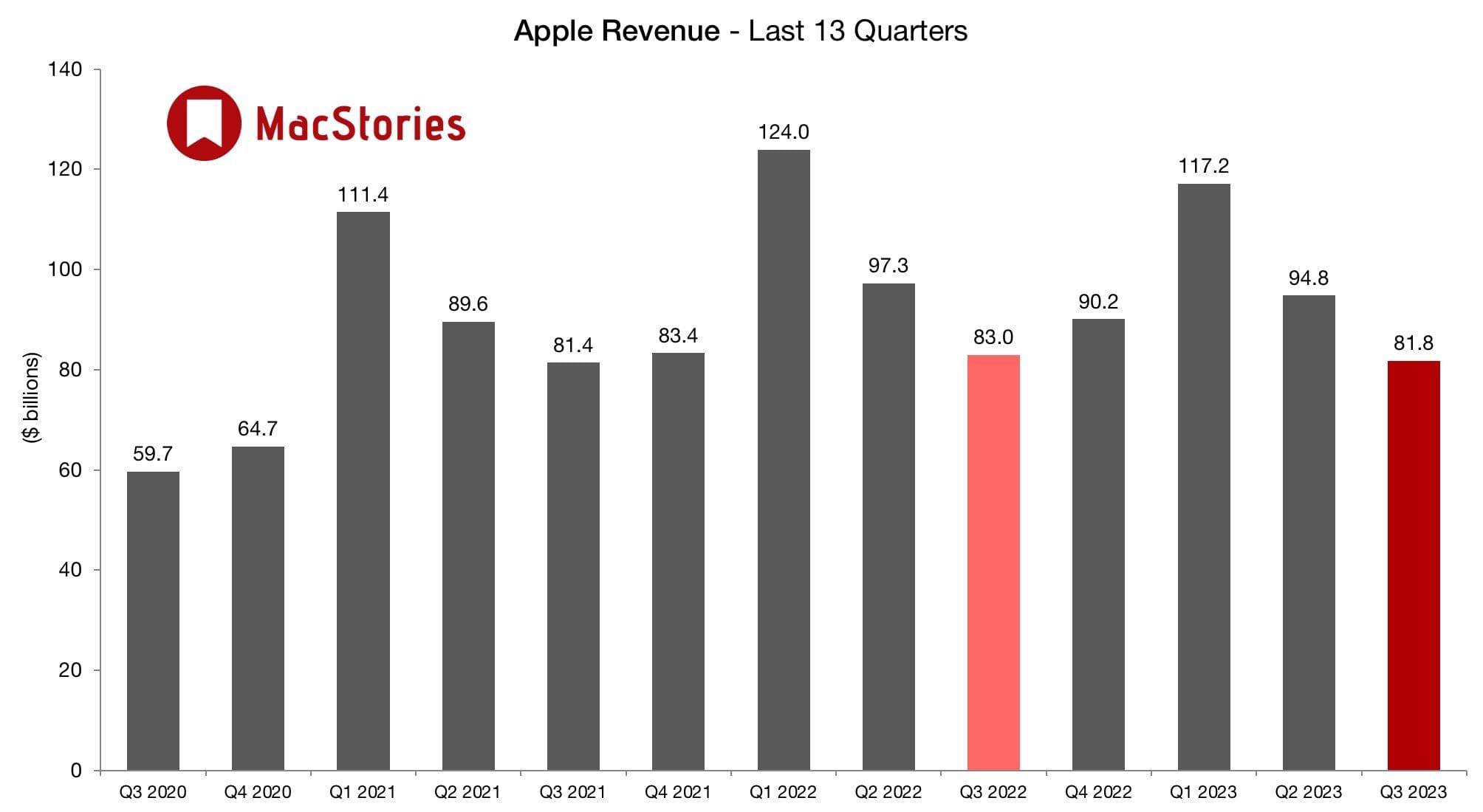

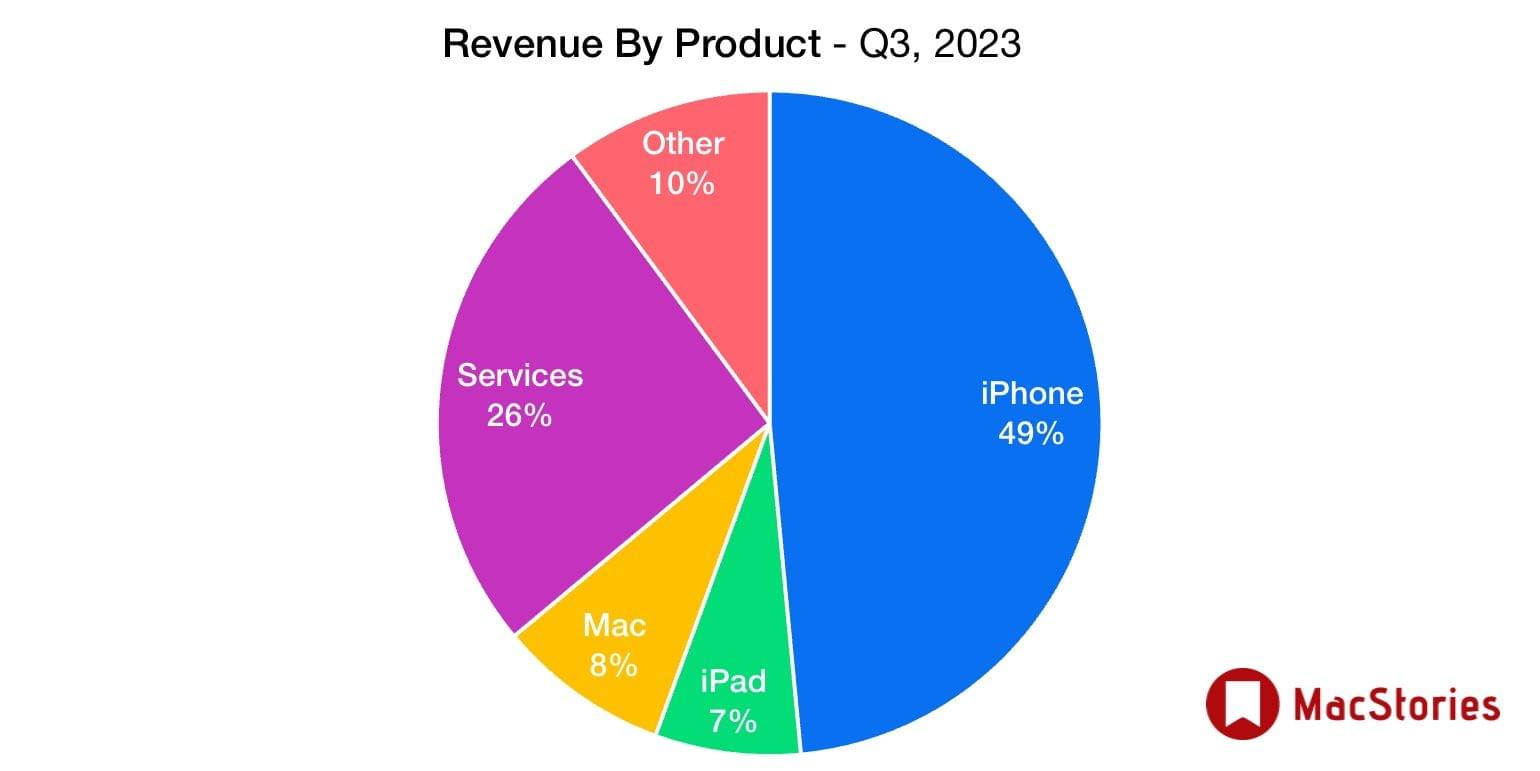

Today, Apple announced $81.8 billion in Q3 2023 revenue, a drop of 1% year-over-year that was likely driven by a soft global economy that has caused an industry-wide reduction in smartphone demand. The results mark the third consecutive quarter of revenue declines for the company. With so much of Apple’s quarterly earnings tied to the success of the iPhone, the results aren’t surprising. Going into today’s earnings call, the expectation was for a 1.6% drop in quarterly revenue.

CEO Tim Cook had this to say about today’s results:

We are happy to report that we had an all-time revenue record in Services during the June quarter, driven by over 1 billion paid subscriptions, and we saw continued strength in emerging markets thanks to robust sales of iPhone. “From education to the environment, we are continuing to advance our values, while championing innovation that enriches the lives of our customers and leaves the world better than we found it.

Despite recent revenue declines, Apple’s stock has remained resilient, rising steadily since March, with total gains in 2023 of 51% going into today’s call and analysts targeting it to go even higher.

Although today’s revenue decline is notable for being the third consecutive quarterly decline in several years, a better gauge of Apple’s longer-term fortunes will come later this year when it refreshes the iPhone lineup. With economies around the globe still recovering, it will be interesting to see if rumors of a hardware redesign of the iPhone are sufficient to offset what some speculate will be Apple’s most expensive smartphone ever.