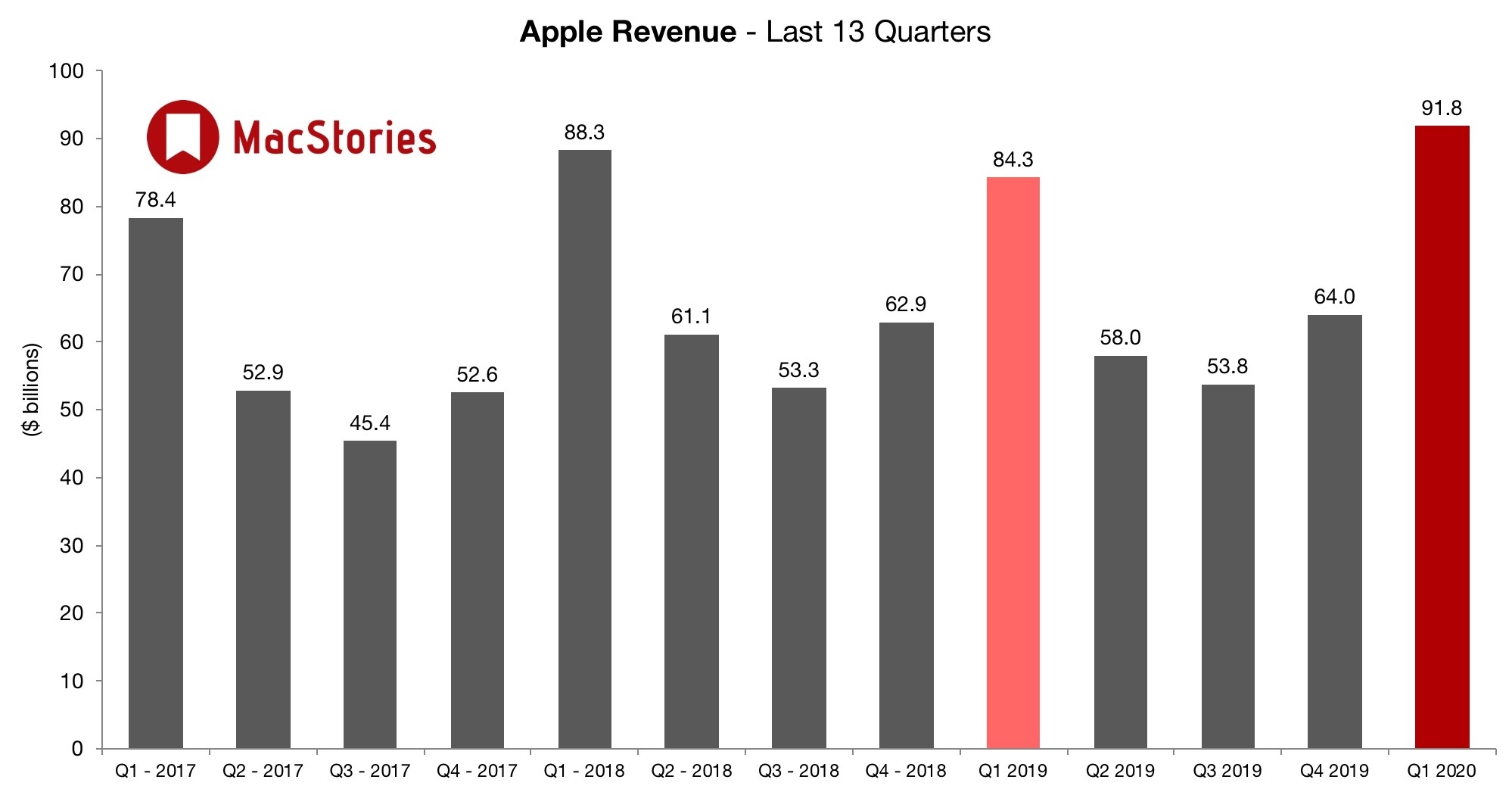

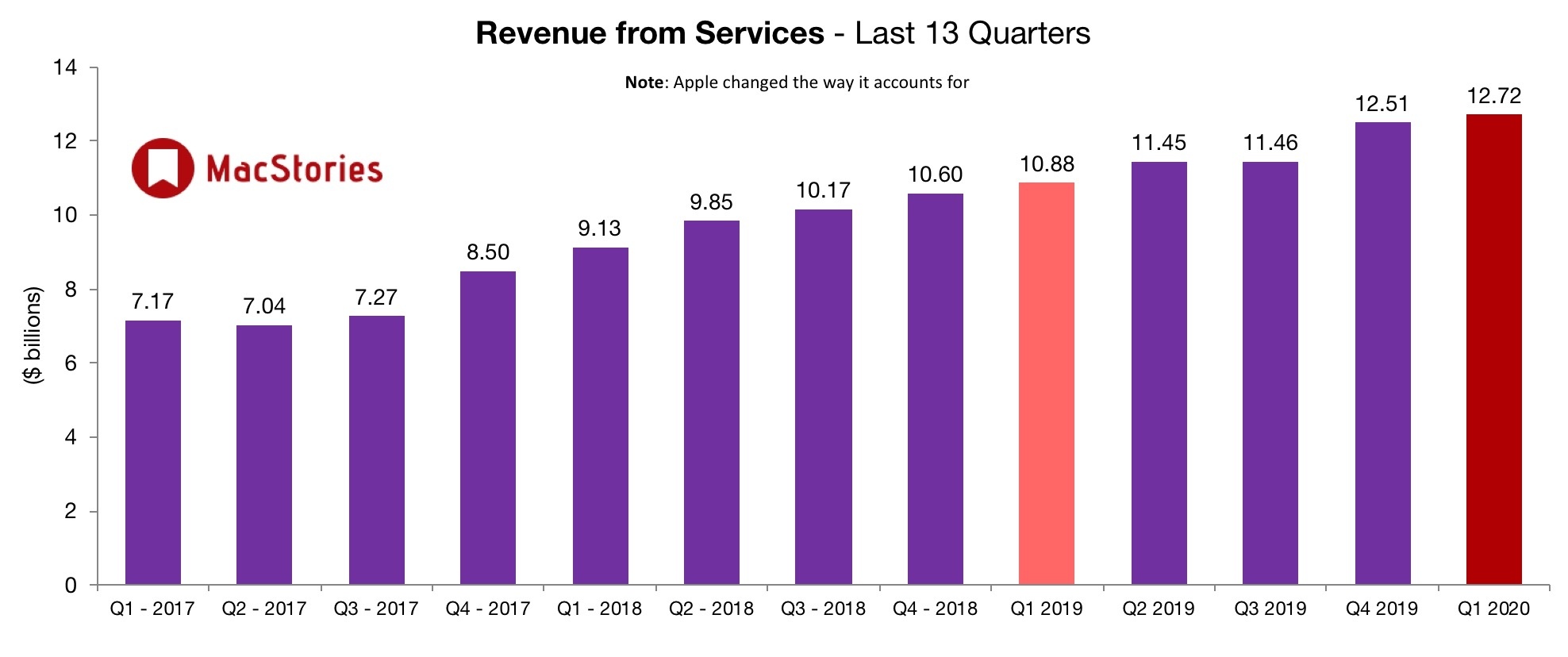

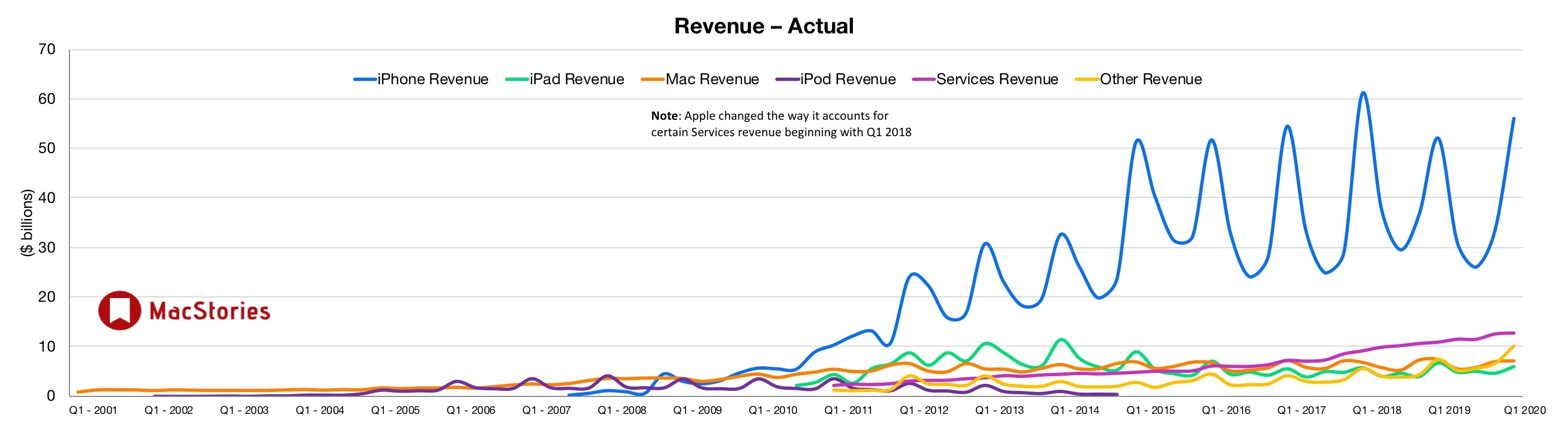

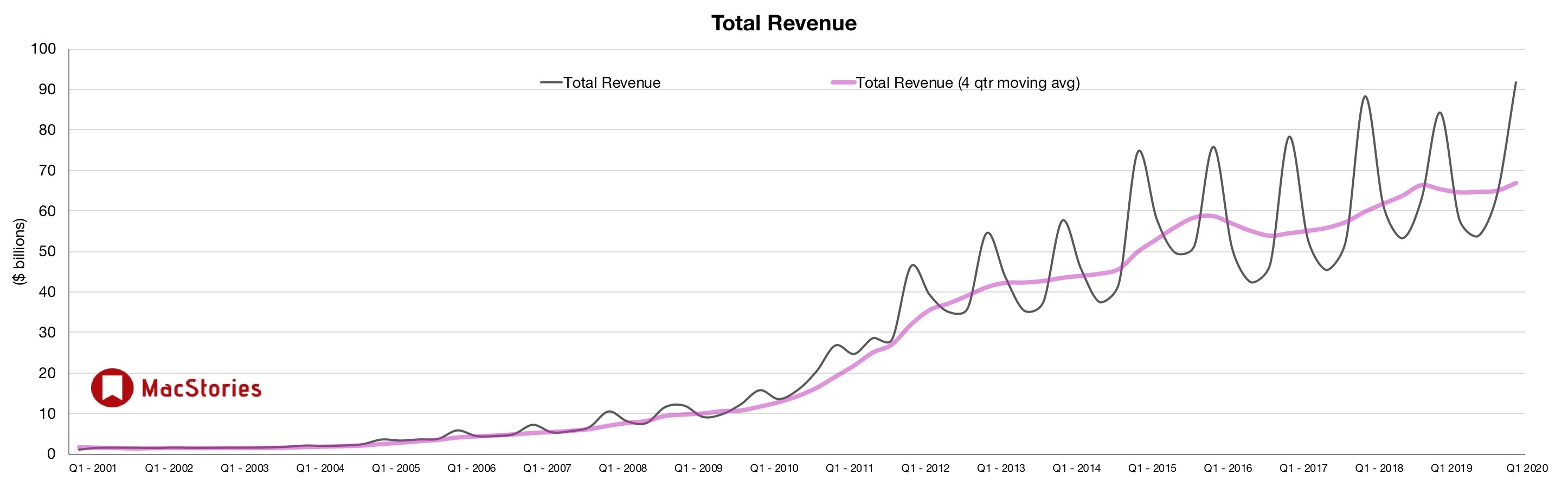

Apple has just published its financial results for Q1 2020. The company posted revenue of $91.8 billion. Apple CEO Tim Cook said:

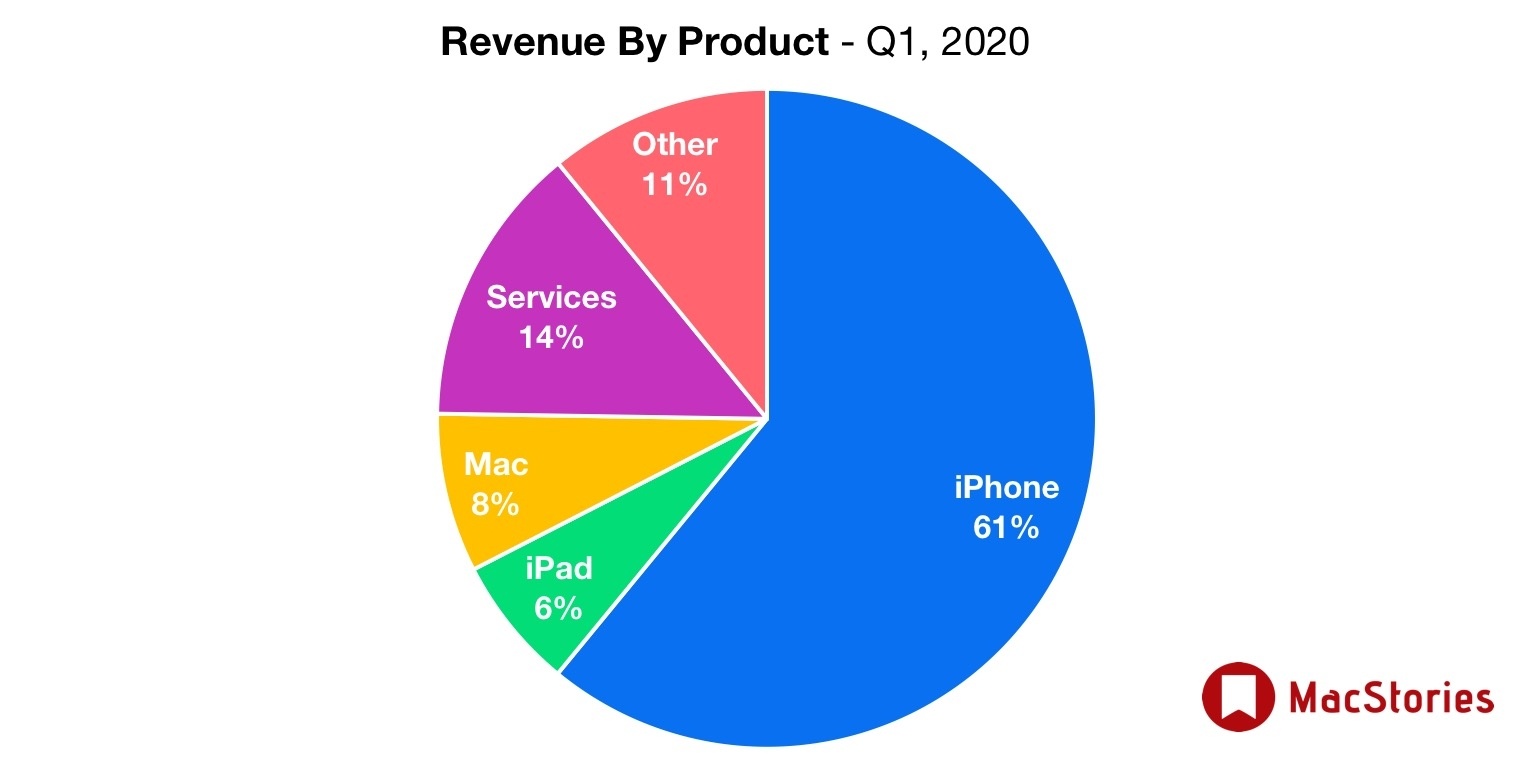

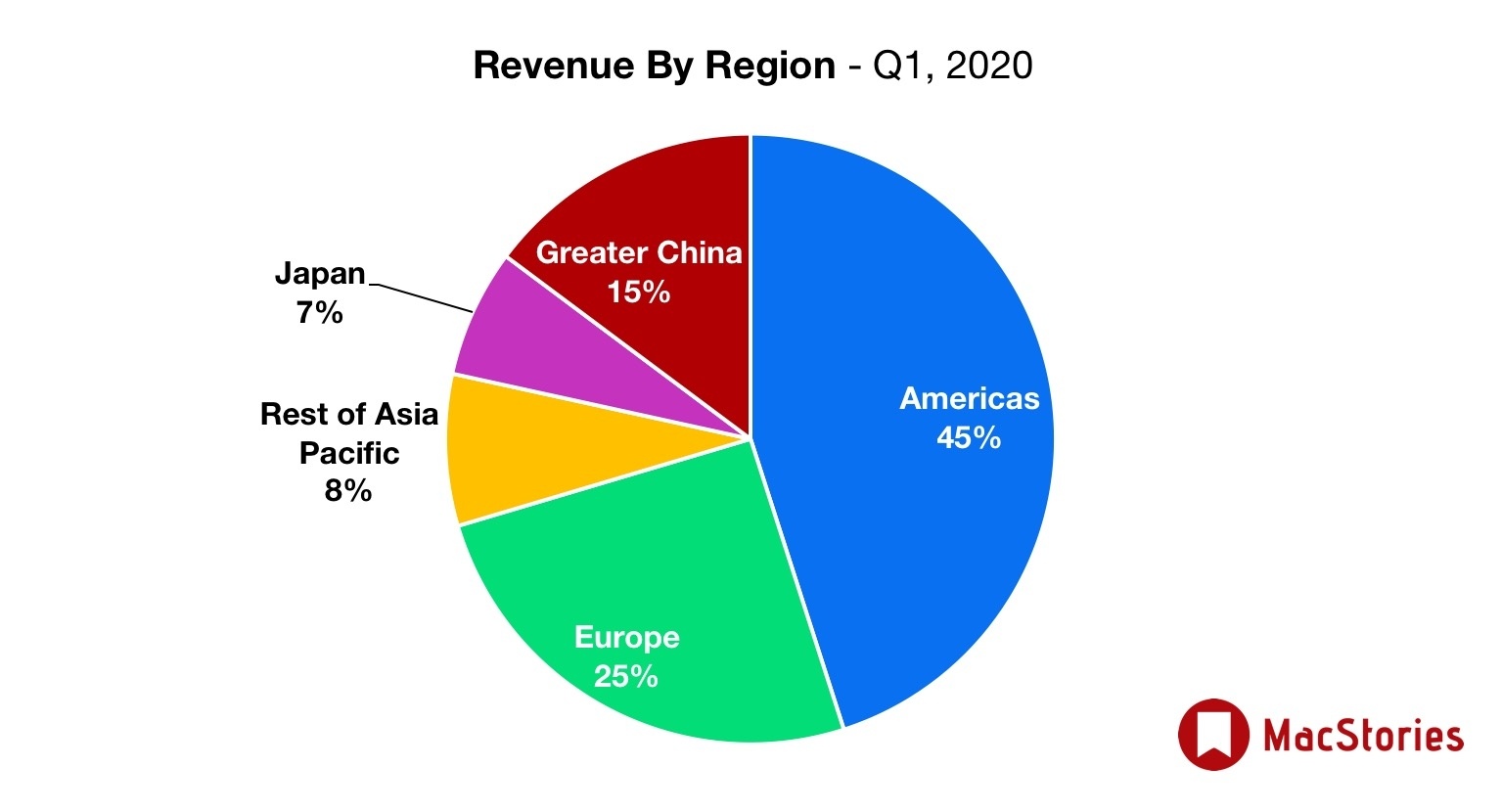

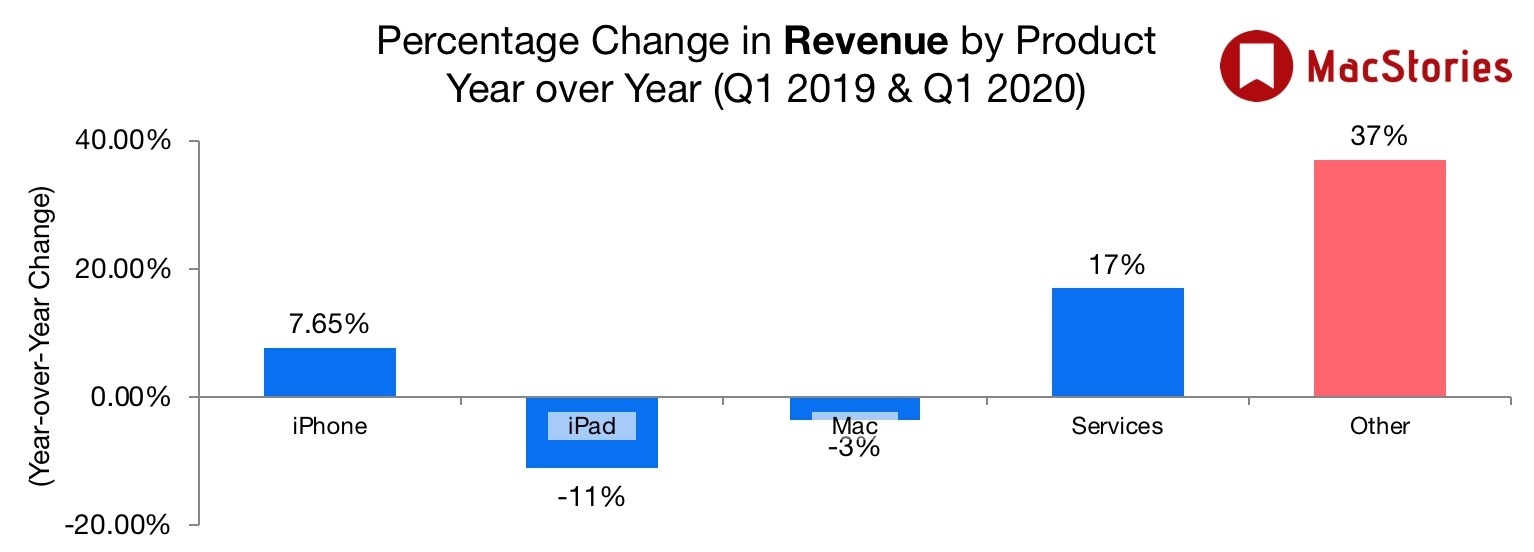

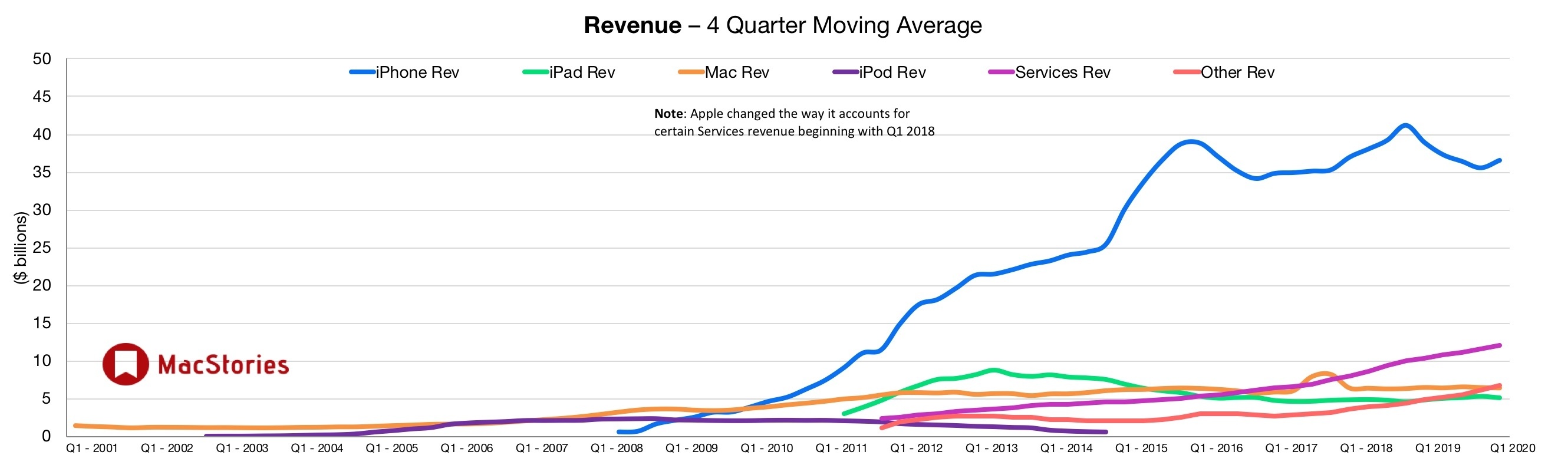

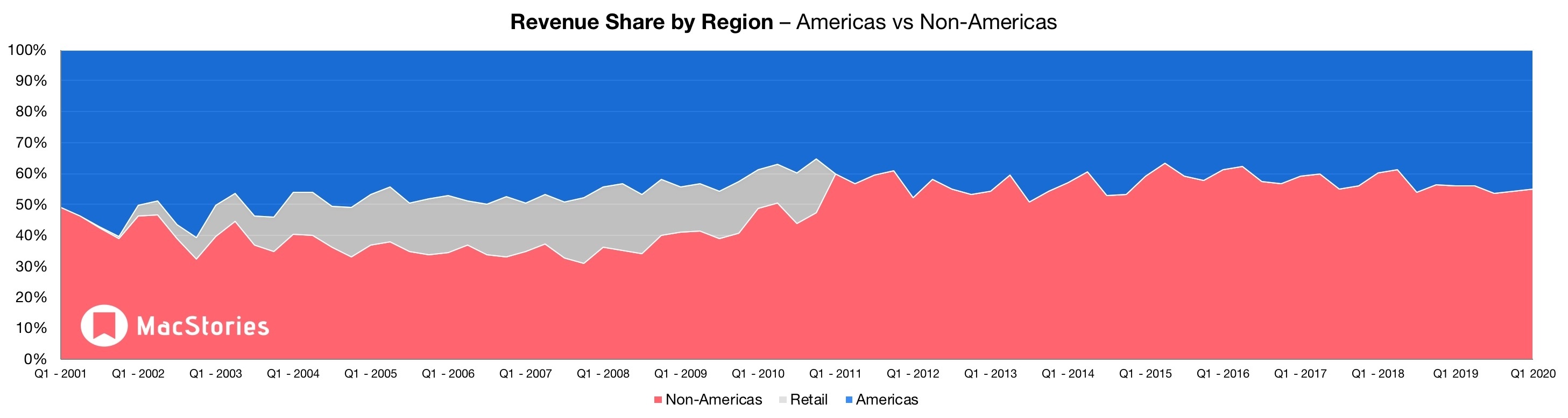

“We are thrilled to report Apple’s highest quarterly revenue ever, fueled by strong demand for our iPhone 11 and iPhone 11 Pro models, and all-time records for Services and Wearables,” said Tim Cook, Apple’s CEO. “During the holiday quarter our active installed base of devices grew in each of our geographic segments and has now reached over 1.5 billion. We see this as a powerful testament to the satisfaction, engagement and loyalty of our customers — and a great driver of our growth across the board.”

Estimates and Expectations for Q1 2020 and the Year-Ago Quarter (Q1 2019)

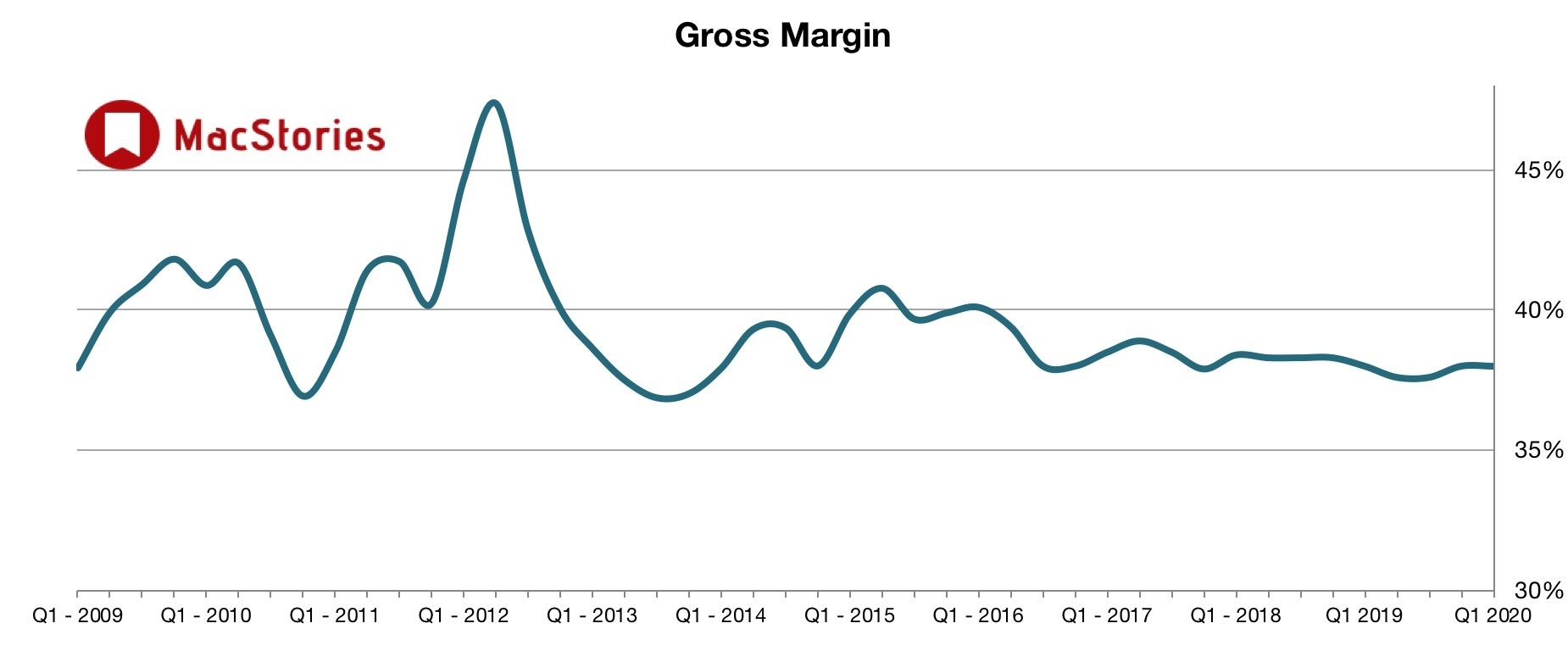

Apple’s revenue guidance for Q1 2020 fell between $85.5 billion and $89.5 billion, with gross margin estimated to be between 37.5% and 38.5%.

Going into today’s earnings call, CNBC said:

Analysts are expecting earnings per share of $4.55, up from $4.18 per share from a year ago, according to Refinitiv. Revenue is expected to be $88.5 billion, up year-over-year from $84.3 billion.

In the year-ago quarter (Q4 2018), Apple earned $84.3 billion in revenue.

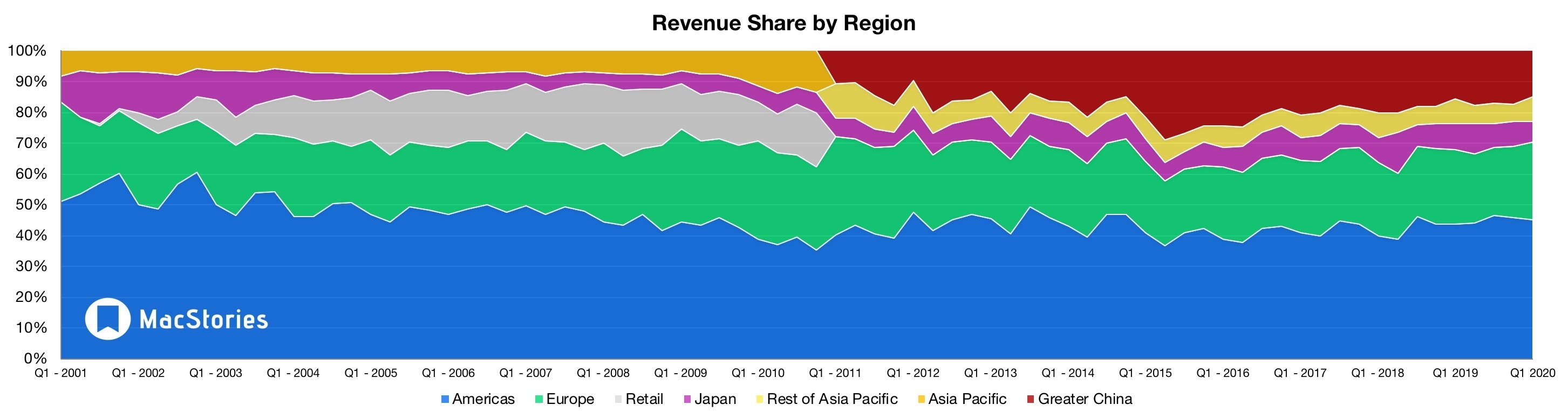

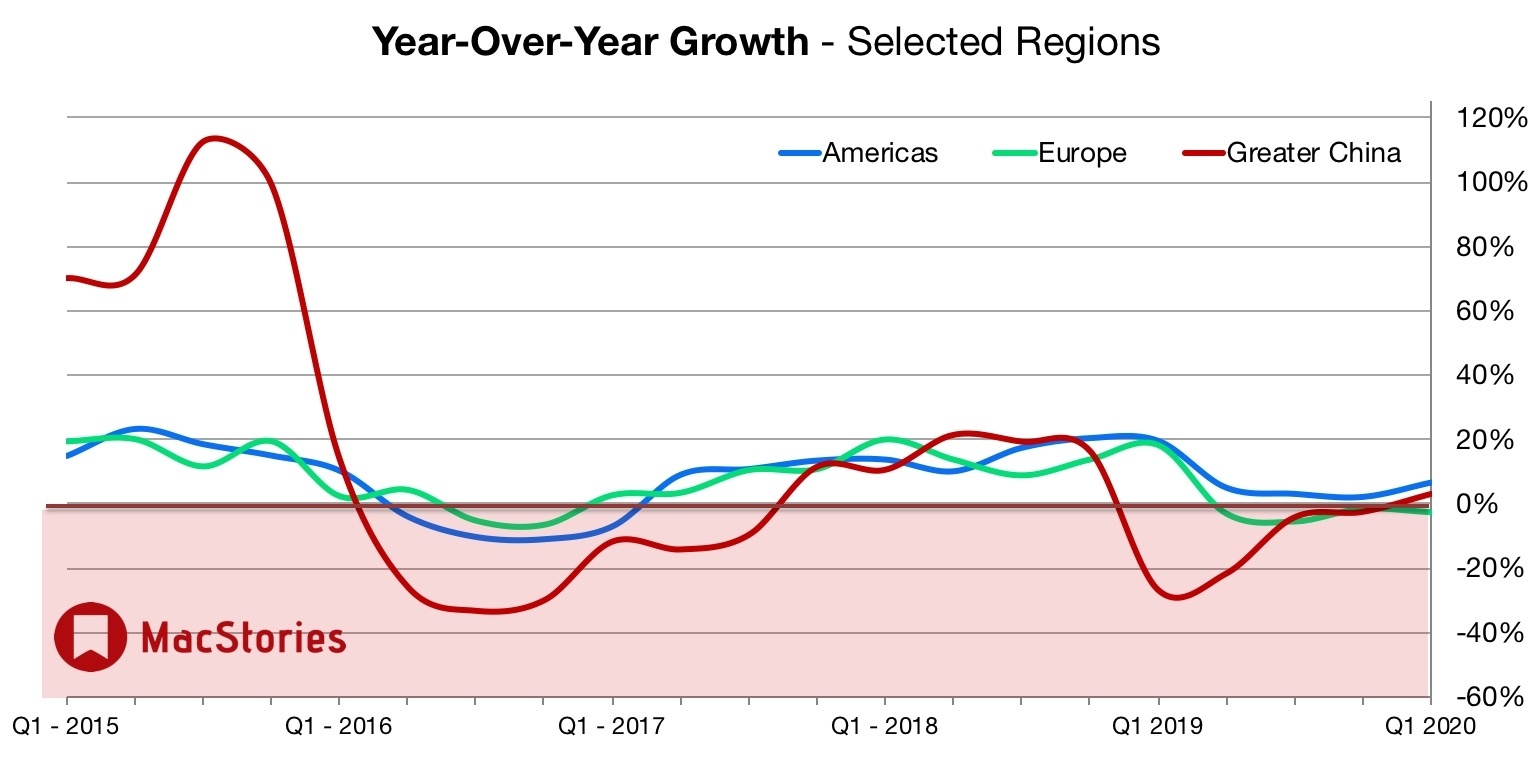

After the break, we’ve compiled a graphical visualization of Apple’s Q1 2020 financial results.

Graphical Visualization

Apple Q1 2020 on Twitter

TC outlines steps Apple is taking to mitigate coronavirus impacts, including seeking alternate suppliers to those in the affected areas, limiting travel to business critical situations, and dealing with factories opening later in February.

— MacJournals.com (@macjournals) January 28, 2020

TC: We’re primarily measuring Apple TV+ success right now on number of subscribers (including free trials). The product itself is about storytelling, and if we do that will it will be creatively successful (as in awards).

— MacJournals.com (@macjournals) January 28, 2020

Very likely Apple will have 2 billion active devices in 2025.

— Horace Dediu (@asymco) January 28, 2020

The iPhone 11 was Apple’s top-selling model every week.

The three flagship iPhones (iPhone 11, iPhone 11 Pro, iPhone 11 Pro Max) were the top three models.

— Neil Cybart (@neilcybart) January 28, 2020

Tim Cook says Apple has shut a store in China and is restricting employee travel because of coronavirus https://t.co/K7OR5Dm6Bk by @willfoia @cnbctech

— Lora Kolodny (@lorakolodny) January 28, 2020

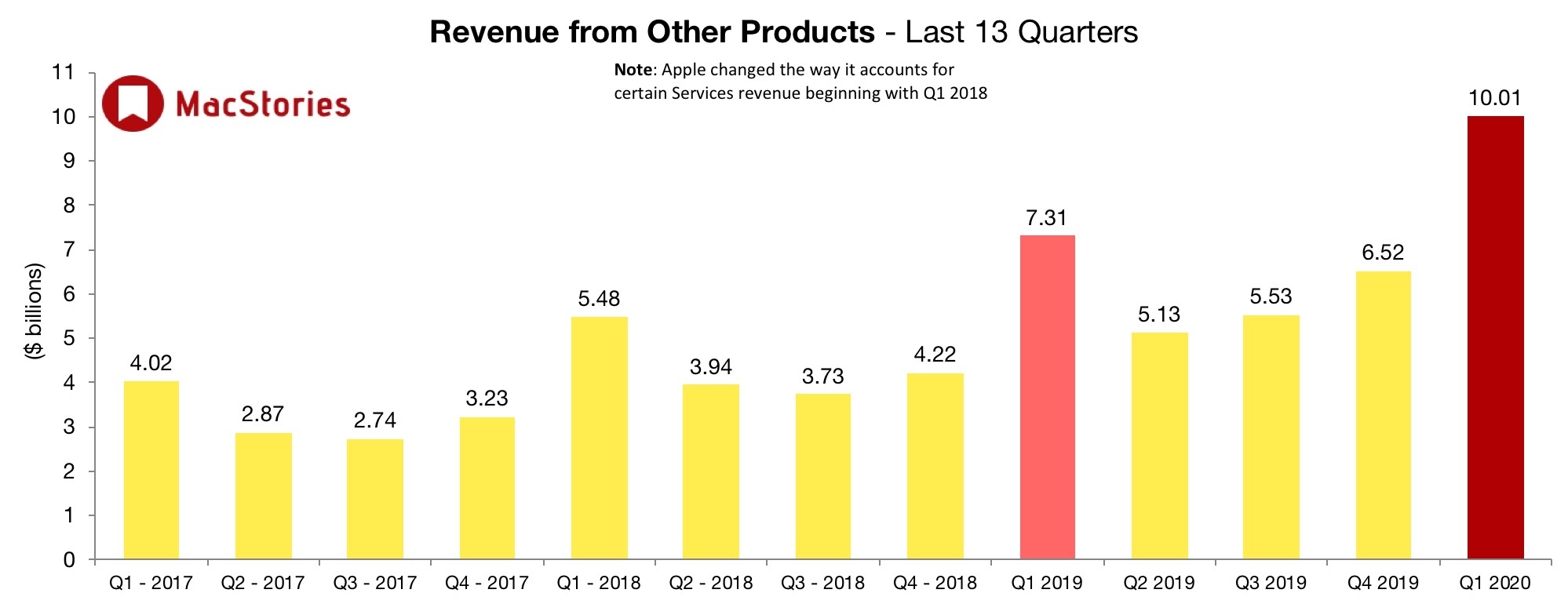

All time record on wearables in every market. Fortune 150 sized.

AirPods Pro demand phenomenal.

Apple Watch all-time revenue record.

75% new to Apple Watch.

Supply constraints on Series 3 and AirPods Pro.

— Rene Ritchie (@reneritchie) January 28, 2020

“Blowout quarter for wearables” says @tim_cook I hope we get more on that from Luca cause I am sure Apple Watch series 5 and 3 made a huge difference to that number aside from AirPodsPro #AAPL

— Carolina Milanesi (@caro_milanesi) January 28, 2020

iPhone up 8% YoY. Based on iPhone 11 series demand.

iPhone 11 was top selling every week.

Double-digit growth in US, UK, emerging markets.

— Rene Ritchie (@reneritchie) January 28, 2020

Apple’s 2Q20 revenue guidance:

$63B to $67B

My expectation: $57.5B to $60.5B (I included a $2B negative impact from coronavirus)

Consensus was $62.5B

Another wow. This is really strong guidance for Apple.

— Neil Cybart (@neilcybart) January 28, 2020

$AAPL market cap is now $1.393T per YFinance

i recall when all the big 5 adding up to $3T total was a big deal (mid-2017) - now MSFT + AAPL = $2.65T by themselves

— alex (@alex) January 28, 2020

*Breaking* @Apple just recorded one of the all-time quarterly profits for any company, ever:

-Profits up 11% to $22.2bn

-EPS up 19% to $4.99

-Revenues up 9% to $91.8bn.All above expectations. iPhone sales grew 8%. Story coming on @FastFT

— Patrick McGee (@PatrickMcGee_) January 28, 2020

Whoa - after hours $AAPL https://t.co/u25wJQSwvY pic.twitter.com/kJCkmQvRZz

— Barry Schwartz (@rustybrick) January 28, 2020

CNBC: Tim Cook on possible impact of coronavirus: “As you can see from the range, [Apple’s Q2 guidance] anticipates some level of issue there. Otherwise we would not have a $4 billion range.”

— MacJournals.com (@macjournals) January 28, 2020

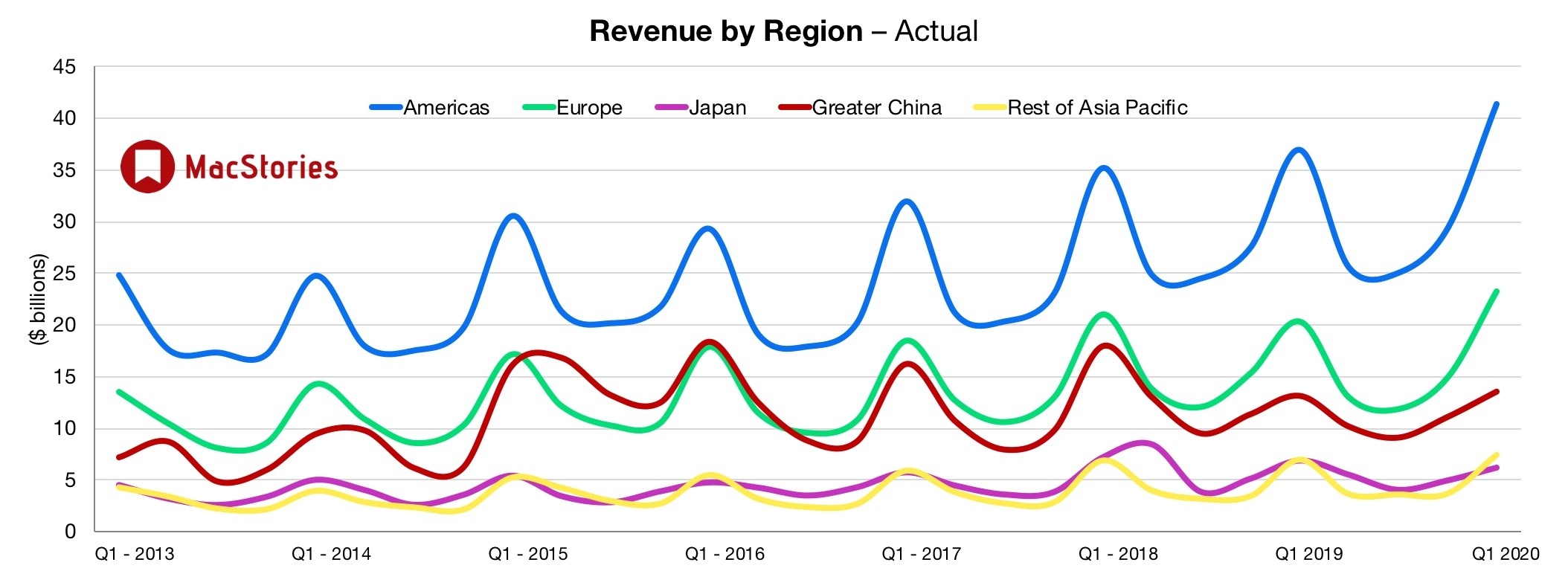

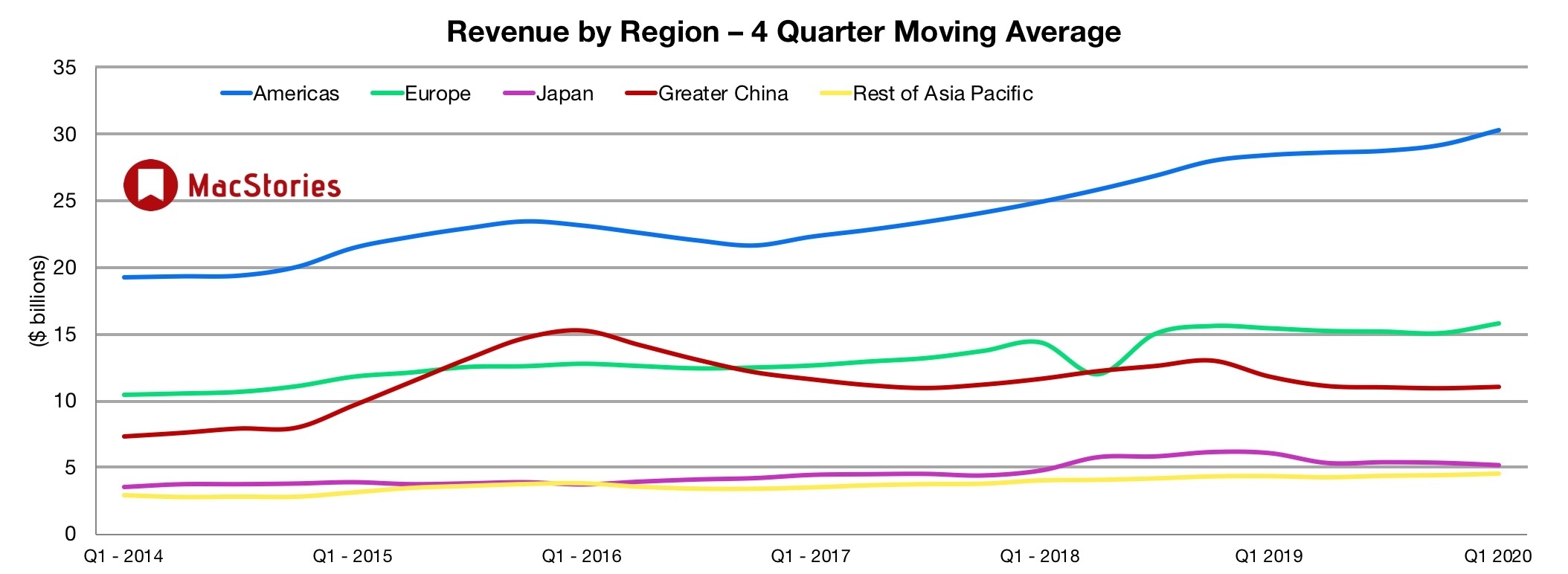

CNBC: Greater China up 3% in the quarter. For Q2: $63-$67B, above analyst estimates. Margin between 38-39%.

— MacJournals.com (@macjournals) January 28, 2020