Monthly is a money-tracking app aimed at helping you budget and manage your expenses.

The above sentence is notably simple – I wanted to write it that way so that you can understand the philosophy behind Monthly before you even launch it. You’ll find that Monthly funnels itself into one area and doesn’t budge; for most apps, the reality behind that fact is a kiss of death. But Monthly, in all of its simplicity and speed, stands on its own as an app that does its one job incredibly well.

The Method

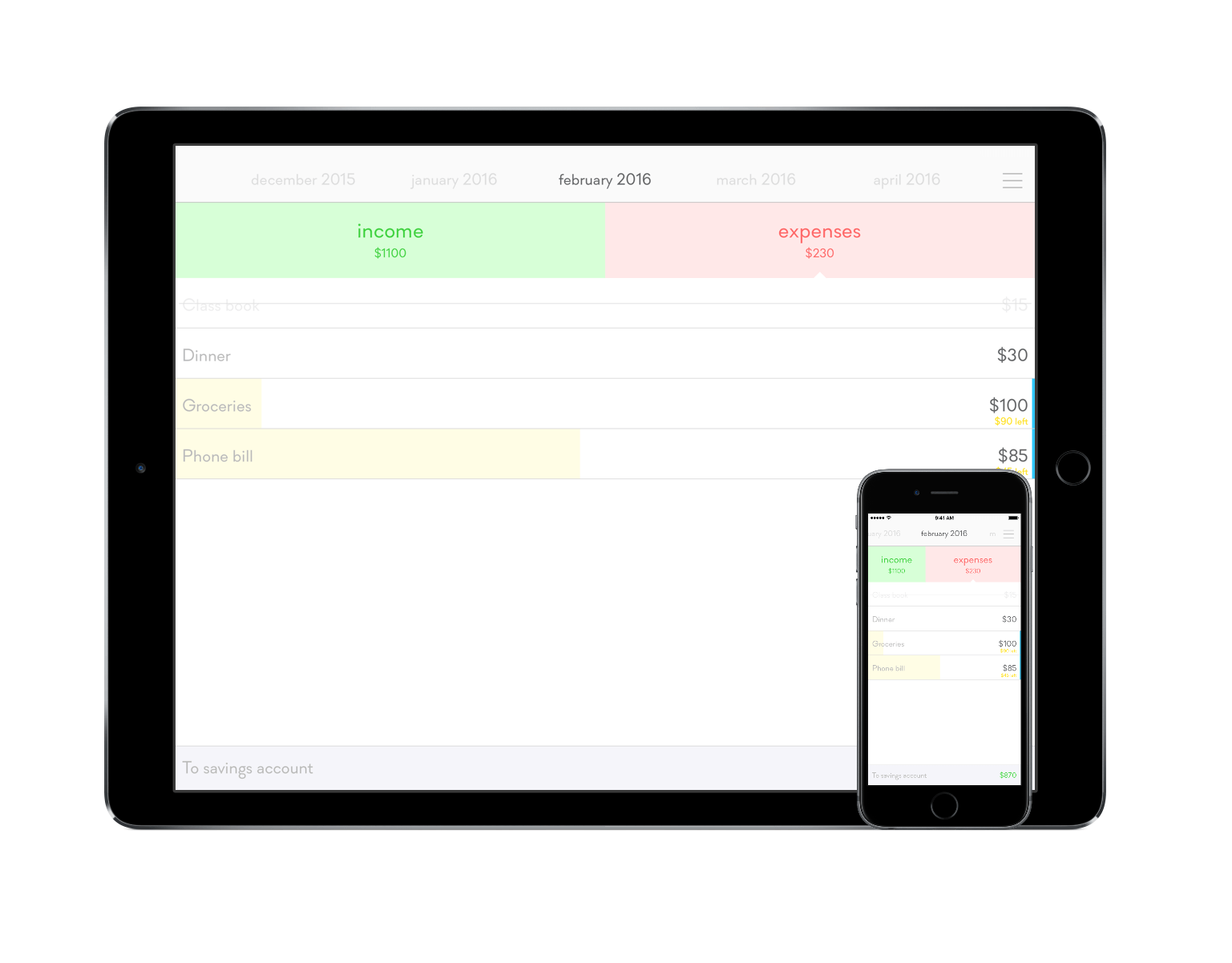

Monthly strips away the clutter of menus and text (mostly) to provide the user with a quick way to keep track of their money. The main screen shows two sections for entry: income and expenses. Tapping on either will shift you over to that section and allow you to enter in your information by swiping down in the white space.

When adding an item, Monthly will require you to add a short title and then the amount. In either section, you’ll see that every item you add into Monthly will increase the number below the title. Once everything is set for the month, the app will do some basic math and display at the bottom how much money is estimated to go into your savings account at the end of the month.

However, monetary surprises can happen, both positively and negatively. Because of Monthly’s capability to adjust to your lifestyle, you can add as many entries in either section as you need.

For both past and future reference, Monthly includes months/years along the top to swipe through.

Reoccurring Incomes/Expenses

While the method is simple, developer Marek Ekes took some precautions in avoiding a huge potential annoyance: reoccurring incomes and expenses. For example, you may not want to enter in your work payments or phone bill every month.

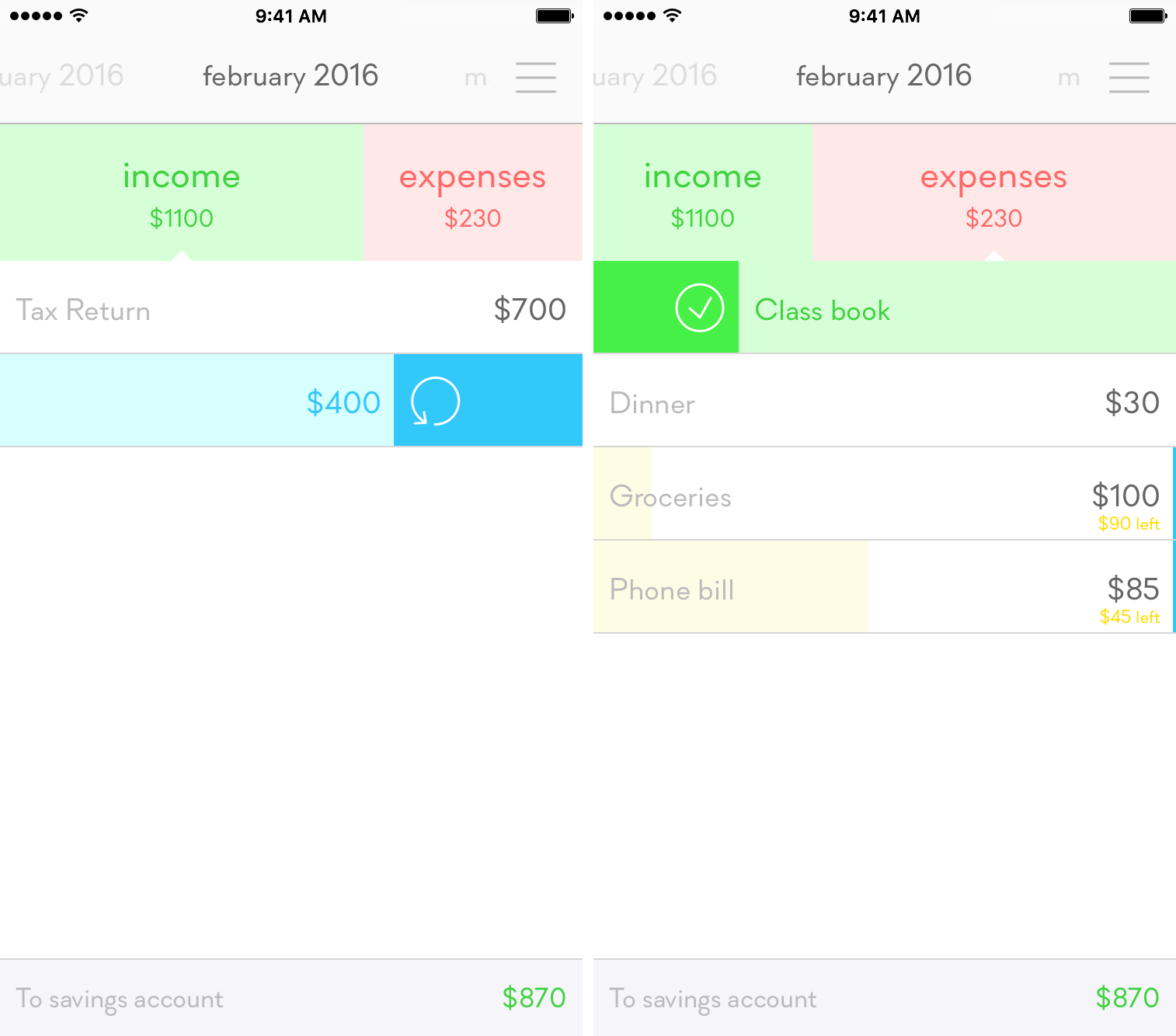

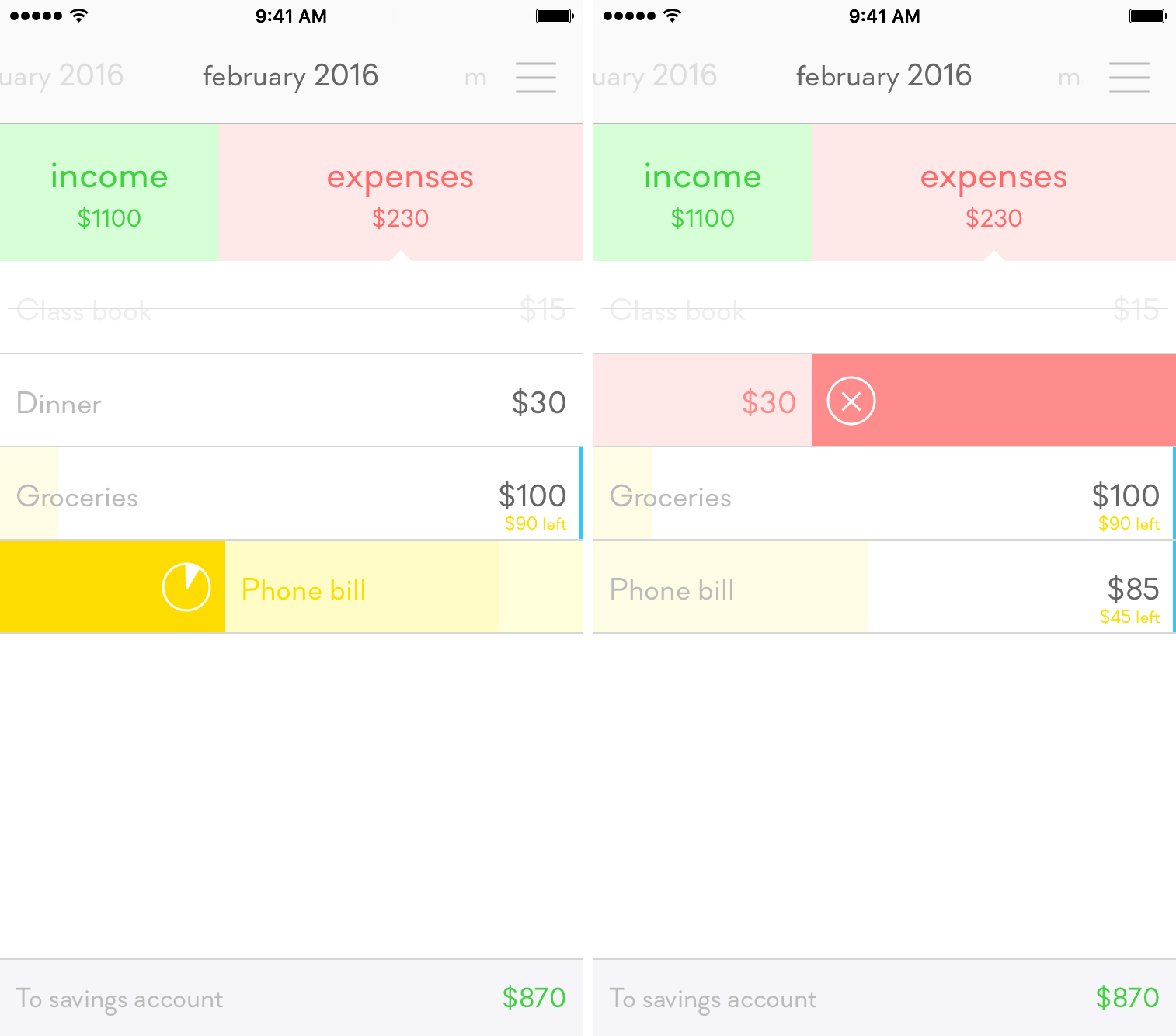

To prevent time-wasting, any entry can be swiped to the left; when this gesture is performed, a slim blue bar will appear on the far right side of the entry. This indicates that Monthly will apply this expense of income source to every month after it’s created.

Other Important Gestures

In addition to the gesture mentioned above, Monthly also sports three other actions when swiping: delete, mark as complete, or add progress. While delete is self-explanatory, the second and third options require some elaboration.

When swiping slightly to the right on an entry, you’ll see a green check mark that will result in the amount being crossed out. This indicates that you’ve taken care of that payment or received that source of income. Although this isn’t necessary to the functionality of Monthly, it’s a nice step to have.

Further swiping to the right brings you to a yellow option with a pie chart icon. Selecting this option provides you with the opportunity to show that you’ve chipped away at an expense. I consider this to be one of the best features of Monthly – instead of having to keep track in your head or on paper that you’ve paid of a certain amount of a bill, you can enter it in and add progress.

Experience Customization

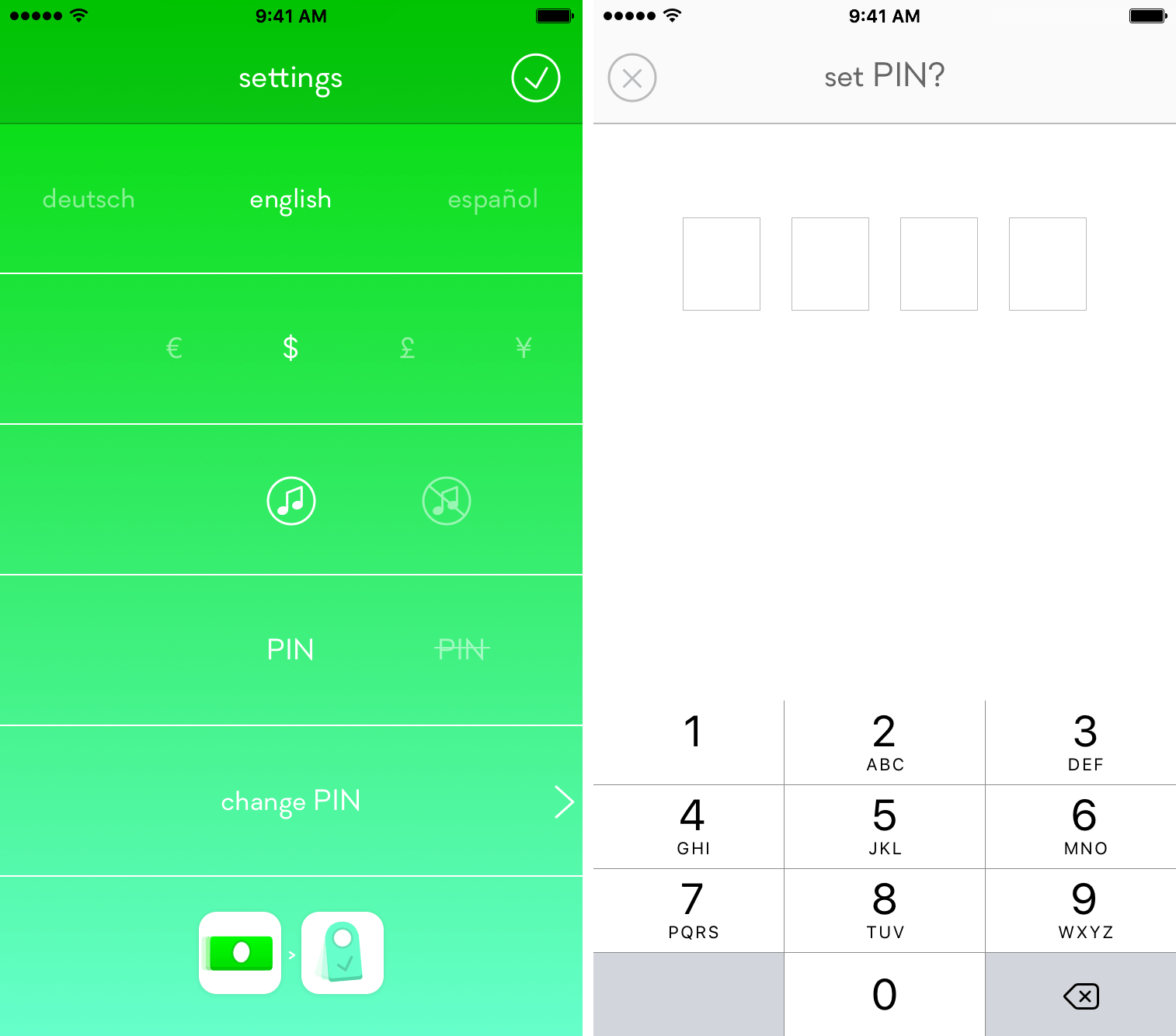

There’s one menu in the entire app placed at the top right hand corner. By tapping it, you’ll see a few key customization choices you can make to enhance Monthly’s experience. Monthly supports 17 different languages and shifting through them is as easy as swiping between them at the top. Similarly, you can change the currency you’d like recorded if needed.

One other feature worth noting is support for Touch ID and PIN. If you choose to use this, you’ll be prompted with a request for your fingerprint or PIN every time you launch the app.

The Place for Monthly

It’s possible that Monthly’s simplicity could be its downfall for some users; because of the effective but limited functionality, the app may not have all of the necessary features for some people.

With that in mind, Monthly has become something that I’ve been able to integrate into my workflow with ease. Admittedly, my monetary situation as a college student is undoubtedly vastly different than that of others – my incomes and expenses are usually that complicated.

But what Monthly does is help you manage your money and see how much you’ll be able to put in the bank at the end of the month and that’s something that can be used by anyone. Will it fit everyone’s needs? No. Can its core concept be beneficial for a typical user? Absolutely.

Wrap-up

Monthly does face its own set of struggles, some of which are more painful to deal with than others. In my eyes, the most annoying is the constant need for a fingerprint or PIN whenever you leave the app, no matter for how long. Future versions should include an option that allows the user to determine how long they’d like the app to remain unlocked before enacting the security feature.

I was also slightly frustrated by the inability to simply add a dollar amount without a title. While this is possible with some workarounds (such as putting a space bar as text), I’d like for that to be an optional field.

The overall quality of Monthly isn’t held back by those gripes, and it’s obvious why the app can be used as a solid budget planner. To my surprise, it’s a tool that has encouraged me to keep better records of my income and expenses. After logging my information, I’m confident in its capabilities to change the way people track their monetary lives.

Monthly can be purchased in the App Store for $1.99 as a Universal app.