Apple has just posted their Q3 2011 financial results. The company posted record-breaking revenue of $28.57 billion, with 9.25 million iPads, 20.34 million iPhones and 3.95 million Macs sold. Apple reported record quarterly net profit of $7.31 billion, or $7.79 per diluted share. Wall Street consensus’ estimate was earnings of $5.80 per share and revenue of $24.92 billion. The company posted record quarterly revenue of $28.57 billion and record quarterly net profit of $7.31 billion, or $7.79 per diluted share.

In Q2 2011, the company said they expected revenue of about $23 billion and diluted earnings per share of about $5.03 in the third fiscal quarter of 2011.

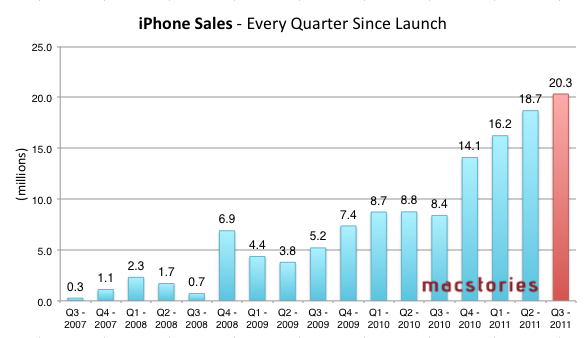

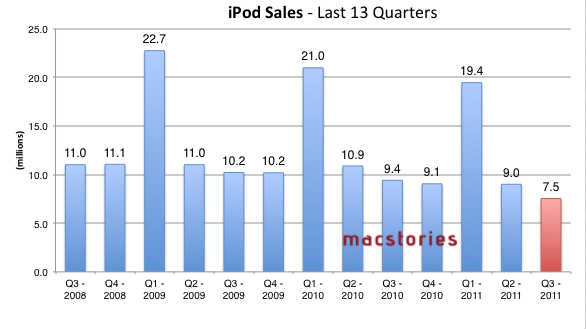

From the results, iPhone is growing 142% year over year, and with 9.25 million units sold the iPad saw a 183% increase over the year-ago quarter. Apple sold sold 7.54 million iPods with a 20% unit decline. The third quarter has been the best non-holiday Mac quarter ever, best iPhone quarter ever, best iPad quarter ever. There are now 28.7 million iPads out there, including 14 million units shipped this calendar year.

In Q2 2011, the company posted revenue of $24.67 billion with 4.69 million iPads, 18.65 million iPhones and 4.69 million Macs sold. In the year-ago quarter, Apple posted revenue of $15.7 billion and net quarterly profit of $3.25 billion. The company sold 3.47 million Macs, 8.4 million iPhones and 3.27 million iPads, which began selling during the quarter.

Apple will provide a live audio feed of its Q3 2011 conference call at 2:00 PM Pacific, and we’ll update this story with the conference highlights. Full press release is embedded after the break.

Liveblog starts at 2 PM PT. Highlights below.

- All-time quarterly record for iPhone and iPad sales.

- June record for iPhone sales.

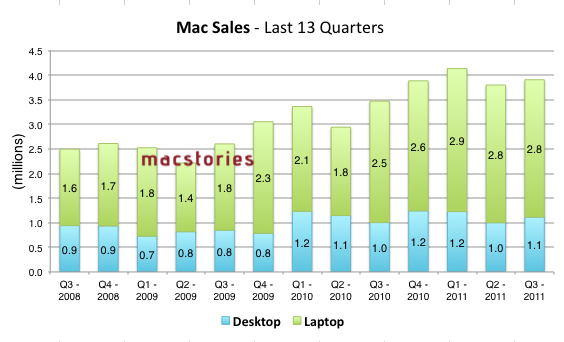

- June quarter record of sales with 3.95 million Macs, 14% increase year over year. Growth over 4 times of IDC’s of 3% growth for PC market.

- Mac sales strong Asia Pacific up 57%.

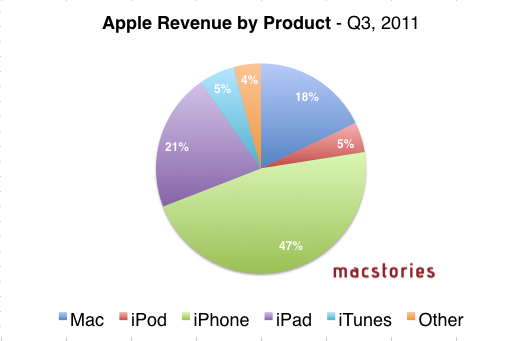

- iTunes revenue $1.4 billion, up 36% year over year.

- Music, video, apps: strong sales. #1 music retailer, 15 billion songs.

- 20.3 million iPhones compared to 8.4 million in previous June quarter, 142% year over year compared to IDC estimate of 60%.

- New carrier relationships - iPhone was available on 228 carriers in 105 countries.

- 5.9 million iPhones in channel inventories, remain within target range of 4 to 6 weeks. 91% of Fortune 500 testing or deploying iPhones. 57% of Global 500 testing or deploying iPhones - examples: Nestle, Dow Chemical, Supervalue, and Comcast.

- iPad: We sold every iPad we could make, ended quarter with distribution in 64 countries. Over $6 billion compared to 2 billion year over year. 179% increase. 1.05 million iPads in channel increase, well below target range of 4 to 6 weeks. Strong adoption internationally.

- iPhone + iPad + iPod touch - 222 million iOS devices sold.

- (details on iOS 5 and iCloud as announced at WWDC in June)

- Retail stores: new record in June, grew $3.5 billion from 2.6 billion year over year. Increase 36%, with higher volume of iPads, iPhones, and Macs. 768,000 Macs sold - half of the Macs sold were customers who never owned a Mac before. 4 new stores: two in France, 1 in UK, 1 in Germany, ending with total of 327 stores.

- Store traffic: 73.7 million visitors, compared to 60.5 year over year. In June Apple set up 2 million Macs, iPhones, iPads, and iPods collectively. 30 new stores, 1st store in Hong Kong, 28 new stores outside US.

- Account implications: Apple will continue to charge for periodic OS upgrades as well as upgrades from iLife; revenue will be fully deferred at time of sale, and recognized over 3 years. Mac customers will have access to iCloud in the fall. Combined value + software upgrade and iCloud services is 22 dollars. As of June 6th, Apple began deferring 22 dollars of revenue associated with each Mac sold and will continue to do so for 4 years. On June 6th, Apple also began deferring portion of revenue of iCloud for iOS devices sold. $16 dollars of revenue for iPhone and iPad sold, and total of $11 dollars for iPod touch.

Q&A starts

- “Future product transition we’re not going to talk about today” - CFO Oppenheimer says it will affect September quarter, could be the rumored iPhone 5 in September.

- Q: iPad 2 sales and trends - seeing in terms of cannibalization away from portables etc. A: Even more customers choose iPad over a Windows PC - more Windows PC business to cannibalize than Mac. Mac has many other attributes that would make it continue to do well.

- Q: Growth about China - any update on China? A: China was very key to our results. Revenue was $3.8 billion during quarter. This has been a substantial opportunity for Apple and I firmly believe that we’re just scratching the surface right now - there is an incredible opportunity for Apple there.

- Q: Component aspect? A: NAND, DRAM, LCD, batteries, and components are in good supply, pricing is expected to fall; hard drive supply is currently constrained, but less than historical rate. Components favorable on a sequential comparison; offset by one time benefits that we received in gross margin, therefore not a part of the bridge Peter talked about.

- Q: Patent disputes - some seem to have gone in Apple’s favor, and others haven’t. What is your IP strategy - how is it impacting comptetive landscape? A: We love competition, but we want people to invent their own stuff - we want to make sure we defend our stuff fervently.

- Q: Can you provide color on iPhone strength, new carriers? A: We did add 42 new carriers in 15 new countries, we continued our expansion efforts to get up beyond 100 countries. It occurred throughout the quarter, real improvement was due to a merging and developed market. China was a big part, but also Mexico and Brazil. Middle East was a big part, which is great for Apple because these are markets that Apple hasn’t been as strong in. We’re beginning to see fruits of our labor in these markets.

- Our numbers are very straightforward and transparent. In terms of iPhone, up 142% year over year; more than 2x rate of growth of smartphone market - that’s incredible. Also, as Peter said earlier, we sold every iPad 2 in quarter we could make; not a shortage of demand and we’re gaining traction in enterprise. Obviously now our attention is a penetration focus: App Store is the largest marketplace by far, and if you look at iPad specific apps, you’d be over 100,000 and others don’t have over 100 hundred. Other tablets have no traction, and we’ve paid $2.5 billion to developers.

- Q: Apple TV. A: Apple TV continues to do well. But I don’t want to mislead - we still call it a hobby here, and we do that because we don’t want anyone to conclude that it’s another leg of the stool because it’s not in the market that the iPhone, iPad, Mac, or iPod is in. We love it - it’s great that customers love it - we really guided it right when we went to new Apple TV - but right now it’s still in hobby status, and we’re continuing to invest in it because we believe there’s something there.

- Q: Yields? A: Supply of iPads improved dramatically, we added almost 100% - as for supply demand balance in some countries, we feel very good about progress in that area.

- Q: With pre-paid purchasing power in direct distribution, are you going to address that? A: In some cases we’ve convinced markets to adopt a post-paid plan as it’s better in long term, but we’re not avoiding pre-paid market.

- Q: Tim, this is for you: Mac growth was 5% sequential, do you think there was cannibalization in anticipation of Lion? A: I look more at year over year than sequential. I’m proud of the numbers that we achieve - to grow at 14% when market is growing at 2.5%. But why isn’t it higher than 14%? There are three things that are primary factors I don’t want to try to quantify, but I do want to list them and how we look at it. As I said before, I think there was some cannibalization of new Macs by iPads: 9.2 million iPads during quarter is over 2x number of Macs, so it’s clear that some customers chose to purchase an iPad instead of a new Mac. More customers chose to buy an iPad than a PC. Second: some customers have delayed purchase until Lion: we’re launching Lion tomorrow and we’re looking forward to getting Lion out - it’s a fantastic product, it’s really a revolutionary change. Third: in the year ago quarter, we launched new MacBook Pros; we launched new iMacs in this quarter. Both products were well received, MBP make up majority of units that we sell in the Mac area, so if you change the MBP and it’s well received, it’s going to make this more difficult to compare to.

- Q: Anything you guys are doing differently in investing in enterprise sales force? A: We have a dual pronged strategy with iPad and iPhone; as we work with carrier sales forces (and they have large ones because they’re selling services in enterprise, and many enterprises want our devices connected to it) we train and provide quite a bit of help for sales forces. We’re very happy about the level of interest and taking people to pilot and deployment stages - now our focus is on traction. To be this far into the enterprise with a product that’s only been shipping for fifteen months is incredible - enterprise typically is much more conservative and takes time to evaluate products and it’s moving at a speed I haven’t seen. Last quarter we sold more iPads than Macs, to do that just after five quarters is shocking.

- Q: Views on iCloud and how you feel as a service it’s going to drive more volumes of Macs and expectations of halo effect on iOS devices? A: We cannot wait to get iCloud and iOS 5 in the hands of customers this fall, we really think that we have done it right - it’s seamless and integrated - they’re gonna love it, it’ll be easy, and it didn’t go unnoticed to us in the Changewave results that it’s a reason why iOS devices are #1 to buy.

- Q: Mirror content - it feels like that’s a competitive edge. A: We’re certainly very good with the Internet, with telecommunications and delivering content - we’ve proven that for a decade with iTunes and App Store and payments to developers - we probably have some things to learn, but we have skill and we are excited.

- Q: Tim, I want to revisit China and pre-paid phone market. China Mobile said it has 5.6 million iPhones on network, adding them at incredible rate but China Mobile doesn’t sell the phone, so they have unlocked or prepaid phones on network. Could you tell us how significant pre-paid is in China and emerging markets? What lessons have you learned? A: Ugh, pre-paid or unlocked phones are…are phones sold without a contract…they are very key in China and in a number of emerging markets where credit systems are not as well established as US, Japan, rest of Europe, and Australia - iPhone volume for first 3 quarters for fiscal year was up 5x times year over year. I’m not saying out we’ve figured out how to perform perfectly in that environment - more to do and more to learn, but I feel very, very good about progress. If any of us would have been told a year go we would do 3.8 billion in China in a quarter, I don’t think anyone would have believed it.

- Q: More movie titles? A: We have a very, very broad library of movies and TV shows in the US, we’re adding more content internationally each quarter, so look for more content later this quarter across various stores, as we have some neat stuff coming.

End of the call.

Graphical Visualization

We have compiled a series of graphs and charts to offer a graphical visualization of Apple’s third quarter.

Apple Reports Third Quarter Results

All-Time Record Revenue and Earnings

iPhone Sales Grow 142 Percent; iPad Sales Grow 183 Percent

CUPERTINO, Calif.–(BUSINESS WIRE)–Apple® today announced financial results for its fiscal 2011 third quarter ended June 25, 2011. The Company posted record quarterly revenue of $28.57 billion and record quarterly net profit of $7.31 billion, or $7.79 per diluted share. These results compare to revenue of $15.70 billion and net quarterly profit of $3.25 billion, or $3.51 per diluted share, in the year-ago quarter. Gross margin was 41.7 percent compared to 39.1 percent in the year-ago quarter. International sales accounted for 62 percent of the quarter’s revenue.

“Looking ahead to the fourth fiscal quarter of 2011, we expect revenue of about $25 billion and we expect diluted earnings per share of about $5.50.”

The Company sold 20.34 million iPhones in the quarter, representing 142 percent unit growth over the year-ago quarter. Apple sold 9.25 million iPads during the quarter, a 183 percent unit increase over the year-ago quarter. The Company sold 3.95 million Macs during the quarter, a 14 percent unit increase over the year-ago quarter. Apple sold 7.54 million iPods, a 20 percent unit decline from the year-ago quarter.

“We’re thrilled to deliver our best quarter ever, with revenue up 82 percent and profits up 125 percent,” said Steve Jobs, Apple’s CEO. “Right now, we’re very focused and excited about bringing iOS 5 and iCloud to our users this fall.”

“We are extremely pleased with our performance which drove quarterly cash flow from operations of $11.1 billion, an increase of 131 percent year-over-year,” said Peter Oppenheimer, Apple’s CFO. “Looking ahead to the fourth fiscal quarter of 2011, we expect revenue of about $25 billion and we expect diluted earnings per share of about $5.50.”

Apple will provide live streaming of its Q3 2011 financial results conference call beginning at 2:00 p.m. PDT on July 19, 2011 at www.apple.com/quicktime/qtv/earningsq311. This webcast will also be available for replay for approximately two weeks thereafter.

This press release contains forward-looking statements including without limitation those about the Company’s estimated revenue and earnings per share. These statements involve risks and uncertainties, and actual results may differ. Risks and uncertainties include without limitation the effect of competitive and economic factors, and the Company’s reaction to those factors, on consumer and business buying decisions with respect to the Company’s products; continued competitive pressures in the marketplace; the ability of the Company to deliver to the marketplace and stimulate customer demand for new programs, products, and technological innovations on a timely basis; the effect that product introductions and transitions, changes in product pricing or mix, and/or increases in component costs could have on the Company’s gross margin; the inventory risk associated with the Company’s need to order or commit to order product components in advance of customer orders; the continued availability on acceptable terms, or at all, of certain components and services essential to the Company’s business currently obtained by the Company from sole or limited sources; the effect that the Company’s dependency on manufacturing and logistics services provided by third parties may have on the quality, quantity or cost of products manufactured or services rendered; risks associated with the Company’s international operations; the Company’s reliance on third-party intellectual property and digital content; the potential impact of a finding that the Company has infringed on the intellectual property rights of others; the Company’s dependency on the performance of distributors, carriers and other resellers of the Company’s products; the effect that product and service quality problems could have on the Company’s sales and operating profits; the continued service and availability of key executives and employees; war, terrorism, public health issues, natural disasters, and other circumstances that could disrupt supply, delivery, or demand of products; and unfavorable results of other legal proceedings. More information on potential factors that could affect the Company’s financial results is included from time to time in the “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” sections of the Company’s public reports filed with the SEC, including the Company’s Form 10-K for the fiscal year ended September 25, 2010, its Forms 10-Q for the quarters ended December 25, 2010 and March 26, 2011, and its Form 10-Q for the quarter ended June 25, 2011 to be filed with the SEC. The Company assumes no obligation to update any forward-looking statements or information, which speak as of their respective dates.

Apple designs Macs, the best personal computers in the world, along with OS X, iLife, iWork and professional software. Apple leads the digital music revolution with its iPods and iTunes online store. Apple has reinvented the mobile phone with its revolutionary iPhone and App Store, and has recently introduced iPad 2 which is defining the future of mobile media and computing devices.

NOTE TO EDITORS: For additional information visit Apple’s PR website (www.apple.com/pr), or call Apple’s Media Helpline at (408) 974-2042.