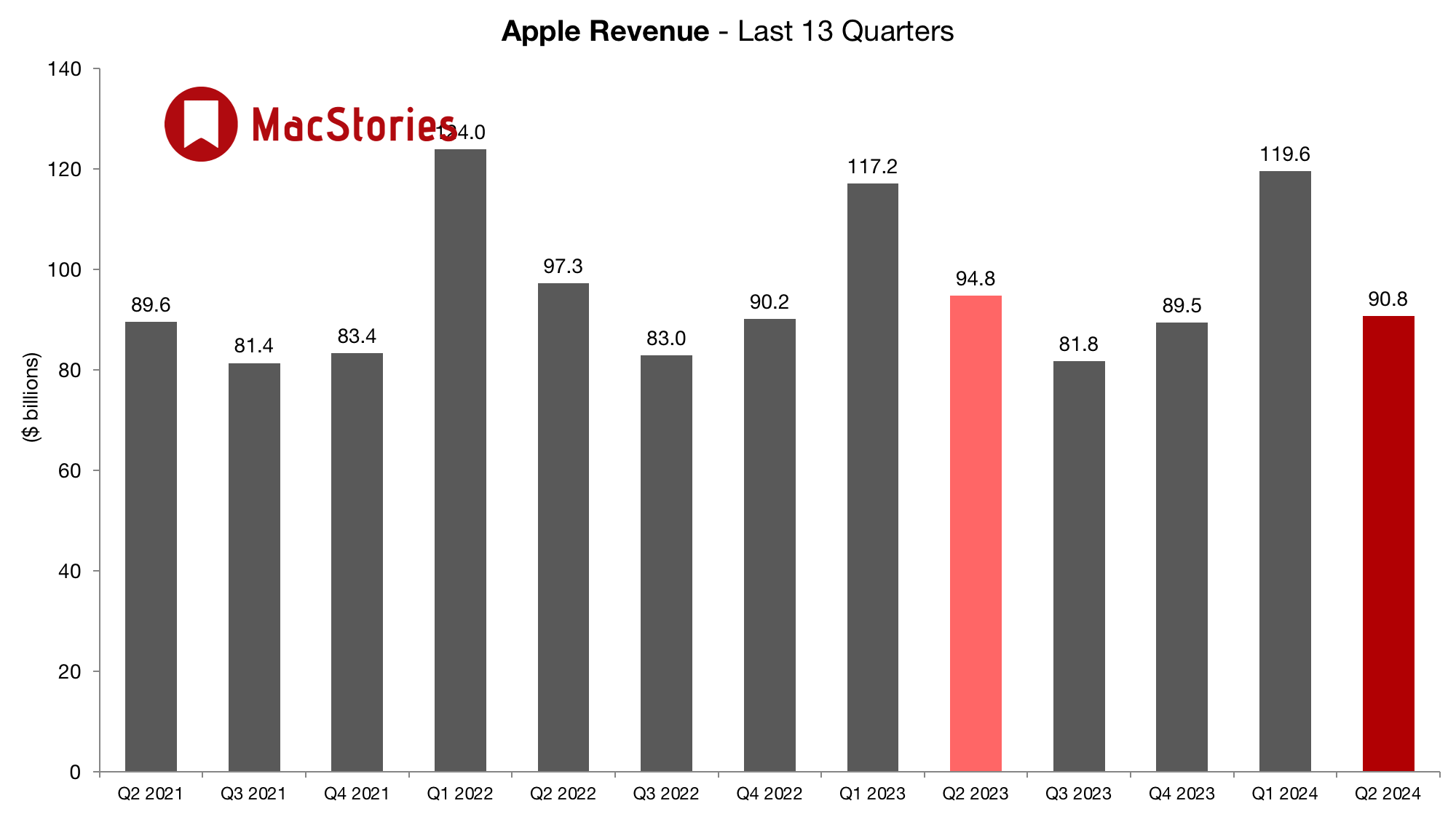

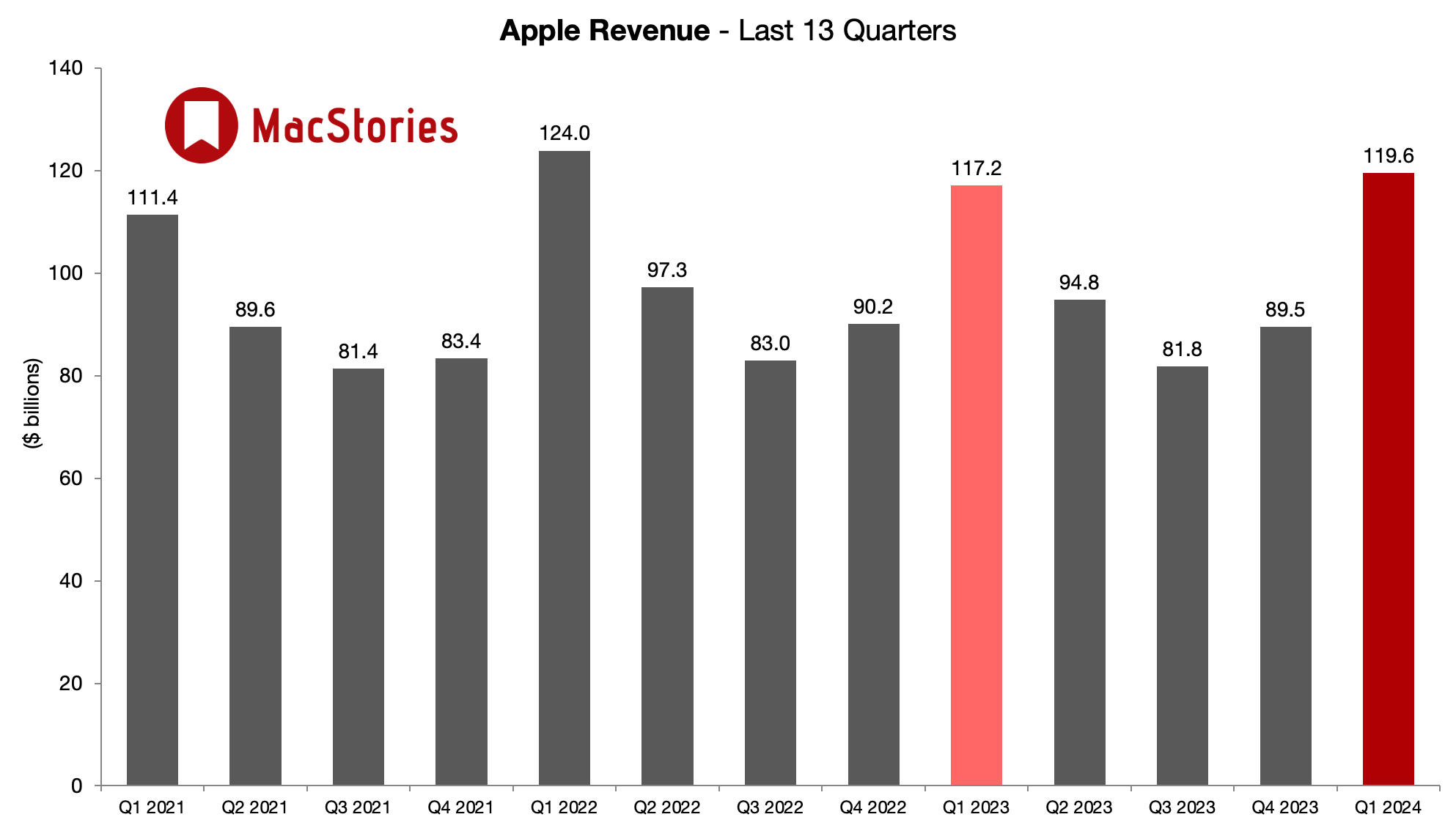

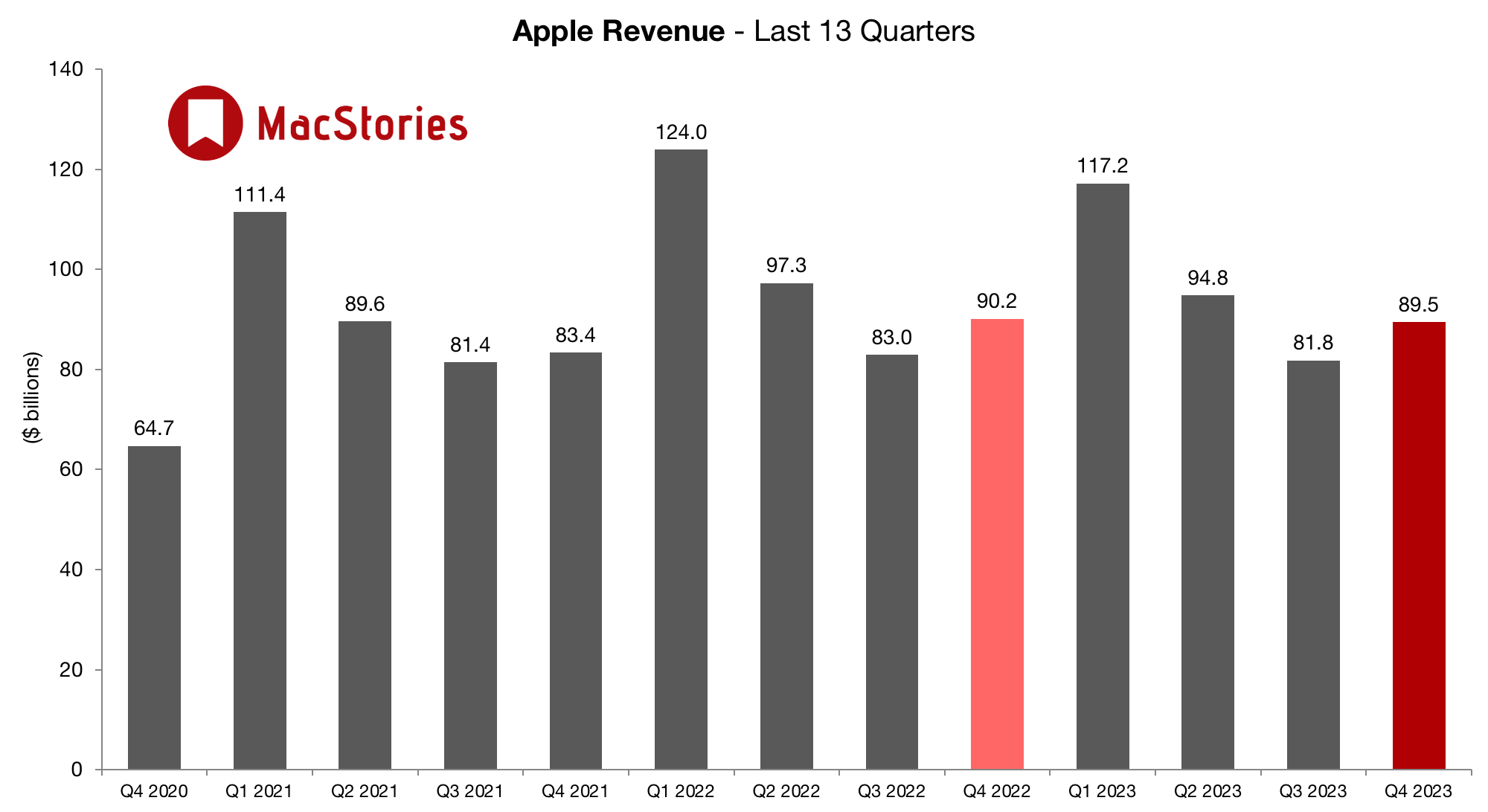

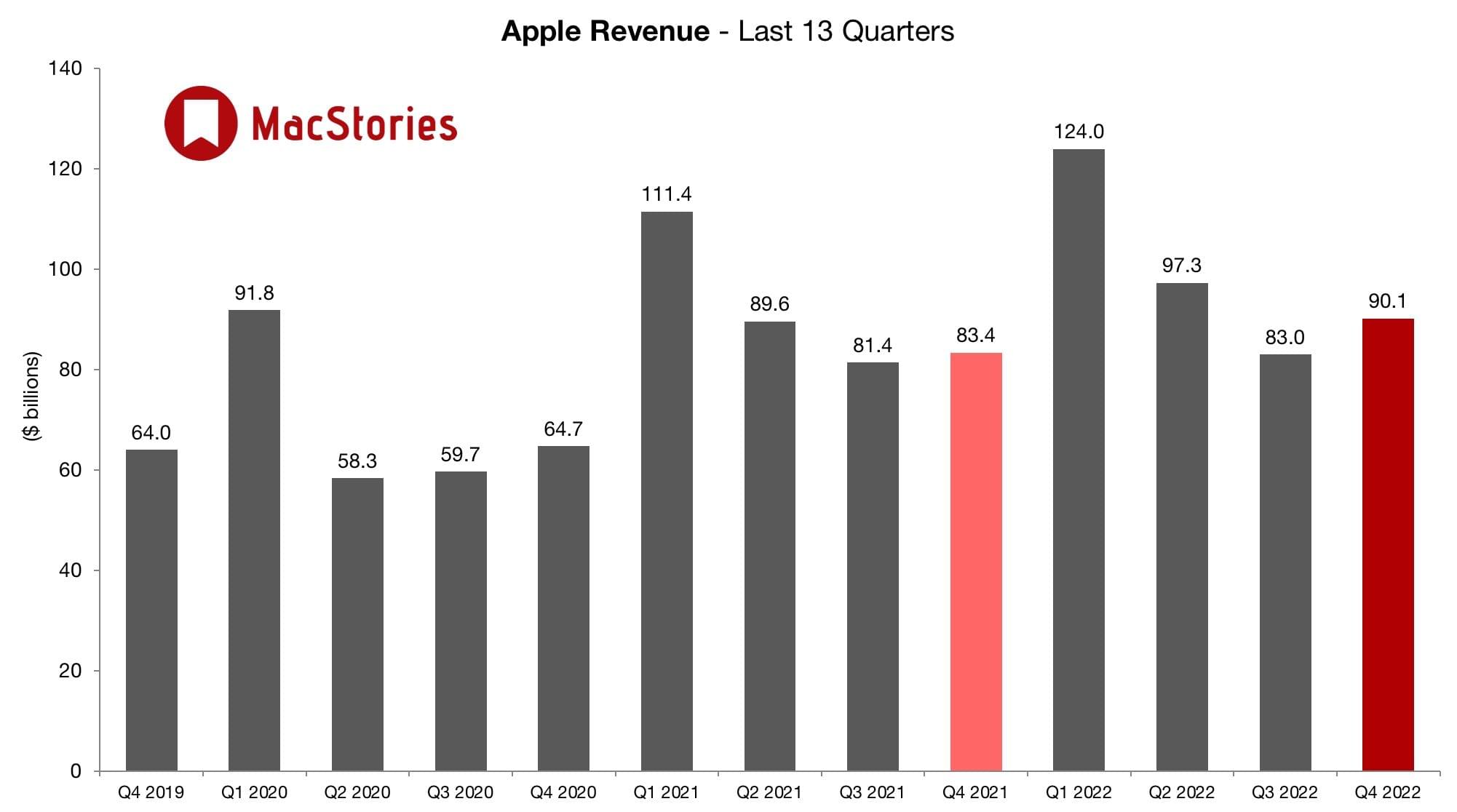

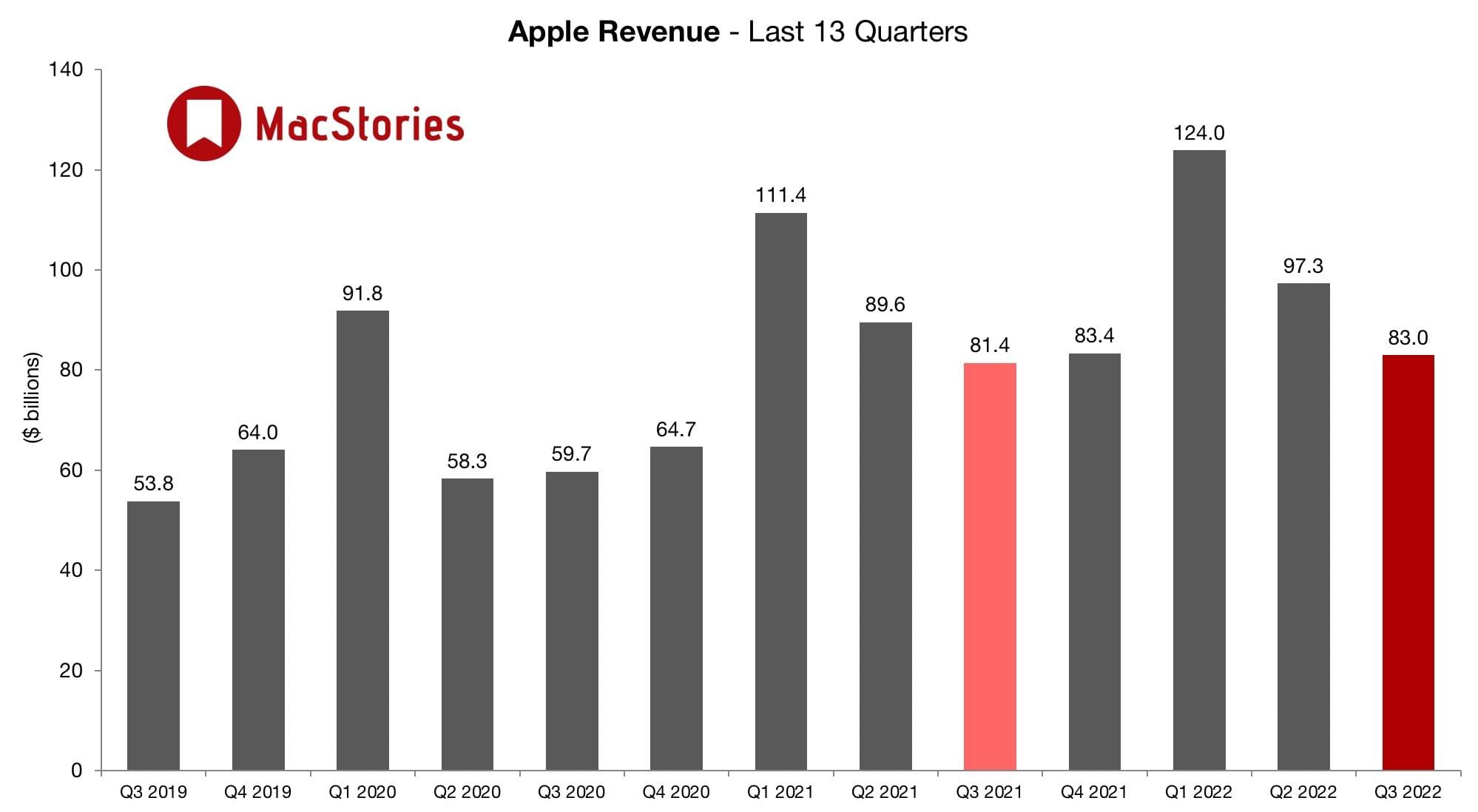

Last quarter, Apple reported revenue of $94.9 billion, which was a 6% year-over-year gain.

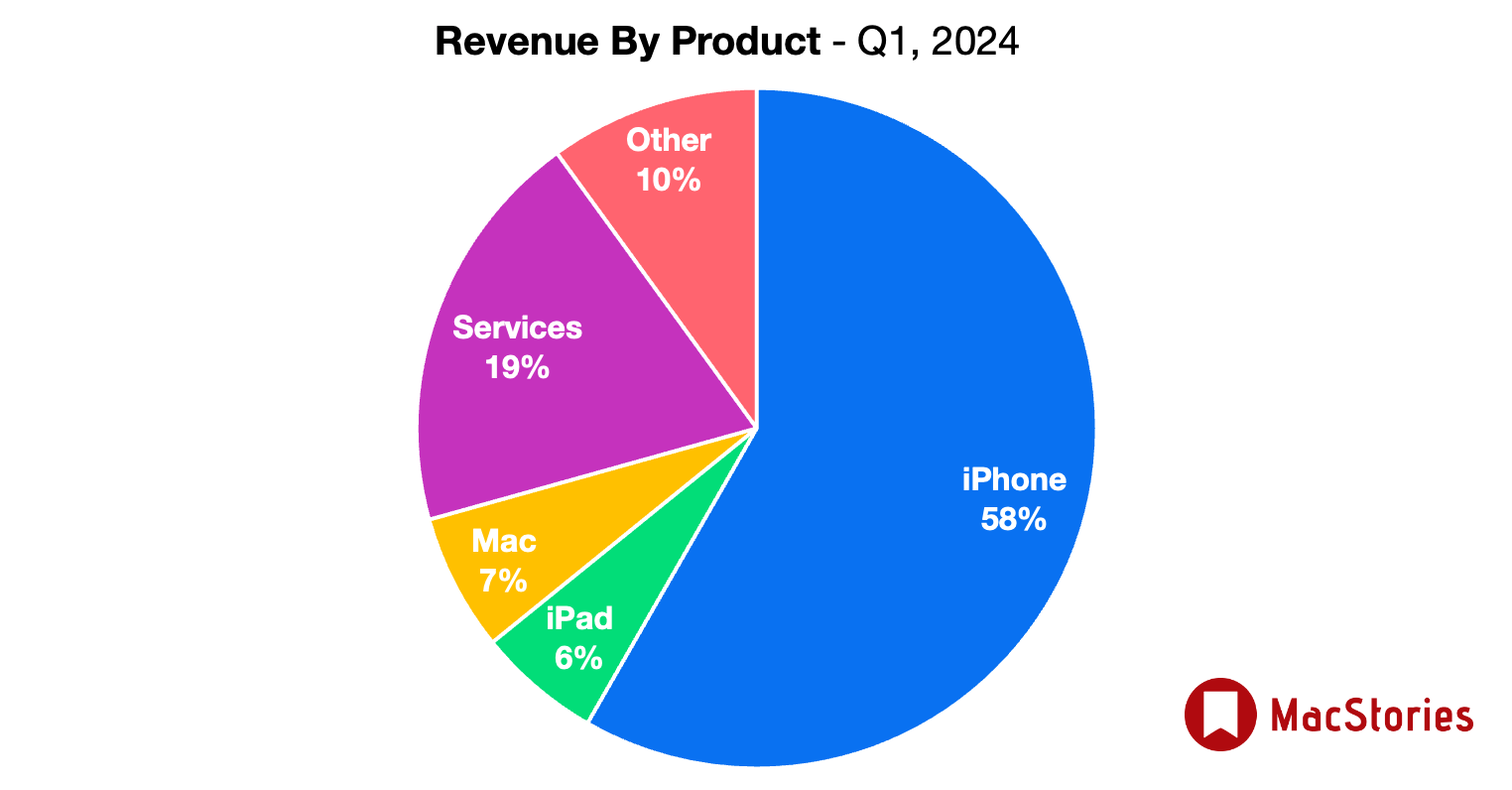

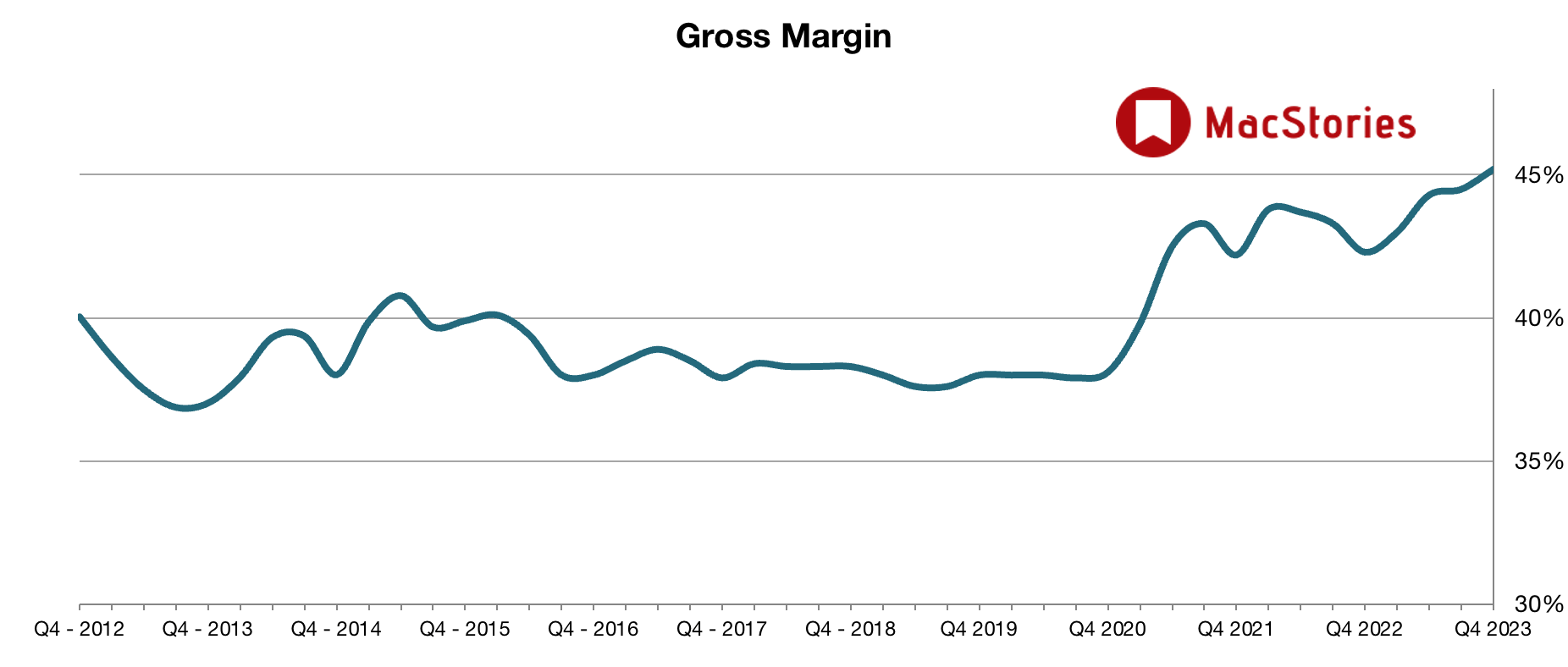

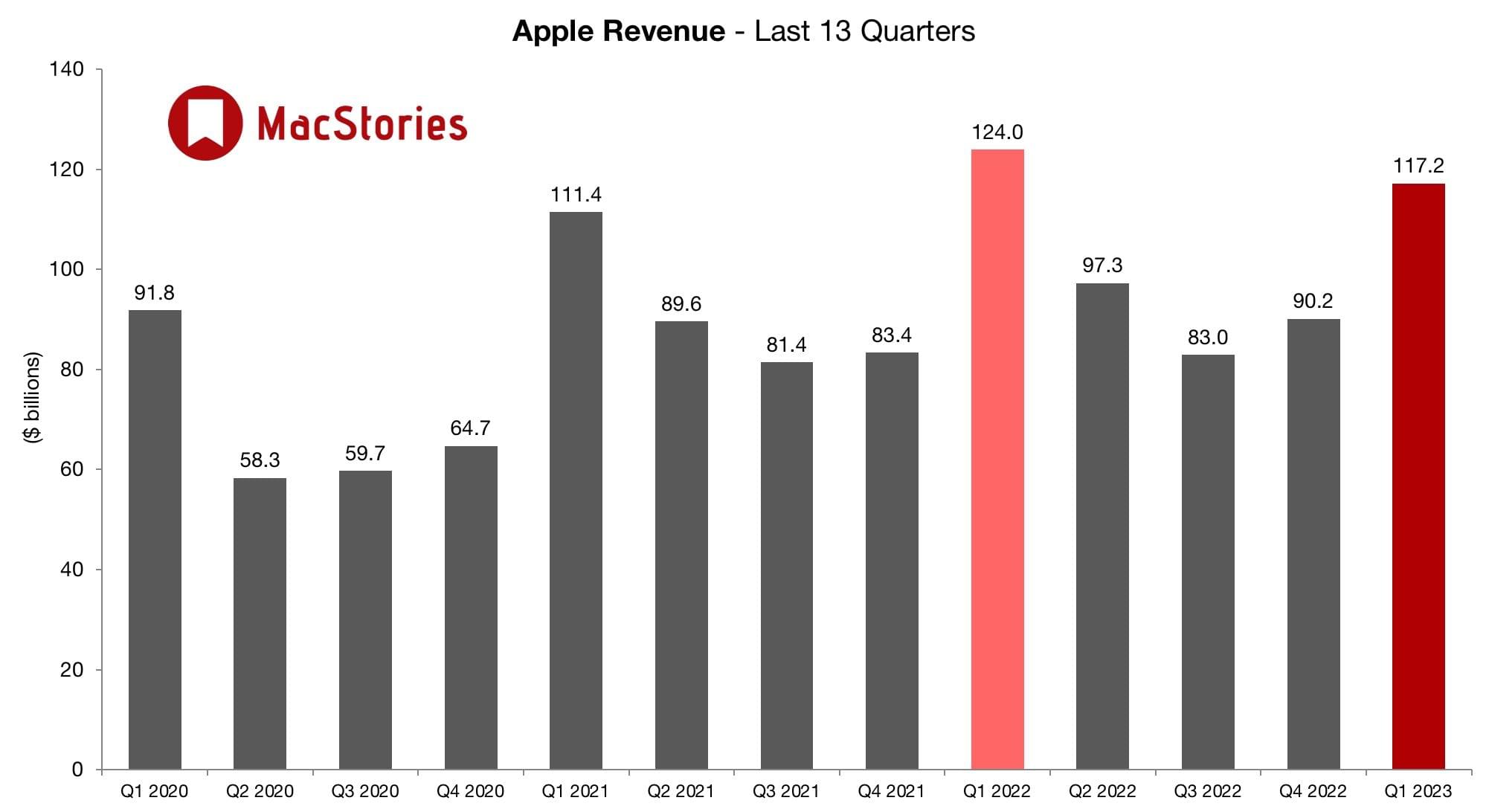

Today, first-quarter 2025 earnings are out and Apple reported record revenue of $124.3 billion, a 4% year-over-year gain. The diluted earnings per share was $2.40 a 10% year-over-year gain.

Today Apple is reporting our best quarter ever, with revenue of $124.3 billion, up 4 percent from a year ago. We were thrilled to bring customers our best-ever lineup of products and services during the holiday season. Through the power of Apple silicon, we’re unlocking new possibilities for our users with Apple Intelligence, which makes apps and experiences even better and more personal. And we’re excited that Apple Intelligence will be available in even more languages this April.

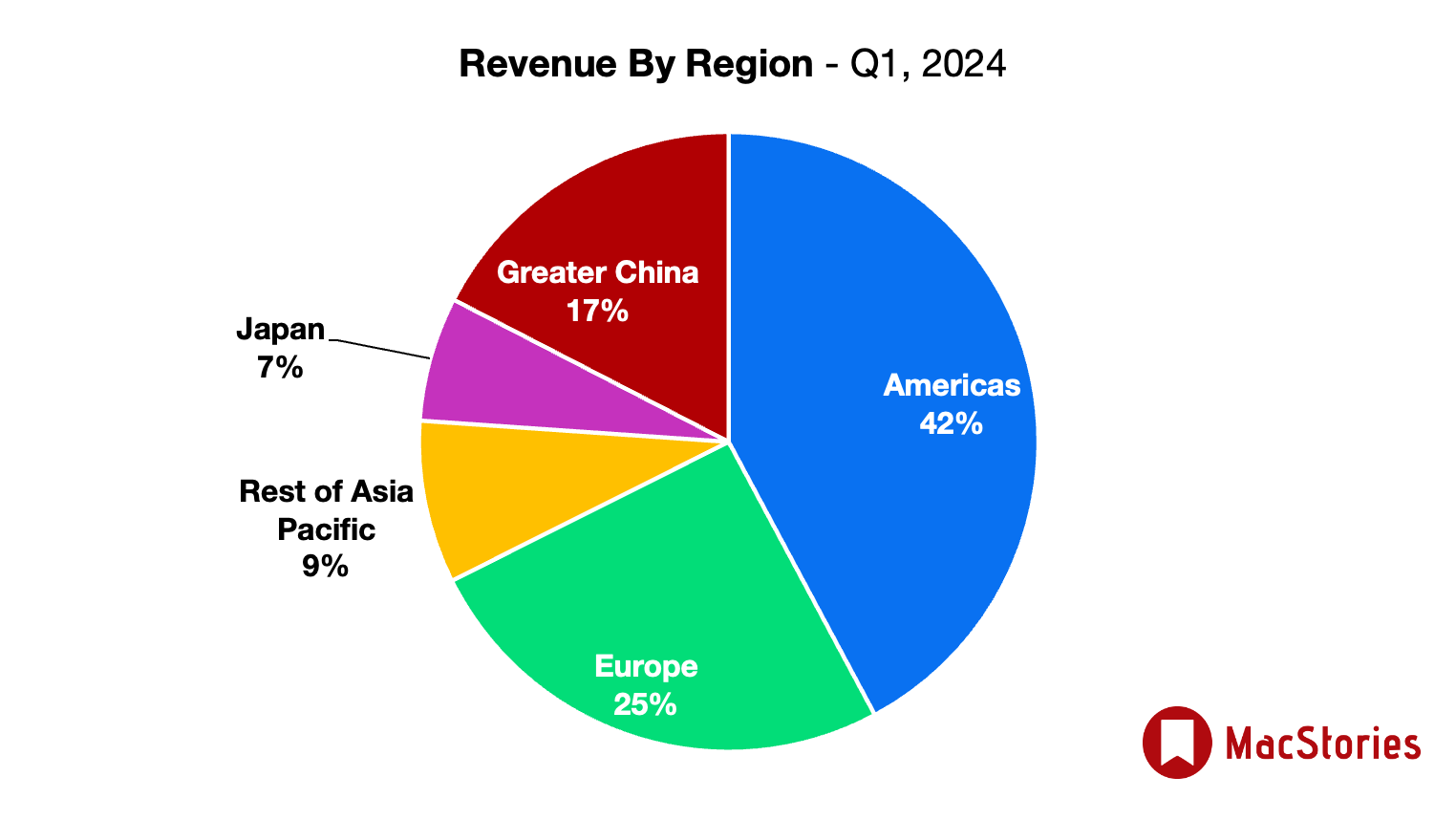

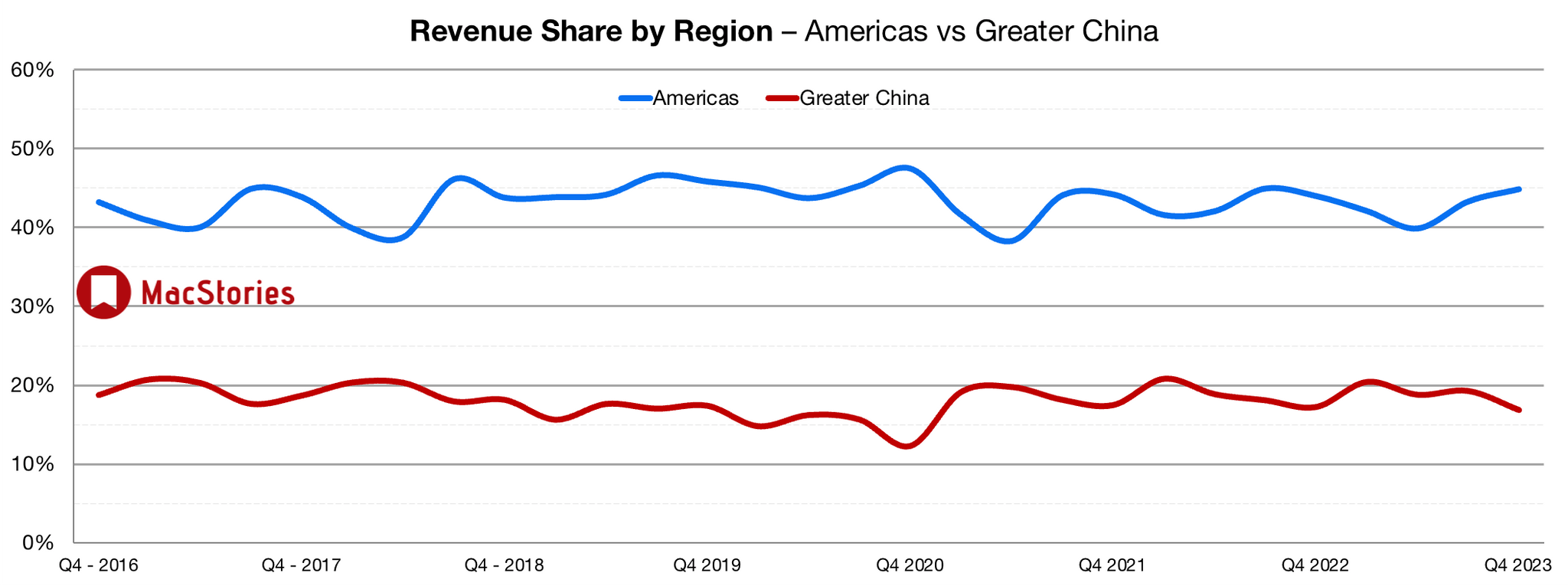

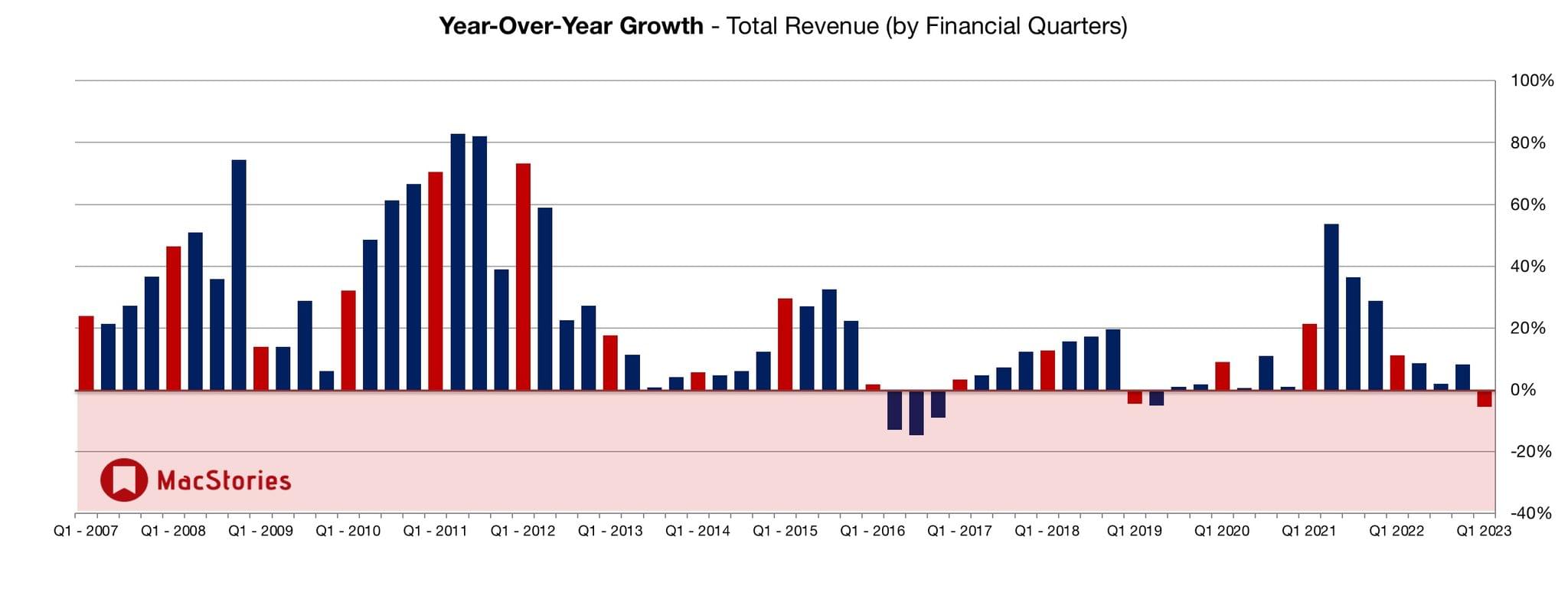

Going into today’s earnings call, Apple’s stock was downgraded by multiple analysts. Factors cited in the downgrades included weak sales in China, an expectation that Apple wouldn’t meet earnings expectations, and the the lack of any boost in iPhone sales from Apple Intelligence.

It’s possible that some of the most powerful Apple Intelligence features that have yet to debut will drive future sales of iPhones and other devices even further than last quarter. That’s not a bet I’d necessarily take, but irrespective of hardware sale accelleration, the volatility among the companies behind the leading artificial intelligence models may insure to Apple’s benefit as investors move their investments into stocks that are perceived as safer.

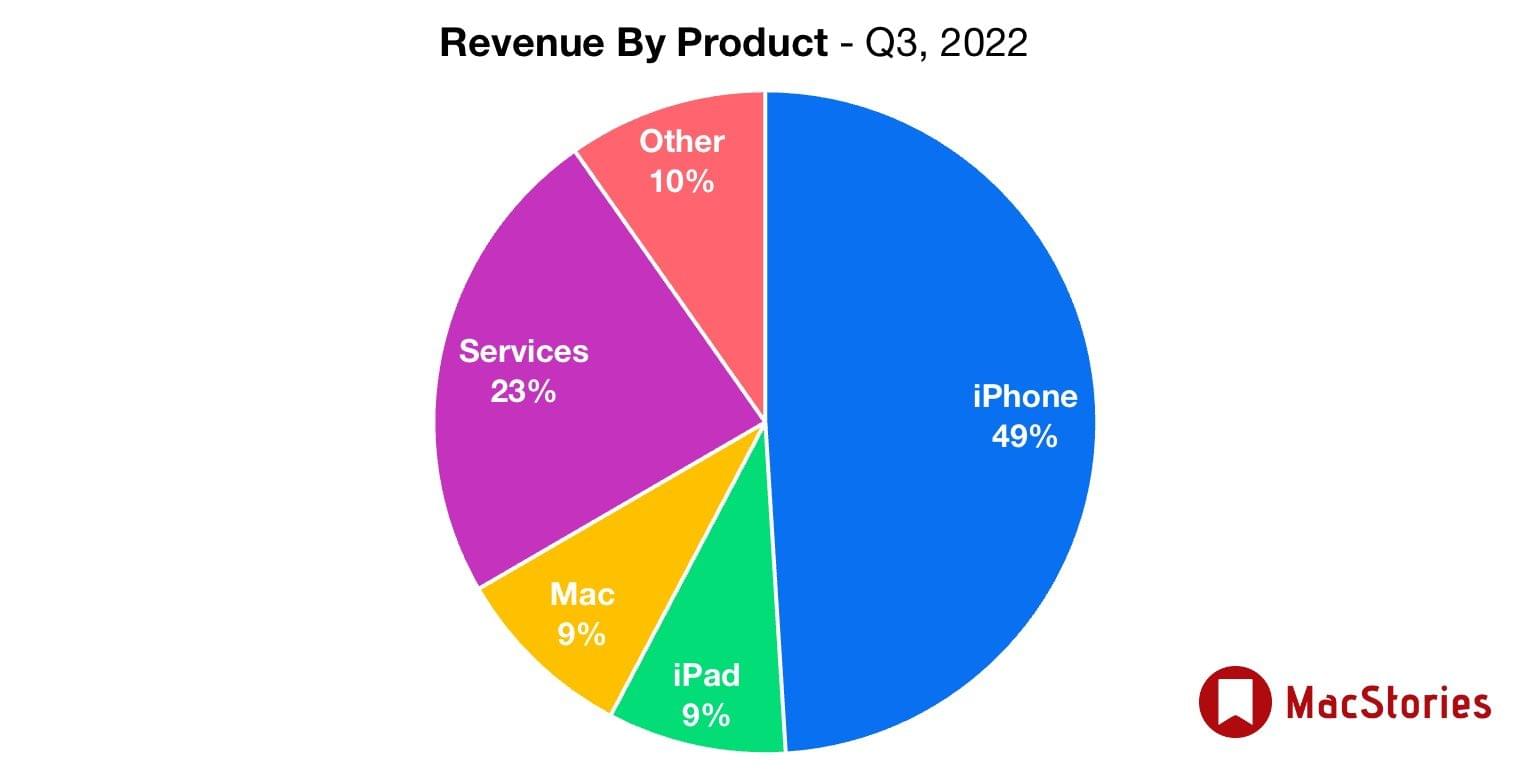

](https://cdn.macstories.net/967466ed-d433-4313-8ccf-4500db12f669-1659092186095.jpeg)

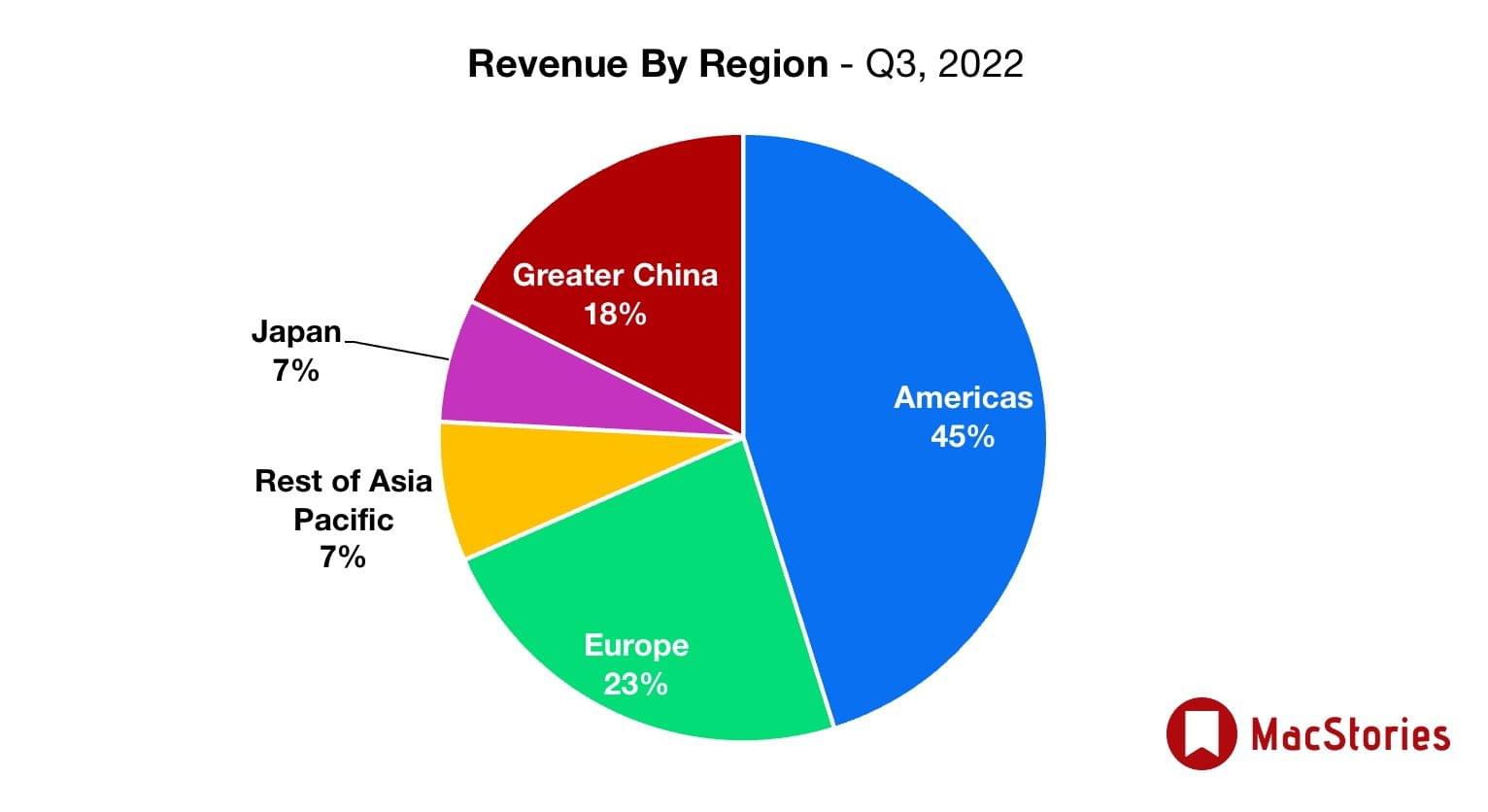

](https://cdn.macstories.net/14b2f904-114f-48be-9424-b5bd63a7c76a-1659092186097.jpeg)

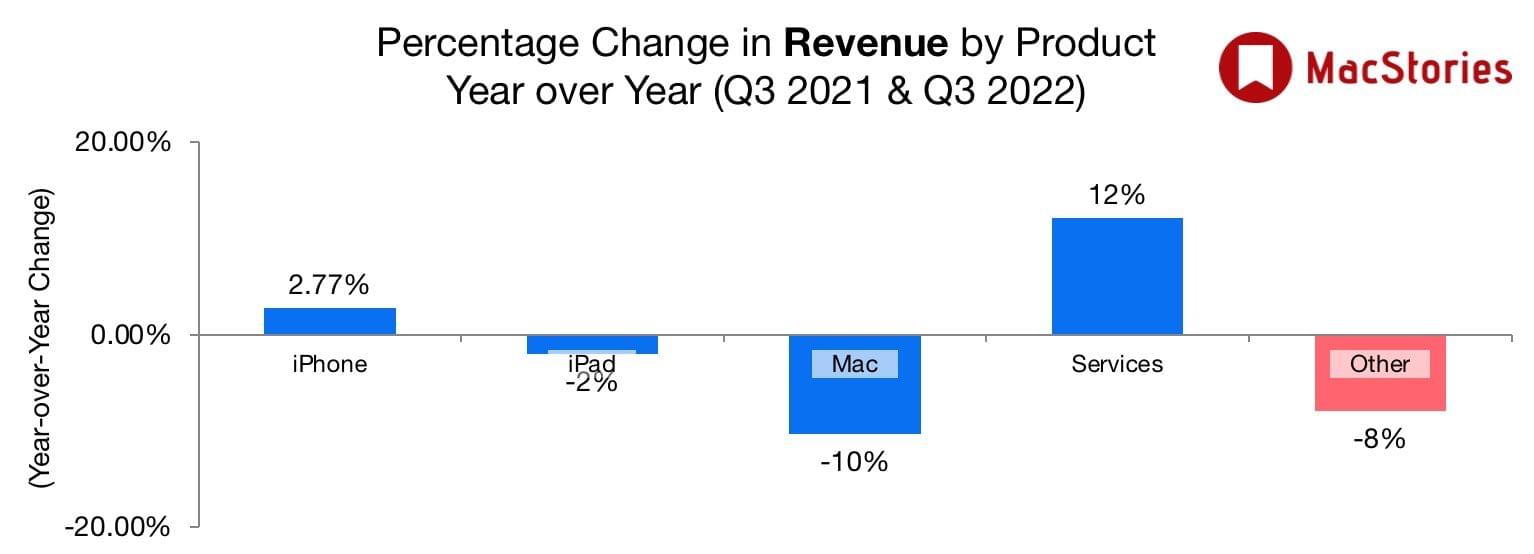

](https://cdn.macstories.net/image-1659119008915.jpeg)