Earlier today, Apple announced another major new functionality coming to iOS 18.1: the ability for third-party apps to offer NFC transactions via the iPhone’s Secure Element:

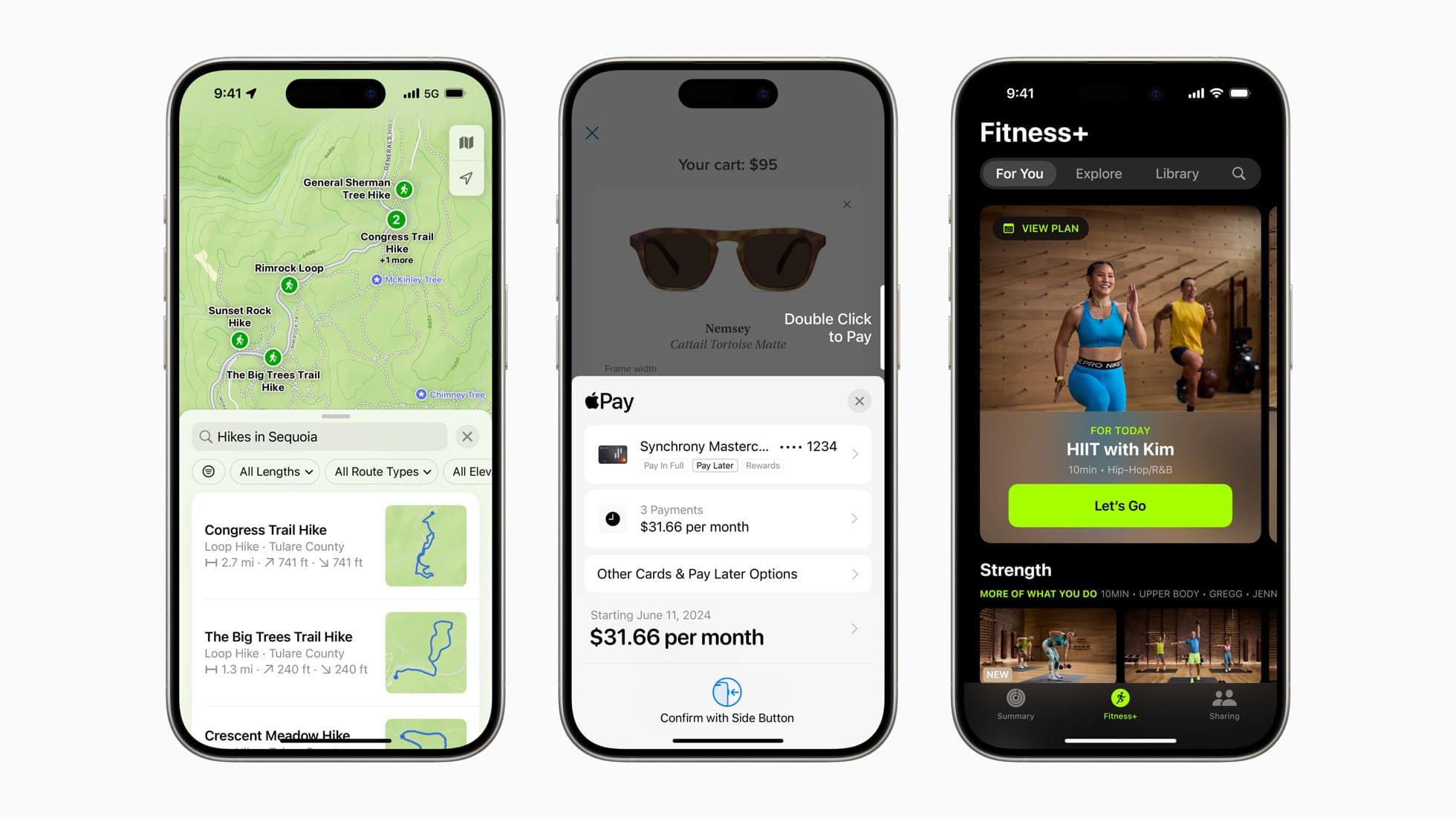

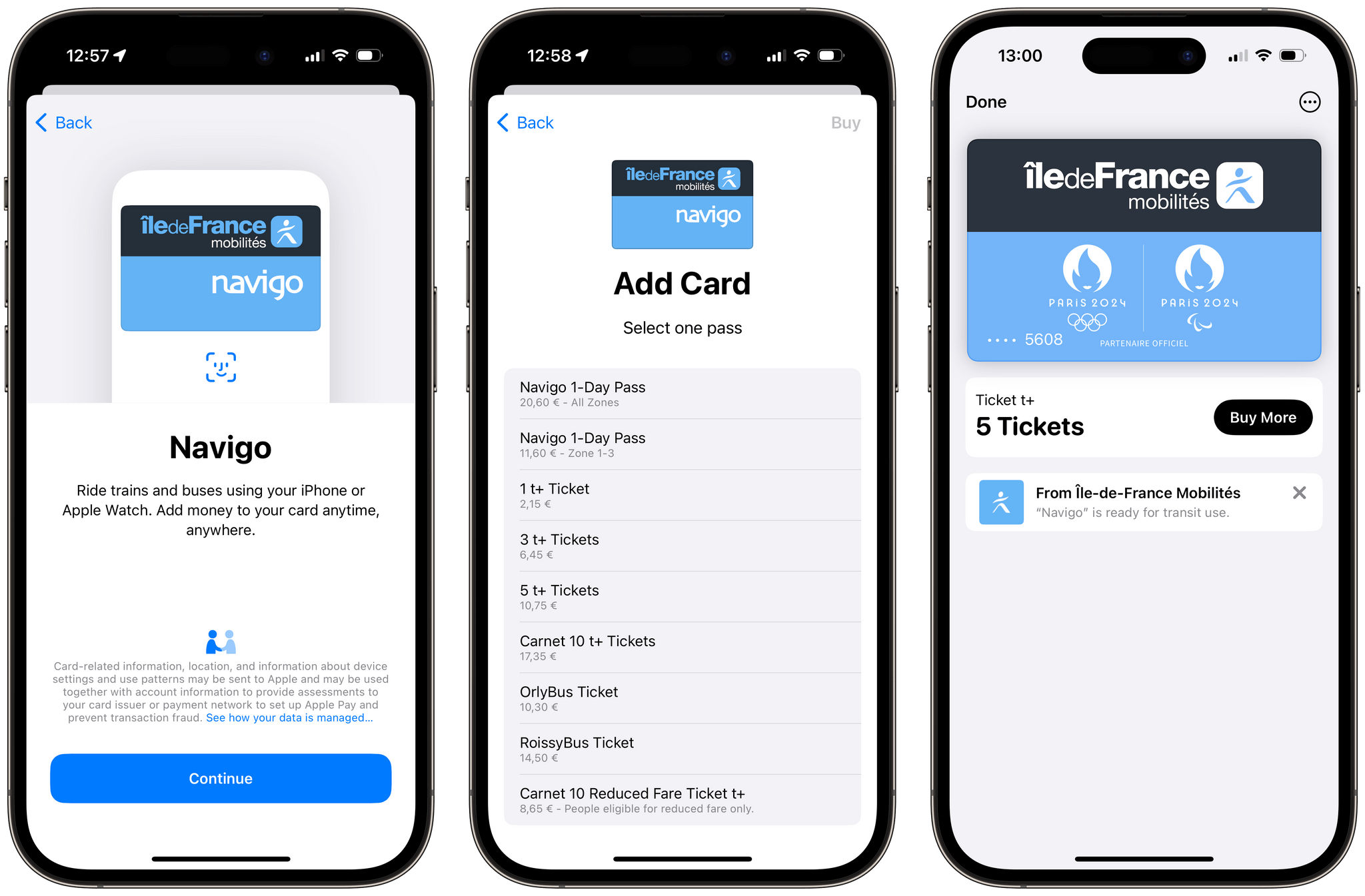

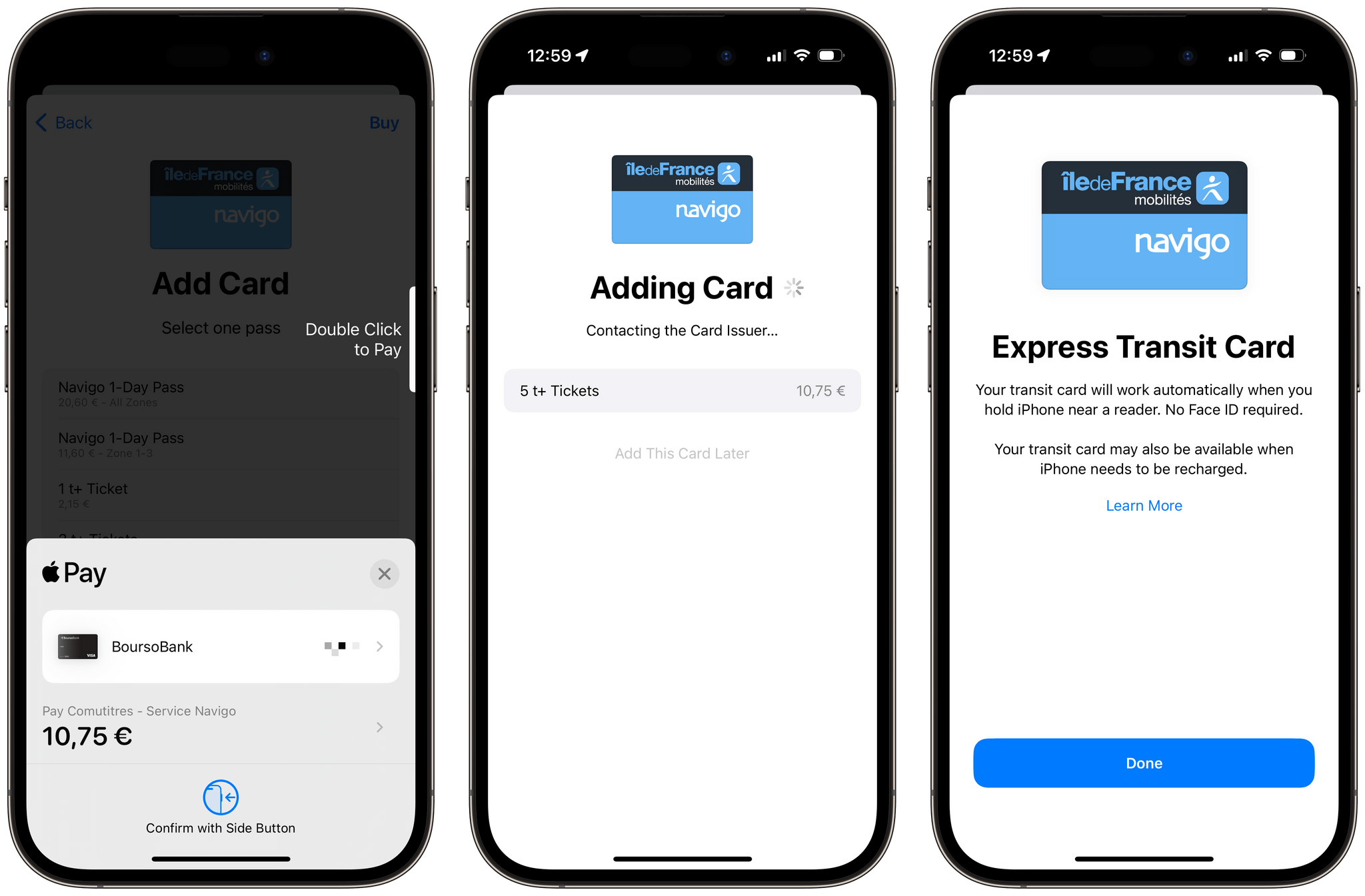

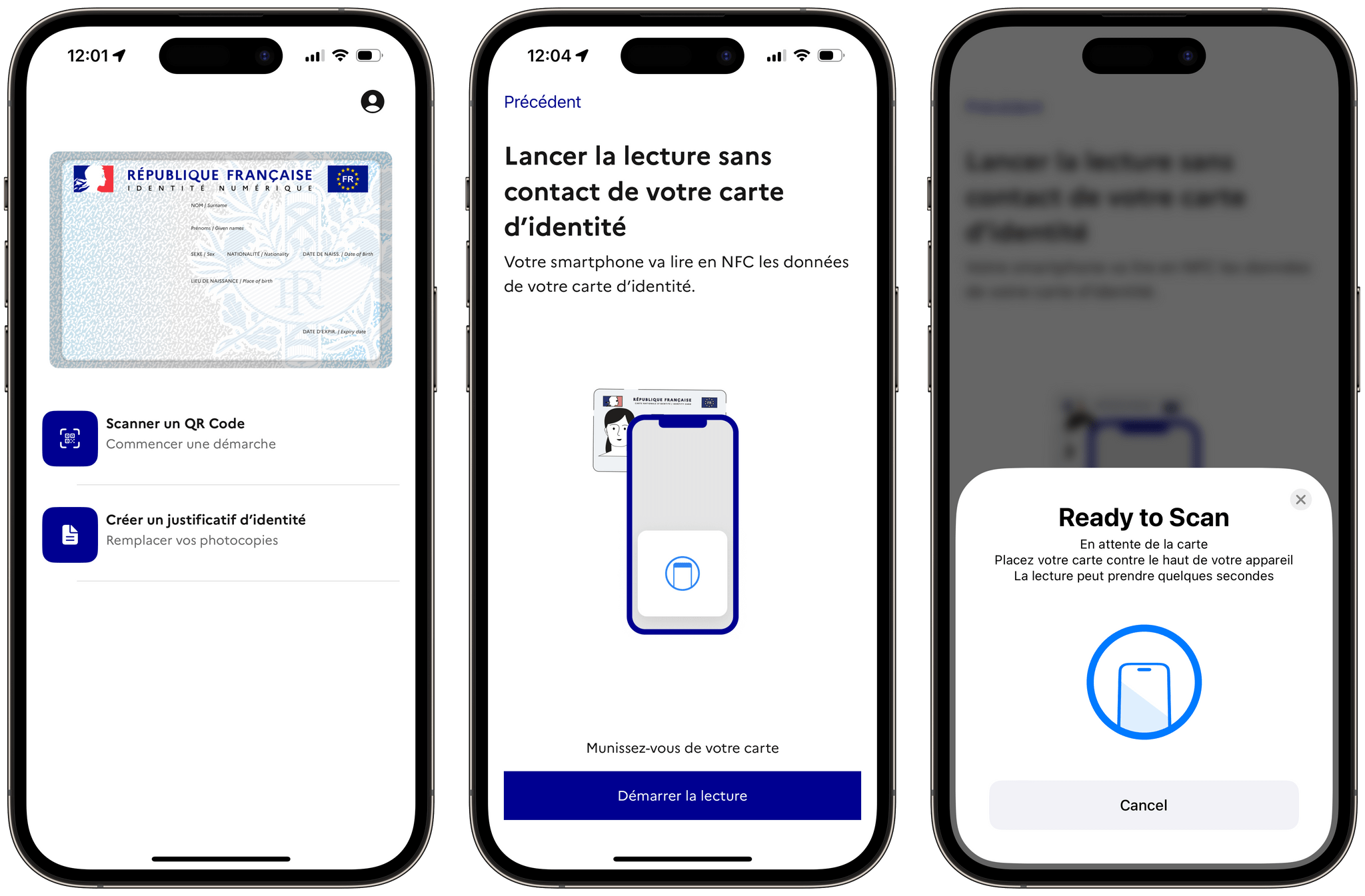

Starting with iOS 18.1, developers will be able to offer NFC contactless transactions using the Secure Element from within their own apps on iPhone, separate from Apple Pay and Apple Wallet. Using the new NFC and SE (Secure Element) APIs, developers will be able to offer in-app contactless transactions for in-store payments, car keys, closed-loop transit, corporate badges, student IDs, home keys, hotel keys, merchant loyalty and rewards cards, and event tickets, with government IDs to be supported in the future.

This is coming in iOS 18.1, which will also mark the official debut of Apple Intelligence. Even better, Apple has published extensive documentation on the new APIs, from which I noticed one detail: in addition to overriding the iPhone’s side button double-click with a different app, a third-party app running in the foreground will still be able to initiate its own NFC transactions, even if you set a different default app.

Eligible apps running in the foreground can prevent the system default contactless app from launching and interfering with the NFC transaction.

And:

You can acquire a presentment intent assertion to suppress the default contactless app when the user expresses an active intent to perform an NFC transaction, like choosing a payment or closed-loop transit credential, or activating the presentment UI. You can only invoke the intent assertion capability when your app is in the foreground.

The irony of all this, of course, is that Apple is under regulatory scrutiny in both Europe and the United States regarding the inability for third-party developers to offer alternative wallets and tap-to-pay systems on iPhone. But as it’s becoming apparent lately, it seems there’s no greater project manager for new iOS features than the fear of regulation.