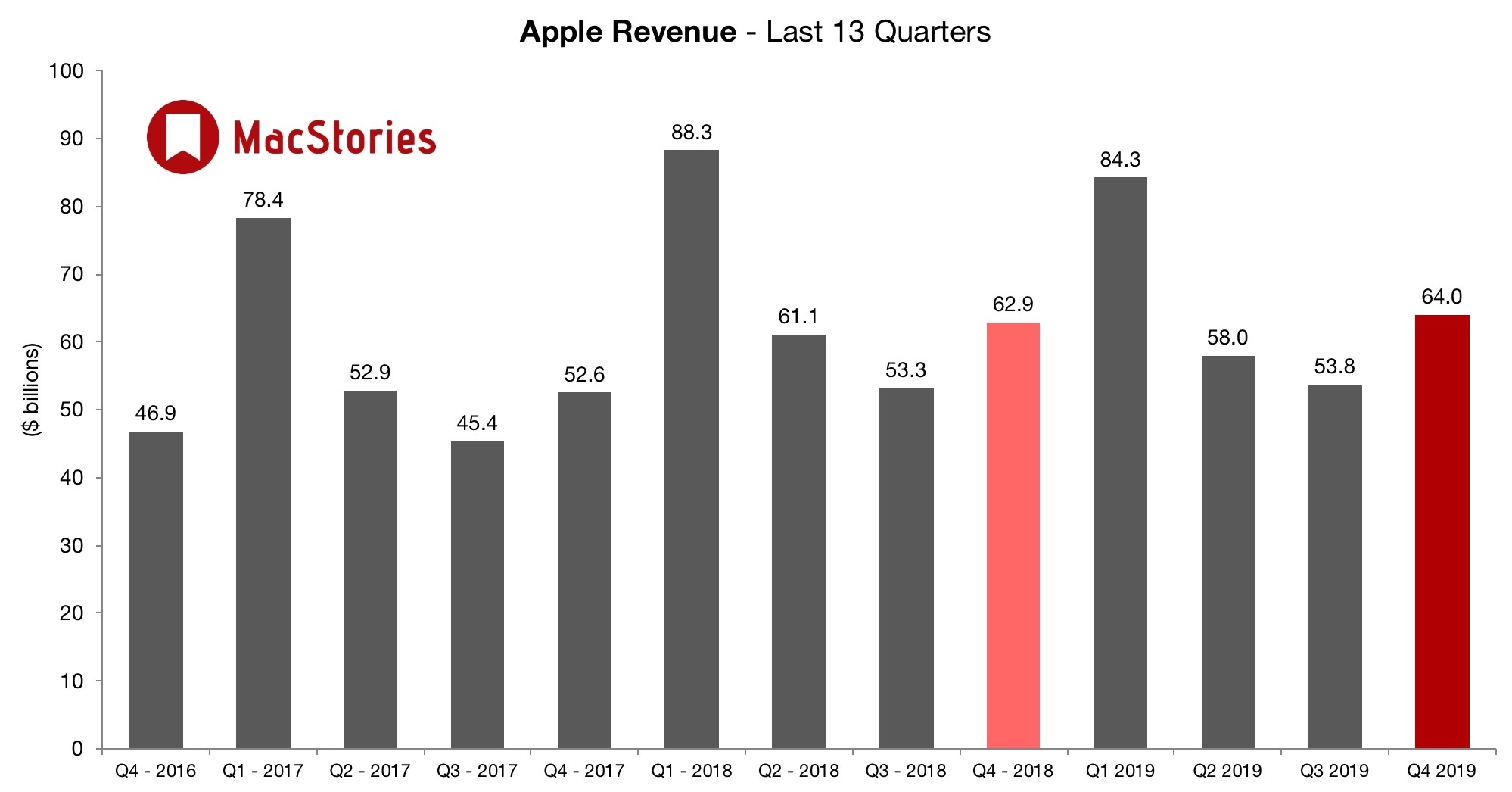

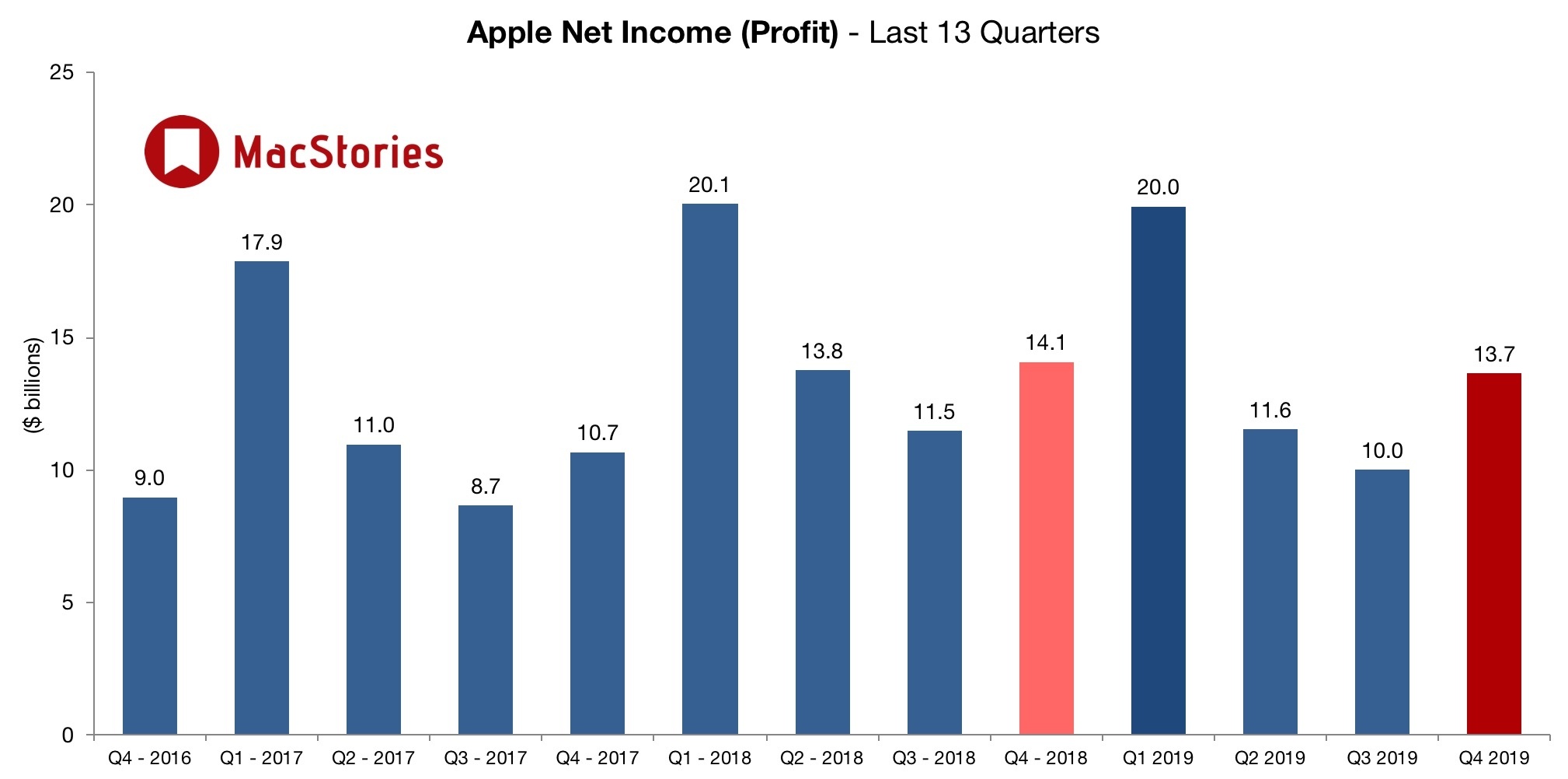

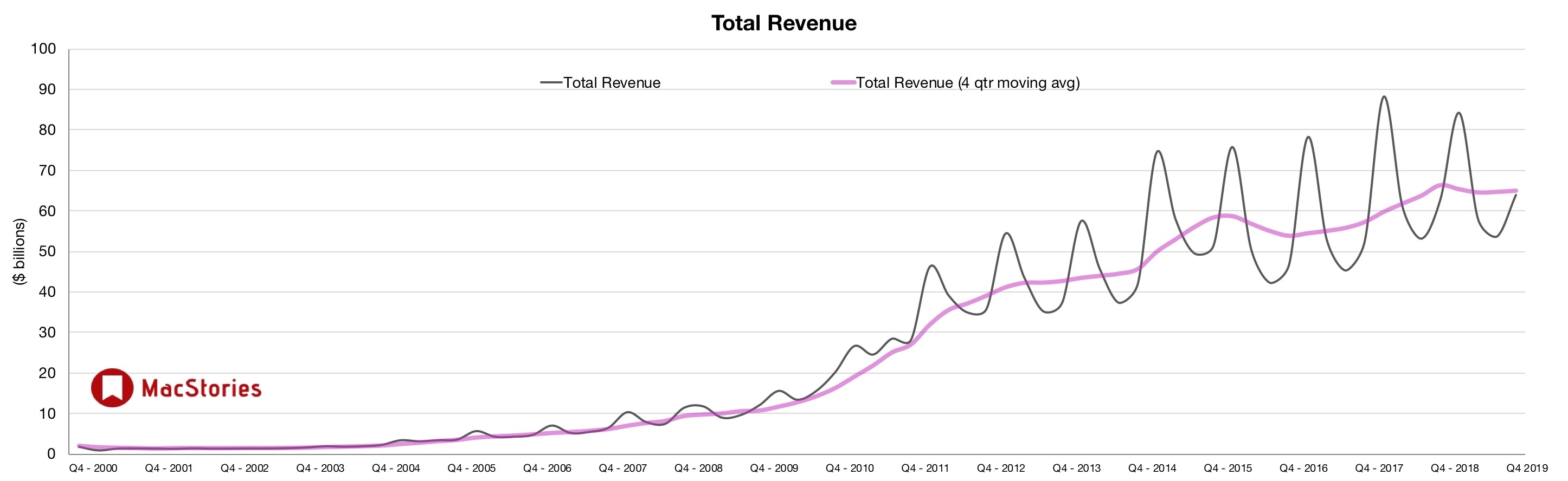

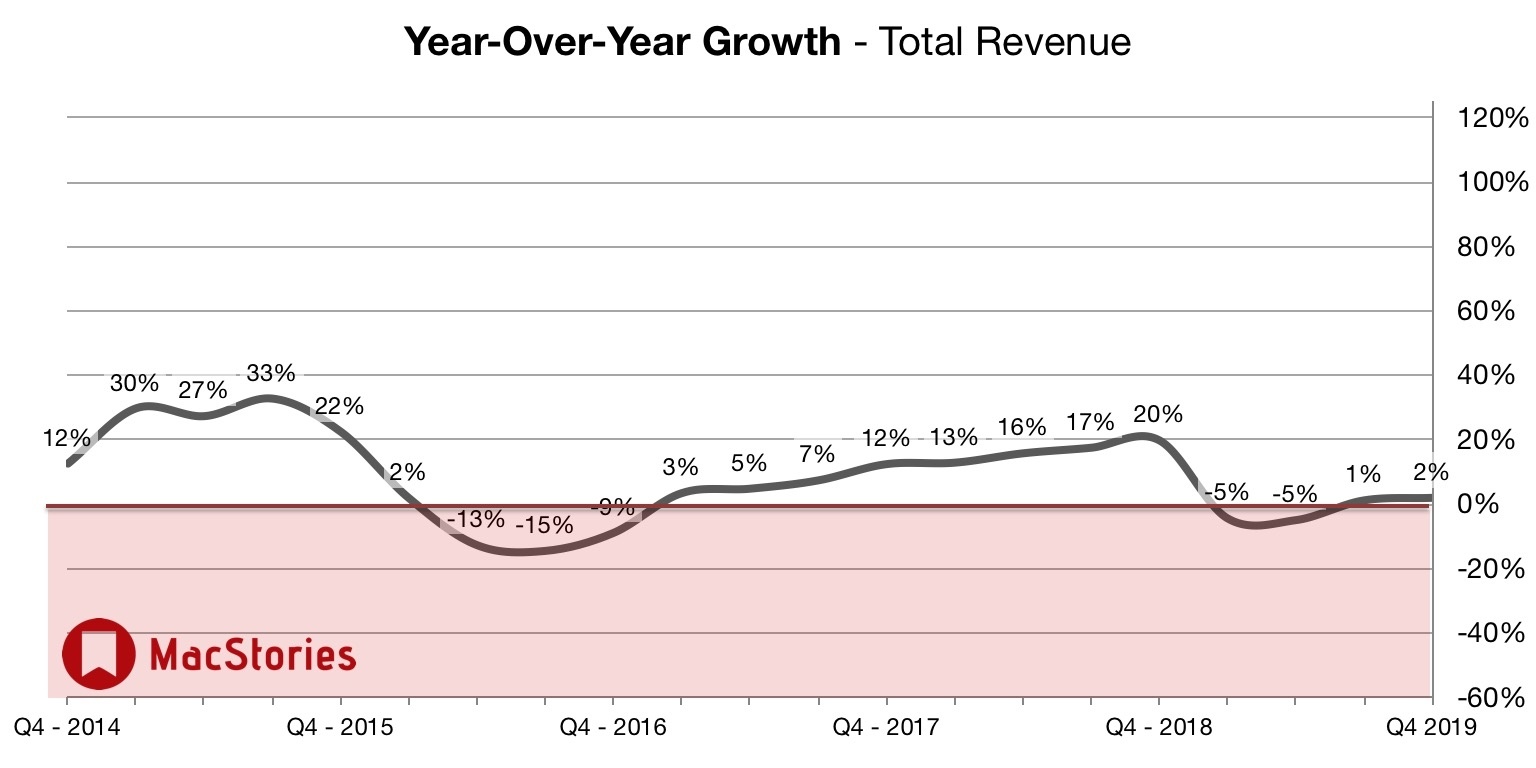

Apple has just published its financial results for Q4 2019. The company posted revenue of $64 billion. Apple CEO Tim Cook said:

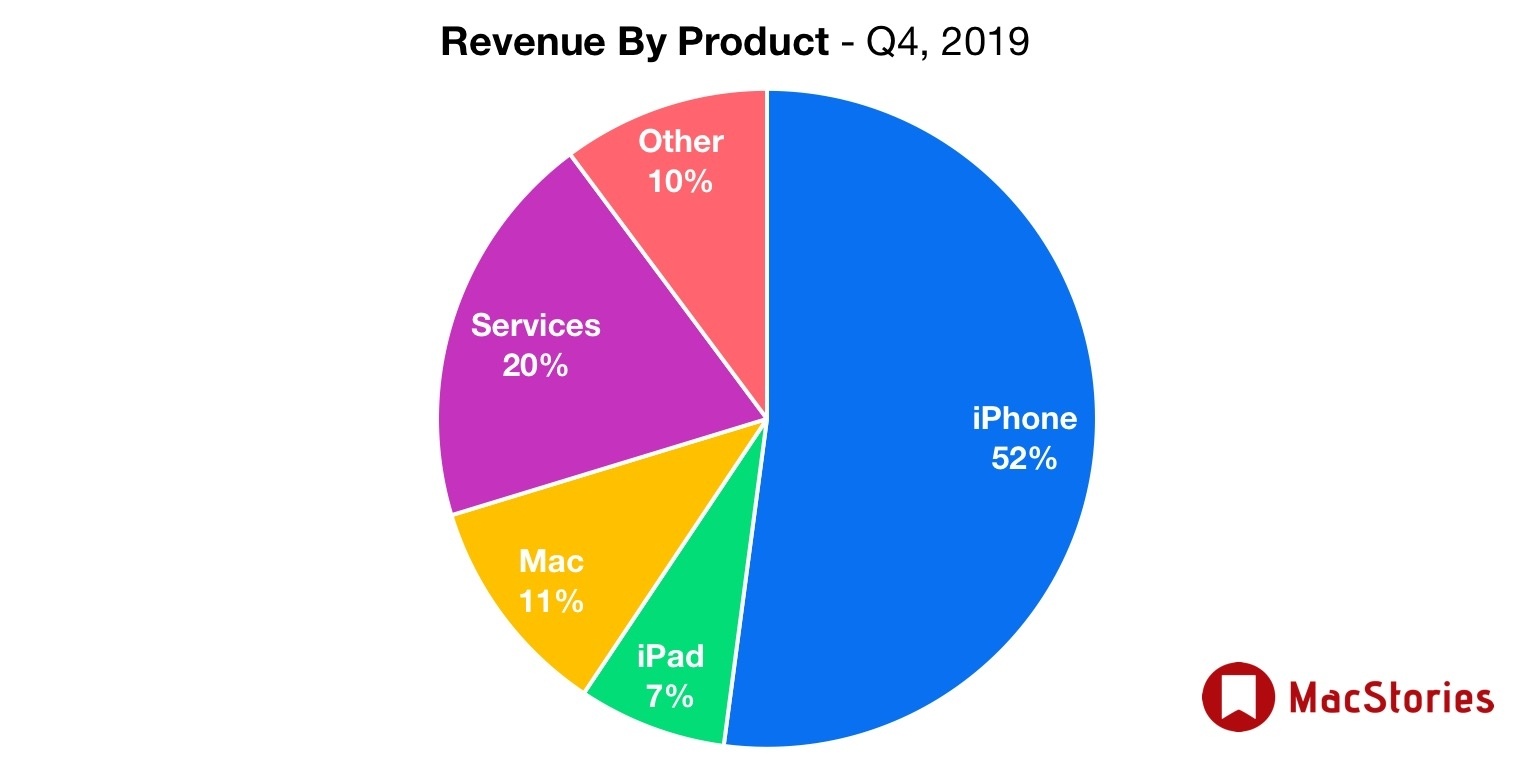

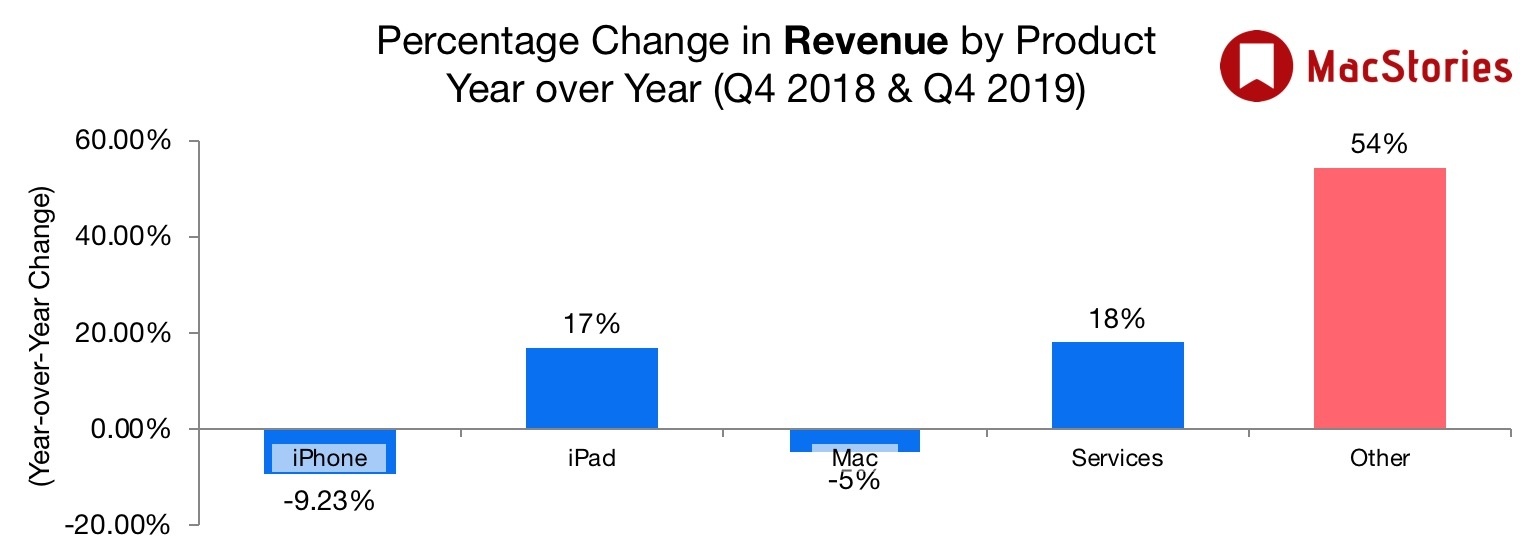

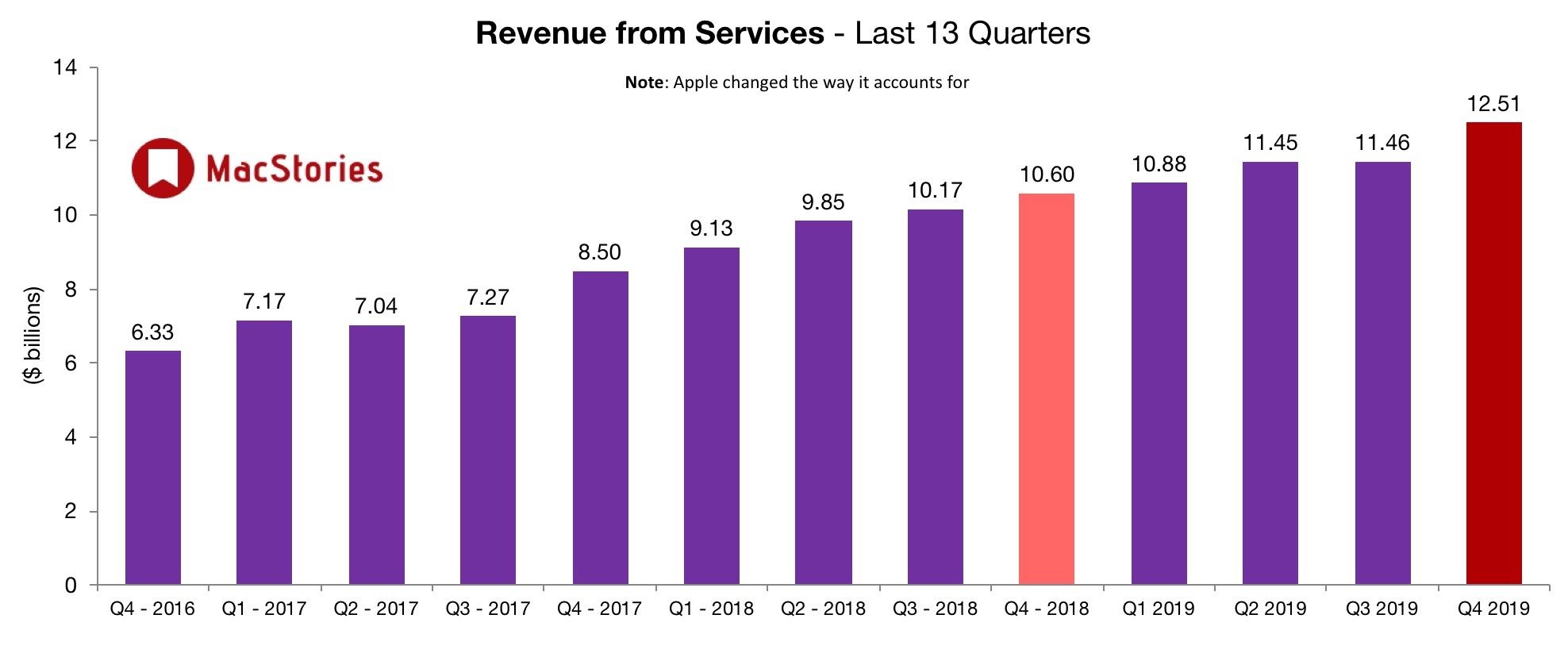

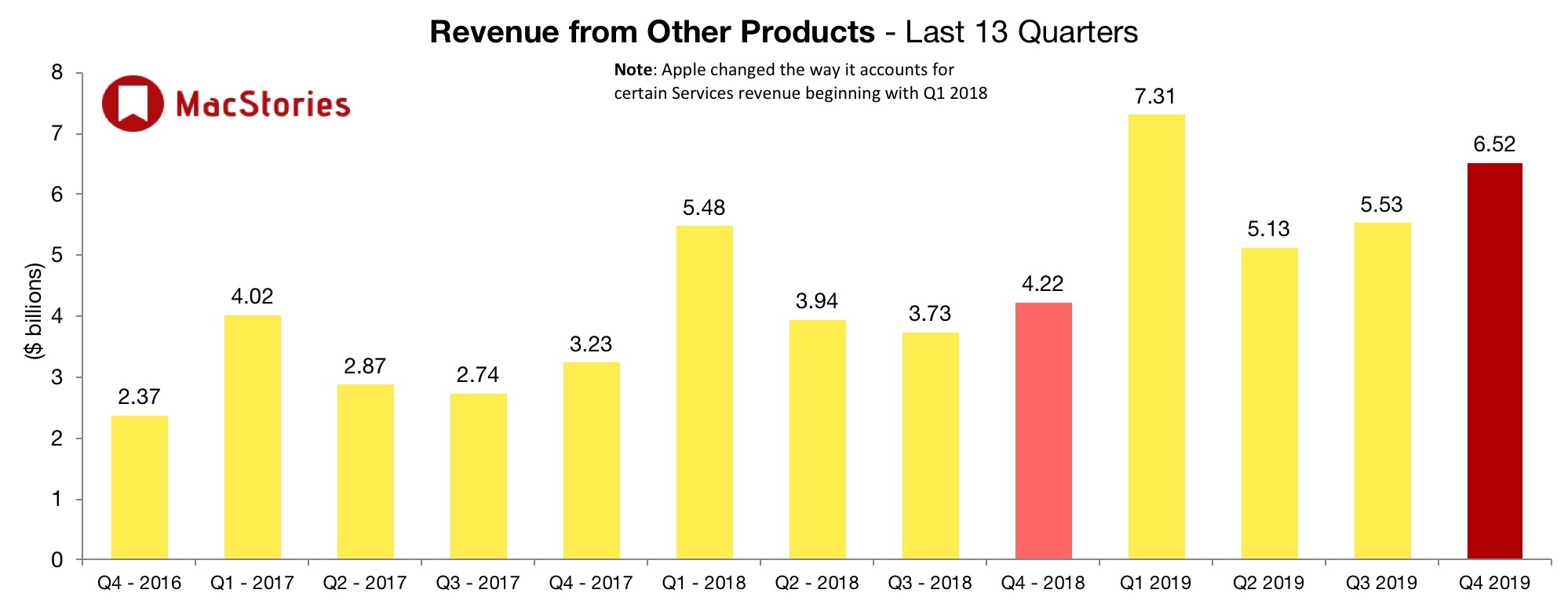

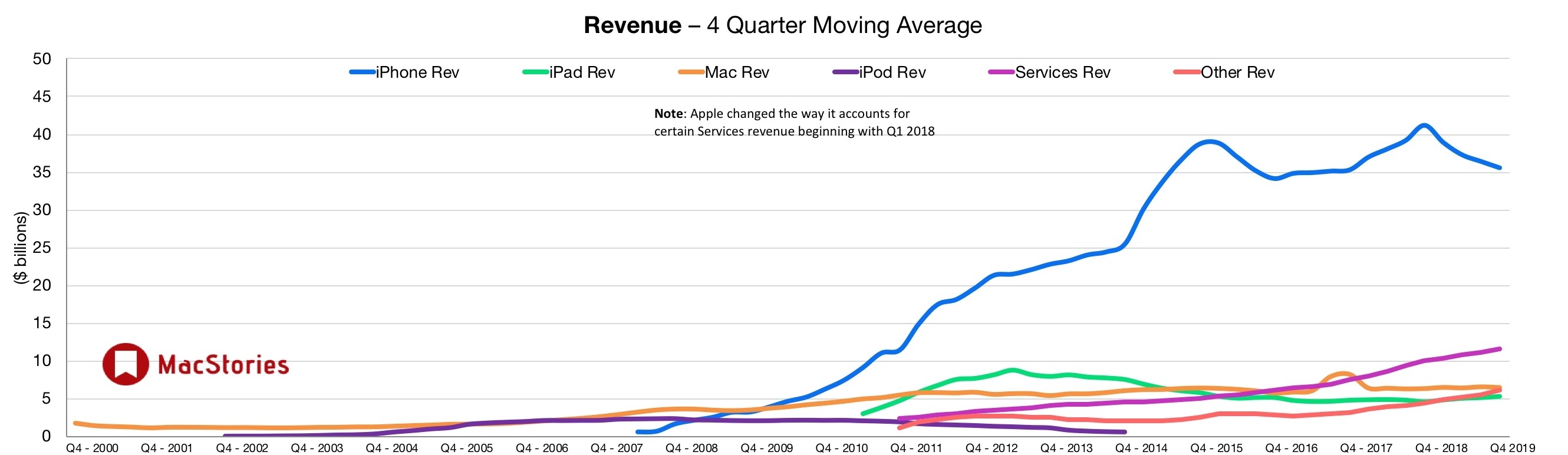

“We concluded a groundbreaking fiscal 2019 with our highest Q4 revenue ever, fueled by accelerating growth from Services, Wearables and iPad,” said Tim Cook, Apple’s CEO. “With customers and reviewers raving about the new generation of iPhones, today’s debut of new, noise-cancelling AirPods Pro, the hotly-anticipated arrival of Apple TV+ just two days away, and our best lineup of products and services ever, we’re very optimistic about what the holiday quarter has in store.”

Estimates and Expectations for Q4 2019 and the Year-Ago Quarter (Q4 2018)

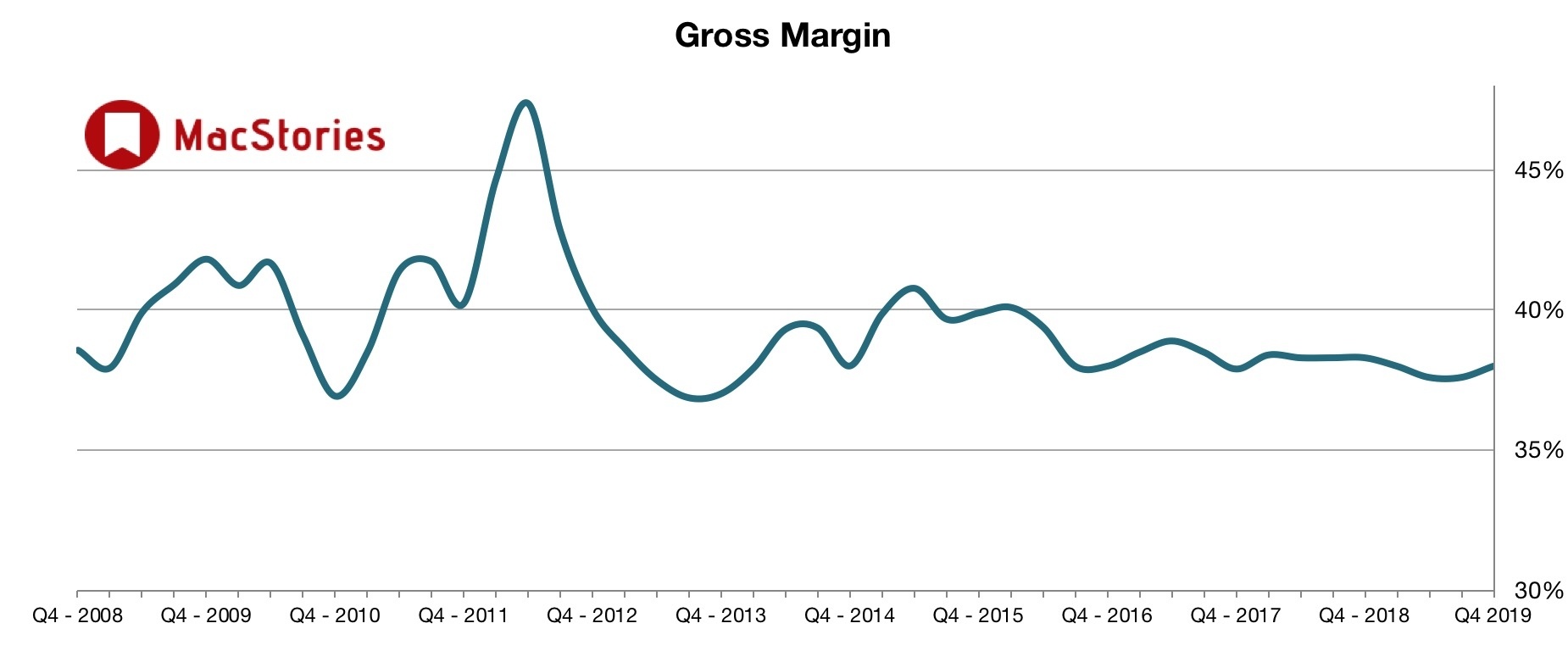

Apple’s revenue guidance for Q4 2019 fell between $61 billion and $64 billion, with gross margin estimated to be between 37.5% and 38.5%.

Going into today’s earnings call, Marketwatch says:

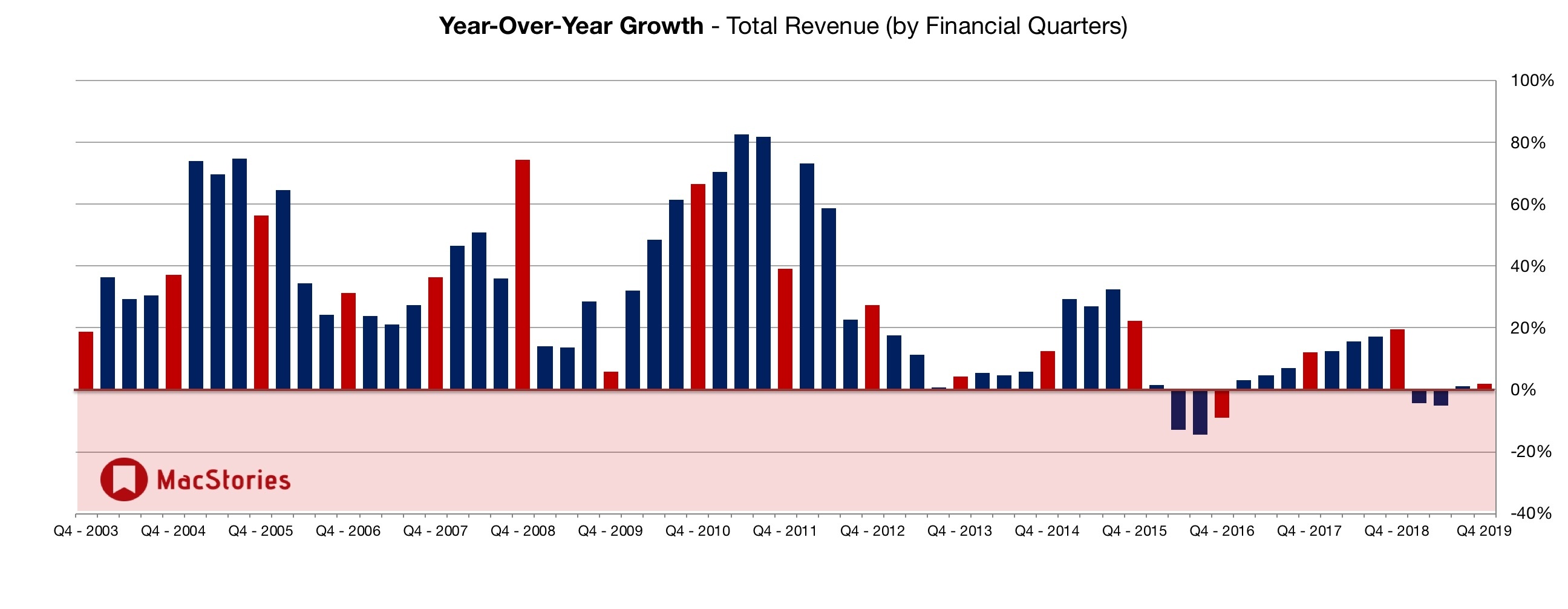

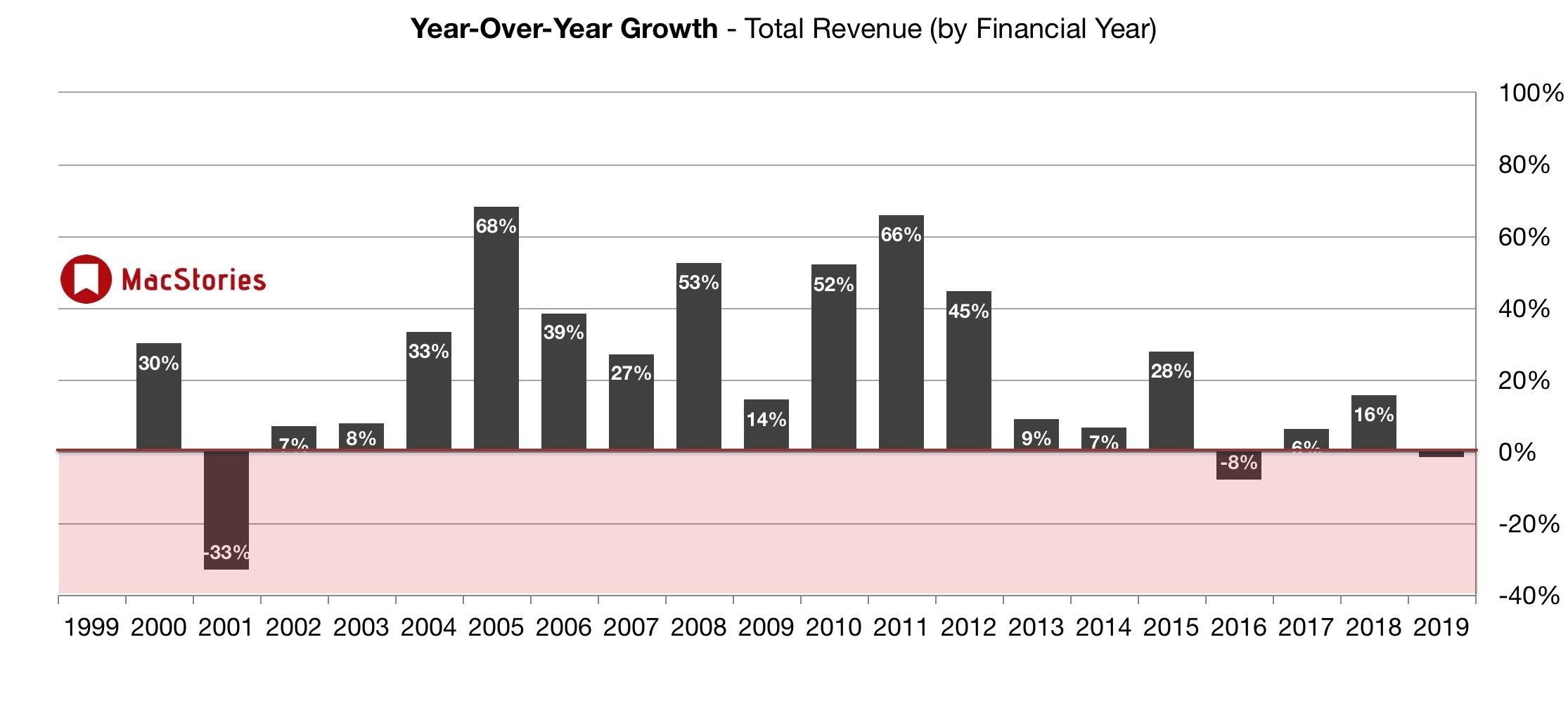

Analysts surveyed by FactSet see the company posting revenue of $63 billion, nearly flat from $62.9 billion a year ago. The report will cap off a fiscal year in which Apple’s earnings and revenue are both expected to decline from a year earlier, which has happened at Apple only once since 2001.

In the year-ago quarter (Q4 2018), Apple earned $62.9 billion in revenue. During that quarter Apple sold 46.9 million iPhones, 9.7 million iPads, and 5.3 million Macs. As announced on Apple’s Q4 2018 earnings call, however, the company no longer reports unit sales for any of its products.

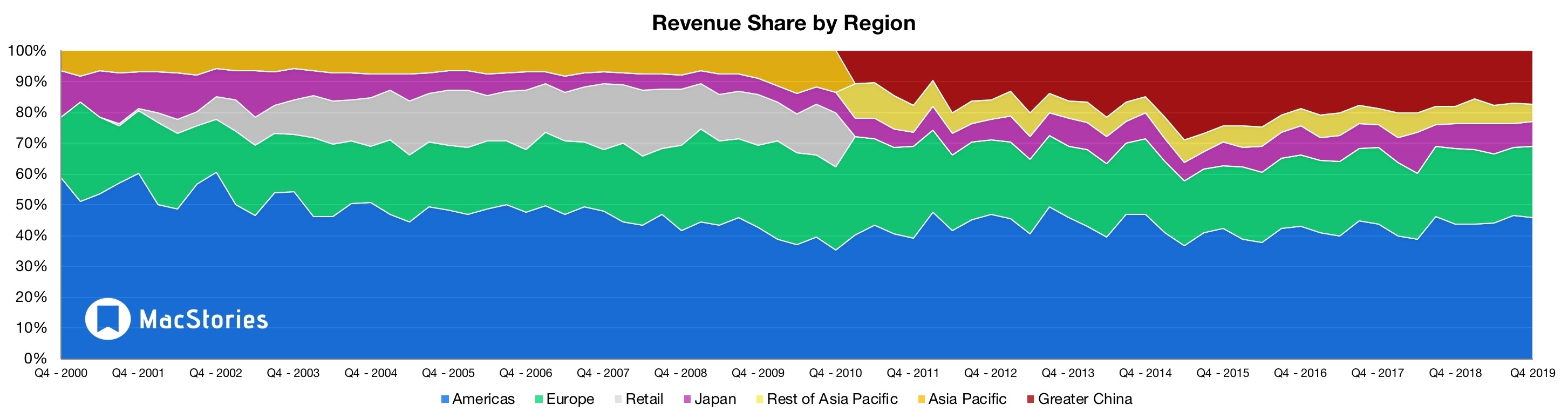

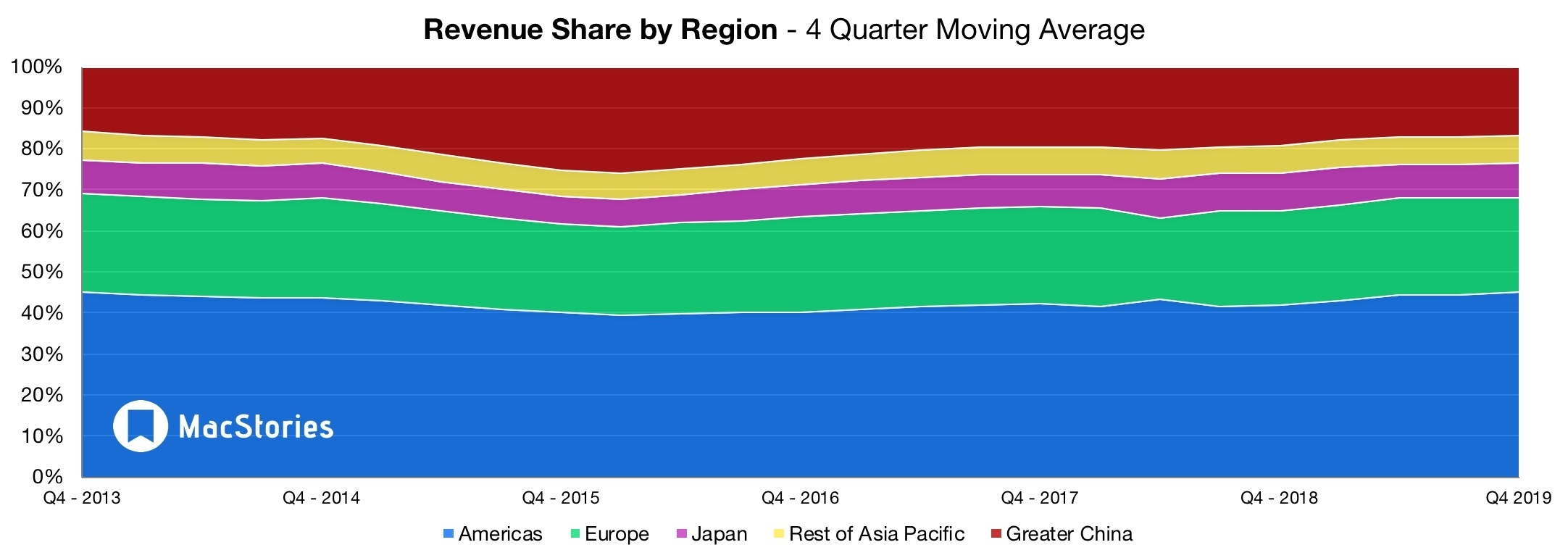

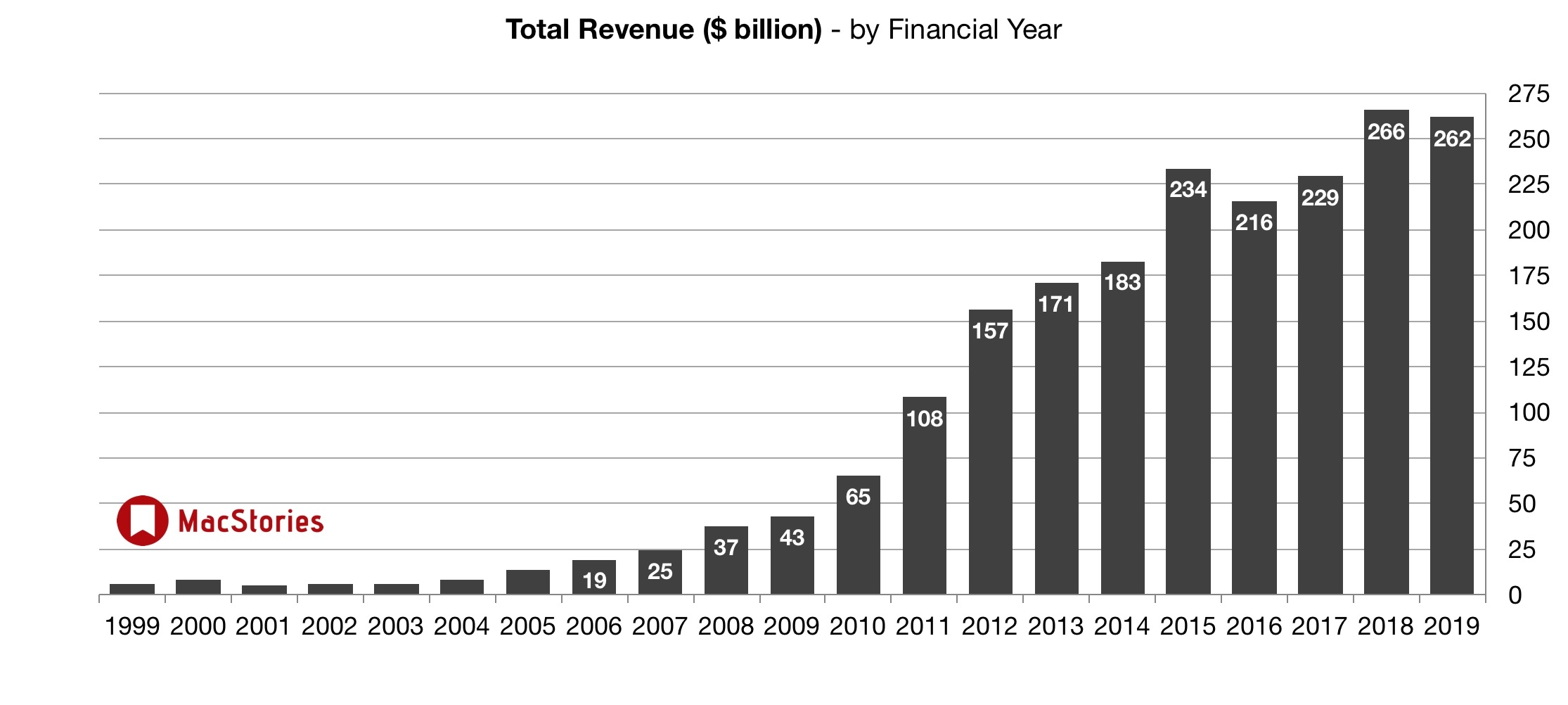

Graphical Visualization

Below, we’ve compiled a graphical visualization of Apple’s Q4 2019 financial results.

Apple Q4 2019 on Twitter

TC: “Three quarters of Apple Watch buyers are new to Apple Watch.” Put another way, one out of four Apple Watch sales is an upgrade (or second watch, maybe for some reason)

— MacJournals.com (@macjournals) October 30, 2019

TC says later this year, Apple Card will allow you to buy a new iPhone and pay for it over 24 months with 0% interest, apparently still including 3% cash back.

— MacJournals.com (@macjournals) October 30, 2019

Apple Q4 iPhone revenue was $33.36B, down 9% YoY, but beating analyst estimates of $32.42B and up from fiscal Q3 revenue of $25.99B (@lauren_feiner / CNBC)https://t.co/kGlDnYHjEuhttps://t.co/zIjHiP6Kdp

— Techmeme (@Techmeme) October 30, 2019

Apple repurchased nearly $18 billion of shares in 4Q19. That’s a big number. Brings the total amount spent on buyback in FY2019 to $67 billion.

— Neil Cybart (@neilcybart) October 30, 2019

Apple: Cash dividend of $0.77/share payable on 2019.11.14 to shareholders of record at close of business on 2019.11.11.

(Auto-correct tried to make that into “hash dividend. Make of that what you will.)

— MacJournals.com (@macjournals) October 30, 2019

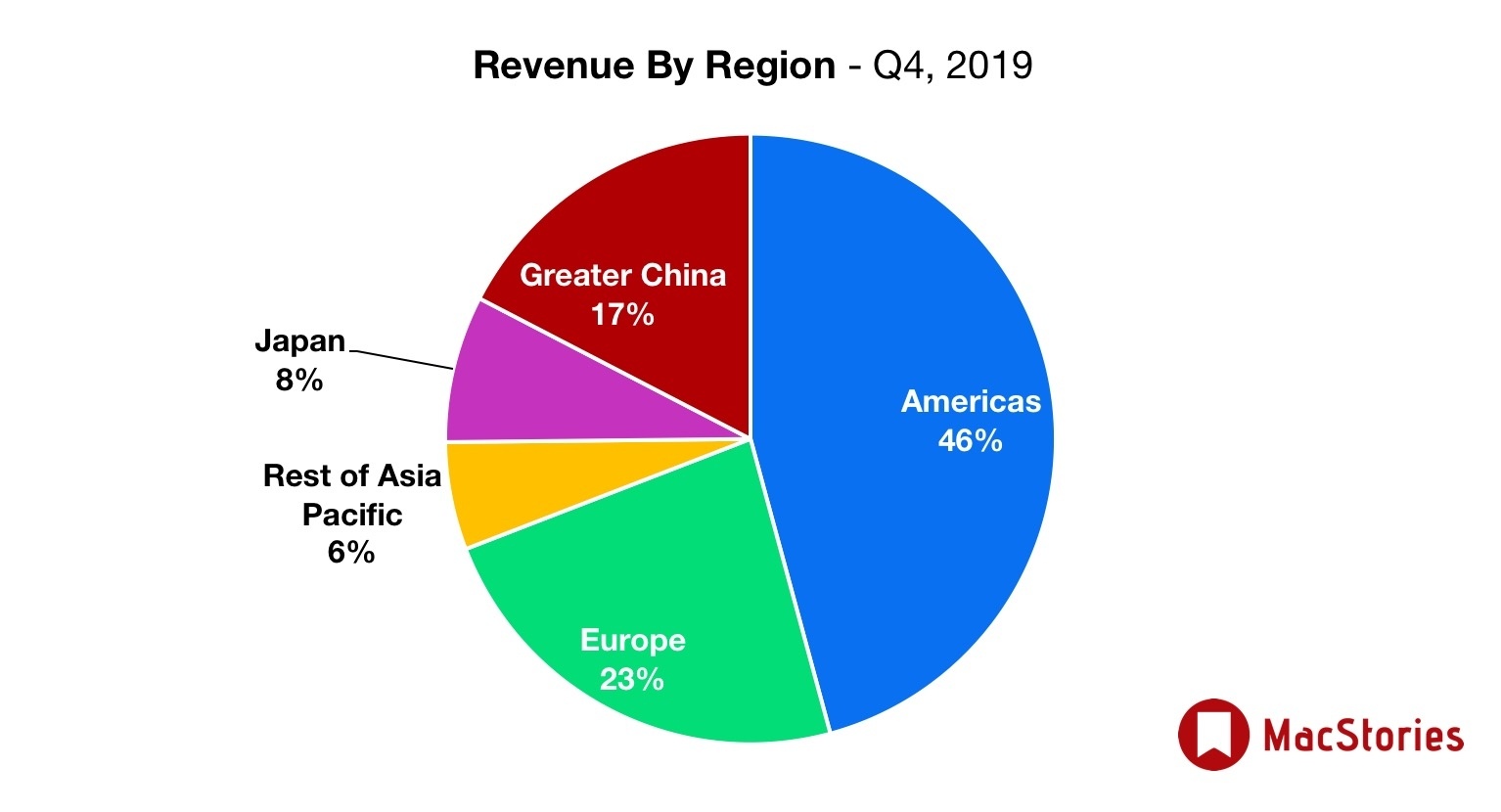

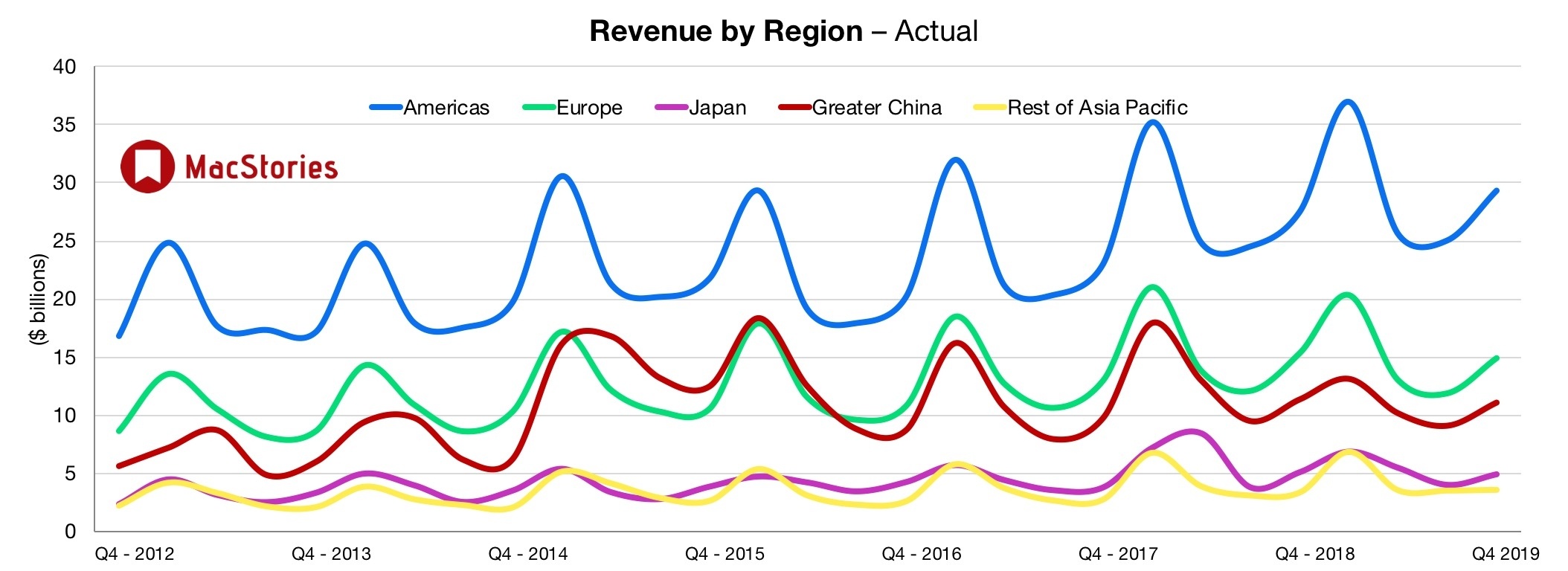

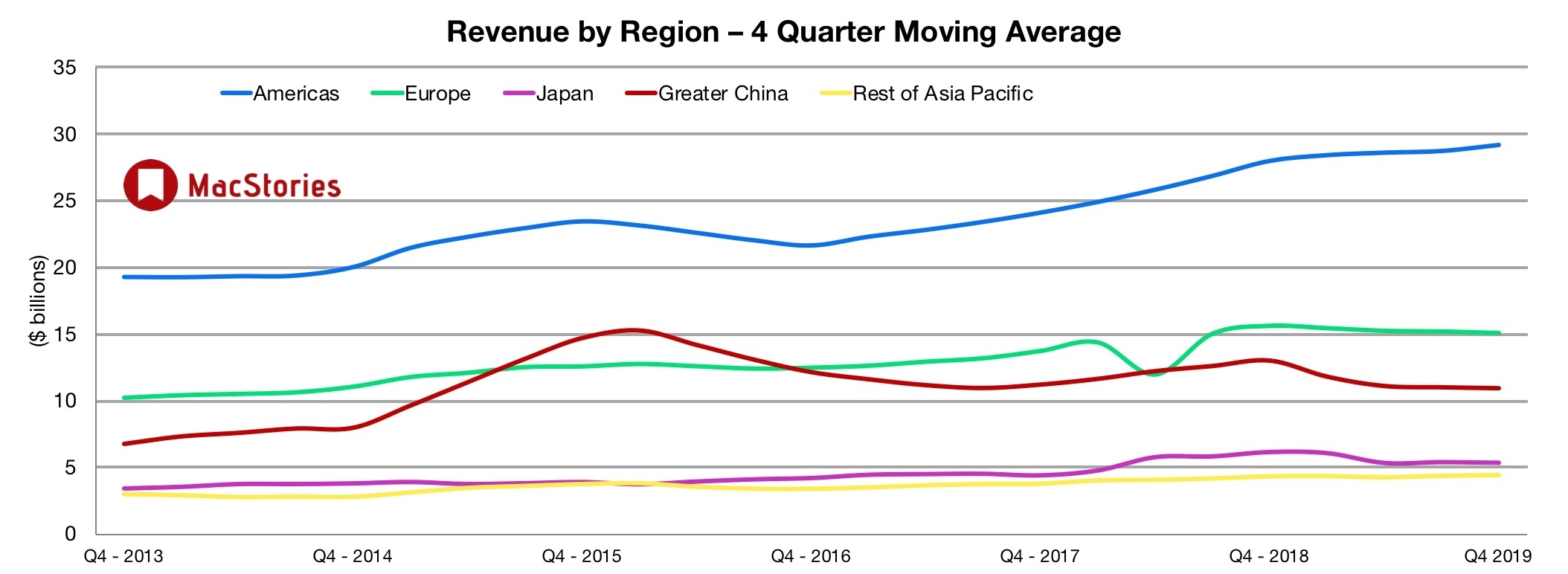

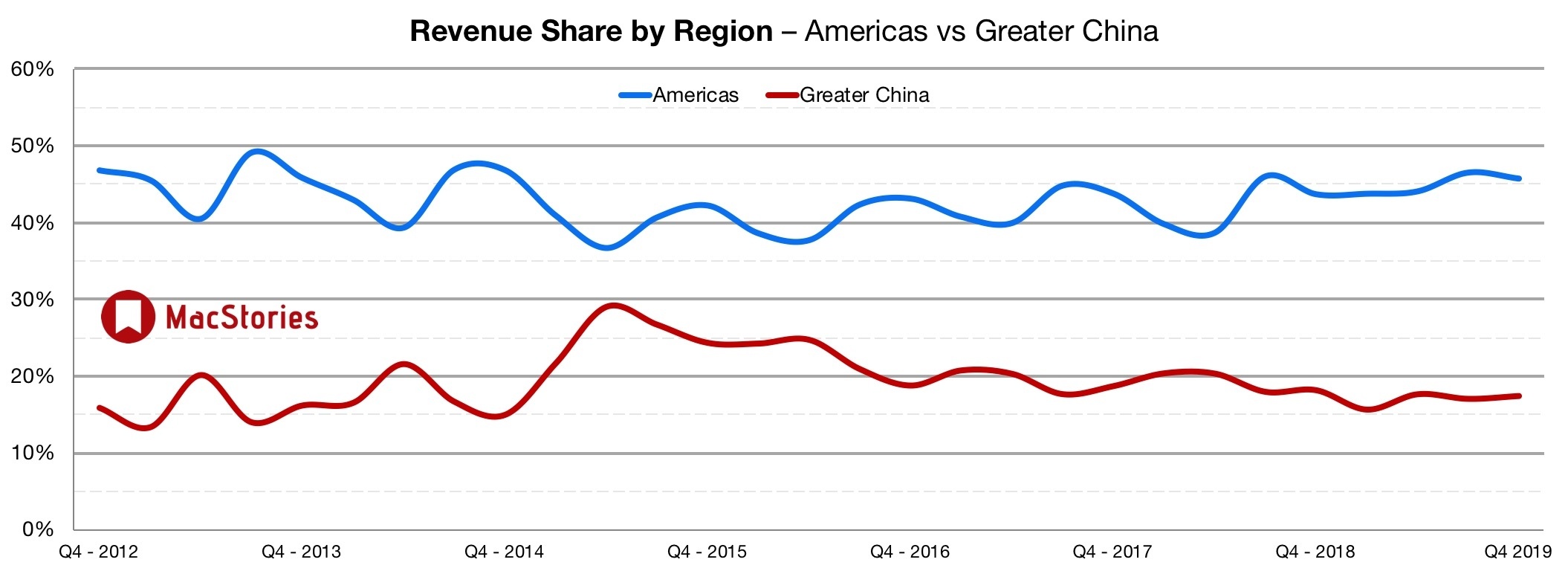

Apple’s quarterly revenues pretty inline with most consensus from analysts. Guide is similarly in line with consensus and Apple must be slightly worried about China still given the low-end of guidance number.

— Ben Bajarin (@BenBajarin) October 30, 2019

$AAPL’s guidance for this coming holiday quarter is $85.5 billion to $89.5 billion.

Apple’s current record is $88.3 billion in 2018:

- 2015: $74.6 billion

- 2016: $75.9 billion

- 2017: $78.4 billion

- 2018: $88.3 billion

- 2019: $84.3 billion— MacRumors.com (@MacRumors) October 30, 2019

CNBC: Tim Cook (TC) was asked if Apple was shipping in more new iPhones to the US because of trade tensions. On tariffs: “I’m still optimistic, as I’ve ben the whole time, that in the end there will be an agreement between the countries where it will not solve everything.” (1/x)

— MacJournals.com (@macjournals) October 30, 2019

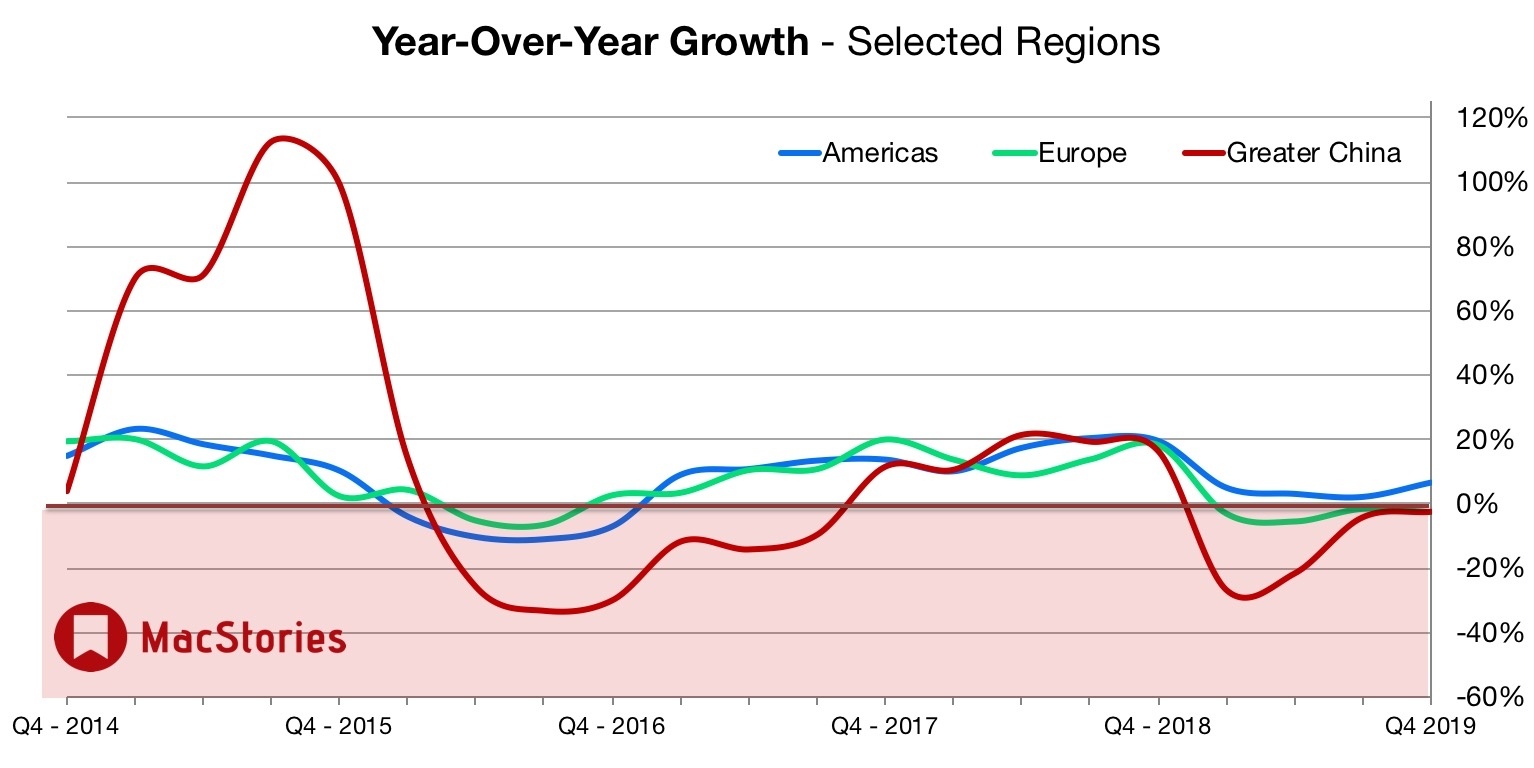

CNBC: Apple guides to revenue between $85.5B and $89.5B for Q1 (holiday quarter) revenue, street estimate is $87.5B. Margin guidance of 38%±0.5%. Greater China revenue down 2%, a sequential improvement.

— MacJournals.com (@macjournals) October 30, 2019