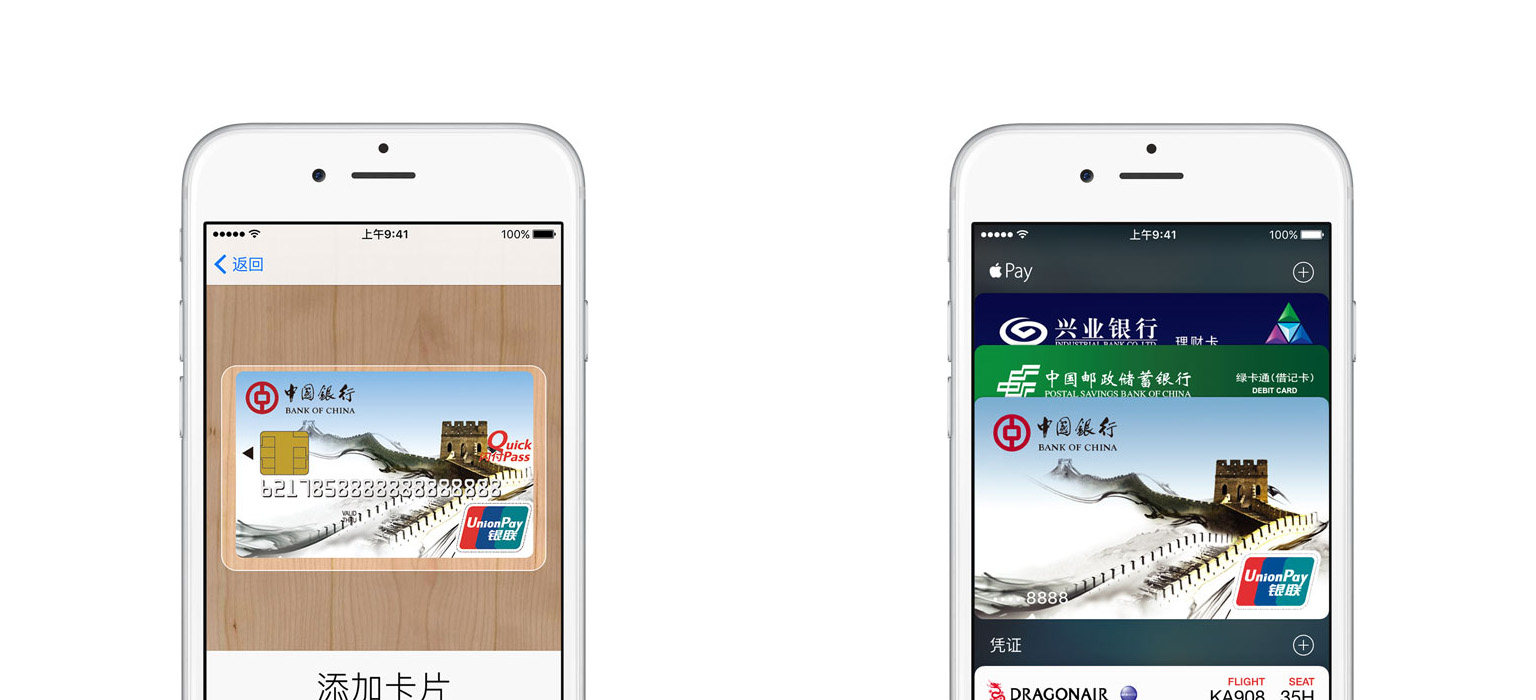

Apple Pay today launched in China, where Apple has partnered with China UnionPay which operates the Chinese inter-bank network (in a role analogous to that of Visa and Mastercard). Jennifer Bailey, vice president of Apple Pay, told Reuters that Apple Pay supports 19 of China’s biggest lenders, which means that 80 percent China’s credit and debit cards are eligible for Apple Pay at launch. Bailey also noted that Apple Pay is currently accepted at about one-third of all locations that accept the supported cards.

Unsurprisingly, Bailey thinks that “China could be our largest Apple Pay market”. That is no surprise, in the other Apple Pay markets there is either a shortage of locations which support Apple Pay (United States) or shortage of financial institutions which support Apple Pay (Australia, Canada). The UK is the only country that has a high level of retail location acceptance and financial institution support – but the population of China far exceeds that of the UK.

Apple’s approach is to not compete with banks and UnionPay, said Bailey.

“China UnionPay and our Apple Pay solution has a huge advantage, given the footprint of China UnionPay,” she said. “Its merchant acceptance network far exceeds what any of the other mobile platforms have today.”

For a full list of the supported financial institutions in China, view this page on Apple’s website. Apple Pay is available in China at retail locations, as well as in iOS apps.

[via MacRumors]