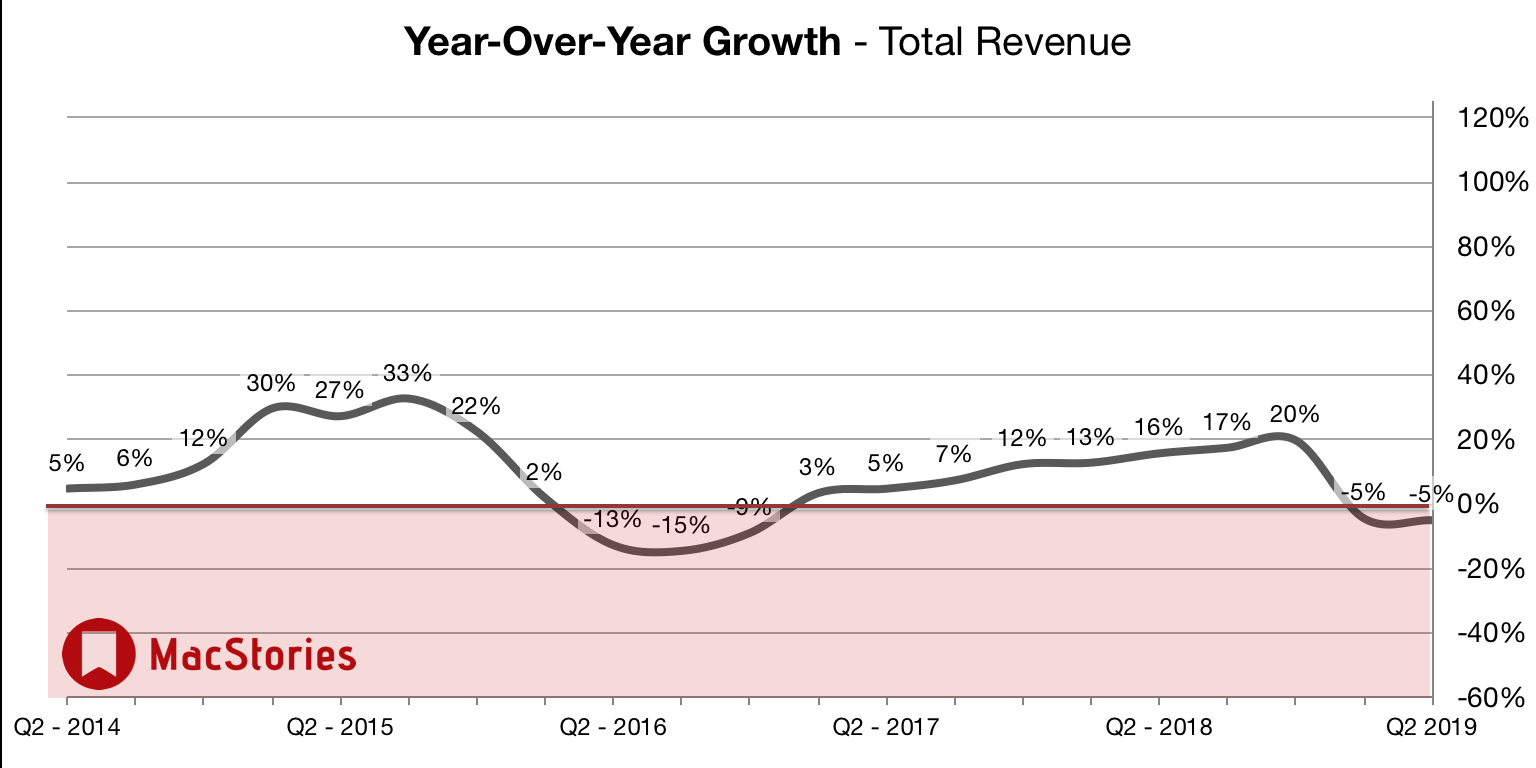

Apple’s revenue guidance for Q2 2019 fell between $55 billion and $59 billion, with gross margin estimated to be between 37% and 38%.

Going into today’s earnings call, Yahoo Finance reported that:

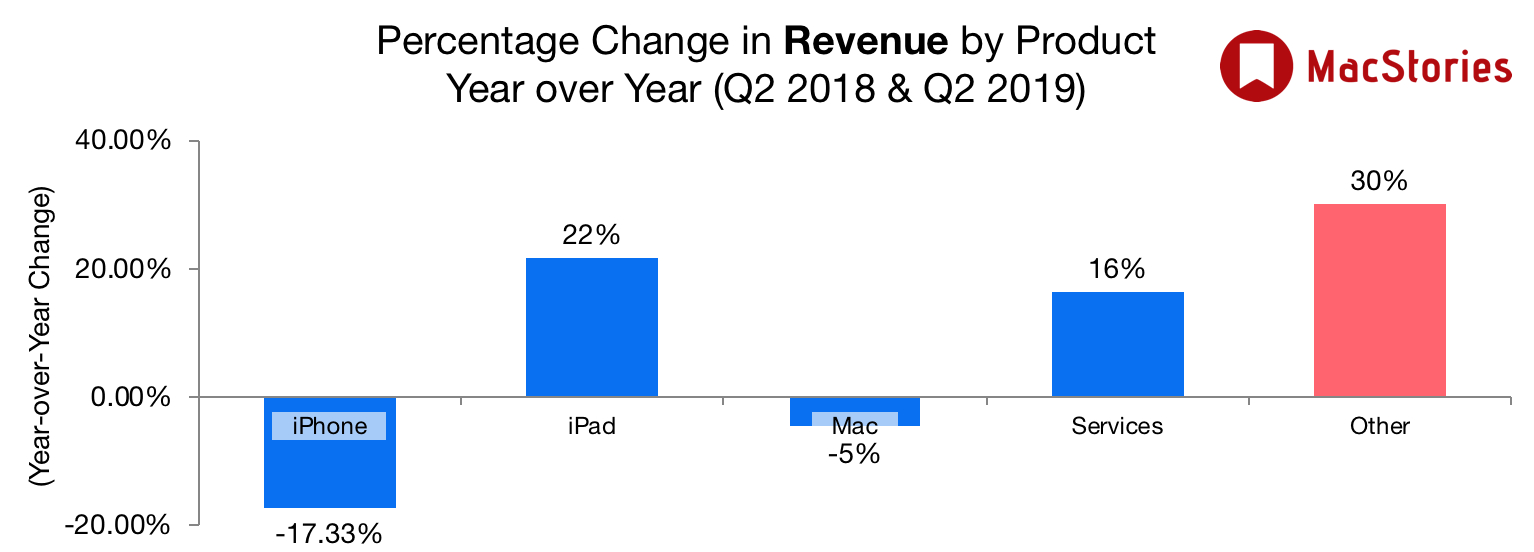

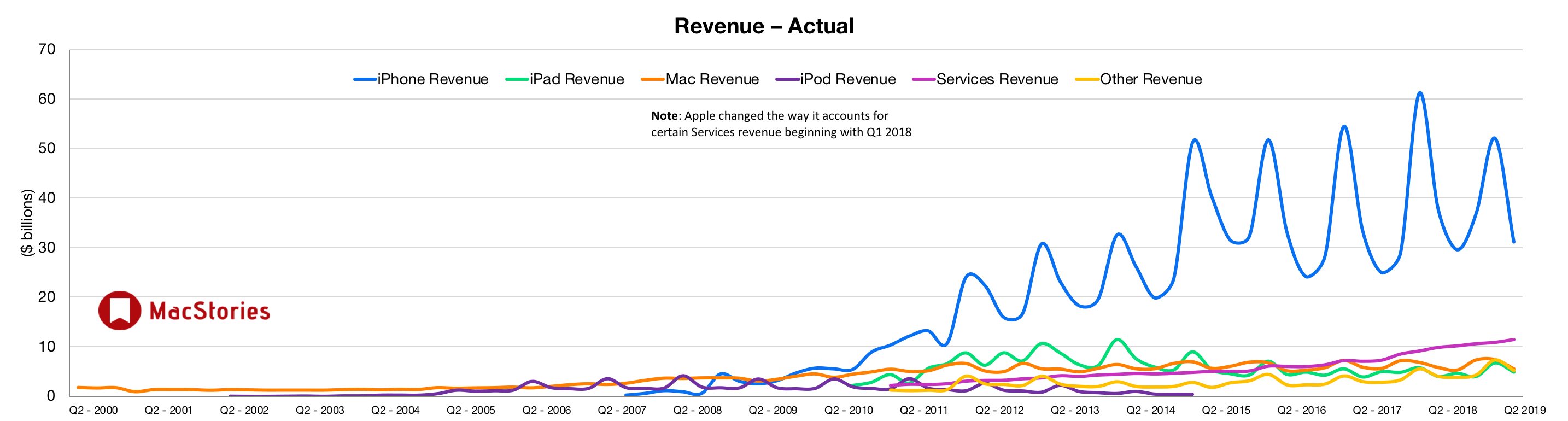

Apple’s Q2 revenue is projected to slip 5.9% from the year-ago period to hit $57.54 billion, based on our current Zacks Consensus Estimate. More specially, second-quarter iPhone revenue is projected to fall roughly 18% from $38.03 billion in the year-ago period to $31.22 billion, based on our current NFM estimates.

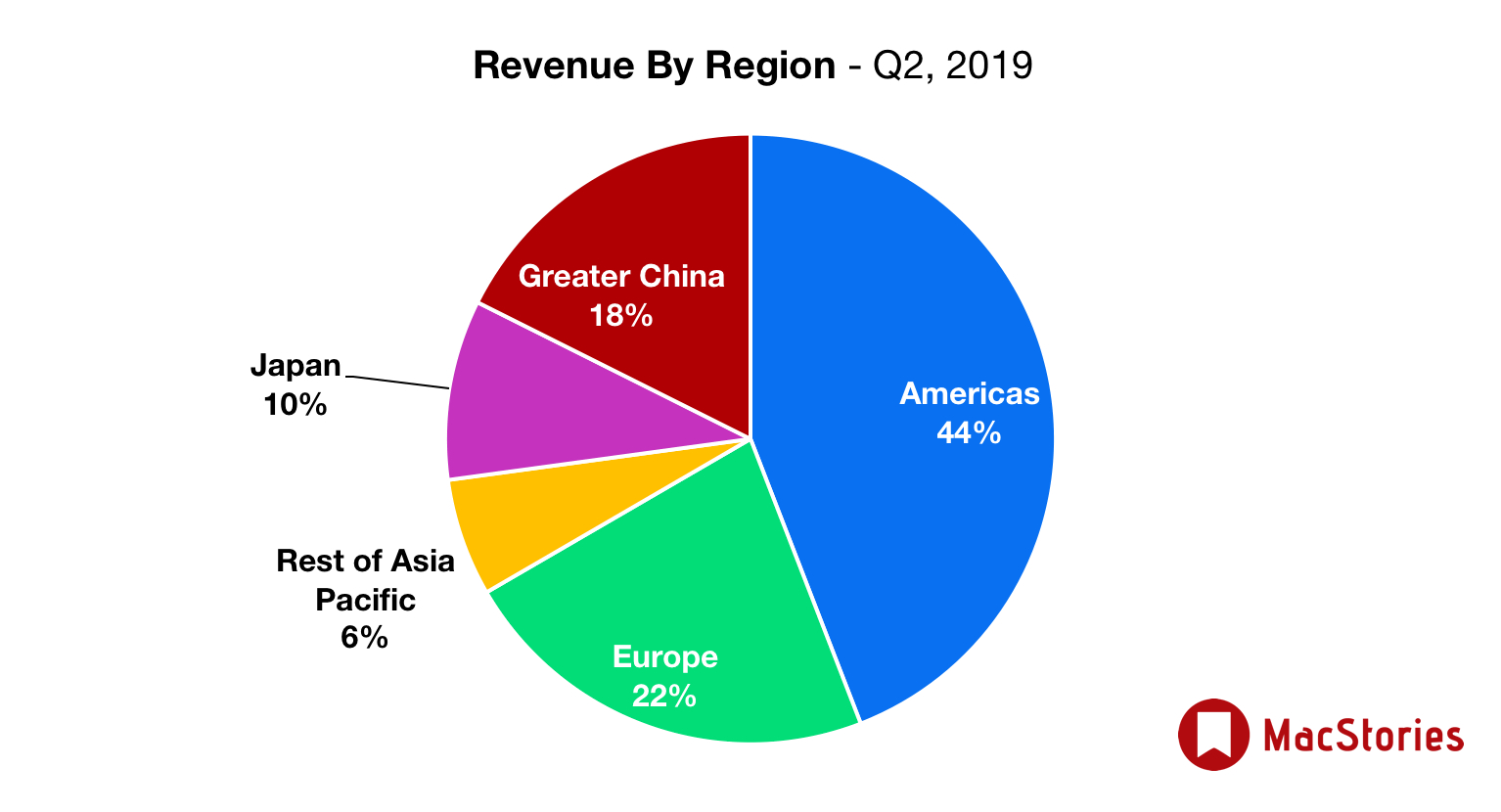

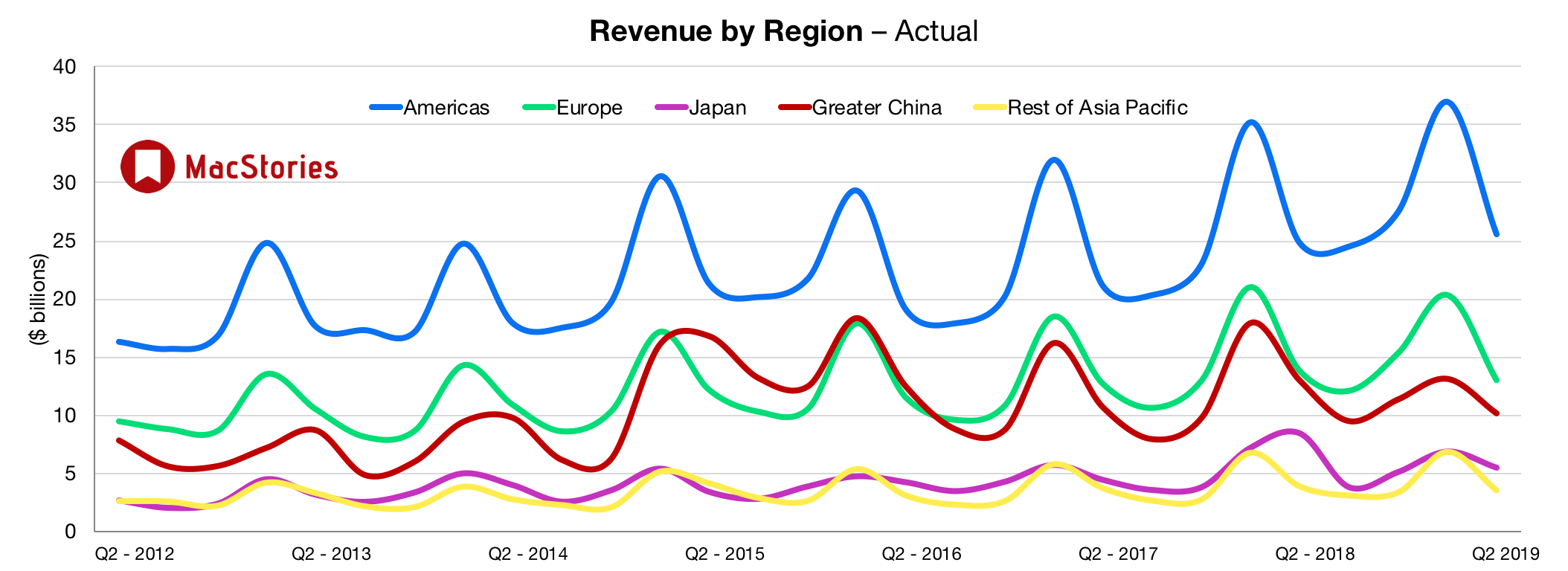

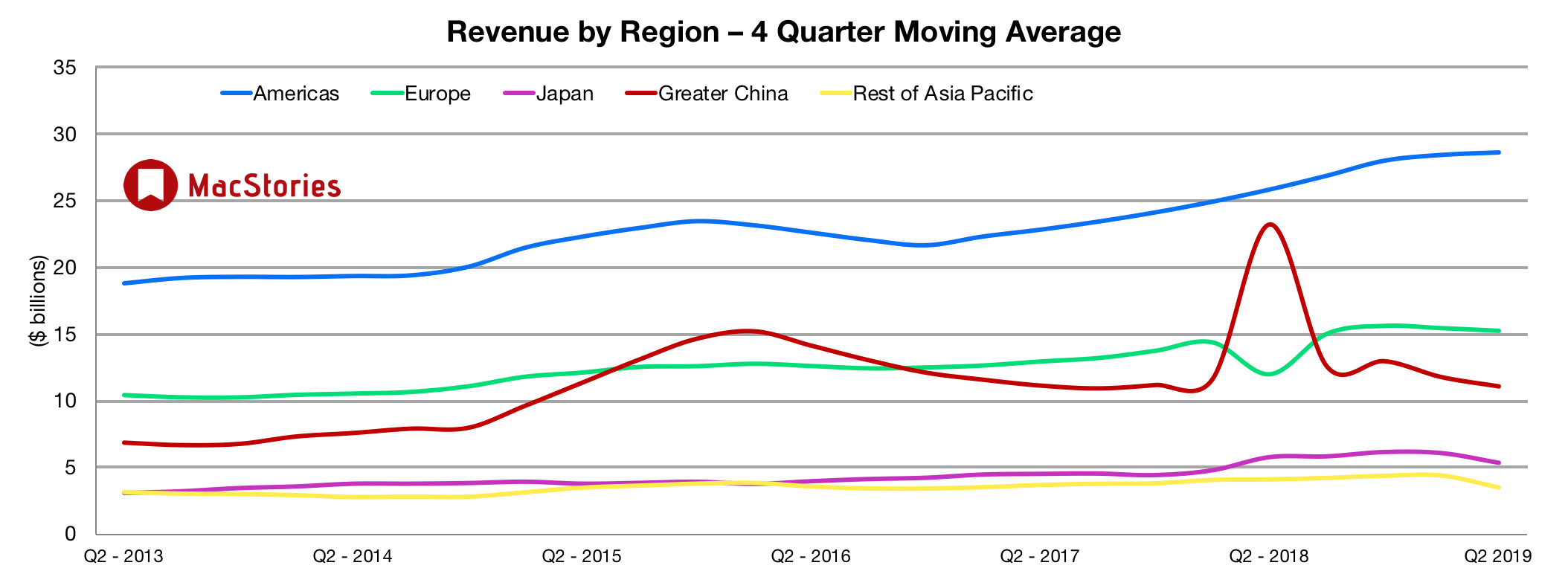

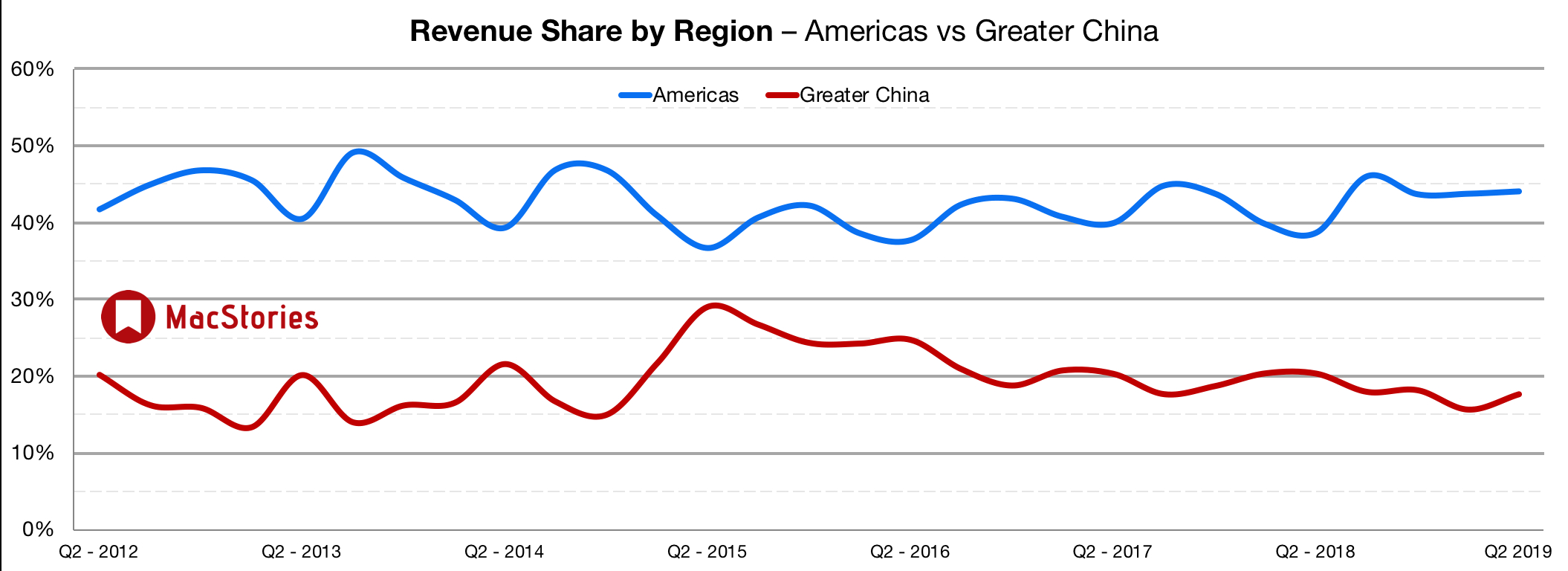

Meanwhile, sales in Greater China are expected to come in at $12.07 billion, which would mark a roughly 7.3% decline from Q2 2018. Luckily for Apple, its Services unit is projected to surge approximately 21% from $9.19 billion to hit $11.16 billion. This would come in above last quarter’s 19% expansion in the increasingly important growth division.

In the year-ago quarter (Q2 2018), Apple earned $61.1 billion in revenue. During that quarter Apple sold 52.2 million iPhones, 9.1 million iPads, and 4.1 million Macs. As announced on Apple’s Q4 2018 earnings call, the company no longer reports unit sales for any of its products.

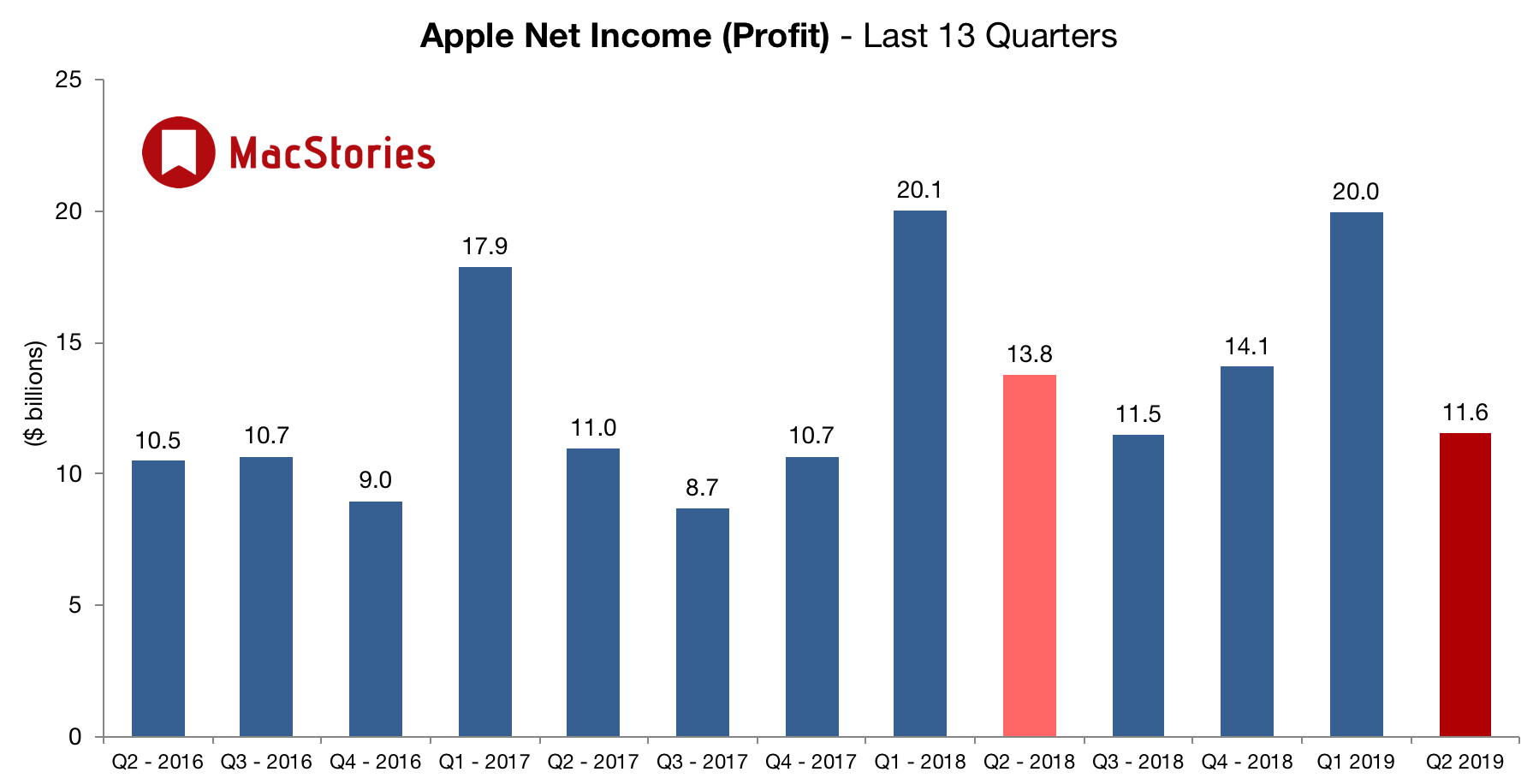

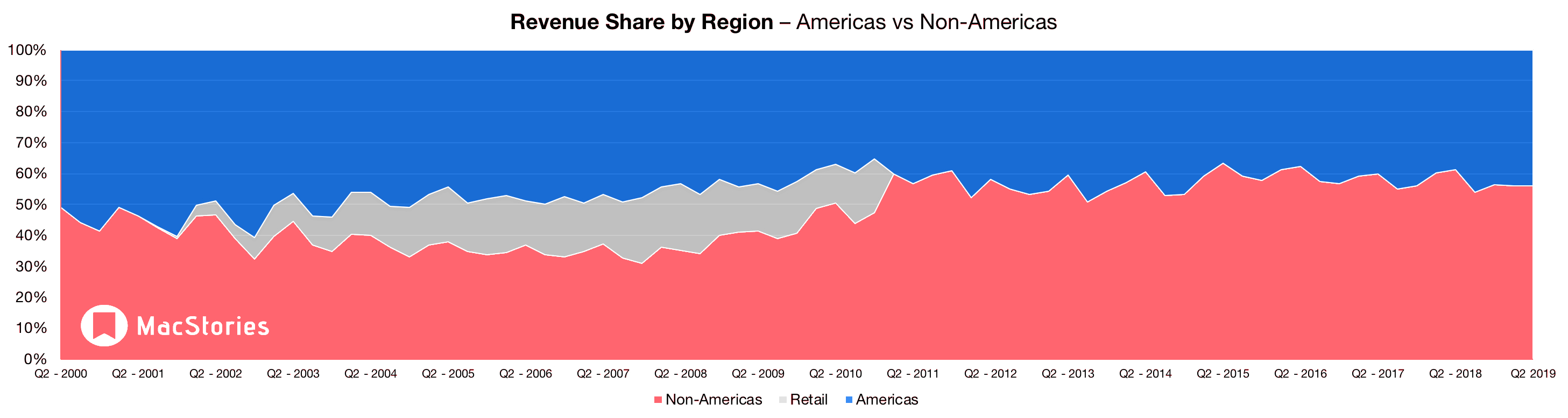

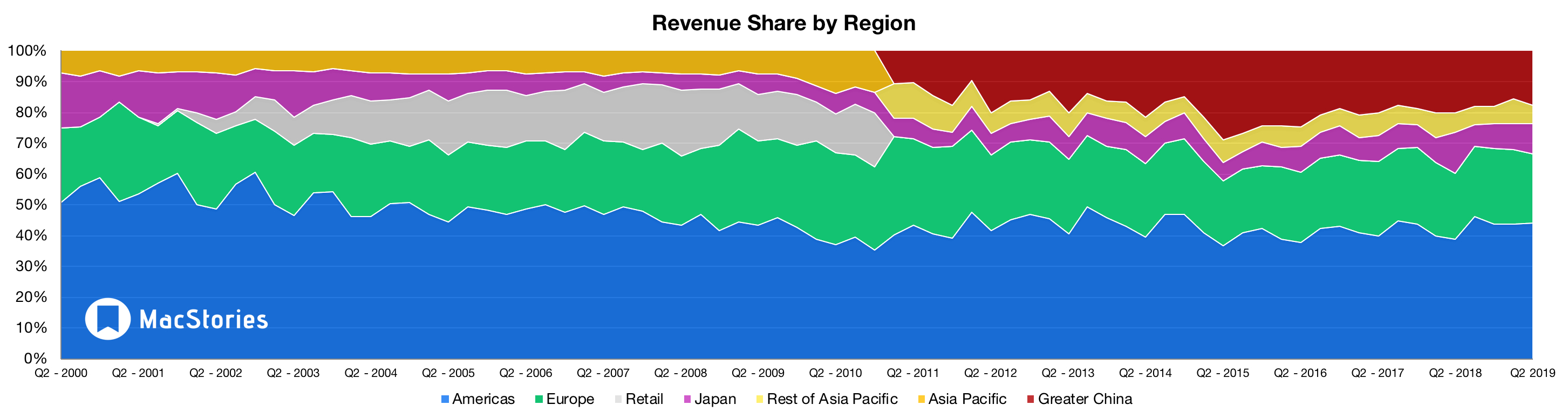

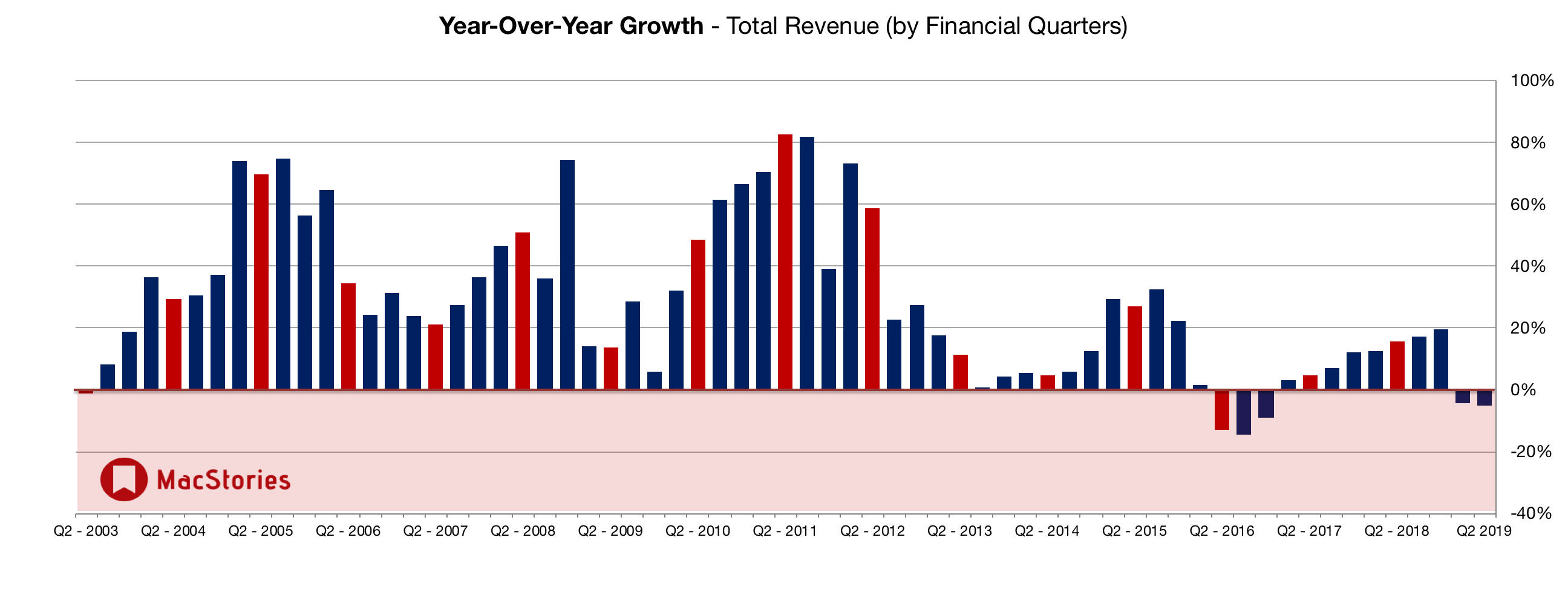

Graphical Visualization

Below, we’ve compiled a graphical visualization of Apple’s Q2 2019 financial results.

Apple Q1 2019 on Twitter

Consolidation in Android land will happen for one. With growth gone there are still too many smartphone brands to survive the long night. https://t.co/fni2DVqDu4

— Ben Bajarin (@BenBajarin) April 30, 2019

Three quarters of Apple Watch sales are going to first-time users.

— Horace Dediu (@asymco) April 30, 2019

Once again, nearly half of Mac customers were new to the Mac.

— Rene Ritchie (@reneritchie) April 30, 2019

iPhone user base sets new record (no specific figure?)

— Horace Dediu (@asymco) April 30, 2019

Mac revenue was down due to component shortages. Revenue would have been up year-over-year otherwise.

Strong iPad revenue was driven by iPad Pro (i.e. ASP gains)

— Neil Cybart (@neilcybart) April 30, 2019

Apple Pay doubling y/y, $10B/yr run rate.

— Horace Dediu (@asymco) April 30, 2019

For iPhone, worldwide revenue down 17% from year ago, but decline was stronger in final weeks of quarter. Nov/Dec were most challenging, so this is encouraging trend. Goal now is to pick up the pace. Importantly, active installed base continues to grow in each geo. segment.

— Six Colors liveblog (@sixcolorsevent) April 30, 2019

Positive customer response to pricing actions in that market, trade-ins, govt. effects to stimulate economy, China-US trade negotiations. Still a slowdown of regulatory approval on games, but pace increasing. Belief strongly in long-term China.

— Six Colors liveblog (@sixcolorsevent) April 30, 2019

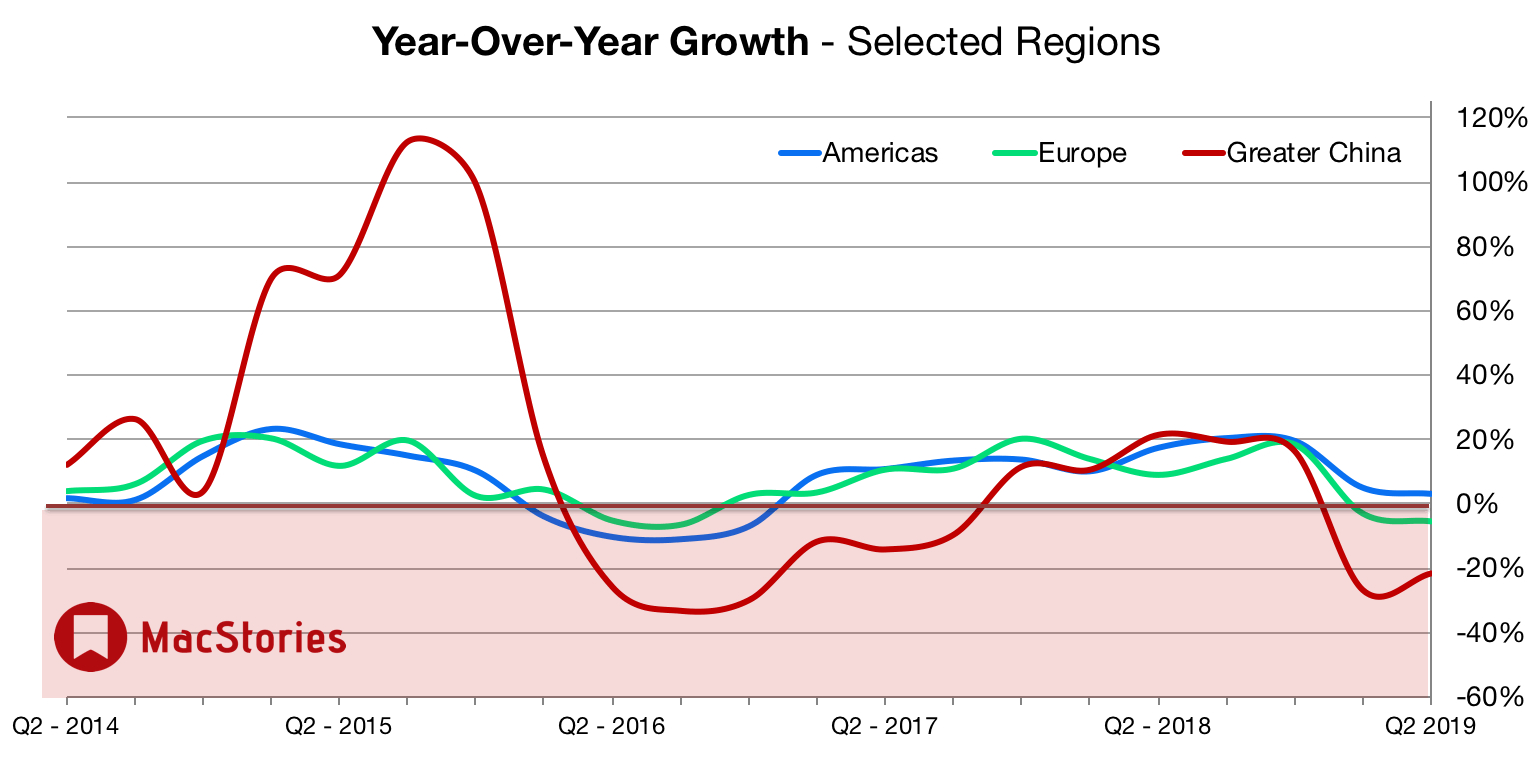

Apple’s Greater China revenue was down 22% year-over-year. Last quarter, revenue was down 27%. A modest moderation in year-over-year declines.

— Neil Cybart (@neilcybart) April 30, 2019

Apple’s hardware margin was 31.2%. Last year it was 33.8%.

The decline likely reflects Apple’s decision to cut product pricing outside the U.S.

— Neil Cybart (@neilcybart) April 30, 2019

Apple has $225 billion of cash on the balance sheet. Excluding $113 billion of debt, Apple’s net cash stands at $113 billion.

— Neil Cybart (@neilcybart) April 30, 2019

CNBC with TC, cont: “Foreign currency by itself was responsible for a year-over-year decline in revenue of 200 basis points and embedded in our guidance for this quarter is a 300 basis point headwind from a year-over-year point of view. So FX is clearly a part of that.” (4/)

— MacJournals.com (@macjournals) April 30, 2019

CNBC with Tim Cook, cont: “That affects consumer confidence in a positive way.” About Services trends, TC said: “Currency is a headwind in both our product businesses and the services businesses.” (3/)

— MacJournals.com (@macjournals) April 30, 2019

CNBC with Tim Cook, cont.: “Next we rolled out our trade-in program that had gotten some success in the United States…and I believe that the trade relationship—I don’t mean the tariff, I mean the tone—is much better today than it was in the November/December timeframe…” (2/)

— MacJournals.com (@macjournals) April 30, 2019

CNBC interview with Tim Cook: Greater China revenue down about 22% but trends “are improving.” “March was better than the average for the quarter…we adjusted price as we got into the quarter, we adjusted it to take back the weakness in the currency…” (1/)

— MacJournals.com (@macjournals) April 30, 2019