Call me old fashioned: I like to track my spending habits by writing down (with a pen and paper — more recently OmniOutliner) my purchases. The purpose in tracking your expenses by hand is so you can better verify your purchases against paper or digital statements you get in the middle or at the end of each month, and it also has the side-effect of making you better aware of the money you’re actually spending. If you’re buying a Starbucks coffee everyday, you’re running upwards of $150 a month, minus the lunch you eat out (an additional $400+ if we take $15 meals into account) and evenings spent out at the bar. Money adds up, and that’s not realized when you’re letting a computer do a lot of that work for you. Maybe you can afford it, but imagine how much money you could save to spend on all the awesome iOS apps we review? See.

So where’s Toshl come in? Well, for one thing they have a website and a mobile app that works across all of your smartphones and any computer you’re sitting at. Combined with the charming Toshl-dog graphics and humorous attention to detail you’ll find throughout the product (PG-13 appropriate I’d say), Toshl has a great sense of style and an immediate demo available so you can try there product. The image that Toshl gives off is very relaxed (and fun), but what does it actually do?

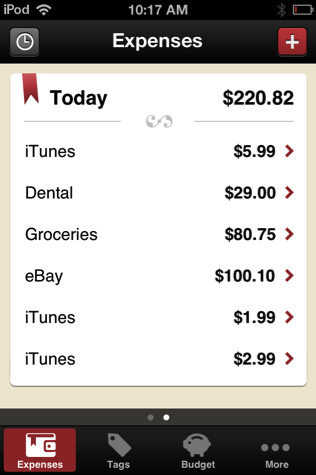

First you start out by downloading the mobile app. You create an account with Toshl (just a username and password), and you’re using their web service. Everything you do is saved online and accessible at any time. From here on out, you only have add your purchases to get started. I’m using the iPhone app to track my spending.

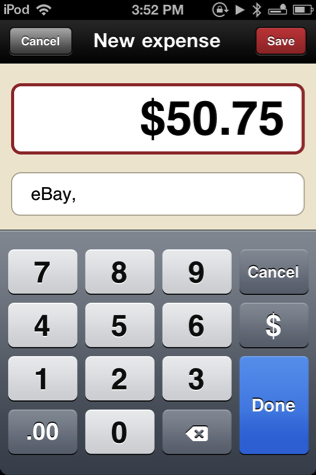

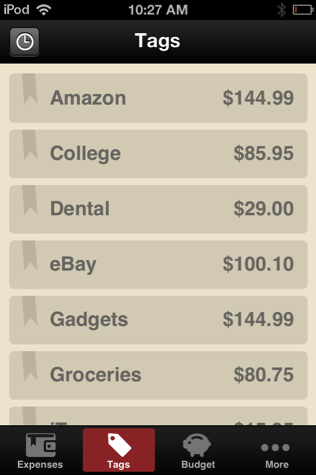

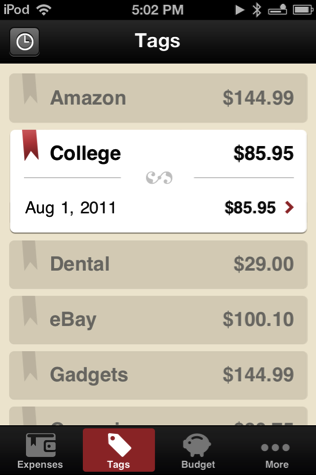

Adding an expense, you simply type in the amount of your purchase. Coffee was $2.50, so we type that amount using Toshl’s custom number-pad. Next, we can add tags to our purchases. Tags can be used to create budget groupings, and can be as flexible as you need them to be. You can create a general “eating” tag or get specific by specifying “coffee-shop”. You can also add multiple tags: if you bought an iPod at Best Buy, you could say: “electronics, gadgets”. It’s your call. Lastly you can set the date (it’s already set to today, so there’s likely no need to change it), and change some advanced settings. If it’s a repeating expenditure like a bill, you can have it repeat on the same day each month. A description of your purchase can also be added (e.g. mocha with white chocolate shavings — tipped barista an additional $1). It’s quick, simple, and the animations are all well done.

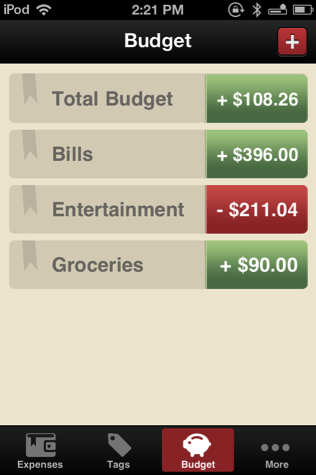

Once you have a pile of expenses to work with and some tags created, you can start to decide how you want to budget things. Maybe you want to limit yourself to $100 a month to spend on gadgets, or maybe you can only spend $60 a week on groceries. Budgets are flexible in time, and can group a bunch of tags together so you know how much you’re spending. Toshl’s main principle (more evident with the pro upgrade) is that you base all of your purchases around these budgets. You can create budget groups, and as the month or week progresses you can stay up to date on how well you’re managing your money.

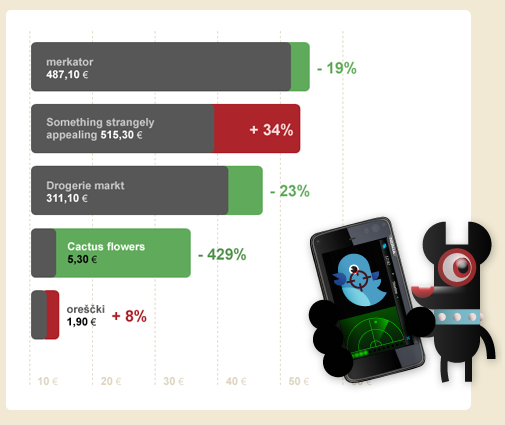

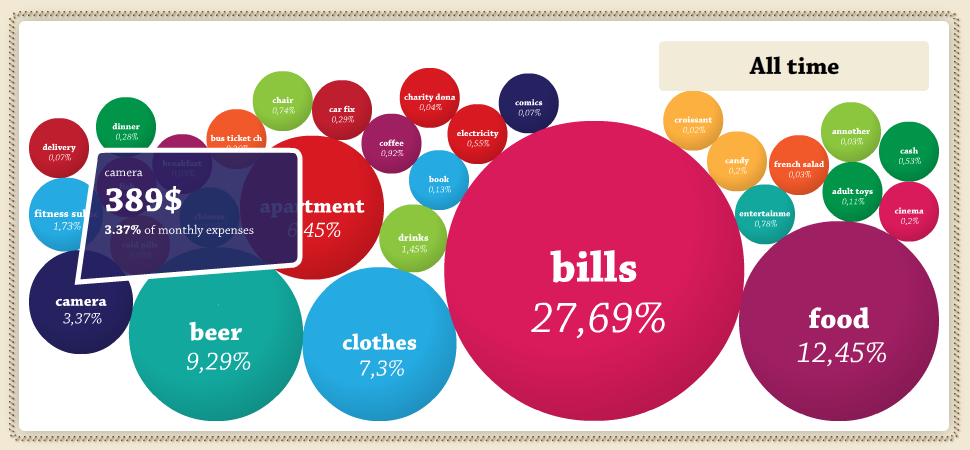

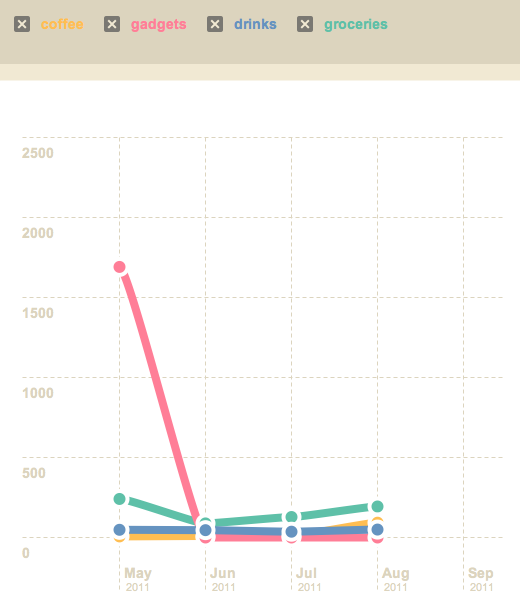

Toshl takes this further by letting you view chart of your spending habits online. You can see where you’re spending the most money (I spent more on gadgets this month in July than Jane AND exceeded my budget), pinpoint expensive purchases or problem areas, and start getting a sense for where you need to improve. Toshl succeeds in providing very good timeline based tools to show you progress and allows you to compare these tags you’ve created with other areas of responsibility you want to focus on.

Toshl is best used for budgeting your daily expenditures. I can’t say it’s terrific for analyzing mortgages or telling you to pay your bills — Toshl is designed in a way where you set a monthly limit for yourself, then you’re allowed to work within those limitations. It’s meant for the things we care about doing on a daily basis, and answers the question of whether seeing a movie with friends is more important than buying that $15 iOS game.

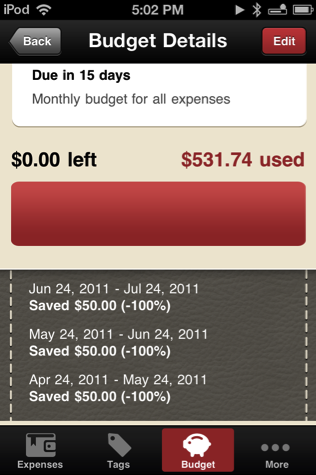

While you can set these limitations for yourself, there’s no rewards system in place to acknowledge that you’re doing well, nor is there really any downside to blowing past your budget on Toshl’s side. Toshl will tell you that you need to watch your money, but it doesn’t make you feel like a bad person (as it should). What I mean is that if the purpose of the app is to help me manage my spending, it should really scold me on doing a bad job. Something like this should happen in some form: “Hey dude, you had a budget of $250 for video games and you spent $450. I’m gonna drop your budget this month to $50 while you chill out.” I think Toshl’s challenge will be not only be helping responsible people keep track of their spending, but people who are actually looking for help to be reminded that their spending habits are poor. I want to see Toshl target that area — I want more action information than a full red bar. But it can’t all be reactive — Toshl has to be active in saying that I’m about to go overboard with an unnecessary purchase.

As for the apps, the web app and the mobile app are fairly good. The smartphone counterparts are mostly meant for input and quickly glancing at your budgets while you’re at the store, and nothing more. Toshl on the iPhone is very fast, has great animations that are slick, although I do have to say some of the UI can be slightly confusing. In the expenses view, I had no idea you could see a chart of your overall progress for the month by swiping right. There are some nice touches, such as being able to password Toshl to keep your expenses from prying eyes, although I do wish switching currencies would change all the numerical amounts as well (it simply changes the reference sign).

Toshl makes a point to say they’re mobile, but really the web app is well done and offers all of the fancy graphs you want to look at (you can mix and match tags and do lots of nice comparisons) in three simple views for expenses, tags, and budgets. There are no pie-charts in Toshl — instead you can see how your purchases weigh against each other with everyone’s favorite bouncy-balls in the Tags view.

For those of us who like to keep track of spending manually, I think Toshl has a great online presence with a well-done app that lets me enter my information quickly, and presents that information in lots of different ways so I can better keep in mind whatever questions I might have about my money. I do wish Toshl offered solutions to spending problems (such as goals to work towards or better highlighting of problem areas), but the convenience of quick input makes a fine and friendly product for tracking your spending habits.

Toshl is free to use, but upgrading to the pro version ($19.95 a year) will get you lots of advanced features — you can get automated email reports, budgeting involving specific tags, and export to PDF or Google Docs depending on how you roll. You can upgrade to the pro version by logging in at https://toshl.com/getpro/, and you can learn more on Toshl’s about page.