Yesterday at the keynote for Google’s I/O developer conference, the company introduced a News app launching soon for iOS and Android, which will replace the existing Google Play Newsstand app. The app is rolling out some time in the next week, but here are the highlights for what it’ll contain.

Like Apple News, the landing page for Google News is called For You, which is where Google aggregates stories based on your interests. The second tab, Headlines, is strictly about the biggest stories in the world each day. These stories will be the same for everyone within a given geographic region, with no personalized curation at all. Finally, Favorites and Newsstand give you quick access to the publishers you follow, including the ability to subscribe to publications from directly within the app.

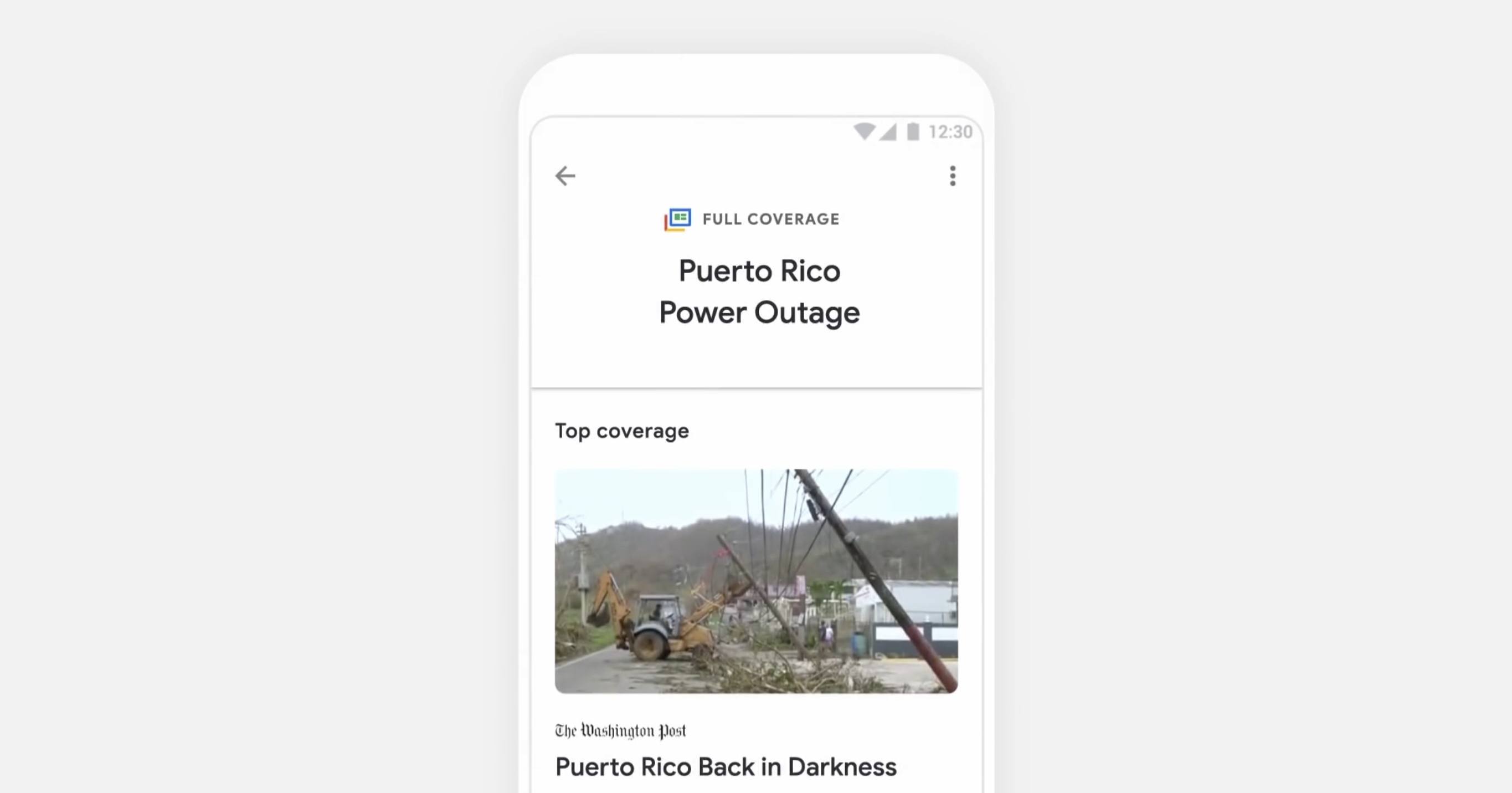

For the most part, Google News is a close imitation of Apple News – it has a similar layout, and a similar design with white backgrounds and a heavy focus on photography. The way it best differentiates itself is a feature that I think is the highlight of the app: Full Coverage. When you’re reading a story and want to gain more insights and perspectives on the same topic, tapping the ‘Full Coverage’ option opens a view that aggregates a wide array of sources covering a variety of angles on that story. It’s one way Google is aiming to promote solid journalism while gently combating filter bubbles. Based on the examples that have been shown so far, Full Coverage will list stories on an event timeline, offer answers to frequently asked questions about an event, highlight tweets and opinion pieces, fact checks, videos, and more. It’s meant to be a comprehensive overview of a given story, and I think it looks fantastic.

It’s unclear how widely available Full Coverage will be throughout the app, but we can assume that the most significant news events at least will include a Full Coverage component to them. Google demoed one Full Coverage story focusing on the Puerto Rico power outage situation.

Despite being different in execution, Full Coverage is similar in spirit to the Spotlight tab in Apple News: both aim to provide substantive overviews on a given topic by aggregating a variety of sources. While Spotlight is updated daily to cover a new topic, I appreciate Google’s approach with Full Coverage because it will make those aggregated pages more accessible and relevant to readers. I love Spotlight and check it regularly, but it’s frustrating that Spotlight stories can only be accessed the day they’re published. Apple should take a note from Google News’ playbook and start offering links to previous Spotlight features at the bottom of related stories.