Earlier today, Apple updated its Investor Relations webpage to include a placeholder for the company’s next earnings call, scheduled for July 24. As usual with Apple’s conference calls, the event will be provided as an audio webcast for investors and listeners.

Apple plans to conduct a conference call to discuss financial results of its third fiscal quarter on Tuesday, July 24, 2012 at 2:00 p.m. PT.

Ended on June 30, Apple’s third fiscal quarter will provide insight into the company’s recent performances with the new iPad (launched on March 16 in 10 initial countries), iPhone 4S (which is entering its late-stage product cycle), and revamped Mac line. In the previous quarter, Apple set guidance for Q3 at $34 billion and diluted earnings per share of about $8.68. Currently, consensus by Wall Street analysts averages $37.34 billion in revenues for the third-quarter.

The new iPad has been Apple’s fastest product rollout to date, and Q3 will be the first full quarter for device sales in all the countries where it’s been released. Apple added 56 launch countries in 42 days, and recently expanded to the Middle East and Latin America through official distribution channels and retailers.

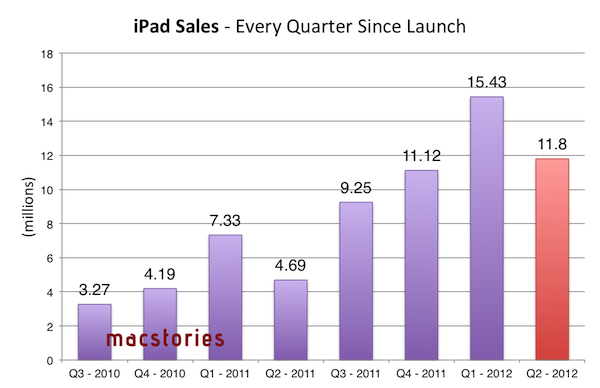

With 12 million units sold in Q2 2012, Apple said the new iPad was “off to a great start”, and Q3 2012 will provide the first real opportunity to measure to device’s impact on a wider level. During the past earnings call, CEO Tim Cook noted how he was confident the company would be able to “supply a significant number of iPads during the quarter”.

The iPhone 4S, on the other hand, was released eight months ago, and amidst speculation of a new model coming this Fall – perhaps as soon as October – Q3 2012 will be key to understand the device’s sales over the past four months and, more importantly, its performances in China.

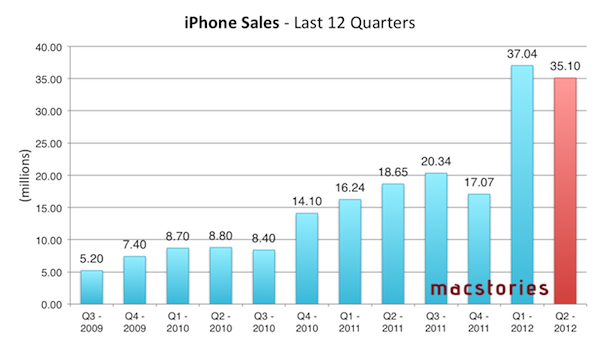

The iPhone 4S launched on its second Chinese carrier – China Telecom – on March 9th, and Q3 2012 will be the first “full quarter” to measure sales in the region. With 35.1 million iPhones sold in the past quarter, Apple reported a 5x growth year-over-year in Greater China, noting how “the incredible quarter” was the result of efforts to understand the market – where more people are moving to the middle class – “as good as we can”.

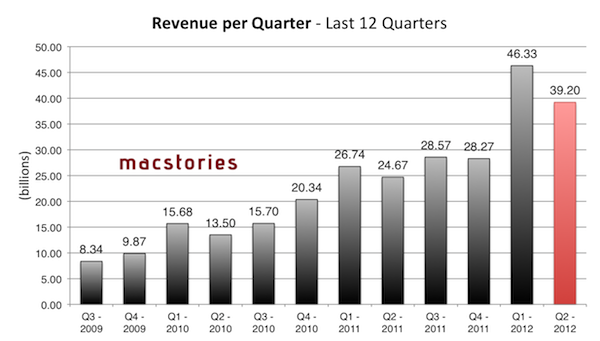

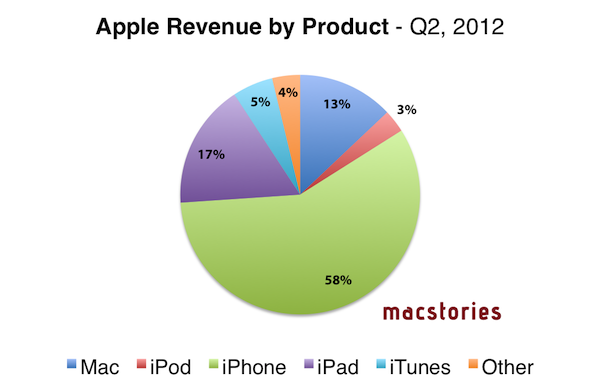

In Q2 2012 – the company’s biggest non-holiday quarter to date – Apple posted revenue of $39.2 billion, with 11.8 million iPads, 35.1 million iPhones and 4 million Macs sold. Apple sold 7.7 million iPods, a 15 percent unit decline from the year-ago quarter. The company posted quarterly net profit of $11.6 billion, or $12.30 per diluted share.

In the year-ago quarter, Apple posted revenue of $28.57 billion, with 9.25 million iPads, 20.34 million iPhones and 3.95 million Macs sold. Apple reported record quarterly net profit of $7.31 billion, or $7.79 per diluted share.

In his own estimates for the upcoming Q3 results, Asymco’s Horace Dediu forecasted the following numbers:

- iPhone units: 28.5 million (40%)

- Macs: 4.5 million (15%)

- iPads: 24 million (160%)

- iPods: 6 million (-20%)

- Music (incl. app) rev. growth: 35%

- Peripherals rev. growth: 20%

- Software rev. growth: 15%

- Total revenues: $41.9 billion (46%)

- GM: 44.8%

- EPS: $11.54 (48%)

In their initial projections for Q3 2012, Seeking Alpha estimated higher Mac sales due to the new models released during the quarter (Apple also dedicated a new commercial to the Retina MacBook Pro) and quarterly revenues around $39 billion. As noted by Philip Elmer-DeWitt at Fortune, “as usual the indies are more bullish than the pros”, with independent analysts projecting earnings on average $5 billion higher than the Street’s consensus.

To put these possible numbers in better context, here’s a graphical representation of how Apple performed in the past quarters.

Apple’s quarterly dividend won’t begin until the fourth fiscal quarter of 2012. We will provide live updates from the call on our site’s homepage on July 24 starting at 2 PM PT. For a recap of news and events that may have affected Apple’s results in the quarter, check out our Month In Review roundups here.