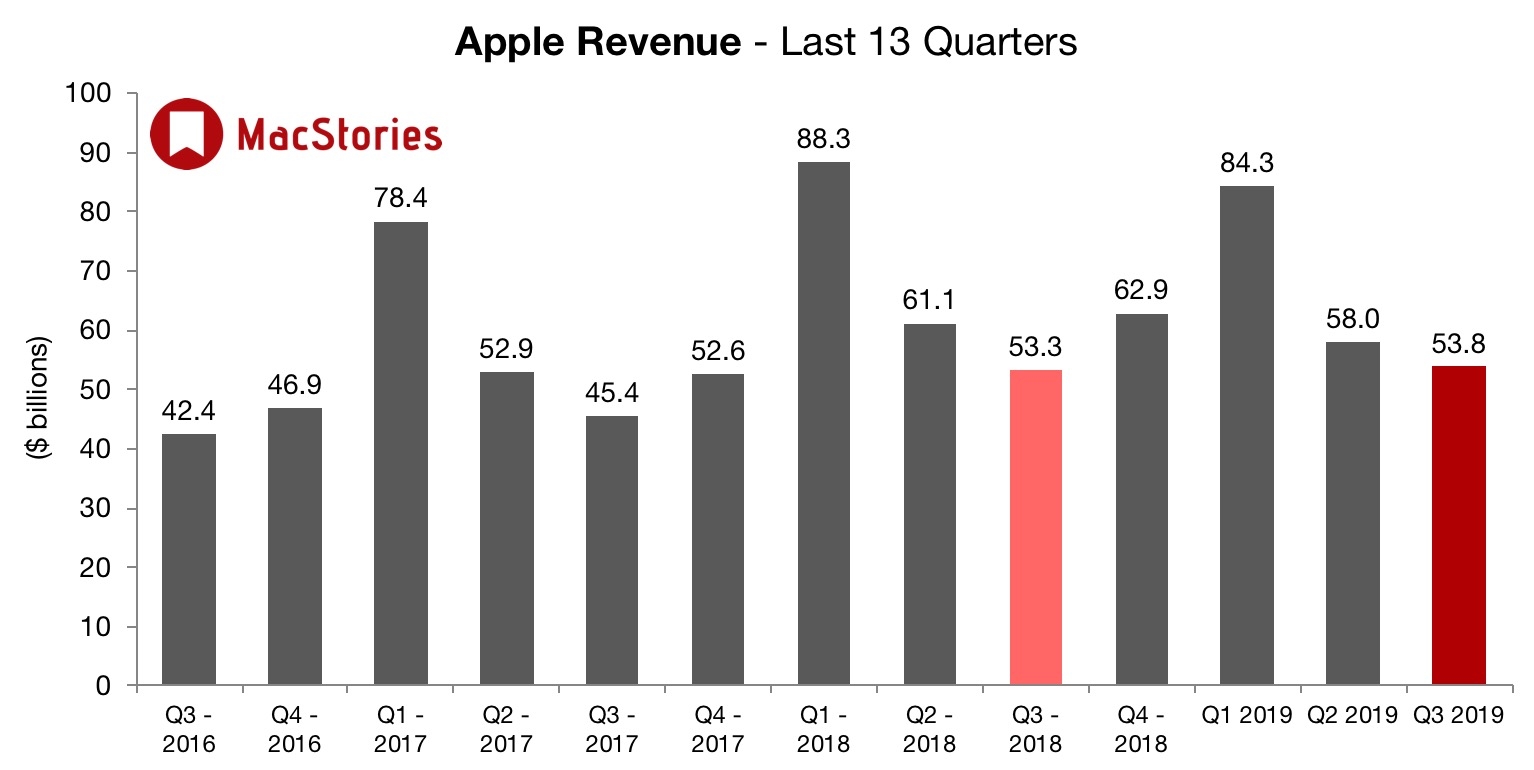

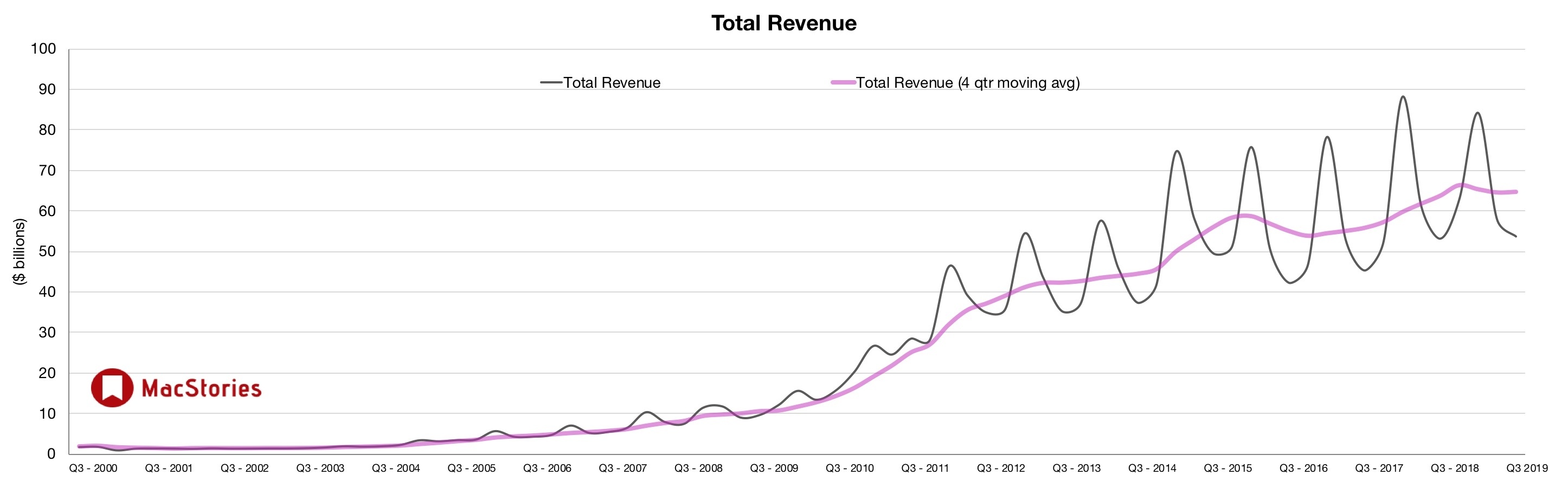

Apple has just published its financial results for Q3 2019. The company posted revenue of $53.8 billion. Apple CEO Tim Cook said:

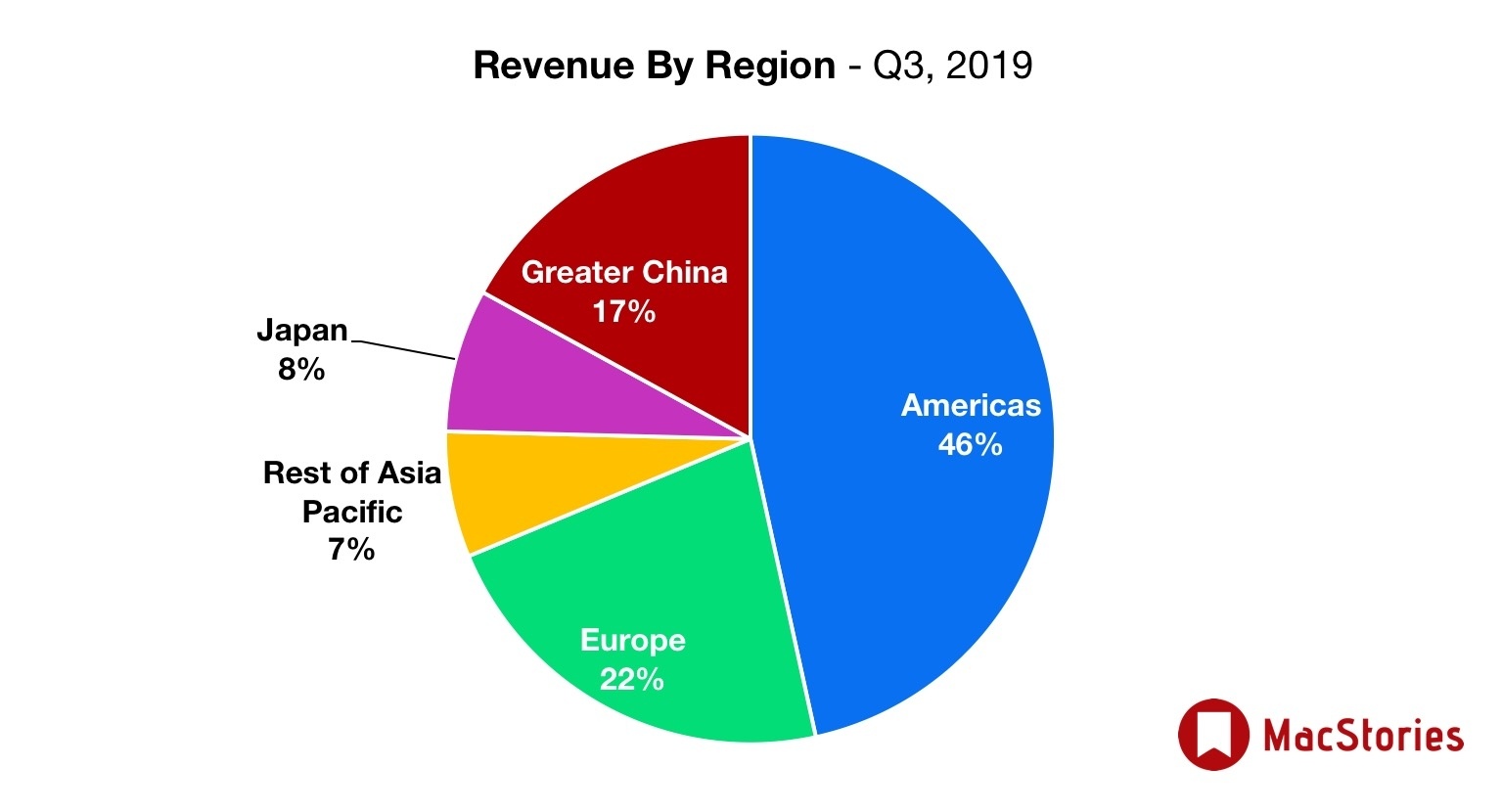

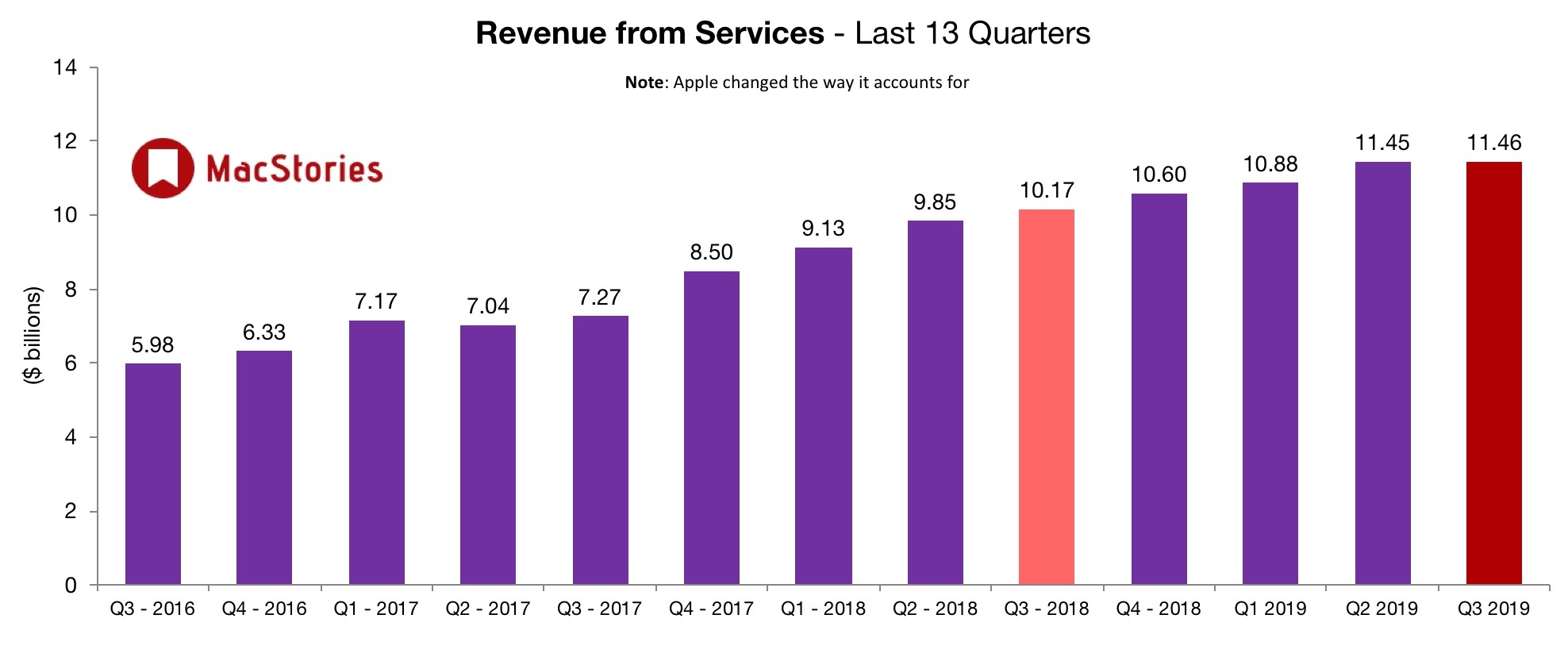

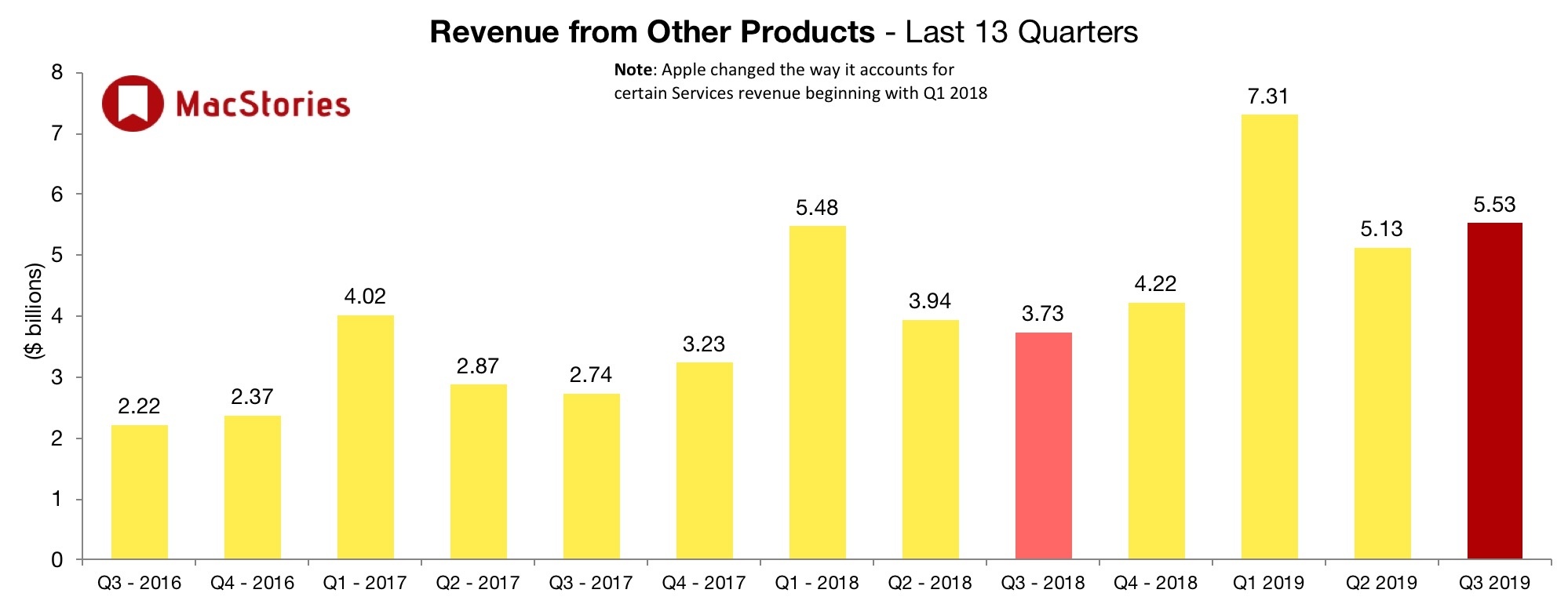

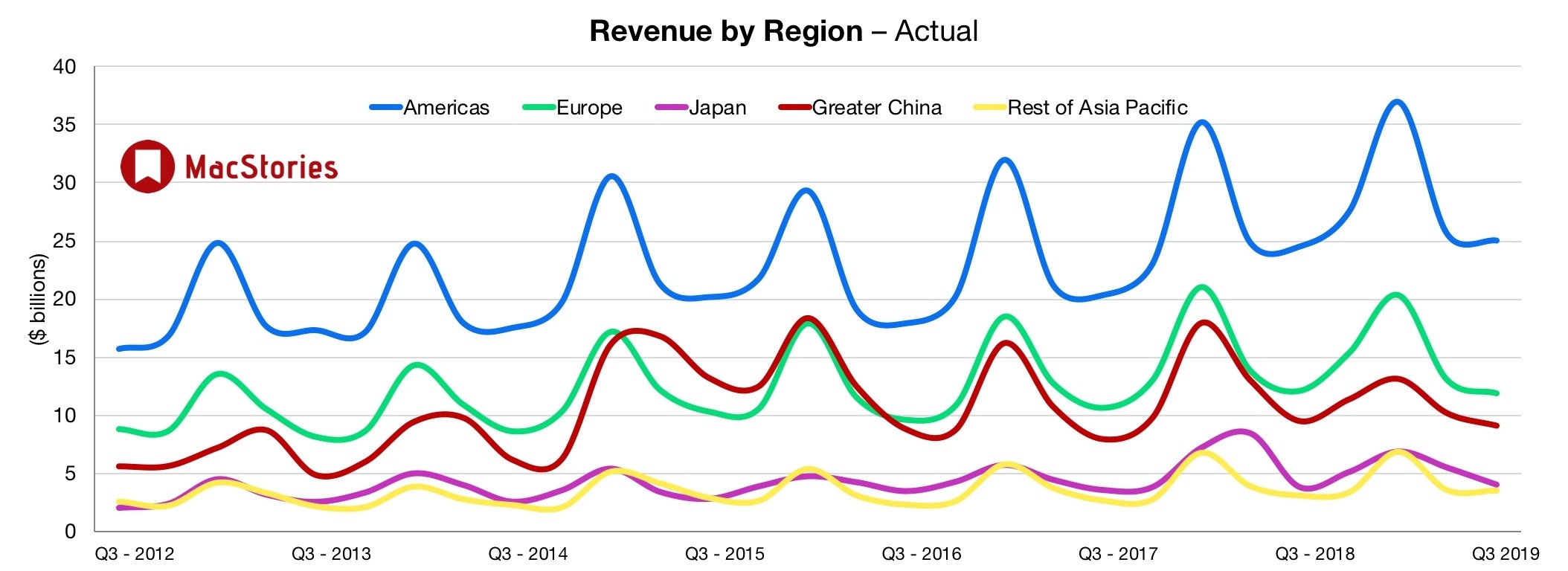

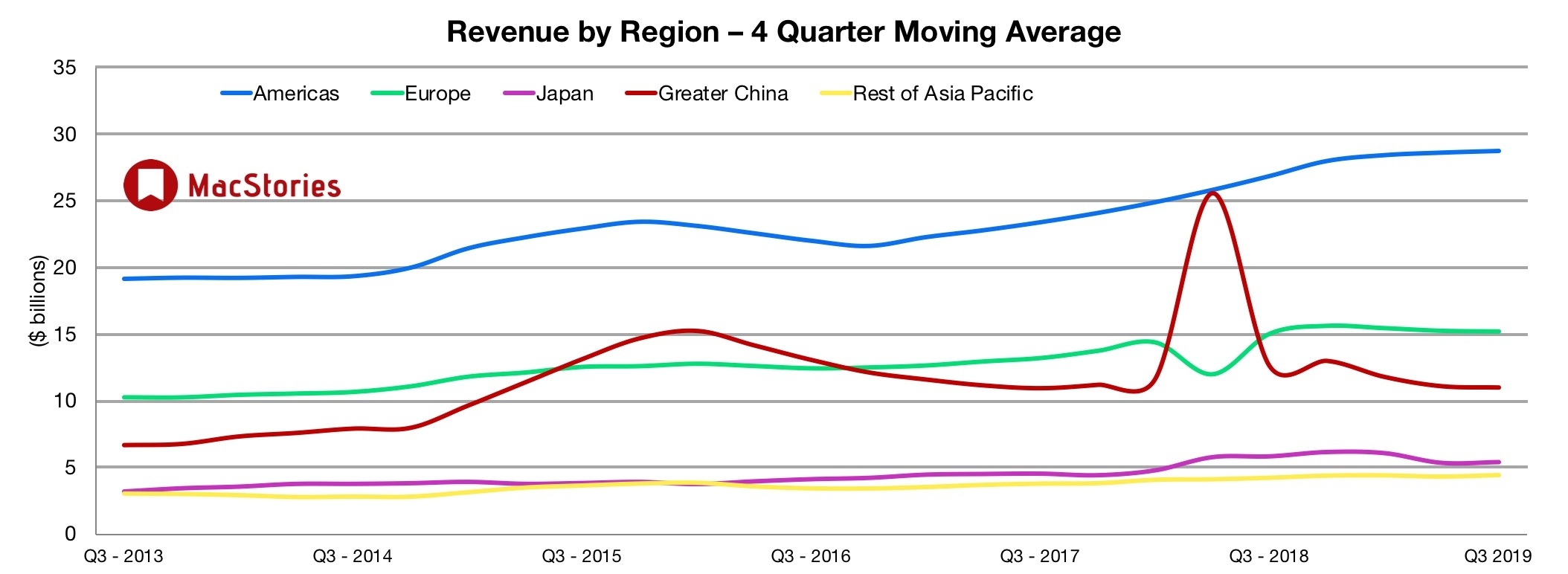

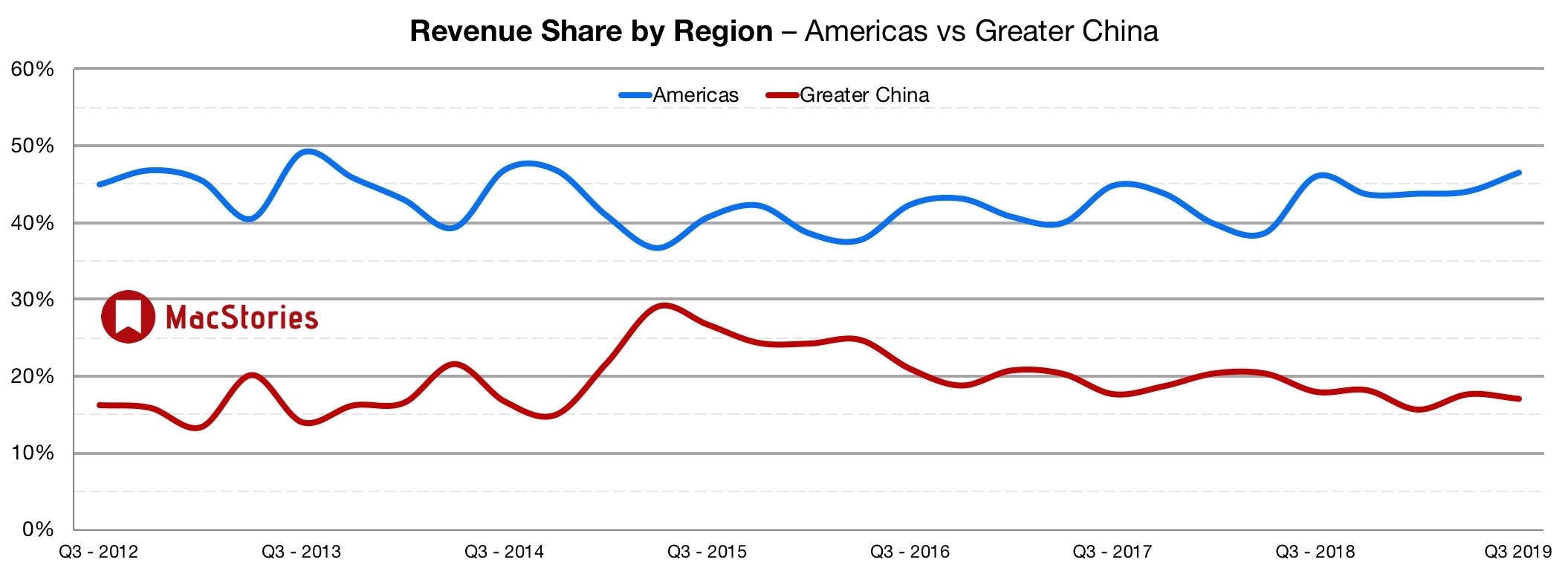

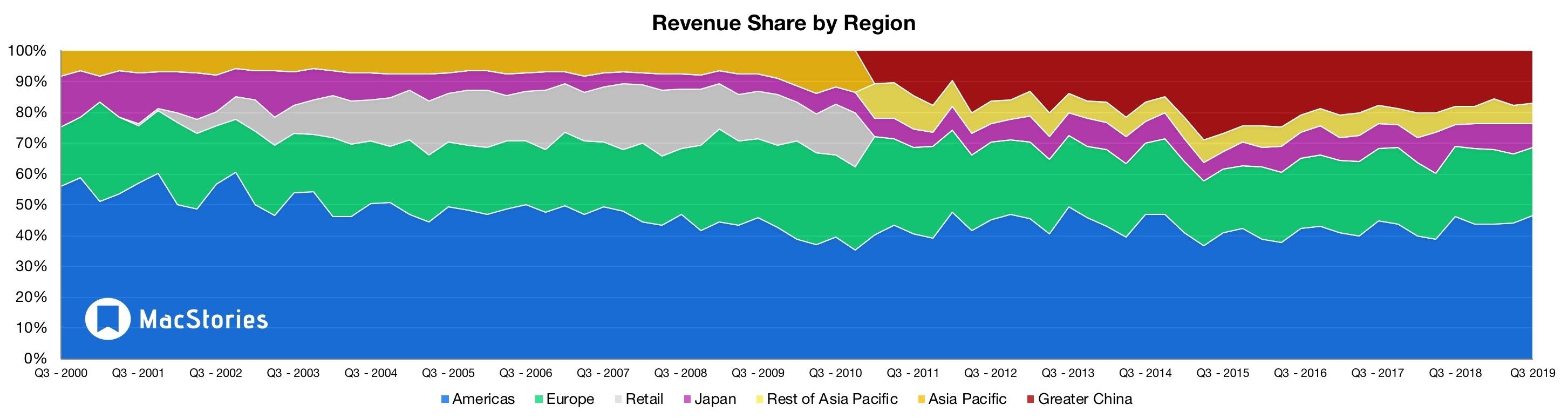

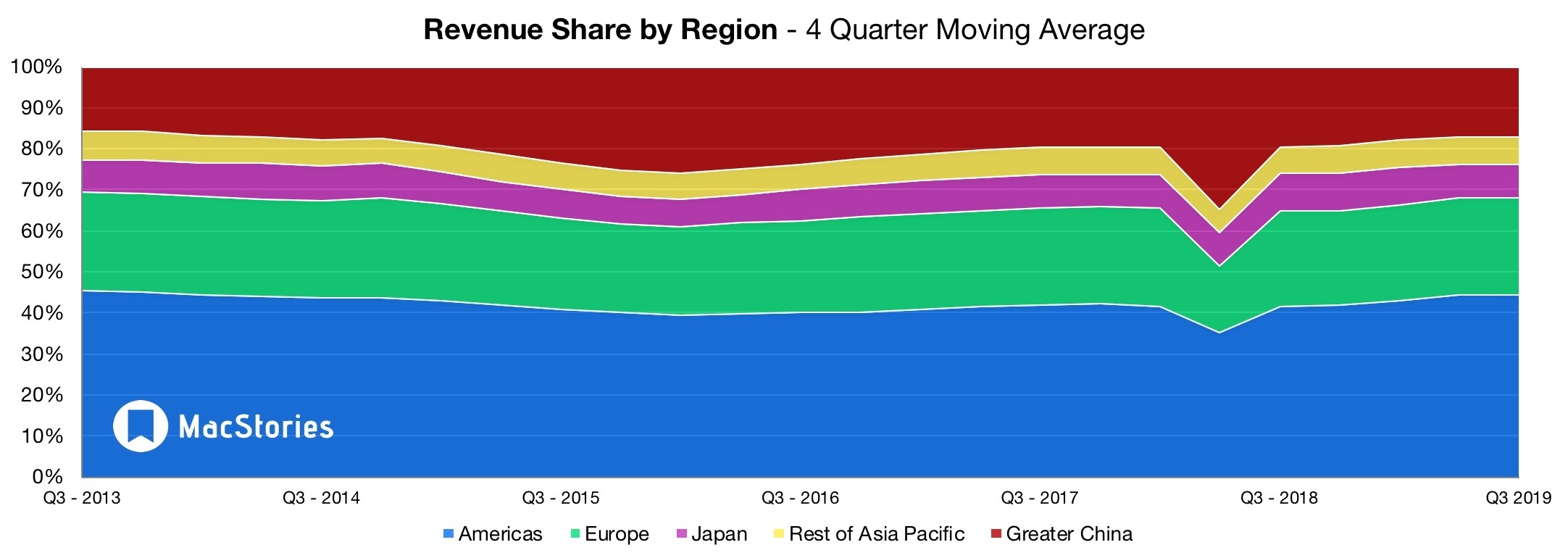

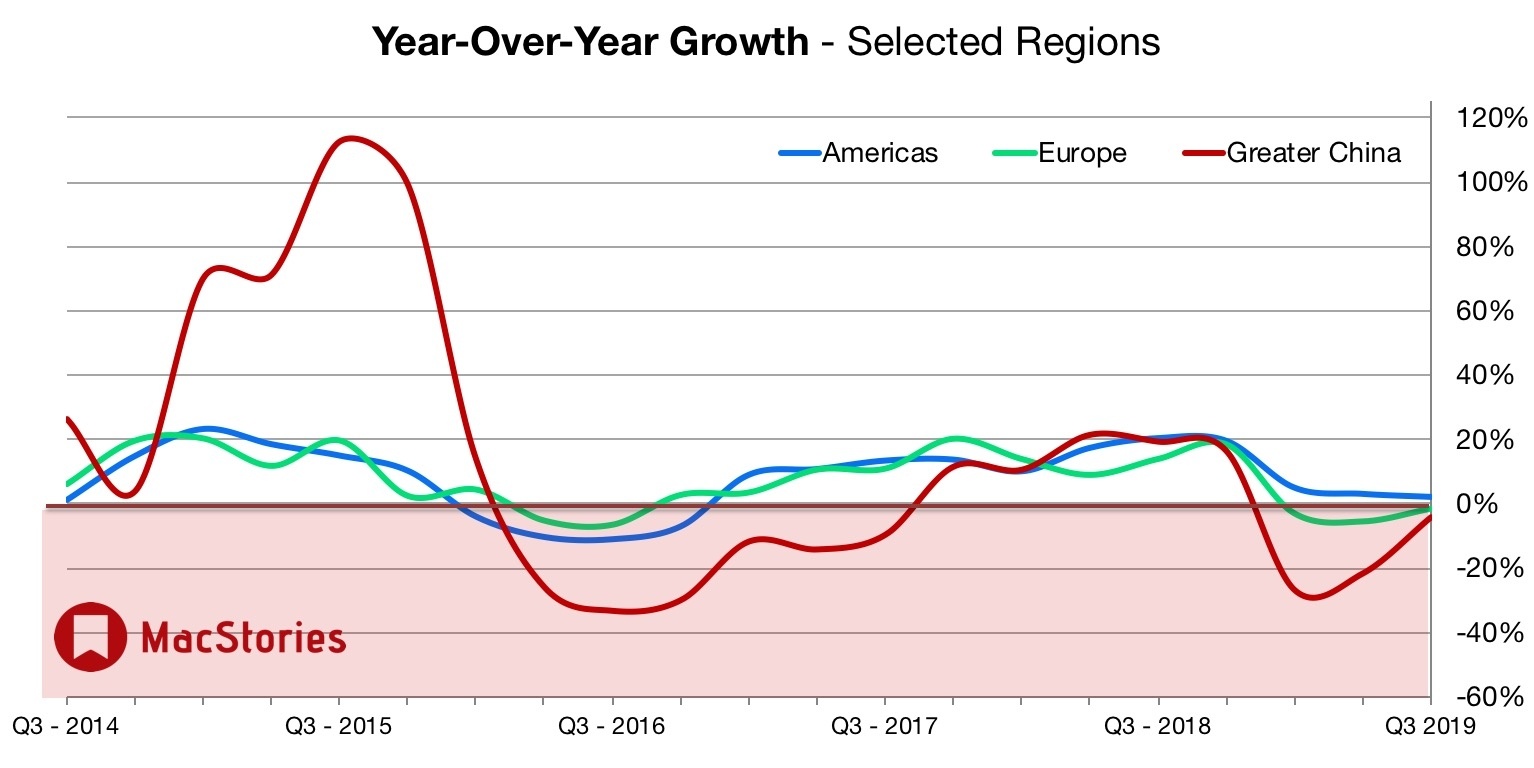

“This was our biggest June quarter ever — driven by all-time record revenue from Services, accelerating growth from Wearables, strong performance from iPad and Mac and significant improvement in iPhone trends,” said Tim Cook, Apple’s CEO. “These results are promising across all our geographic segments, and we’re confident about what’s ahead. The balance of calendar 2019 will be an exciting period, with major launches on all of our platforms, new services and several new products.”

Estimates and Expectations for Q3 2019 and the Year-Ago Quarter (Q3 2018)

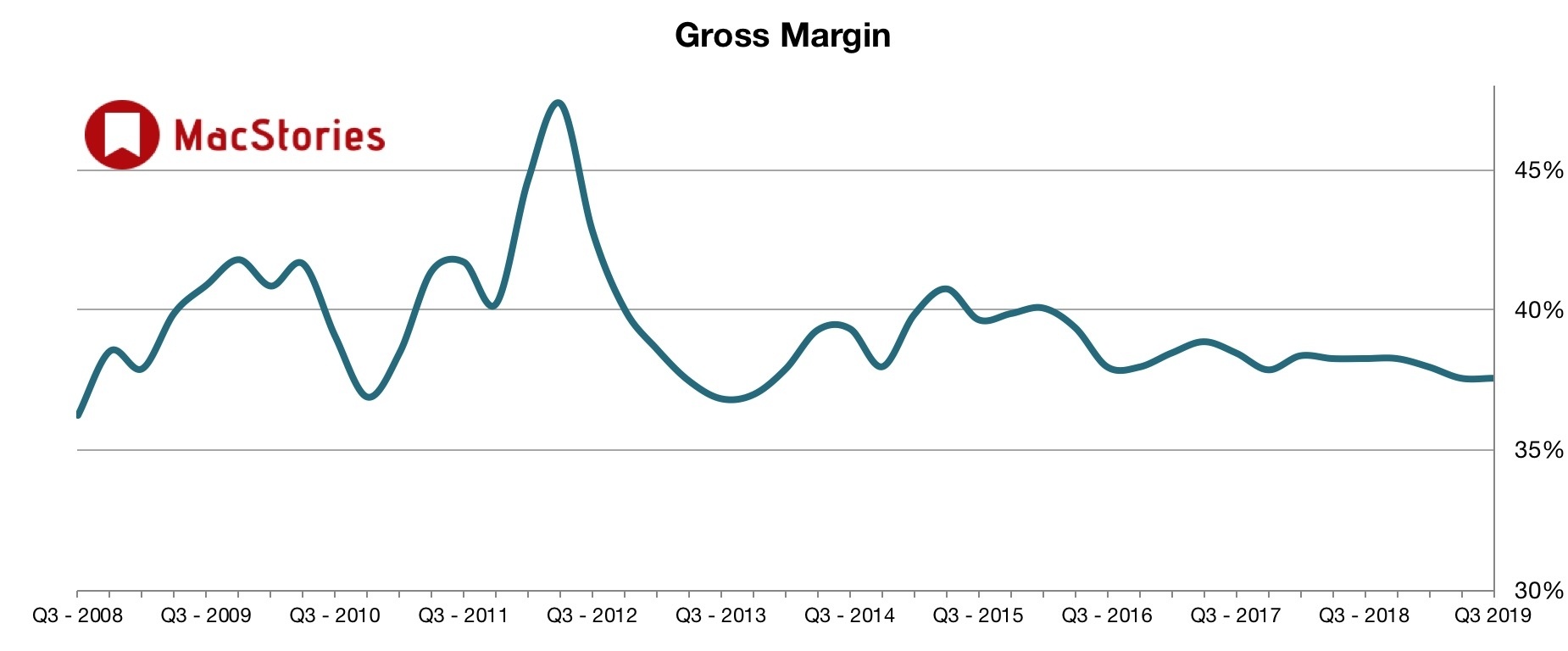

Apple’s revenue guidance for Q3 2019 fell between $52.5 billion and $54.5 billion, with gross margin estimated to be between 37% and 38%.

Going into today’s earnings call, Yahoo Finance said that analysts, who were not expecting extraordinary financial results from Apple, would be focused on News+ and other revenue generated by services,

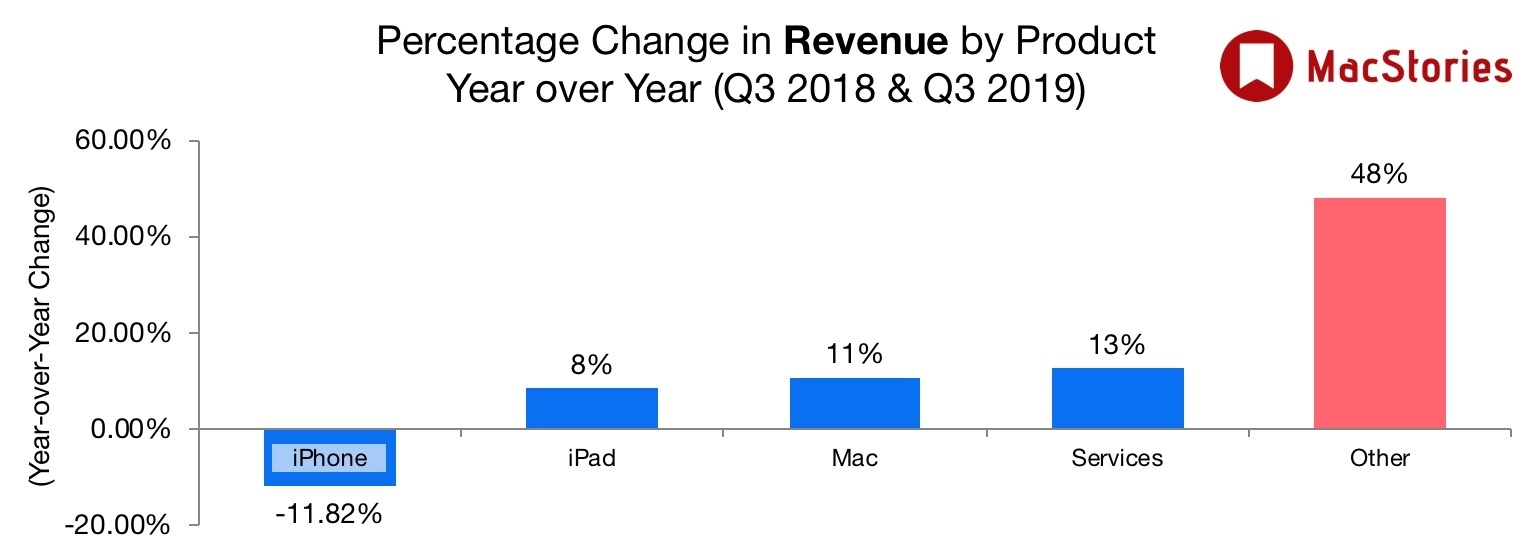

But according to Bloomberg’s MODL consensus, iPhone sales are expected to fall 10.3% in Q3, pushed lower by the ongoing trade war between the U.S. and China.

The same consensus, however, also points to an increase in sales of iPads, Macs, wearables like the AirPods and Apple Watch, and services by as much as 14.4%. Don’t forget, Apple recently revamped its iPad and Mac lineups, and released a new version of the seemingly ubiquitous AirPods.

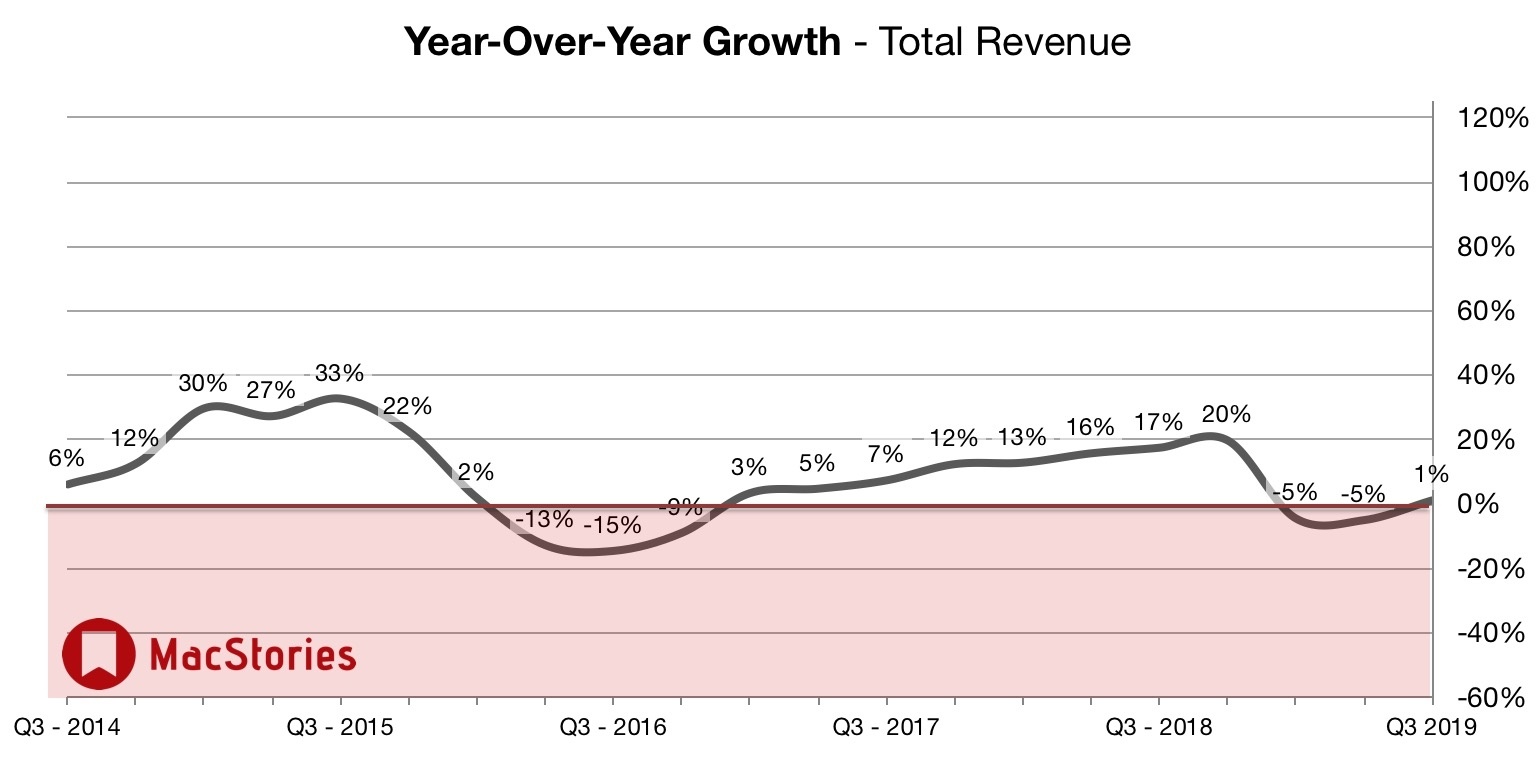

In the year-ago quarter (Q3 2018), Apple earned $53.3 billion in revenue. During that quarter Apple sold 41.3 million iPhones, 11.6 million iPads, and 3.7 million Macs. As announced on Apple’s Q4 2018 earnings call, however, the company no longer reports unit sales for any of its products.

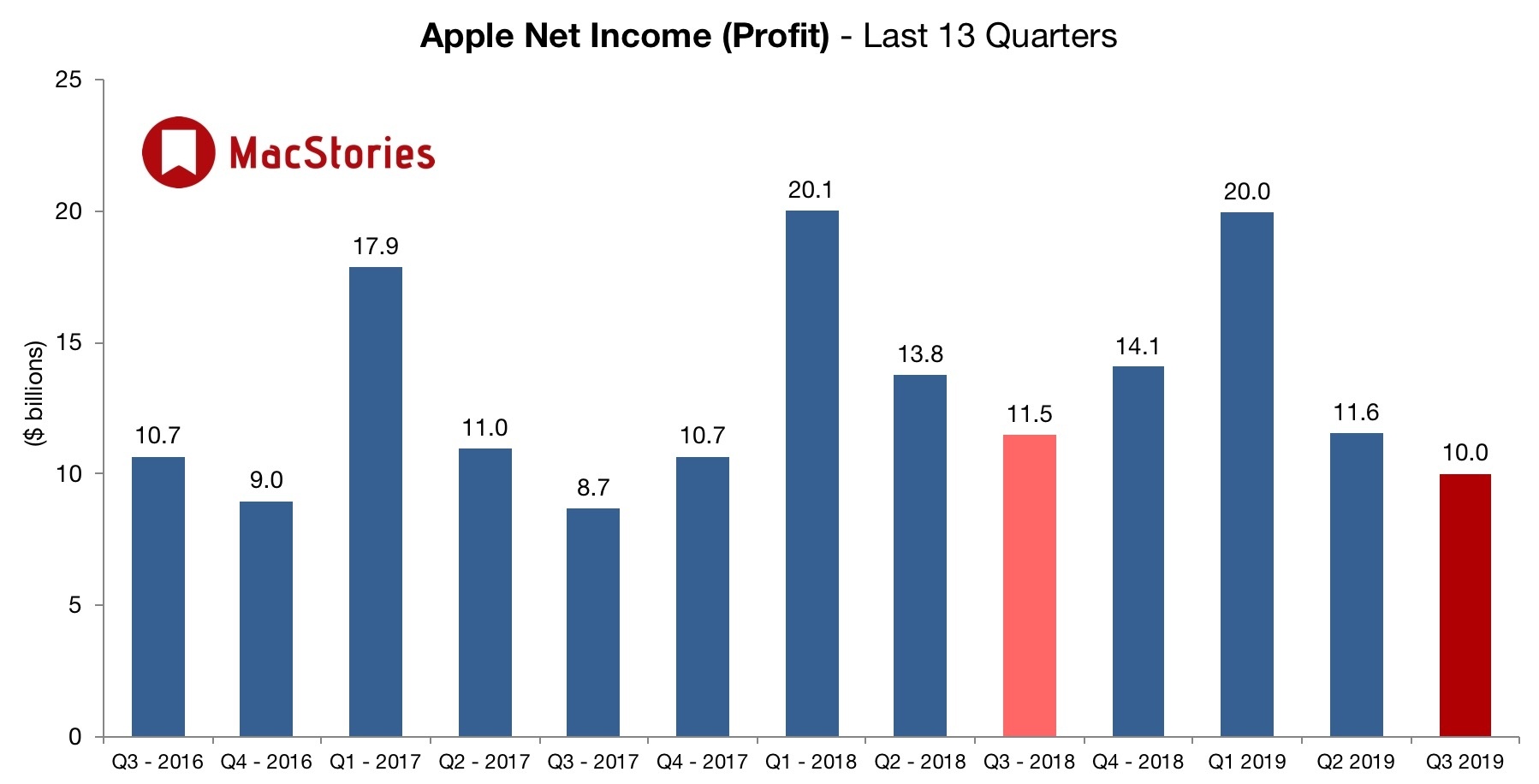

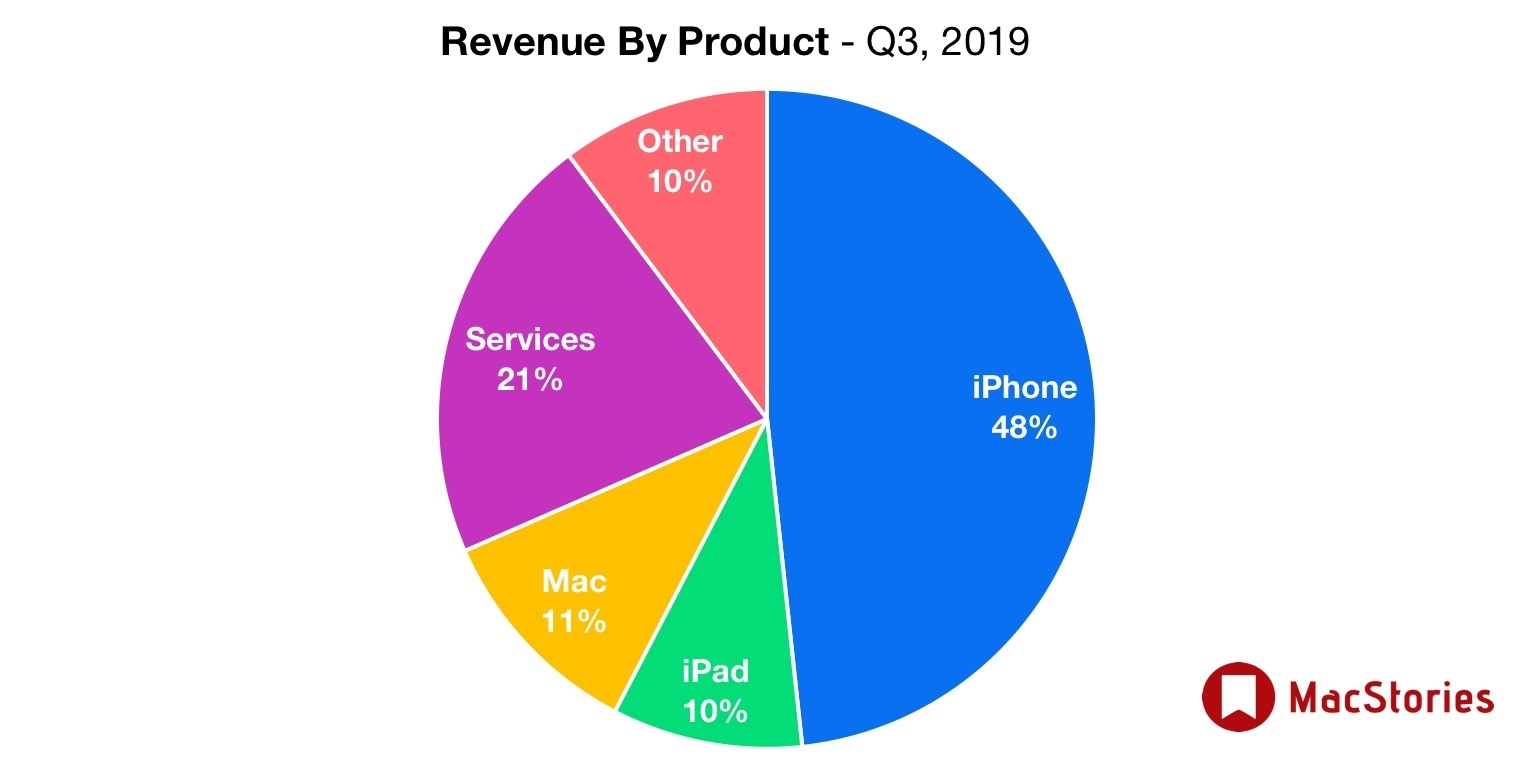

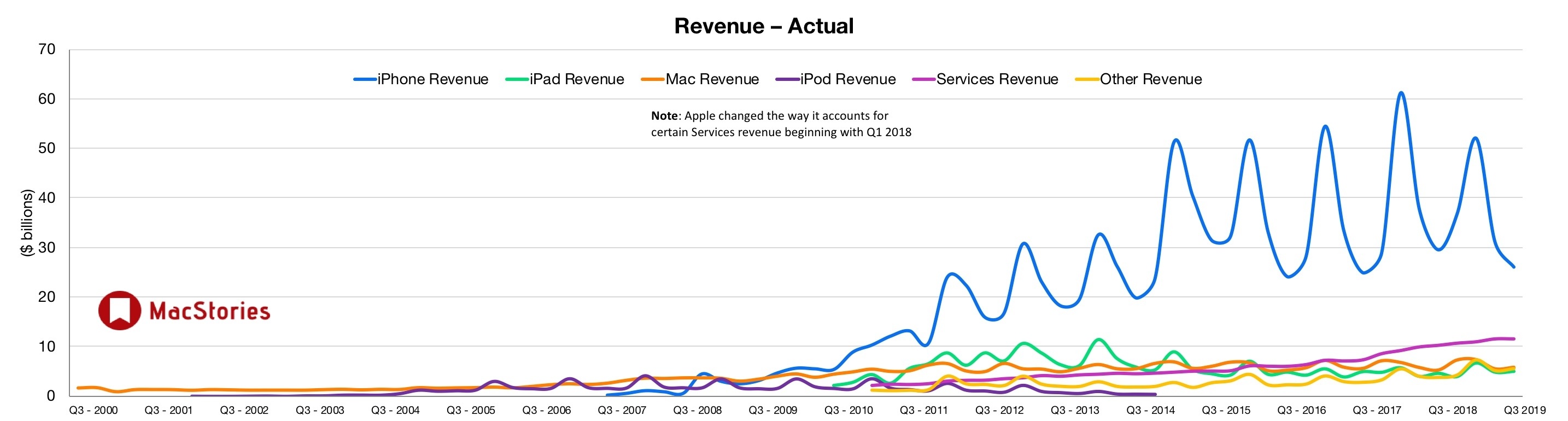

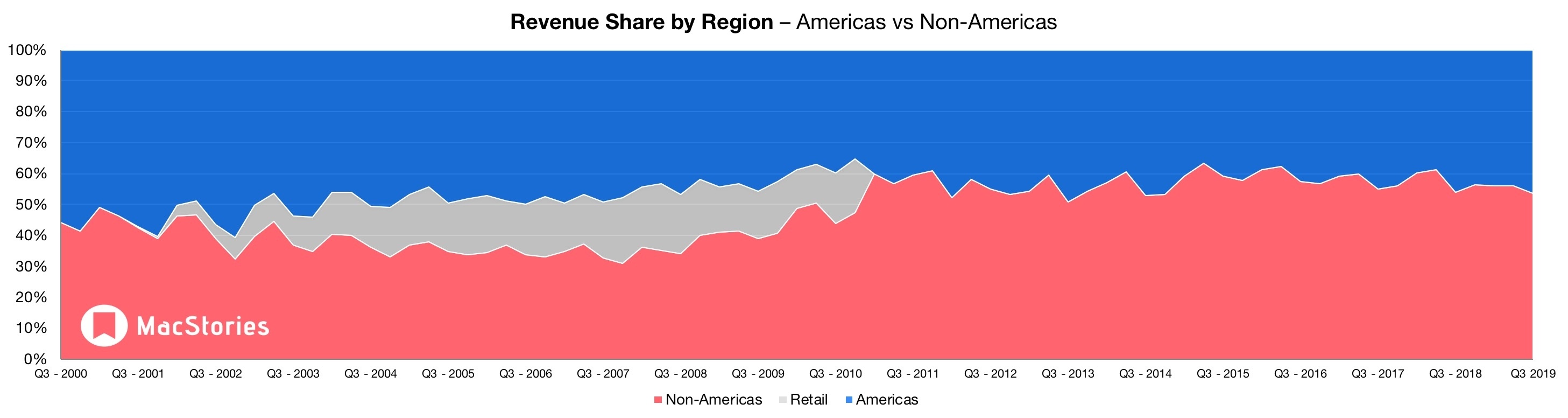

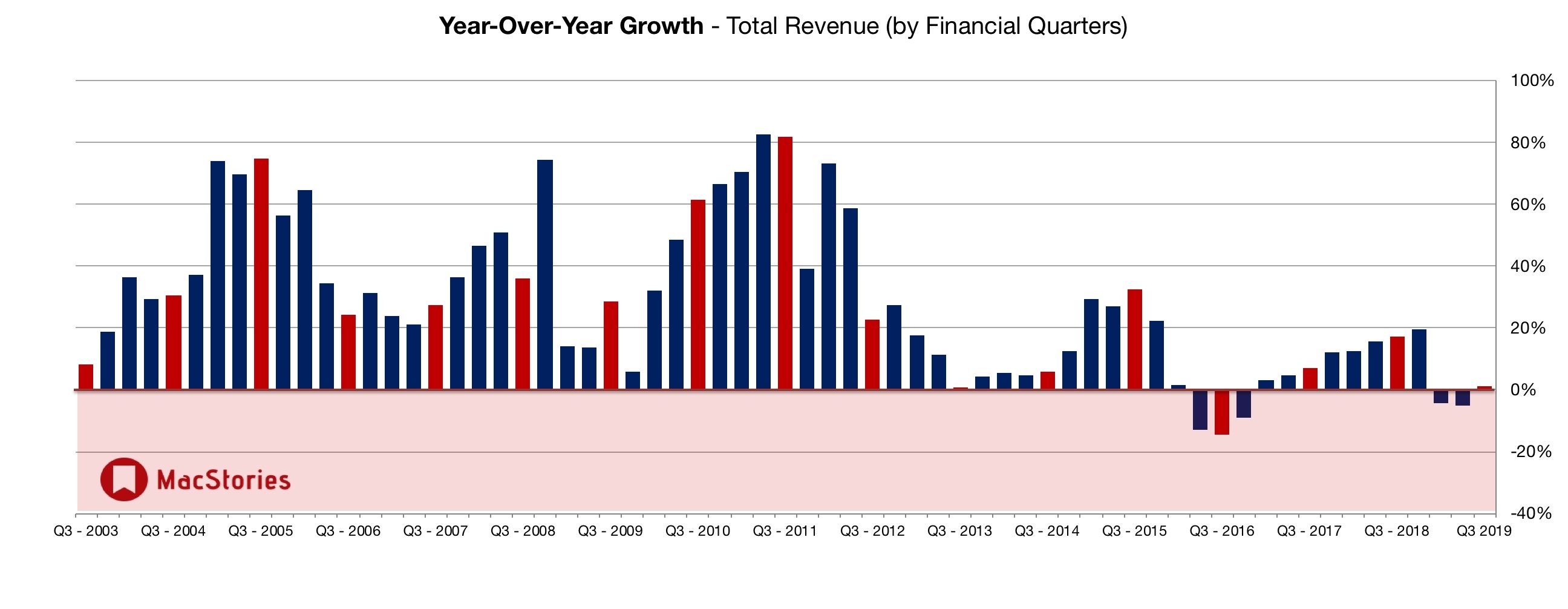

Graphical Visualization

Below, we’ve compiled a graphical visualization of Apple’s Q3 2019 financial results.

Apple Q3 2019 on Twitter

On CNBC, Gene Munster points out that Apple “is a cash machine,” and generated more than 2X the cash of Amazon and Facebook combined in the June quarter.

— MacJournals.com (@macjournals) July 30, 2019

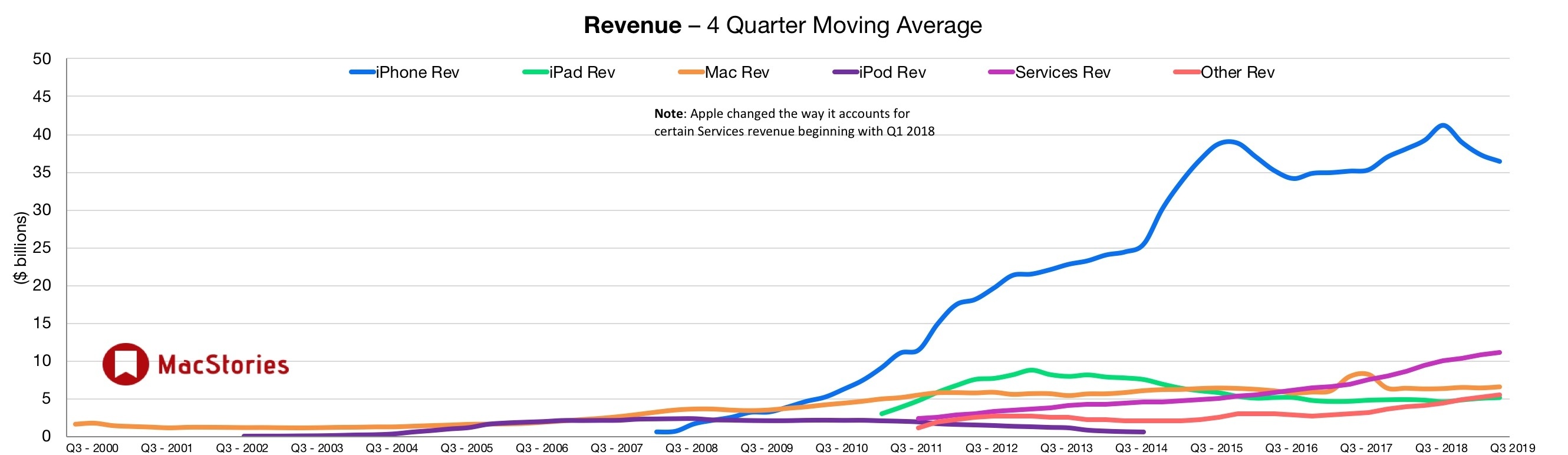

A year ago, iPhone revenues were 56% of Apple’s Q3 revenues. This year they are 48%.

— MacJournals.com (@macjournals) July 30, 2019

Tim Cook just made quite a statement about acquiring Intel’s modem business IP. Now over 17,000 wireless patents in Apple hands…

Owning and controlling the most important parts of Apple’s products.

— Ben Bajarin (@BenBajarin) July 30, 2019

Oh, forgot this: “Apple’s board of directors has declared a cash dividend of $0.77 per share of the Company’s common stock. The dividend is payable on August 15, 2019 to shareholders of record as of the close of business on August 12, 2019.”

— MacJournals.com (@macjournals) July 30, 2019

CNBC: TC continued: “we only want to make the best. And secondly is the audience. We don’t aspire to have the biggest audience…[sic] Almost by nature, when you focus on doing the best, it doesn’t necessarily wind up [having] the highest market share.” (2/2)

— MacJournals.com (@macjournals) July 30, 2019

Call is underway but CNBC is giving more quotes from their conversation with TC earlier. On judging a streaming service: “The most important thing is, one, the product and, two, the number of subscribers. Whether we are going to announce that or not, I don’t know…” [sic] (1/x)

— MacJournals.com (@macjournals) July 30, 2019

Wearables - AirPods, Apple Watch - really took off. Look at that. https://t.co/wJZIHdEaqR

— Charles Arthur (@charlesarthur) July 30, 2019

Apple’s revenues are up only 1% year-over-year, but are more diverse. iPad is 11% of the total now compared to 9% a year ago. Mac sales are 10% of the total compared to 9% a year ago.

— MacJournals.com (@macjournals) July 30, 2019

According to Apple’s consolidated statements of operations, the company spent 7.9% of revenue on R&D last quarter, compared to 6.9% in the year-ago quarter.

For the first nine months of FY19, Apple spent 6.2% of revenue on R&D, compared to 5.1% in the first nine months of FY18.

— MacJournals.com (@macjournals) July 30, 2019

Apple’s quarterly non-iPhone revenue (everything other than iPhone) exceeded iPhone revenue for the first time in seven years.

— Neil Cybart (@neilcybart) July 30, 2019

CNBC asked Tim Cook about Apple’s iPhone trade in program: “It was a key part of the improvement sequentially. Also, the trade-in and financing program were key to our results in China. It was an important part of what we did, in addition to what I mentioned last call…” (1/x)

— MacJournals.com (@macjournals) July 30, 2019

Apple shares are up about 3.25% in after-hours trading.

— Horace Dediu (@asymco) July 30, 2019