Ivan Mehta, writing for TechCrunch:

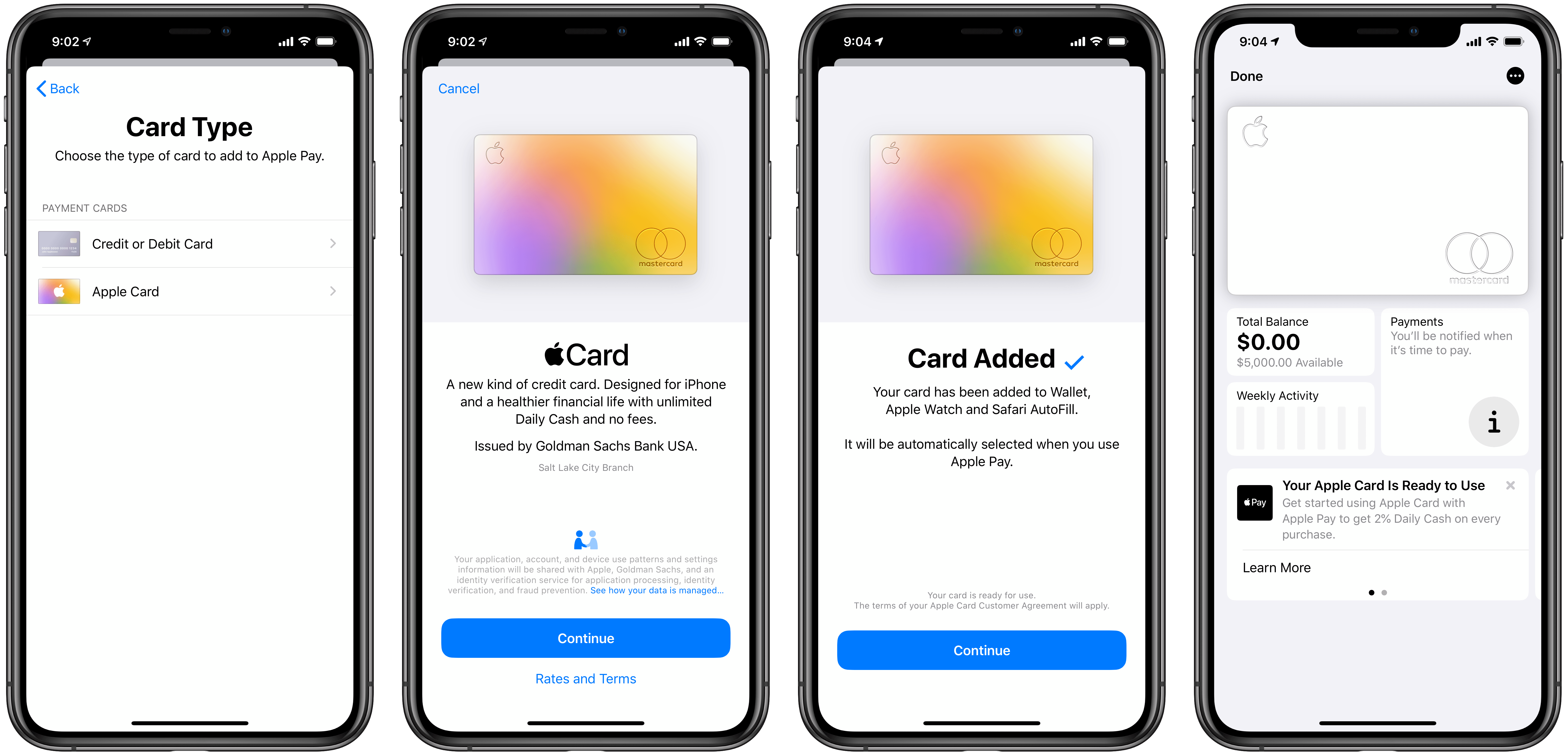

Apple’s iOS 17.4 update is primarily about adapting iOS to EU’s Digital Market Act Regulation. But the company has also released a new API called FinanceKit that lets developers fetch transactions and balance information from Apple Card, Apple Cash, and Savings with Apple.

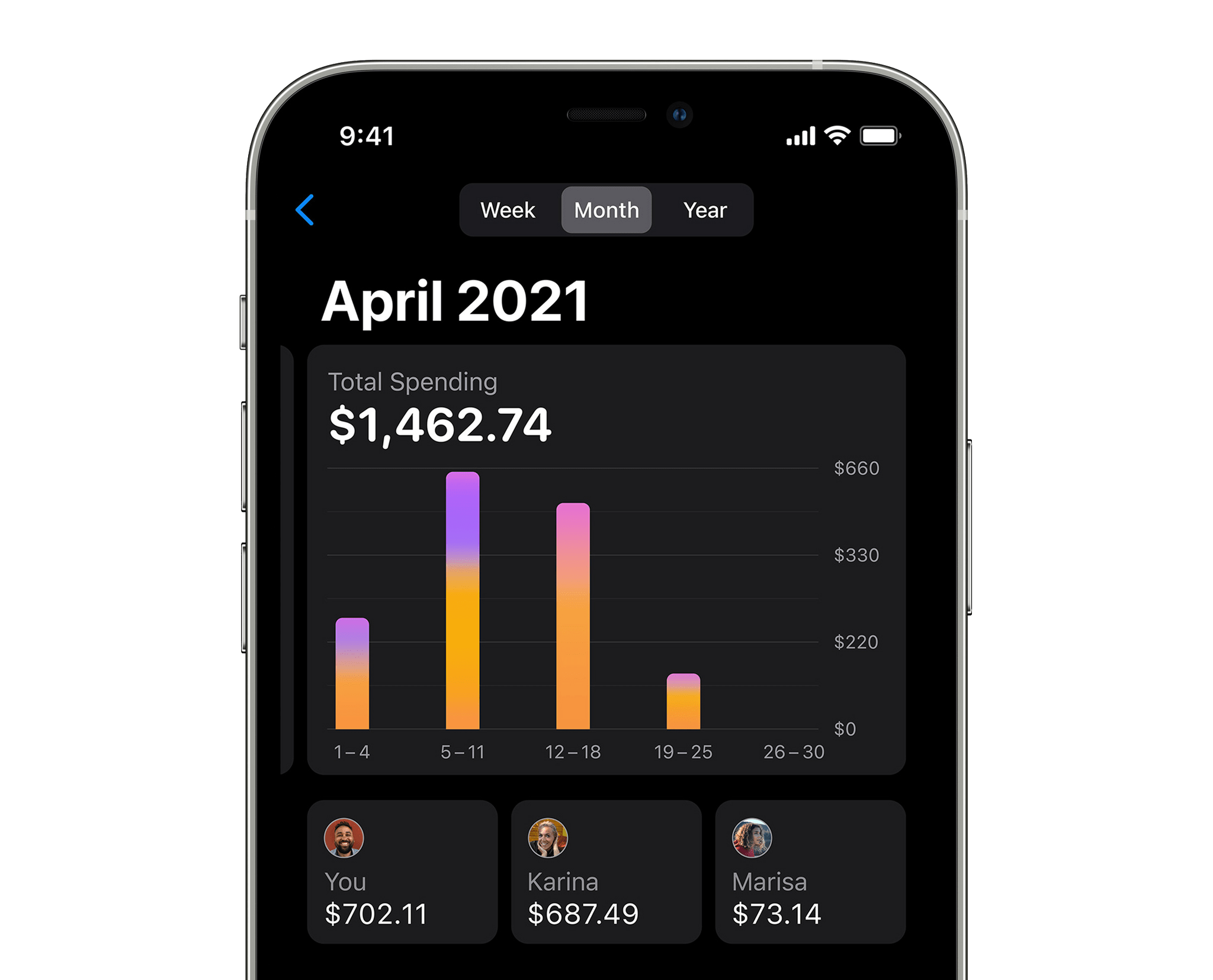

If you use an Apple Card and a budgeting and financial tracking app, you’ll know why this is a big deal. I’ve been tracking my expenses with Copilot for over a year now, and I was pleased to see in Mehta’s story that Copilot, along with YNAB, Monarch, have teamed up with Apple to be the first third-party apps to use FinanceKit.

Before FinanceKit, I could only track my Apple Card expenses by importing a CSV file of my transactions one time each month when a new statement appeared in the Wallet app. Not only was that laborious, but it defeated the purpose of an app like Copilot, which otherwise lets you see where you stand with your budget in real-time. The process was such a bad experience that I used my Apple Card a lot less than I would have otherwise. Now, those Apple Card transactions will be recorded in Copilot, YNAB, and Monarch as they’re made, just like any other credit card.